The American consumer is at a standstill, which is never a good sign

Link

Markets ended the half-year on an upward trend, buoyed by the easing of geopolitical and economic tensions. But US consumer spending is weakening, Europe is stagnating, and China is holding up modestly. Summer could prove volatile.

Key Takeaways

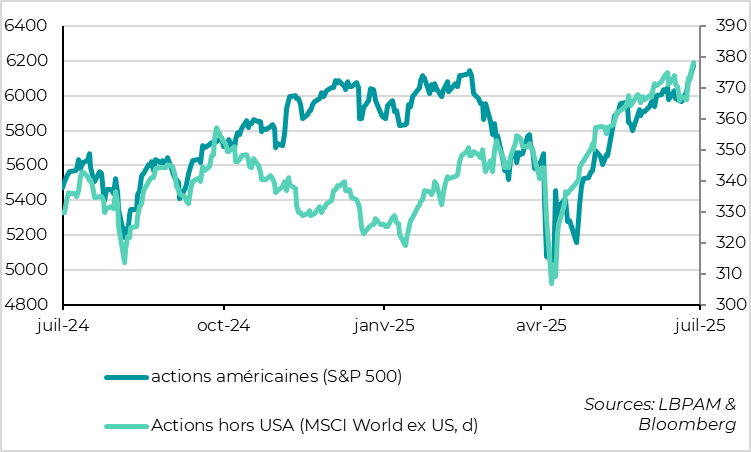

► The market is ending the first half of the year on a high note, with equities at new all-time highs. At the end of last week, the S&P 500 surpassed its February highs, and equities in the rest of the world were back above their pre-Middle East war levels (in dollar terms). This reflects the idea that, despite all the shocks of the first half of the year, everything always ends well: the trade war de-escalated, long rates eased after fiscal fears, the war in the Middle East only lasted 12 days, the US withdrew the foreign investment tax (section 899)...

► It's true that the worst-case scenarios have been avoided, which justifies the rebound in assets from their April lows and reduces the risk of a sharp correction in the future. But we still find it hard to believe that (1) there will be no further political shocks that could end up worse, and above all that (2) the shocks will not have a negative impact on the macro for the rest of the year. That's why we think the summer could be a volatile one for the markets.

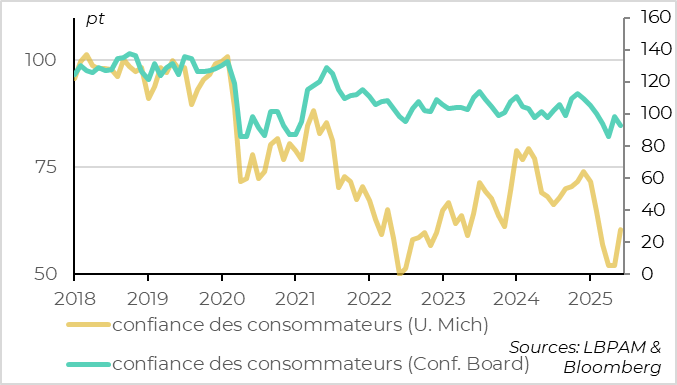

►In fact, the bad news on the macro level is that the American consumer has been at a standstill since the start of the year, even before the impact of tariffs on household purchasing power had begun. Consumption fell by 0.3% in May, after stagnating in April and being revised to just 0.5% for the 1st half. And household confidence remained low at the end of June, according to the final University of Michigan survey, even though it has rebounded slightly since April thanks to the easing of inflationary fears. The clear slowdown in the leading US growth engine points to a sharp decline in growth this year, even if a recession should be avoided.

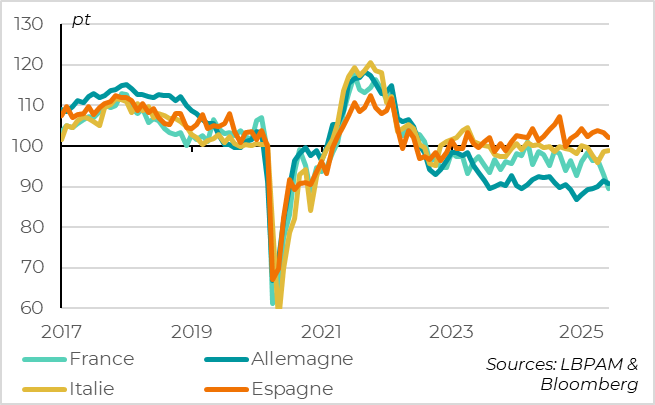

►In Europe, the June surveys were a little disappointing, pointing to stagnating activity in Q2 and still low confidence, which does not argue in favor of a clear upturn in activity this summer. We are positive on European growth prospects in the medium term, thanks in particular to the rise in public investment (in defense and especially in Germany), but believe that any acceleration will have to wait until the end of the year due to the negative impact of the trade war and uncertainties.

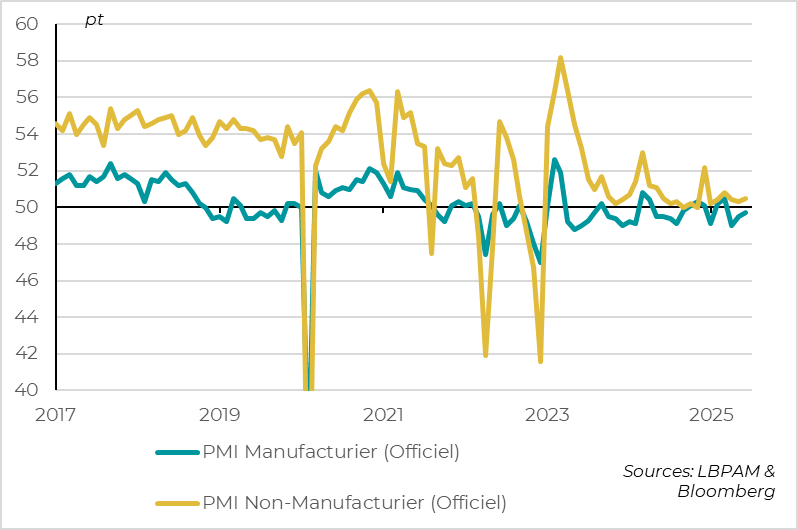

► The good news this morning came from China's official PMIs, which rose slightly in June following the truce in the trade war with the Americans announced in mid-May. The manufacturing PMI remains in contraction territory, but rose by 0.2 pt to 49.7pt. The non-manufacturing PMI rose from 50.3 to 50.5pt, driven by infrastructure. This confirms that Chinese growth remained resilient throughout the first half of the year, albeit limited and likely to slow slightly in the second half.

To Go Further

Markets: equities end first half at new highs

United States: consumption stagnates since the start of the year

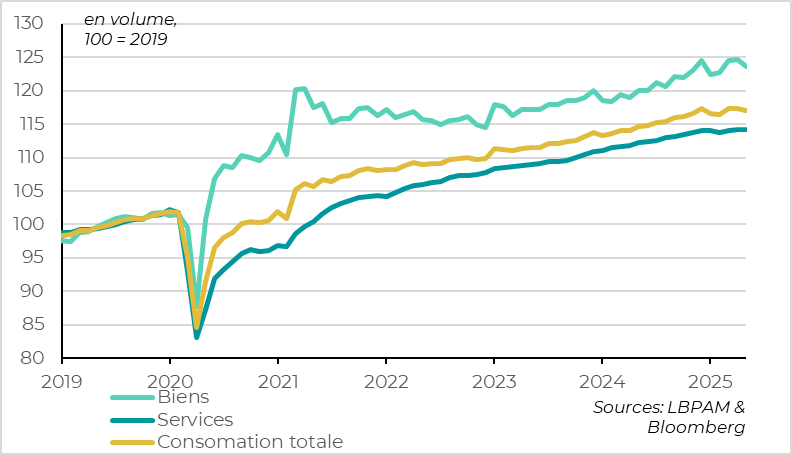

US consumer spending fell by 0.3% in volume terms in May, having risen by just 0.1% in April. They were also revised downwards significantly for the first quarter, during which consumption grew at an annualized rate of just 0.5%, compared with a previous estimate of 1.7%. Following these figures, the growth assumption for the 2nd quarter is only 1.5%, but the trend for the summer is zero.

The fall in consumption in May was due to a 0.8% drop in goods consumption, which was expected given the correction in car sales, which had been abnormally high in March and April in anticipation of tariff hikes. More worrying, however, is the slowdown in demand for services, which stagnated in May. While the weakness in service consumption is exaggerated by the drop in tourism-related demand (transport, hotels, etc.), it nevertheless points to a real loss of momentum for a sector that is not directly exposed to the trade war.

United States: despite slowing inflation in Q2 before impact of tariffs

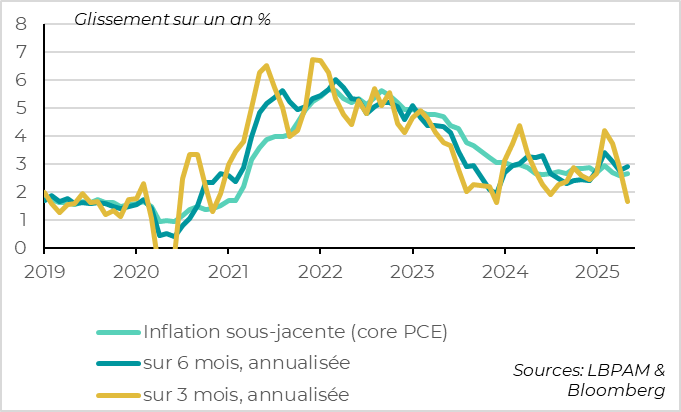

This slowdown in consumption is not due to rising inflation, which has in fact been limited over the past 3 months.

However, this is no reason for the Fed to accelerate its monetary easing, given that the inflationary impact of tariffs is still ahead of us and remains uncertain.

United States: this reflects a rise in the savings rate, not a fall in incomes

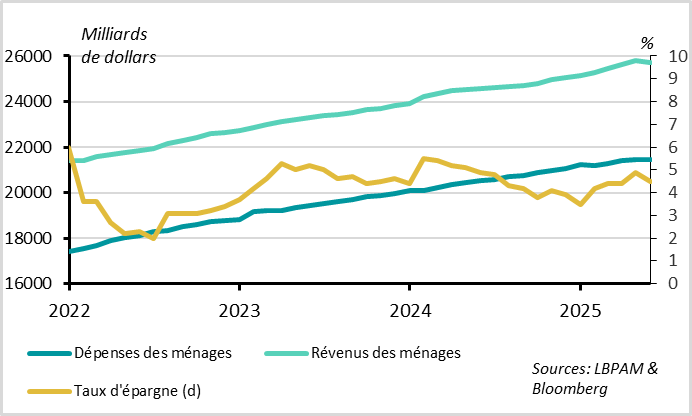

And household incomes remained buoyant. After 3 months of strong growth, household incomes fell by 0.4% in May due to the normalization of social transfers following exceptional payments in March-April. But wage income, which better represents the trend in household incomes, continued to grow by 0.4% over the month, thanks to rising employment.

Even before the impact of customs duties on goods prices and purchasing power, households have therefore reduced their spending as a precautionary measure. Beyond the monthly volatility linked to social transfers, the savings rate rose by one point in the first half, from 3.5% to 4.5%, and remains on an upward trajectory. This is consistent with the decline in household confidence over the period.

United States: consumer confidence stabilizes but remains weak

The final result of the University of Michigan survey confirms the slight rebound in consumer confidence in June from very low levels in April-May, rising from 52.2 to 60.7pt. But it remains, like confidence in the Conference Board survey, at a deteriorated level, well below its pre-trade war levels. While the peak of uncertainty seems to have passed, household confidence remains limited overall, encouraging a further rise in the savings rate.

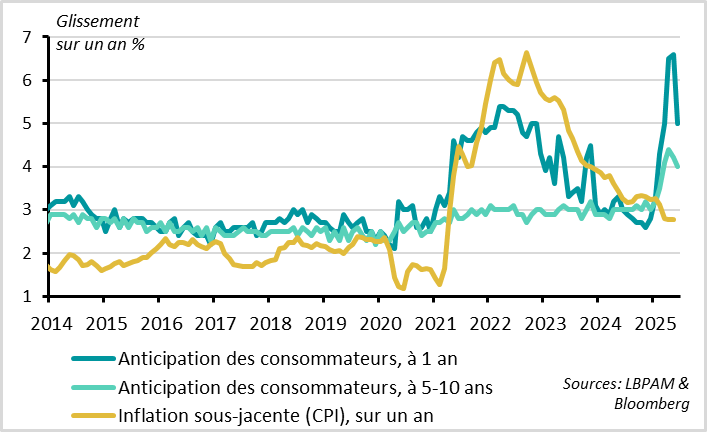

United States: inflation expectations slowly receding

The slight improvement in household confidence stems mainly from the easing of inflationary fears, which nonetheless remain high.

Thus, 1-year inflation expectations fell from 6.6% to 5% in June, while 5-year expectations dropped from 4.2% to 4.0%. However, these remain historically very high levels.

For the Fed, it is reassuring to see that inflation expectations are rapidly coming back into line. This could enable it to start cutting rates before inflation has fully returned to target. But the fact that inflation expectations are still too high argues for caution as long as the effects of tariffs push inflation upwards, which should be the case until Q4.

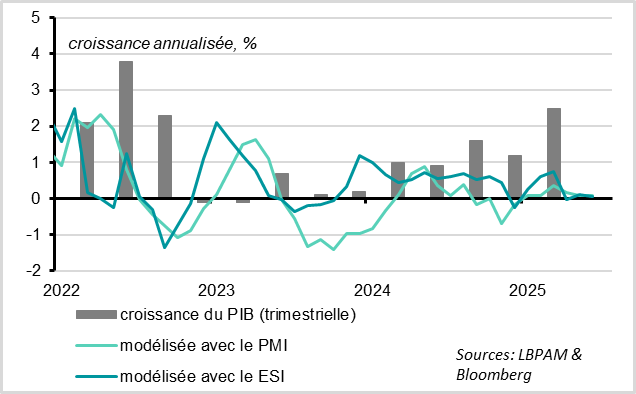

Euro zone: surveys point to stagnation in Q2

In the Eurozone, the Commission's economic sentiment indicator fell slightly but unexpectedly in June, from 94.8 to 94pt. Like the PMI, the Commission's survey is consistent with the economy stagnating in Q2.

The slight decline in June was due to a further drop in industrial and consumer sentiment, after a slight rebound last month.

On the other hand, confidence in services finally stabilized in June, after falling sharply since the start of the year, so that it remains positive. And confidence in the construction sector is returning to normal after stagnating since the start of the year. This is reassuring for domestic demand in the Eurozone.

Euro zone: sentiment falls in France in June, offsetting improvement in Germany

In terms of countries, 90% of the drop in Eurozone sentiment in June came solely from France, where the sentiment indicator fell from 93 to 89.6pt. This is its lowest level since the Covid, and the drop in the French indicator is widespread.

Like the PMI survey, the Commission's survey indicates that the gloom in France is deepening, offsetting in the short term the growing optimism in Germany linked to public investment prospects. This is not very encouraging at a time when the budget debate for 2026 is about to begin, and looks set to be a complicated one.

China: PMIs rise slightly in June

Xavier Chapard

Strategist