The debate over the landing of the economies persists

Link

-

Since the last Fed meeting at the beginning of the month, when Jerome Powell seemed to indicate that the Fed had finished its campaign of rate hikes, we have seen a complete reversal of the trends of the summer. Indeed, the fever that had gripped interest rates, pushing US 10-year yields towards 5%, turned into a chill, with a fall of more than 50 basis points, accompanied simultaneously by major rate cuts in most of the major countries. This, in part, helped to fuel risk-taking with powerful gains on the stock markets, wiping out much of the decline of the previous three months. The Nasdaq even came close to its high for the year. In our view, this reversal of fortune reflects the return of the scenario of a very soft landing for the US economy (i.e. a moderate and temporary slowdown in growth) as the dominant view, and of short-term stagnation in activity in Europe. This would be sufficient for inflation to fall sharply to around 2% and, above all, would be accompanied by a rapid cut in key interest rates. We remain on the side of a much sharper slowdown, particularly in the United States.

-

In our view, growth momentum is crucial in determining the direction of monetary policy. If we are to succeed in bringing inflation down towards 2%, we believe that the labour markets need to loosen up, particularly in the US, so that wage growth continues to moderate. This should lead to a moderation, or even contraction, in consumption and, ultimately, in the economy as a whole. Such an environment is generally not very favourable for risky assets. Analysts are still expecting corporate profits to rise in 2024. Above all, many market participants expect the Fed to cut interest rates sharply, even if the economy holds out. The almost Pavlovian market reflex since the start of the new millennium has been that any sharp cut in key interest rates is associated with a rise in risky asset prices. In our view, this is too risky a gamble in the current circumstances. Much of the resurgence in inflation has been driven by a demand shock in the US, something that has not happened since the 1980s. Demand will surely have to slow further to ensure that the central bank achieves its objectives.

-

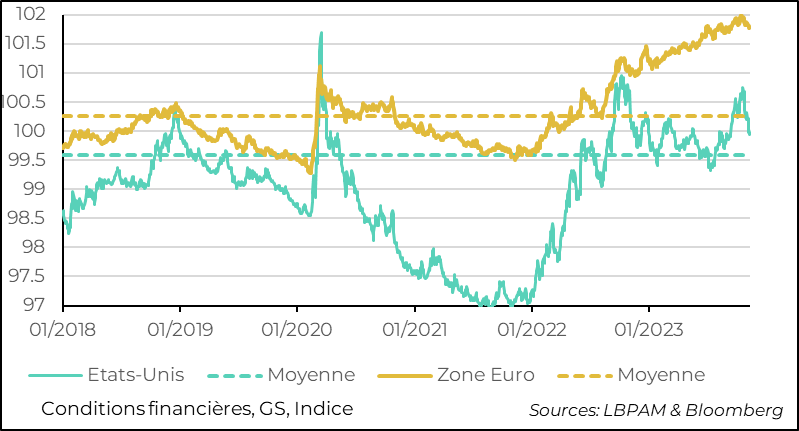

Paradoxically, by already lowering the key rates of central banks, particularly the Fed, the market is also softening financial conditions, which could prove counter-productive for the Fed as it seeks to cool the economy. In fact, as long-term interest rates soared, the Fed even decided to highlight the role played by financial conditions in its decision in its latest monetary policy statement. It used their sharp tightening to justify its caution and inaction. How should the Fed react when they have returned to a neutral stance in just a few weeks? The good inflation figures for October should not lead us to complacency. The trajectory of the US economy, and of inflation in particular, is still very uncertain, even if both are heading towards moderation.

-

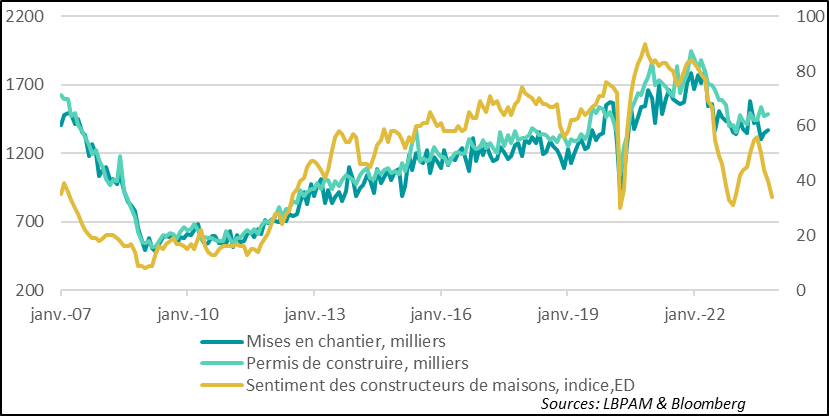

Data from the US continues to blow hot and cold. Particularly in the sector that is most sensitive to interest rates, real estate. Some segments are suffering, while others seem to be holding up. Nevertheless, we would like to see some consistency in the figures. However, the latest figures for October on housing starts and building permit applications were much better than expected, showing growth over the last month rather than the expected contraction. This is at odds with the housebuilders' survey, whose index fell to its lowest level since 2020. In the face of the housing shortage, and despite very high mortgage rates, it seems that certain segments of the market are holding up somewhat, but it is difficult to foresee a lasting rebound as long as the cost of credit remains so high.

-

The coming year will see elections in a large number of countries. In particular, we are concerned about the US presidential election, which will be important for the direction of world affairs. Nevertheless, we would like to hope that there will be some pleasant surprises, or at least that we will not be strangely surprised. If Argentina is a guide to what lies ahead, then we can expect to be troubled. The Argentinians have decided to experiment. While rejecting the populist option of the ruling Peronists, whose year-on-year inflation in September was 142%, they elected a far-right libertarian, Javier Milei, to the presidency. He is a professor of economics and a member of parliament (for nearly two years). His highly controversial positions are numerous. But the flagship measure in his programme is the abolition of the Central Bank and the dollarisation of the economy. Negotiations underway with the IMF to repay the country's debt look set to be rather stormy, and the trajectory of the Argentine economy difficult to predict.

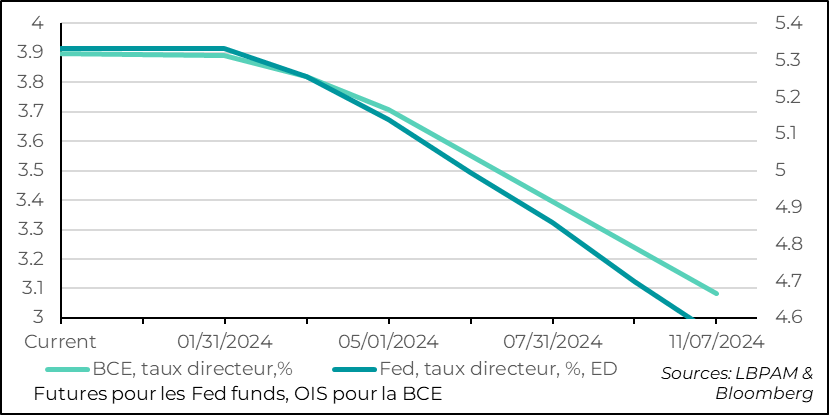

Over the past week, the markets have stepped up their expectations of major rate cuts by central banks in 2024. In the United States, these cuts were fuelled by the interpretation of Fed Chairman Powell's statements, which suggested that the rate hike campaign was coming to an end, by signs of moderation in the labour market, with the rise in the unemployment rate, and by a slightly stronger-than-expected deceleration in inflation.

In addition to the influence of the US market, the continuing slowdown in growth in Europe has also helped to fuel this trend towards a strong loosening of the central bank vice next year.

Thus, for 2024, market expectations are for an even faster cut in key rates than previously on both sides of the Atlantic, reaching at least 100 basis points by the end of 2024. This would be the result of a rapid fall in inflation.

In Europe, the easing would come from a slowdown in activity. This is in line with our scenario.

In the United States, on the other hand, expectations are of a moderate and short-lived slowdown in activity, which would be sufficient to allow this rapid fall in inflation. Thus, the inflationary pressures associated with the excess demand would dissipate without a marked adjustment. This scenario is not impossible, and would reveal that it was mainly a succession of supply shocks that were at the root of the inflationary surge.

The strong wage increases show that this is not necessarily the case. Thus, our scenario of significant Fed rate cuts is accompanied by a much sharper slowdown in activity, even though we do not believe at this stage that we are heading for a severe recession in the US.

Fig.1 Key rates: The market forecast for key rate cuts has increased for 2024

Changes in financial conditions over the past few weeks have made it difficult to interpret the trajectory of the US economy. Indeed, the Fed had rightly decided to point to the very sharp tightening in financial conditions up to the end of October to justify its decision to maintain the status quo on monetary policy, i.e. not to raise key rates. Since then, the sharp fall in interest rates across the entire US yield curve, the strong rebound in stock markets and the fall in the dollar have eased financial conditions considerably, to the point of wiping out all the tightening seen in October.

Financial conditions have returned to a neutral level.

At this stage, the argument that financial conditions are loosening sharply is fading as a guide to the Fed's decisions. However, the moderation in inflation, which was stronger than expected in October, surely remains a factor. Nevertheless, as J. Powell has already said, one figure cannot be judged as a trend, although caution will continue to be the order of the day.

We believe that the Fed will maintain its status quo, particularly as the economy continues to slow. November's employment figures at the Fed's monetary policy meeting in mid-December will undoubtedly play an important role, as will inflation figures the day before.

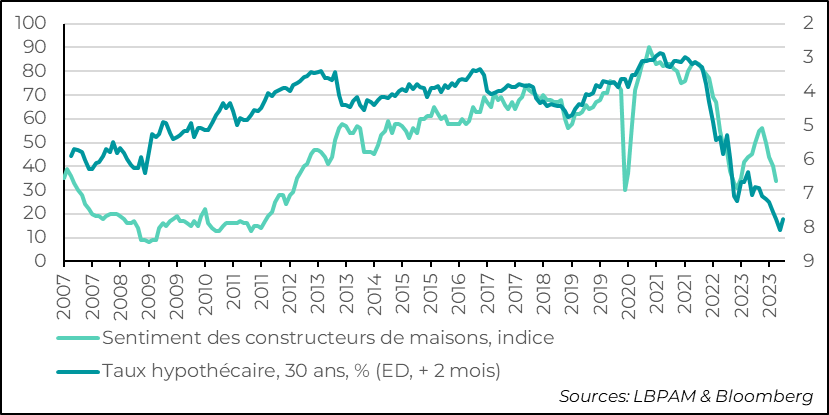

The sharp easing in long-term rates in the United States has obviously also been reflected in mortgage rates. But they remain at very high levels. In fact, the 30-year mortgage rate is close to its highest level since the start of the new millennium.

This should continue to weigh on construction activity and demand for credit. Nevertheless, certain structural factors, notably the shortage of housing supply, seem to be preventing a more marked collapse in activity in this sector.

So, while housebuilders are taking a very gloomy view of activity (the NAHB index is close to its lows), the figures for housebuilding in October surprised on the upside. Both the number of housing starts (which are sensitive to the weather) and building permit applications rebounded, whereas expectations were for a continued contraction.

Fig.3 United States : The rise in the cost of credit is affecting activity in the property sector, but not uniformly...

Nevertheless, it is hard to believe that the property sector can turn around quickly given the level of the cost of credit. Most likely, the weakness will continue, especially if we see a deterioration in the US labour market in the months ahead, as we expect.

Fig.4 United States: ...nevertheless, it is difficult to imagine a rebound in activity with the cost of credit so high.