The ECB could accelerate rate cuts

Link

Market Analysis for September 30, 2024 by Sebastian PARIS HORVITZ

In summary

►Last week, markets were buoyed by announcements from Chinese authorities aimed at supporting a slowing economy. This week, more details on the promised fiscal measures are expected. Additionally, the drop in oil prices has helped reduce inflation and support growth through purchasing power, further fueling risk-taking. Nevertheless, the trajectory of monetary policies remains a key driver for the markets.

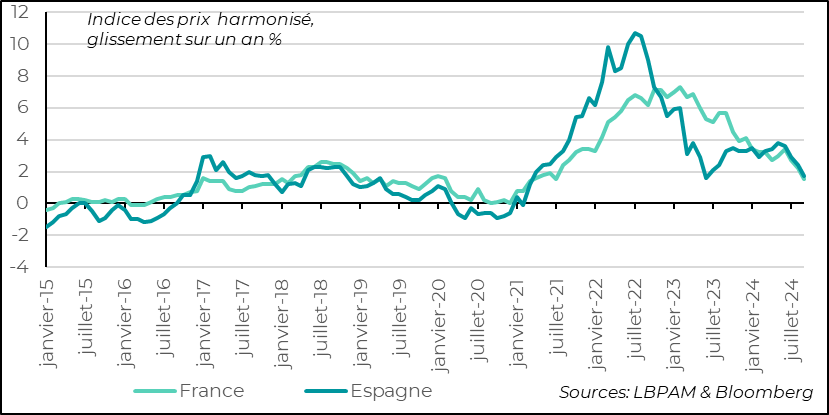

►Following mediocre growth statistics for the eurozone in September, the initial inflation figures point to an acceleration in the decline of inflationary pressures. This leads us to consider that a rate cut as early as October now seems very likely. Indeed, the drop in inflation in France and Spain in September (falling below 2% year-on-year) was much stronger than anticipated, primarily due to the decline in energy prices. In our view, this offers a timely window for the ECB to accelerate its rate cuts. We maintain the scenario of another cut in December.

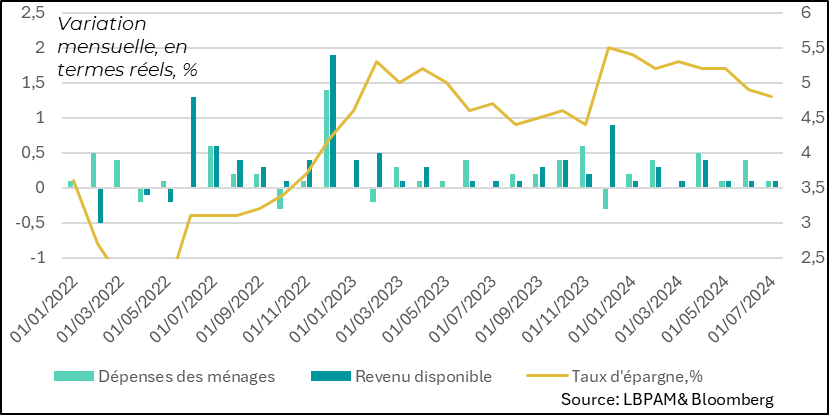

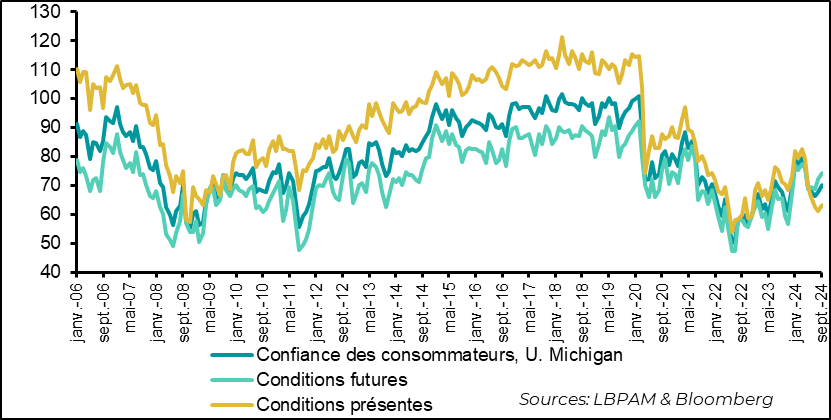

►In the United States, household consumption, as anticipated, slowed significantly in August after the rebound in the previous month. The contraction in goods purchases is behind this moderation in consumption. This corroborates our projection of a moderation in spending appetite in the coming months. At the same time, confidence remains resilient, even rebounding in September according to the University of Michigan survey. Employment figures, to be published next Friday, will provide more insight into the supports still benefiting consumers. These data will likely add a degree of volatility to the markets.

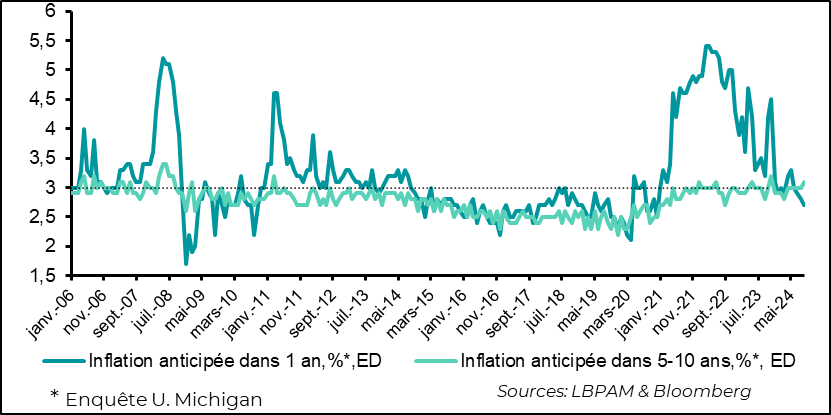

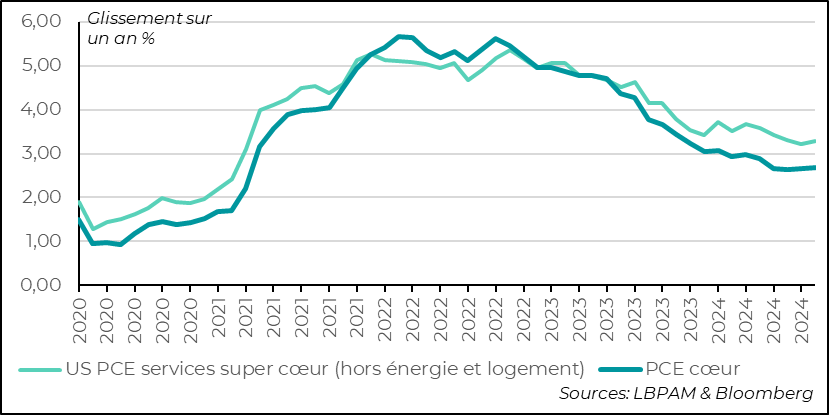

►On the inflation front, the publication of the Personal Consumption Expenditures (PCE) deflator, the Fed’s preferred gauge for tracking inflation, came in slightly weaker than expected in its monthly variation for the core part. However, on an annual basis, it slightly accelerated to 2.7%, as expected. As in other developed countries, inflation in services, including non-housing services, remains more stubborn to decrease. The expected deceleration in wages should help gradually slow the price dynamics in services.

►In Japan, the unexpected appointment of Shigeru Ishiba as the head of the ruling party, the LDP, created a negative shockwave in the markets. This veteran and former Defense Minister is perceived as less inclined to support the markets. He seems more committed to supporting the independence of the BoJ in its ongoing gradual monetary tightening campaign. Additionally, he holds tougher positions towards China and wants to “rebalance” relations with the United States. He is expected to take the post of Prime Minister following a parliamentary vote on October 1st. We will see how he attempts to reassure the markets.

To go deeper

Recent economic indicators in the eurozone have been rather mediocre, showing weakened growth. In this context, the preliminary inflation figures for France and Spain for September have gained significant importance. Indeed, they indicate a much stronger deceleration in inflation than anticipated.

In France, for the first time since the summer of 2021, total inflation has fallen below 2%, while in Spain, this is the first time since the spring of 2021, following a brief episode in June 2023. A significant part of this decline in inflation is due to the drop in energy prices. However, it is particularly noteworthy that core inflation also seems to have begun a welcome decline.

It is expected that the rest of the eurozone will follow, especially Germany. The figures for Germany will be published today, and those for the eurozone tomorrow.

Eurozone: Inflation Finally Appears to Decline More Rapidly as Indicated by September Figures for France and Spain

If this is the case, as we believe, the ECB would have a window to accelerate its rate cuts. Until now, we thought it would opt for a more gradual approach.

Indeed, these inflation figures, amid the deteriorating economic situation and the potential restrictive effects of upcoming fiscal policies in some countries, should push the ECB to anticipate an even more benign inflation trajectory in the coming months.

Thus, like many in the market, we believe that the probability of a 25 basis point (bp) rate cut as early as October has become very high. We also maintain the scenario of a rate cut in December (25bp). In fact, it seems to us that the ECB should rather advance the “agenda” of its rate cuts, rather than maintain too much gradualism. The European economy seems to be in strong need of monetary easing to relax credit conditions and support growth.

It is certain that the upcoming decisions will be complex within the ECB’s Governing Council because the deceleration of inflation, although on track, may not be linear. We could therefore face some bumps. In particular, the decline in wage growth will be one of the gauges the ECB will use, even though the evolution of demand will be crucial in the disinflation process.

In the United States, household consumption moderated in August as expected, after the very strong rebound in the previous month. It is mainly the slowdown in goods purchases that is behind this trend, given the sharp increase in July. Spending on services progressed at roughly the same pace as the previous month.

In our opinion, this moderation in consumption should persist in the coming months. Indeed, the continued moderation in the labor market should push households to slightly adjust their savings behavior after the continuous decline we have observed in recent months. This would also be consistent with the ongoing decline in interest rates.

United States: Household consumption weakened in August, while the savings rate continued to decline

The employment report figures, to be published this Friday, should provide more insight into the labor market dynamics. Continued easing would be consistent with a period of calm in consumption appetite and contribute to a more or less smooth landing of the U.S. economy.

For now, there does not seem to be a dynamic of massive layoffs, as shown by the low unemployment claims statistics. At the same time, surveys indicate that the labor market is normalizing and the excess job openings have significantly decreased.

In fact, it is difficult at this stage to fear an abrupt deceleration in consumption. This is confirmed by the final University of Michigan survey on household confidence, which rebounded well in September, reaching its highest level in five months. Nevertheless, it remains at a relatively low level compared to its historical average. This trend is largely linked to rather pessimistic views on the current situation, especially on the eve of the upcoming elections. However, optimism about future economic conditions is gaining ground.

United States: In September, Consumer Confidence Reaches Its Highest Level in 5 Months, with a More Optimistic Outlook on Economic Prospects

The survey also shows that the sharp drop in energy prices reinforces households’ view of price easing for the coming year. However, medium-term inflation expectations remain at the higher end of recent years. This is a trend to watch for the Fed.

United States: Short-term inflation expectations remain low with the drop in energy prices, but are at their highest in the medium term

These dynamics are consistent with the publication of the consumption deflator for August, the Fed’s preferred measure for tracking inflation. Indeed, total inflation decelerated as expected (2.2% year-on-year, compared to 2.4% previously), following the price index figures. This deceleration was largely due to the easing of energy prices and, more broadly, goods prices. However, on a monthly basis, core inflation indicated a slightly slower progression than anticipated. But, year-on-year, it slightly increased to 2.7%.

United States: Total annual inflation decreases significantly, mainly due to energy and goods prices. Core inflation, however, does not decrease.

It should be noted that core inflation, as in many countries, is more difficult to decline, particularly in services. In fact, even excluding the effect of housing prices, inflation in non-energy services does not really decrease year-on-year

United States: Inflation in services is more difficult to reduce, even excluding the effect of housing

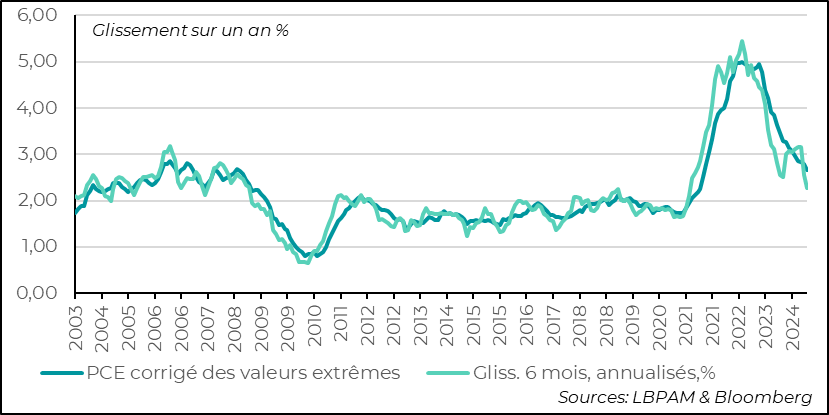

As elsewhere, the easing in wage growth, which should intensify with the normalization of the labor market, should help the Fed in converging inflation towards 2%. However, we continue to believe that this should be rather slow. The coming months should give us a clearer view of the disinflation dynamics we are in. Thus, we will see if the much more favorable trend of recent months is confirmed. Indeed, excluding the most extreme developments, we see that inflation has decelerated significantly in recent months, as observed over a 6-month annualized period. We will therefore need to see if this abrupt deceleration is confirmed.

United States: Price dynamics, when excluding the more extreme and volatile effects, seem more favorable in the short term, but this remains to be confirmed

Sebastian PARIS HORVITZ

Head of Research