The attack on Venezuela weakens global stability but has little impact on markets

Link

What are the key takeaways from the market news on January 06, 2026? Sebastian Paris Horvitz provides some insights.

Overview

► The beginning of this year has already been marked by significant geopolitical events. The United States has intervened militarily in Venezuela to capture N. Maduro, the country's president. He has already been brought before the US courts, which have charged him with various crimes, including drug trafficking. This direct intervention in a sovereign state brings to life the recent publication of the US government's new security strategy. It clearly emphasises the return of the Monroe Doctrine, understood as the control of the entire American continent by the United States.

►At this stage, it is difficult to fully grasp the medium-term geopolitical implications of this decision. Nevertheless, the US government has already threatened to intervene in other territories, including Greenland, to defend US interests. This could exacerbate geopolitical tensions in the medium term and create “risk premiums” on certain assets. On the other hand, in the short term, the impact of US intervention in Venezuela should have a limited impact on the markets.

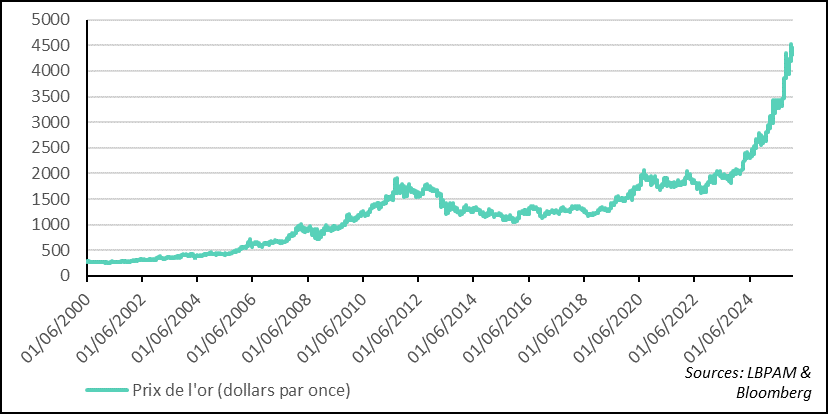

►In the short term, geopolitical risk appears to be maintaining upward pressure on the price of gold, which remains close to its historic highs ($4,500 per ounce). However, given the size of the Venezuelan economy (0.1% of global GDP), the impact of the intervention is negligible. Furthermore, as an oil producer, Venezuela accounts for only 1% of global production and much less in terms of exports.

►From an economic perspective, at the start of 2026, we received the first activity figures for the manufacturing sector for the month of December. According to S&P's final PMI surveys, global activity continued to lose some momentum. Indeed, the overall index compiled by JP Morgan has been declining since July, but remains in expansionary territory, albeit indicating very weak growth.

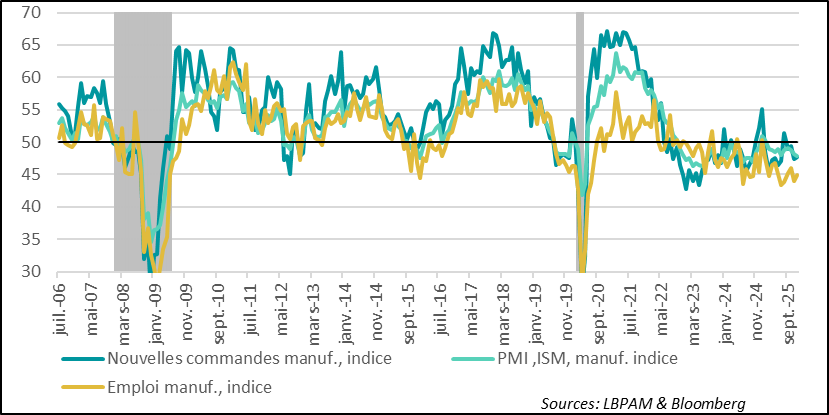

►According to the PMI index, industrial activity in the United States—although slowing—remains one of the strongest among major countries. The survey shows that production remains solid and employment is picking up again, but new orders have moved into contraction territory. However, the message from this survey contrasts with the ISM survey, which is considered more reliable. According to the ISM, manufacturing activity contracted more sharply in December than in the previous month. Even though production continued to grow, new orders remained in contraction. At the same time, both the ISM and S&P surveys continue to show strong upward pressure on input prices. This could signal future price increases for their clients, which may ultimately be passed on to consumers.

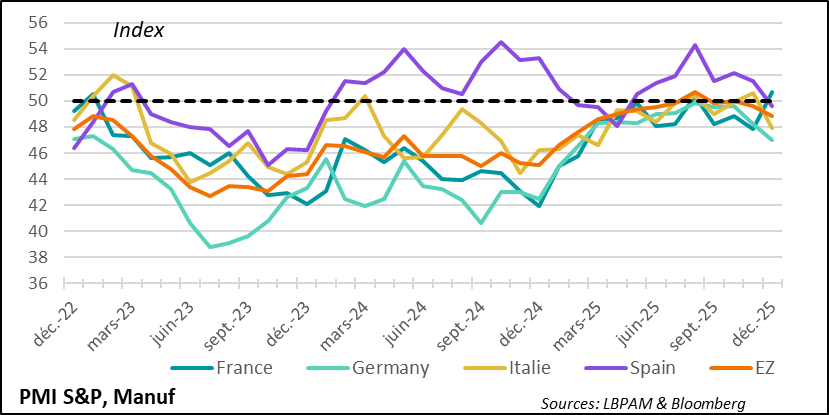

►In the Eurozone, activity according to S&P’s final PMI survey continued to contract in December, more sharply than in the previous month. In fact, the index reached its lowest level since February 2025. The bad news is that the countries that had been holding up best so far—particularly Spain—showed a significant loss of momentum. The Spanish index has actually fallen back into contraction territory.

The good news came from France, where activity returned to growth. Nevertheless, these figures show that the effects of Germany’s fiscal stimulus have not yet filtered through to the manufacturing sector. Indeed, in December Germany posted the lowest level of activity among the major countries in the Eurozone. This development should also be seen as a signal for caution regarding the Zone’s growth outlook and could temper the ECB’s very confident narrative.

Going further

Venezuela: limited short‑term impact, questions for the future

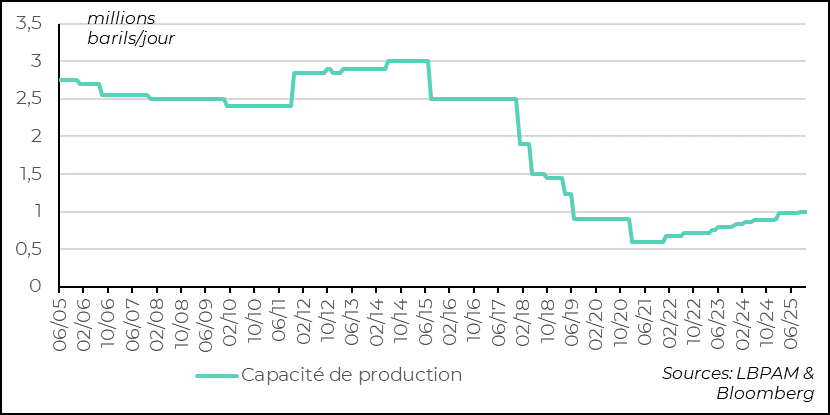

Reduced oil production capacity

Nicolás Maduro, the president of Venezuela, has been captured by the United States in a military operation carried out on Venezuelan territory. The last operation of this kind in Latin America took place at the end of 1989, with the invasion of Panama and the capture of the country’s self‑proclaimed president, Mr. Noriega. Noriega was a notorious trafficker, but also, for many years, a CIA operative and Panama’s strongman, supported not only by the United States but also by other Western countries. This intervention was condemned by the UN General Assembly, just as the capture of N. Maduro has now been condemned.

In a way, this intervention demonstrates the implementation of the new security strategy recently published by the Trump administration, which emphasizes that the Monroe Doctrine is back—that is, the foreign policy approach toward the entire American continent, viewed as a strategic sphere of U.S. dominance.

After the military operation, D. Trump threatened other countries in the region and announced the imminent fall of the Cuban regime, which is highly dependent on oil supplies from Venezuela. Nevertheless, the U.S. president also floated the idea of taking control of Greenland.

For now, following N. Maduro’s capture, a new government is in place in Venezuela, led by Delcy Rodríguez, until now the vice president (since 2018). She was appointed president yesterday. According to statements from the White House, the United States is ready to work with the new authorities. Likewise, Ms. Rodríguez has declared that she intends to cooperate with the United States.

At this stage, this does not constitute a regime change or a democratic transition. The leader of the opposition, Ms. Machado, recently awarded the Nobel Peace Prize, has been excluded from any negotiations. D. Trump’s objective seems primarily aimed at securing control over the country’s oil production capacity. Negotiations are reportedly already underway with U.S. companies to resume exploitation of Venezuelan oil resources, noting that Chevron had been allowed to remain in Venezuela.

For the markets, the recent events have little short‑term impact. Venezuela, despite having nearly 30 million inhabitants, accounts for only 0.1% of global GDP. Moreover, as an oil producer, it represents less than 1% of global output, and its exports are very limited—though they remain the country’s main source of revenue. The country’s production capacity has been divided by three over the past 20 years due to sanctions and lack of investment.

At the same time, any increase—however slow—in Venezuela’s oil production would add to the excess supply that is currently keeping oil prices low. In fact, from a strategic standpoint, the most significant effect could be the dominance of U.S. oil companies over the country’s resources.

Gold prices are returning toward their record highs

In the medium term, D. Trump’s unilateral intervention further deteriorates the global geopolitical balance. We are clearly entering a new era, with some of the world’s major economic or military powers seeking to assert their dominance over certain regions of the world, driven by heightened nationalist ambitions. The global order that had been built for decades on multilateral rules appears to have run its course.

The uncertainties and risks associated with this emerging new world are extremely difficult to assess. Perhaps only the rise in gold prices, rebounding and approaching once again their historical high (4,500 dollars per ounce), seems to reflect some of these risks.

For now, markets remain more focused on the ability of the global economy to rebound in 2026, supported in particular by pro‑growth economic policies. As we expected, risk‑taking is clearly dominating the beginning of the year.

Manufacturing activity: Growth slowed at the end of 2025

Global industrial activity slows in December

As we anticipate a rebound in global activity at the start of this year, the end of 2025 was marked by a slowdown in the manufacturing sector, according to S&P’s final PMI survey for December. Nevertheless, activity continues to grow. In fact, this slowdown was visible in almost all major countries or regions, but it was most pronounced in the euro area.

The United States remains the most resilient economy according to S&P’s survey, despite a deceleration in activity during the month. In contrast, activity in China experienced a slight pickup. Industrial activity in the country still appears to be supported by the export sector, which remains one of the main drivers of growth. We continue to believe that Chinese authorities will gradually seek to stimulate domestic demand in the early part of this year.

United States: The ISM manufacturing survey remains weak

The relatively solid tone of manufacturing activity reflected in S&P’s PMI indicator for the United States contrasts once again with the December ISM survey. Indeed, the ISM shows that industrial activity is contracting again, and even more sharply than in the previous month. New orders remain particularly weak, still in contraction territory. Similarly, on the employment side, firms appear to be adopting a very cautious stance. However, the initial effects of the tax incentives included in the budget to stimulate investment should, in our view, provide some additional momentum to activity in the first half of 2026.

At the same time, it is important to highlight that input price pressures remain high, notably due to rising tariffs. This is reflected in both the ISM and S&P surveys. This poses a risk for inflation in 2026, as a more favorable economic environment could encourage firms to ease margin pressures and pass through tariff‑related price increases more aggressively to their customers.

Euro Area: Industrial activity slows… except in France

In the Euro Area, industrial activity data were disappointing according to S&P’s final survey for December. Activity deteriorated more than expected. In particular, countries that had maintained a favorable industrial momentum appear to have experienced a soft patch in December. This was notably the case in Spain, where the activity index fell back into contraction territory after spending most of the year in expansion. In our view, this setback should be temporary, but vigilance remains warranted—especially as Germany continues to see its industrial activity weaken. The only positive news came from France, where activity moved back into expansion.

We still believe that the German fiscal stimulus plan should support growth in 2026, but the persistent negative effects on external trade due to higher U.S. tariffs should not be overlooked. In any case, this slowdown in activity is likely to temper the ECB’s rather optimistic tone regarding growth and its current monetary policy stance.

Sebastian Paris Horvitz

Head of Research