The American consumer continues to surprise

Link

Key takeaways from the september 30 , 2025 market update insights from Sebastian Paris Horvitz.

Overview

► Yesterday, the meeting between President Trump and the leaders of the Democratic and Republican parties in both chambers failed to reach a compromise to avoid a potential government shutdown scheduled for noon tomorrow. A shutdown would mean the suspension of certain federal services due to a lack of funding. A compromise is needed to pass a law that would release the necessary funds. This law must be approved by 60% of senators. Obviously, the Republicans do not hold such a majority.

► In recent years, such deadlocks have been avoided through compromise. However, given the current hostility between the two parties, the risk of a suspension of certain federal services is high. One symbolic consequence would be the inability to publish September’s employment data this Friday, leaving markets in uncertainty. Clearly, the longer this impasse lasts, the more negative its impact on the economy would be.

► This federal government shutdown threat comes at a time when recent U.S. growth statistics are relatively favorable — much better than we had anticipated. In particular, consumer appetite appears to have rebounded quite significantly in recent months. Major upward revisions were made to consumption data for Q2 2025, and August figures came in stronger than expected. At the same time, the savings rate has resumed a sharp decline over the past two months, which may prove unsustainable. Adding complexity to the analysis, consumer confidence remains very low. We continue to anticipate a slowdown in household spending in the upcoming quarter.

►This potential federal government shutdown comes at a time when recent U.S. growth figures are relatively favorable — much better than we had anticipated. In particular, consumer appetite appears to have rebounded quite clearly in recent months. Significant upward revisions were made to consumption statistics for Q2 2025, and August figures were stronger than expected. At the same time, over the past two months, the savings rate has resumed a sharp decline, which may prove unsustainable. Adding complexity to the analysis, consumer confidence remains very low. We continue to expect a slowdown in household spending in the coming quarter.

►In the Eurozone, this week is expected to see the German government begin deploying its major public spending plan (focused on infrastructure and defense), following last week's budget approval by the Bundestag. Despite concerns about the speed of implementation, we continue to believe that Q4 2025 — and especially 2026 — will bring a total economic boost of nearly 1.6 percentage points of GDP.

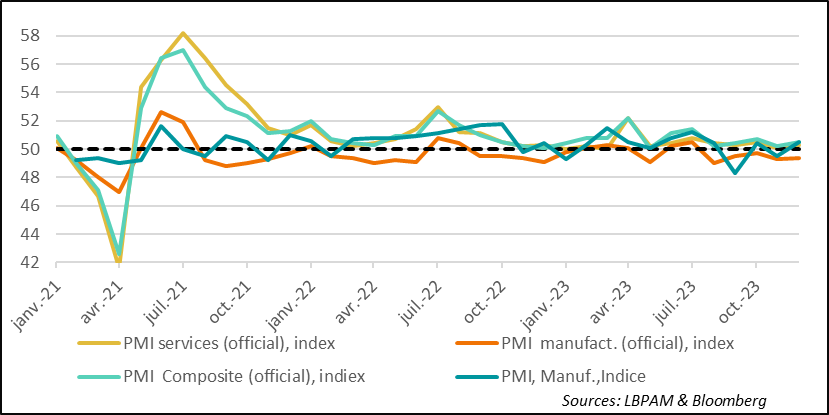

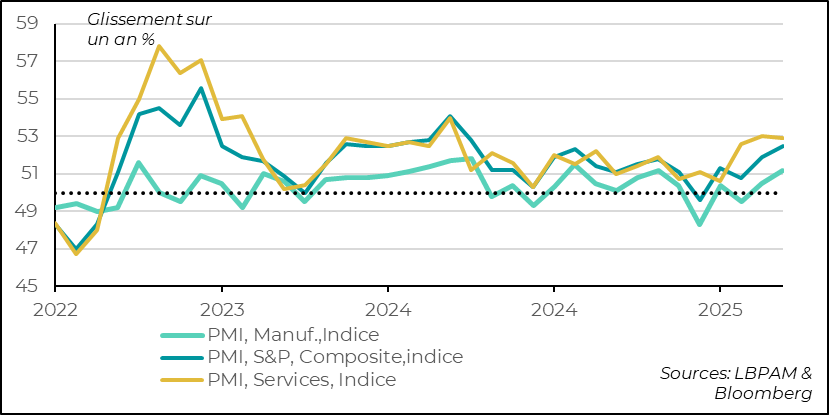

►In China, the PMIs for September came in slightly better than expected. However, the official composite PMI (covering both services and manufacturing) showed that growth remains weak, with service activity appearing stagnant. This partly reflects the continued weakness in domestic demand. The private PMI, which focuses more on smaller businesses — especially those oriented toward exports — showed greater resilience. A modest rebound in the industrial sector suggests that the export segment is holding up. Nevertheless, we expect external demand to moderate, which will likely require stronger efforts from authorities to stimulate domestic consumption.

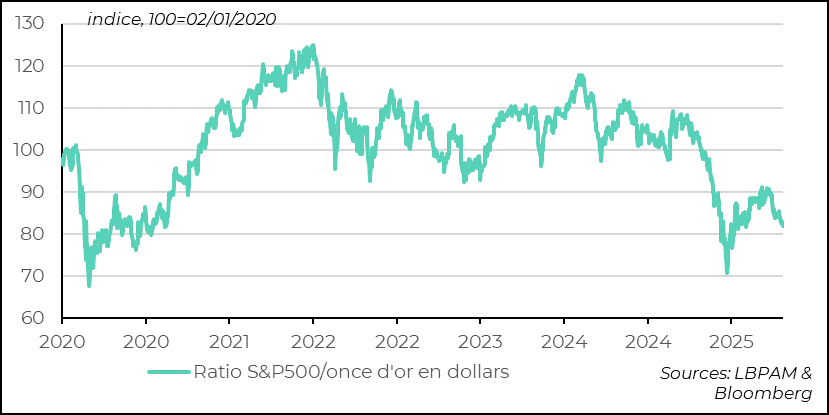

►In the markets, gold prices continue to surprise with their resilience. One way to characterize the exceptional rise of the yellow metal is its remarkable performance compared to the leading U.S. index, the S&P 500. Since the onset of COVID in 2020, gold has significantly outperformed the S&P. The inflationary episode of recent years, and more importantly, a fragmented geopolitical landscape, appear to remain key supporting factors. In the very short term, new highs could be reached.

In-Depth insights

United States: Consumer spending is much stronger than expected

Consumer spending surprises to the upside

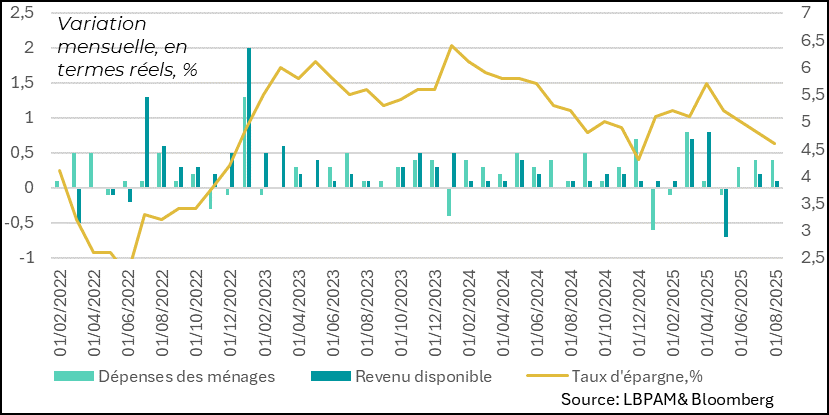

The sharp upward revisions to consumption growth in Q2 2025 (2.5% annualized vs. 1.6% previously) have reshaped the outlook for domestic demand. As a result, consumption is holding up better than expected, and this momentum appears to be continuing into Q3 2025. Indeed, July and August were particularly strong, with monthly growth of 0.4%.

At the same time, income growth has weakened in recent months, leading to an accelerated decline in the savings rate. It’s possible that income is still being underestimated — particularly financial income, as was the case in previous quarters. In part, the resilience in consumption seems to be driven by higher-income households, whose wealth has increased significantly, notably due to strong stock market performance.

We continue to expect a slowdown in consumer appetite in the coming quarter, driven by a slightly less supportive labor market and gradually eroded purchasing power due to price increases resulting from tariff hikes.

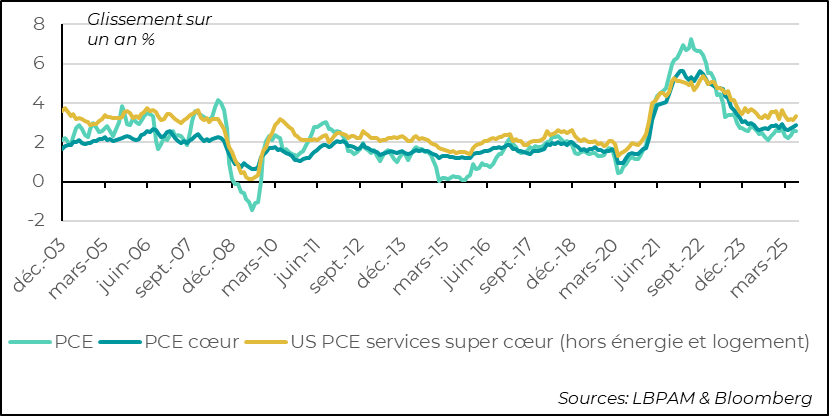

Inflation has stopped declining and is drifting away from the target.

On inflation, the August figures for the Personal Consumption Expenditures (PCE) deflator — the Fed’s preferred measure — were very close to expectations. However, the underlying trend in prices has resumed its upward trajectory. This is particularly notable given that the impact of tariffs on goods prices remains relatively moderate.

More concerning is the renewed upward momentum in service prices. The “super-core” services PCE, often cited by Jerome Powell as a key reference, remains well above 3% year-over-year.

It’s clear that the Fed has shifted its focus toward growing concerns about labor market deterioration. Nevertheless, we believe that inflation trends will remain a key obstacle to any aggressive rate-cutting cycle in the coming months. We foresee more caution than the market currently expects.

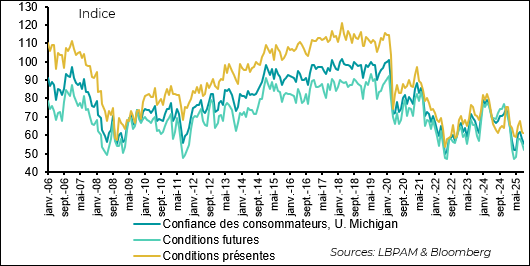

Consumer confidence remains very low

While consumption continues to surprise to the upside, consumer confidence keeps surprising to the downside. In fact, the final University of Michigan survey for September was even more disappointing than the preliminary reading earlier in the month. Both current and future conditions declined, remaining near historically low levels.

Opinions remain sharply divided along political lines. Democrats continue to be very pessimistic, joined by independents, while Republicans remain relatively optimistic.

Such depressed confidence and strong consumption can coexist for a time, but they usually converge. We believe that a moderation in consumption will likely be the first step toward that alignment.

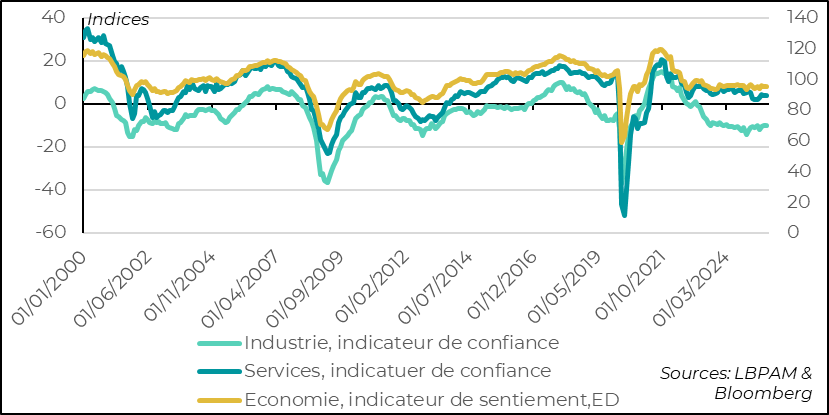

Eurozone: Confidence remains weak, especially in the industrial sector

Confidence remains weak, especially in the industrial sector

The European Commission’s survey on economic confidence remained weak in September, even though the general business climate indicator edged slightly higher during the month. The weakness is still most pronounced in the industrial sector. This contrasts somewhat with recent PMI surveys, which have been slightly more favorable in recent months. Nevertheless, it’s clear that the impact of the U.S. tariff shock has undermined confidence.

We are awaiting the momentum expected from the German stimulus plan, which is set to begin this week and should be a very positive factor in restoring confidence and offsetting the negative effects of tariffs.

The speed of execution of this plan will be key to the credibility of European policymakers and to providing real support for domestic demand in the Eurozone, also backed by a more accommodative monetary policy.

China: Economic activity held up better than expected in September

The official PMIs signal stagnation

The official PMI survey, which tends to be skewed towards larger companies, indicated stable activity in September, albeit at a low level. At just 50.6 points—barely above the threshold separating growth from contraction—the composite PMI suggests that activity, particularly domestic demand, is struggling to gain momentum.

Les PMIs de S&P sont plus favorables

In contrast, the S&P PMIs delivered a more reassuring message. These surveys, which sample smaller and more export-oriented companies, showed a more pronounced rebound.

Notably, the manufacturing sector experienced a resurgence, demonstrating a degree of resilience in the face of tariff shocks.

While these figures offer a more optimistic view of the state of the Chinese economy, the official indices still point to fragile growth. In this context, like many observers, we anticipate stronger support for domestic demand from the authorities. The speed and scale of the response will partly depend on the severity of the negative shock from the trade war with the United States.

The rush for the yellow metal shows no signs of slowing down

Gold continues to shine

Gold has gained over 15% since mid-August, reaching new all-time highs.

Clearly, the uncertainties triggered by the COVID period—marked by highly accommodative monetary policies and the subsequent inflationary shock—have strongly supported gold.

Yet, even though inflation has not returned to target levels in many major economies, one might have expected gold to lose some of its momentum. That hasn’t happened.

In fact, since the onset of COVID, gold has even outperformed the S&P 500 over the period, including dividends.

It appears that in an increasingly fragmented global economy, geopolitical factors are playing a significant role in gold’s performance. It is well known that several central banks, notably China and Russia, have been major buyers of gold, aiming to reduce the dollar’s weight in their reserves.

However, it seems unlikely that the sharp rise in prices can be attributed solely to these actors. A broader sense of concern appears to be driving some financial players to seek refuge in this historical store of value.

In the very short term, gold may continue to shine. But the persistence of positive real interest rates could dampen investor appetite and push some to seek alternative investment vehicles. Of course, a further deterioration in international relations could keep certain investors clinging to gold’s luster.

Sebastian PARIS HORVITZ

Director of Research