The American president backs down but doesn't give up

Link

Read Xavier Chapard's market analysis for April 30, 2025.

Summary

►In his speech celebrating his 100 days in office, Donald Trump's tone was once again a little more aggressive after the appeasement of recent days. He again criticized Jerome Powell, claiming that he knew “far more” about interest rates than the Fed Chairman. He also defended his economic policy and tariff hikes, making it clear that China deserved the heavy taxes imposed. That said, at the same time, the President signed an executive order to mitigate the impact of his auto tariffs.

►All in all, the administration's retreats since mid-April in the face of market volatility have shown that D. Trump is not prepared to weaken the markets too much (the Trump “put”) and have given the Fed a little leeway to limit the damage if necessary (the Fed “put”). This justifies the fact that markets are doing better than at the peak of the escalation. But we can't be too complacent, as economic policy is not going to normalize quickly, and the shocks of the first 100 days are going to weigh on the global economy in the months ahead. Against this backdrop, we think that the recent rebound in equities, which are almost back to pre-“Liberation Day” levels, is probably a little overdone.

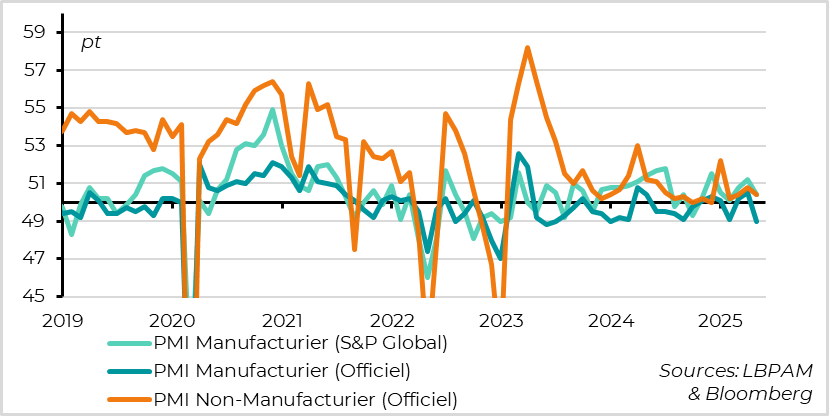

►The impact of these shocks is beginning to materialize in data from around the world. Chinese PMIs, for example, fell sharply in April, with a contraction in manufacturing activity pointing to slower growth in Q2. The authorities will need to step up their support for the domestic economy to stabilize growth as the trade war with the USA drags on.

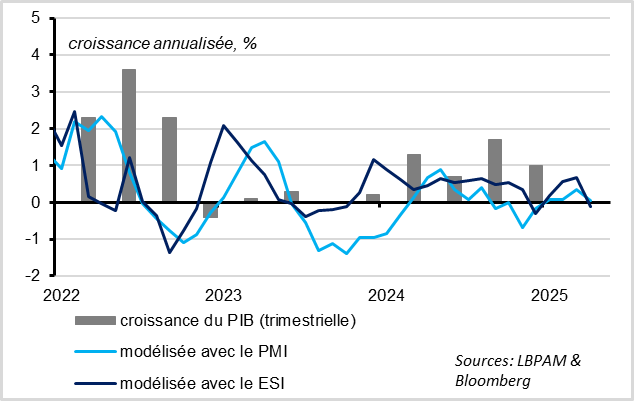

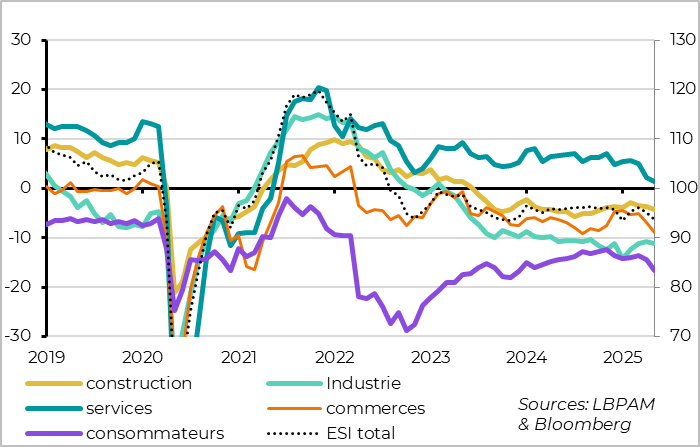

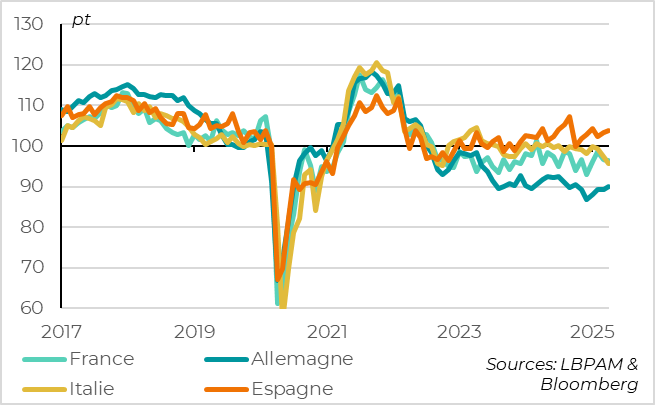

►In the Eurozone, the Commission's Economic Sentiment Index, a survey comparable to the PMIs used to monitor Eurozone business conditions, confirms the slowdown in April and suggests that the economy will stagnate in Q2. For the time being, this is in line with our scenario of a delayed but unchallenged recovery. However, the more pronounced fall in confidence in domestic sectors comes as a surprise to us and poses rather negative risks to our scenario.

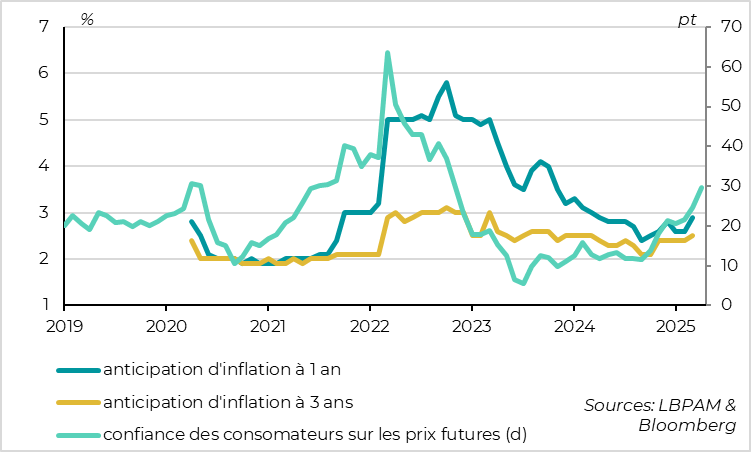

►In particular, the drop in consumer confidence in the Eurozone due to rising inflation expectations is surprising at a time when energy prices are falling, the Euro is appreciating and the ECB is cutting rates. If confirmed, this could limit the ECB's ability to cut rates aggressively.

►In the United States, the latest data indicate that the job market has slowed slightly since the start of the year, with a fall in vacancies, but that it remains solid at least until April. This is one reason why the Fed should be patient before lowering rates further. However, household confidence fell sharply in April, suggesting a sharper slowdown in the months ahead, which we believe should prompt the Fed to cut rates anyway this summer.

To go deeper

China: PMIs fall sharply in April, especially in industry

Chinese PMIs fall sharply in April, reflecting the impact of the escalating trade war with the United States. This confirms that growth is set to slow sharply in Q2, after surprisingly holding steady at 5.4% in Q1. That said, the slowdown is not unprecedented, and the authorities should increase their support for the economy further in the coming months to keep growth close to the 5% target this year.

Official PMIs indicate that Chinese manufacturing activity recorded its worst contraction since December 2023, with the manufacturing PMI dropping from 50.5 to 49 points in April. Both production and new orders fell back into contraction territory after the US raised tariffs by 145% in April. That said, the Caixin manufacturing PMI, more focused on small exporting companies, fell by a more limited amount and remained just above the 50pt limit (from 51.2 to 50.4pt).

At the same time, the official non-manufacturing PMI fell slightly, from 50.8 to 50.4pt, which remains a limited but positive level. This reflects a further slowdown in construction activity, while the services PMI is virtually stable at 50.1pt, close to last year's level. This suggests that, despite the rise in infrastructure investment, the real estate sector remains a drag on the economy, and that the authorities are in no hurry to increase their support for domestic demand in the short term. This is in line with the authorities' announcements last week that they are preparing for a protracted trade war and therefore for substantial but gradual economic support.

Eurozone: April surveys consistent with Q2 stagnation

The Eurozone Economic Sentiment Index fell more than expected in April, by 1.4 points to 93.6pt. This is its lowest level since 2020, which is historically consistent with zero growth in Q2, compared with 0.2% in Q1. This is in line with last week's drop in the composite PMI to 50.1pt in April.

Eurozone: confidence falls more sharply in domestic sectors

As with the April PMIs, the drop in sentiment is widespread, but more marked for sectors less exposed to foreign trade, suggesting that the negative impact of uncertainty is currently greater than the direct impact of US tariffs. This poses a risk to our scenario of a resilient European economy thanks to the recovery momentum of domestic demand.

Indeed, retail and consumer confidence took the biggest hit in April, driven by a sharp rise in price expectations and a worsening economic outlook. Sentiment in the services sector continues to fall sharply, approaching zero for the first time since the post-Covid rebound. On the contrary, sentiment in the manufacturing sector remained deteriorated, but virtually stable in April.

Eurozone: unexpected pressure on household inflation expectations

For the time being, the drop in confidence in April is still consistent with our scenario of a European recovery delayed to the end of the year, but not called into question. But if the sharp drop in confidence in the domestic sectors is confirmed in the coming months, this would increase the risk that the recovery in domestic demand will be aborted, despite the fall in energy prices, the resilience of employment and the easing of monetary policy.

All the more so as the perception of price rises weighing on consumer confidence is difficult to explain, given the fall in petrol prices and the rise in the euro. But it is confirmed by the ECB's survey of household inflation expectations, which rose in March. This could limit the ECB's ability to cut rates in accommodative territory, reinforcing our scenario of a rate cut that would stop at 1.75% after the summer (i.e. another two rate cuts from the current 2.25%), which is slightly less aggressive than market expectations of a rate close to 1.5% by the end of the year.

Euro zone: confidence falls in Italy but remains solid in Spain

On a national scale, Italy appears to be the country currently suffering the greatest impact on confidence, along with the Netherlands and Belgium. These three countries are particularly exposed to the United States. In contrast to the PMIs, confidence in Germany remained stable in April, albeit at a low level. This is due to the fact that the sentiment indicator, unlike the PMI, includes household confidence, which rebounded in April thanks to the stabilization of the political outlook following the February federal elections.

Confidence remains solid in Spain, suggesting that the country should continue to outperform this year. Spain grew by 0.6% in the first quarter according to the first GDP estimate, a slight slowdown after average quarterly growth of 0.8% in 2024. The slowdown was driven by private consumption, which nonetheless remained buoyant (+0.4% over the quarter and +3.5% year-on-year), while investment remained solid.

USA: job market slows only slightly in Q1

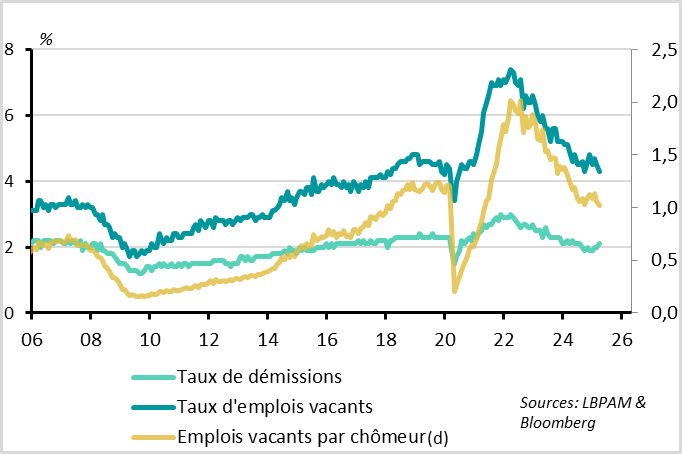

Flow data on the US labor market in March were mixed in the JOLTS survey, but overall point to a trend slowdown with no clear weakening in employment at this stage.

The number of job vacancies fell fairly sharply, from 7.8 to 7.2 million, so that the vacancy rate is back to its low point of last summer. With the number of unemployed slightly higher in March, the number of vacancies per unemployed person returns to 1.0 for the first time since the Covid. This is a solid level well above the historical average, but suggests a slowdown in corporate job supply compared with recent months.

At the same time, the number of redundancies remains historically low (1%), and the number of resignations picked up in Q1 (to 2.1% in March), a sign of household confidence in employment.

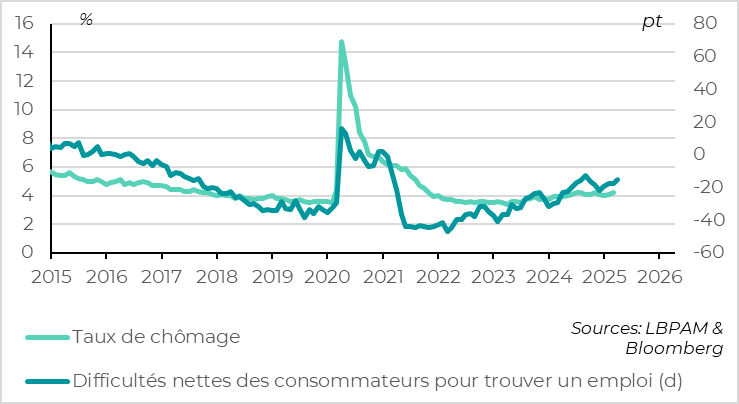

United States: households indicate that the job market remains resilient in April

This still seems to be the case in April, as households report only a marginal increase in the difficulty of finding a job, which remains historically limited at a level consistent with an unemployment rate still well below 4.5% in April.

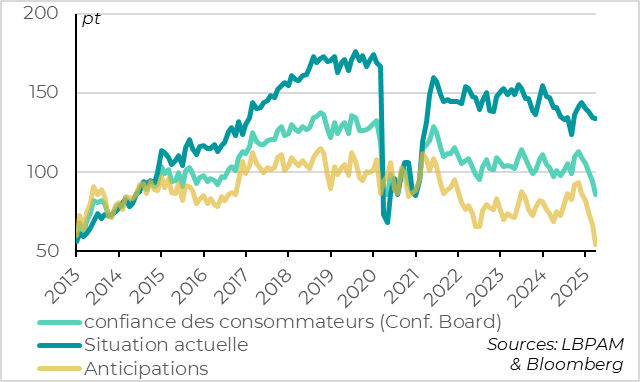

United States: but household confidence in the future falls sharply

Despite the resilience of the labor market, the Conference Board survey confirms that US household confidence fell sharply in April, with the total indicator returning to its Covid lows. This reflects a collapse in confidence in the future, which has fallen to its lowest level since the US downgraded its credit rating in the summer of 2011. In fact, confidence in the future has only been sustainably lower since the global financial crisis of 2008-2009. Against this backdrop, it's no surprise that President Trump's approval rating began to fall in April. And this despite households indicating that their current situation remains solid, better than last summer's lows.

Xavier Chapard

Strategist