The debate on further rate hikes remains unresolved after Jackson Hole

Link

- At the long-awaited Jackson Hole conference (the Fed's big annual conference) this weekend, Powell (Fed) and Lagarde (ECB) gave no clear indication as to whether they would raise rates again in September, although they did reaffirm the need to keep rates high for some time. This contrasts with last year's conference, when all the central bankers warned that they would raise rates sharply to combat inflation.

- Against this backdrop, the forthcoming macroeconomic data will be closely scrutinised to decide whether any further rate hikes are necessary between now and the end of the year. This will start with the Eurozone's inflation figures for August, published on Thursday, and the US employment figures published on Friday.

- Our central scenario is that the Fed and ECB will not raise rates further in the coming months, although the risk of a final rate hike cannot be ruled out. Above all, we believe that the central banks will maintain a hard line until the end of the year, keeping open the possibility of more rate hikes, and will not cut rates until at least the end of the first quarter of next year.

- The markets showed little reaction to the much-anticipated but rather balanced and vague speeches by the central bankers. They anticipate that the risk of a final rate hike by the Fed and the ECB is less than 50% for September and two-thirds by the end of the year. The market's scenario is a little higher than ours, but on the whole it seems reasonable given the high level of uncertainty, hence our neutral to positive stance on bonds.

- In the UK, Broadbent, a deputy chairman of the Bank of England (BoE), has suggested that the BoE could raise rates again. We expect two more rate hikes from the BoE, as wage pressures continue to surprise on the upside, but no more due to signs of a more marked economic slowdown this summer after a solid first half. This is slightly less than the markets were expecting, which could weigh on the pound.

- In Japan, Bank of Japan (BoJ) Governor Ueda reaffirmed that monetary policy in Japan should remain accommodative, as the central bank expected core inflation to remain below the 2% target. Core inflation reached 4% in mid-2023, the highest since the 1980s, but wages and inflation expectations had not risen sufficiently to ensure inflation would remain at 2% for long. He did not comment on the exchange rate, which depreciated again after the BoJ's decision in July to allow 10-year interest rates to rise a little further (to 1% from 0.5%).

Powell and Lagarde discussed why it is difficult to decide whether to raise key rates a little further, but gave no clear indication as to whether or not they will raise rates in September.

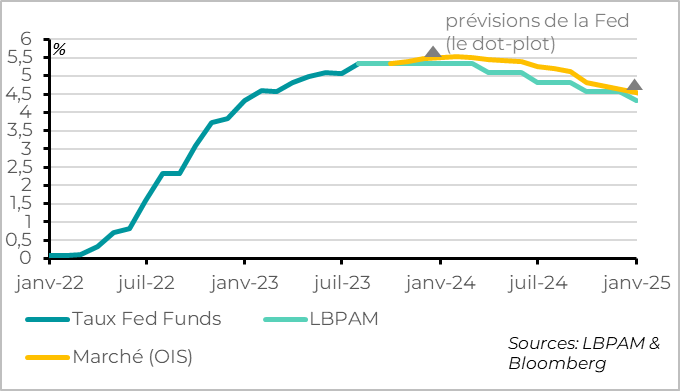

Fig.1 Fed: the key rate has probably reached its high point, despite the risks still being on the upside

Powell's speech may have seemed harsh at first sight. He insisted that the Fed was ready "to raise rates further if necessary" and thought it would "keep policy in restrictive territory" until it was confident that inflation was falling towards the target on a sustainable basis. And given the unexpected re-acceleration in activity this summer, he indicated that the disinflation process remained uncertain and had "a long way to go". Finally, he reaffirmed that the Fed's target "was and would remain" a return of inflation to 2%, while some analysts are speculating on a rise in the inflation target.

This argues in favour of keeping rates high for some time, with the aim of bringing inflation back towards 2% and not stopping once inflation has returned permanently to 3%. This has been our scenario for a long time, and the market took it on board better in August by reducing its expectations of a rate cut next year.

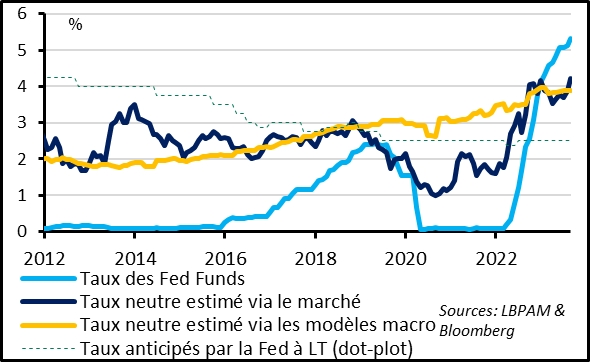

Fig.2 Fed: Powell confirms that the level of the neutral rate is uncertain but that current rates are indeed restrictive

But Powell's stance was less aggressive than in recent months, suggesting that the Fed was moving into a new phase where risk management (in both directions) was becoming more important. Indeed, Powell said that the Fed would "proceed more cautiously" in future meetings, giving itself time to analyse the evolving data and outlook. This position is supported by the sharper slowdown in inflation since June, which allows the Fed to take its time. We believe that the Fed will take a pause in the coming months and, if we are right that growth will slow more markedly towards the end of the year, that it will not raise rates beyond their current level.

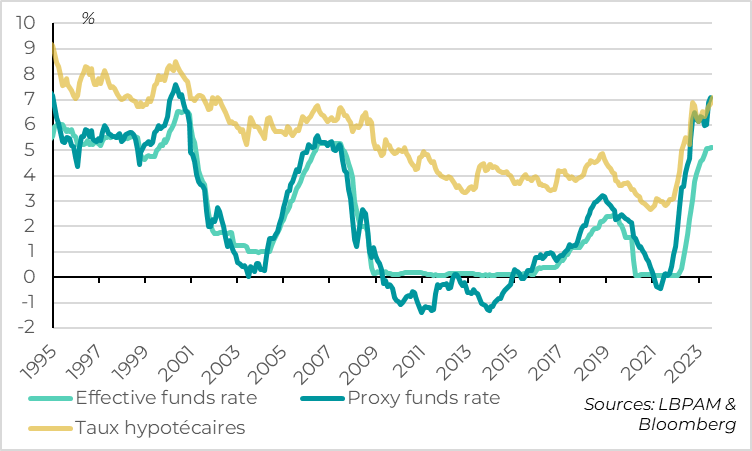

Fig.3 Fed: Unlike in the first half of the year, the markets have been helping the Fed by setting more restrictive financial conditions since the summer.

In contrast to the first half of the year, the markets have been doing some of the Fed's work since June. The rise in long-term rates on the markets and its negative impact on the price of risky assets are leading to a tightening of financial conditions for the economy, despite the slowdown in key rate hikes. This is one of the reasons why we expect the US economy to slow more markedly in the coming months, even if the Fed does not raise rates further.

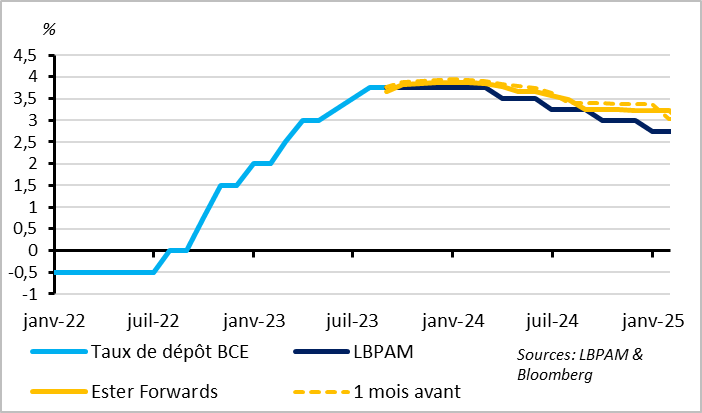

Fig.4 ECB: The debate over a final rate hike in September remains open

On the ECB side, Lagarde gave no more indication of the September meeting than she did after the July meeting: it could be a pause or a hike. While she reiterated the ECB's tough message (rates will be raised as much as necessary for as long as it takes), she also stressed the high level of uncertainty in this new post-Covid economic regime. For example, the risk of structurally higher inflation would argue for higher rates, but the current economic slowdown suggests that the impact of past rate hikes could be greater than anticipated.

We are leaning towards a pause, given the sharp deterioration in economic conditions this summer, although the risk of a hike cannot be ruled out given that underlying inflation will not have shown any clear signs of slowing by then.

The ECB's difficult position is reflected in the speeches made by its members since Lagarde's speech. The usually aggressive members have been quick to indicate that more rate hikes remain necessary until inflation slows more clearly. On the other hand, the usually more cautious members would like to see a pause in rate hikes until the extent of the current economic slowdown becomes clearer. The forthcoming data, and above all the new economic projections from ECB staff, will be decisive for the September decision.