The ECB could act before the Fed

Link

- The path of monetary policy, particularly in the United States, will clearly play a key role in determining the direction of the markets over the coming months. The strength of the US economy and the slow deceleration of inflation have clearly changed market sentiment. This has led to a growing expectation that the Fed will be more patient in initiating rate cuts in 2024. This partly explains the rise in interest rates and the greater reluctance to take risks.

- Today's publication of the US consumer price index (CPI) for March will play an important role in the Fed's decision-making in the months ahead. Rising energy prices will disrupt inflation trends, but the main focus will be on core inflation. The year-on-year deceleration in core inflation is expected to continue, but we continue to believe that convergence towards 2% will be slow. Nevertheless, there is a risk that the market will over-interpret any figure that is higher or lower than expected.

- We believe that the Fed will have to remain patient and perhaps postpone any easing until mid-summer, if the economic data to come remains as strong as it has been recently. Nevertheless, we can see that the US monetary authorities now seem to be worried, almost asymmetrically, about the impact of a monetary policy that remains restrictive for too long and its impact on activity. Hence our forecast that the Fed will cut rates three or at least twice this year.

- At the same time, the resilience of US growth and the recovery of hitherto lagging economies, such as the Eurozone, could further boost risk-taking. In Europe, this momentum would be all the more buoyant given the faster pace of disinflation. This could allow the ECB to cut its key rates before the Fed.

- But the uncertainties will remain high, which is why we continue to maintain highly diversified portfolios, without making extremely large bets between the major asset classes.

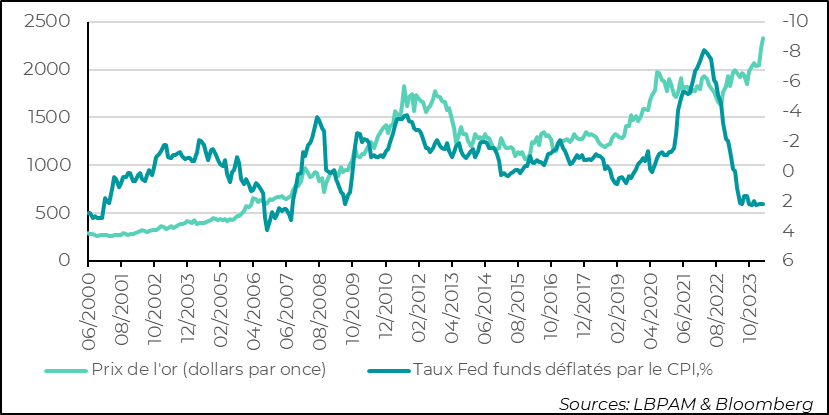

- It should be noted that, despite the strong performance of the riskiest assets, there are still pockets of resilience in very defensive assets, such as gold, the price of which continues to visit all-time highs. Is it the fear of persistent inflation or geopolitical concerns? It's hard to say. But it does show that a degree of anxiety persists.

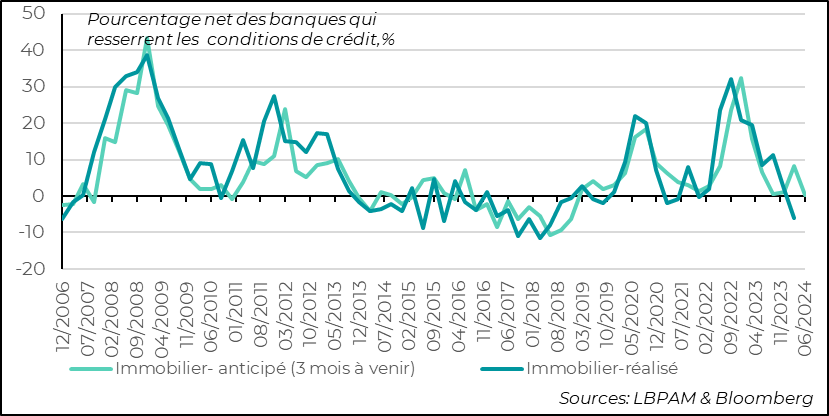

- In the Eurozone, the ECB's survey of banks' access to credit gave a mixed message. Firstly, credit remains constrained in the Eurozone. Nevertheless, for households, it does seem that access to credit is improving slightly and that demand is declining less. For businesses, the situation remains unfavourable. This is an important factor which should play a part in the ECB's decision to ease its policy.

- In the United States, the March NFIB survey of small businesses, mainly in the retail sector, showed that all was not well across the Atlantic. Business sentiment reached its lowest level since 2012, and the survey highlighted the fact that costs remain high (wages are still rising) and, above all, that inflation remains a major problem.

---

Risk-taking has largely dominated since the start of the year. This is partly due to an economy that remains either resilient (USA) or improving (Eurozone), but also to expectations of monetary policy easing. On the latter point, the market has largely revised its position, with more moderate expectations, particularly from the Fed.

The prospect that inflation could fall more slowly is one of the key factors. Today's publication of the consumer price index will give us a further indication of price dynamics in the US economy. The focus will remain on underlying inflation.

Core inflation is expected to decelerate very moderately to around 3.7%, which is still high and shows that the landing is far from complete. Nonetheless, any surprises on the upside or downside are likely to result in considerable market volatility.

We believe that this figure will be important for the Fed. Nevertheless, given the latest macroeconomic figures and the associated comments from central bankers, the Fed should remain patient before starting to ease monetary policy.

Nevertheless, we have seen that J. Powell and many other members of the Monetary Policy Committee seem fairly determined to ease monetary policy from 2024, fearing that the persistence of a restrictive monetary policy for too long could harm growth. This asymmetrical view, which minimises the weight of the inflation outlook, seems to us to be an important factor to take into account. With this in mind, we still believe that monetary policy will be eased in 2024, even if potentially later than expected, i.e. later than June, as previously forecast. In fact, the market has already largely discounted the possibility of a June cut.

The market's hesitation over the direction of US monetary policy should have an impact on risk-taking, even if the improvement in growth will provide support. Added to this is a tense geopolitical context, which could further fuel anxiety, particularly in the run-up to the US presidential elections.

It is surely this message of caution that seems to be keeping the price of gold up. Indeed, the price continues to break new records. The prospect of interest-rate cuts, i.e. a gradual reduction in real interest rates over the coming quarters, seems to have little effect on the price of gold.

It is true that purchases by certain central banks have supported the metal since the start of the war in Ukraine, but today it is clear that it is more speculative movements that seem to be underpinning prices. As in the past, it would appear that some investors are seeking refuge in gold.

---

Fig.1 Gold: at an all-time high despite high real interest rates

- gold price (dollars per ounce)

- Fed funds rates deflated by CPI, %.

The Eurozone has been lagging behind global growth for several quarters now. Tight monetary policy has played an important role in this trend, by restricting access to credit.

The latest ECB survey of banks showed that access to credit remains precarious, particularly for businesses. Nevertheless, there are some signs of improvement. For households, mainly in the area of mortgages, the situation is improving slightly, with banks easing their lending conditions slightly for the first time in two years. This is true in almost all the major countries in the zone.

Fig.2 Eurozone: mortgage conditions for households ease slightly

- Real estate - anticipated (3 months ahead)

- Real-estate

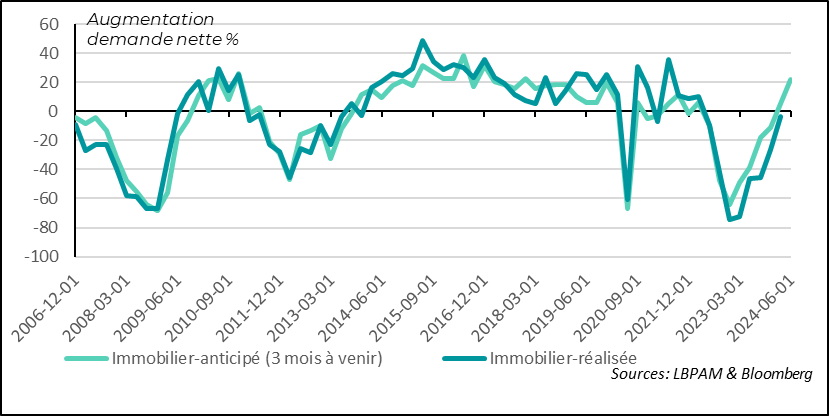

Demand for mortgages is also picking up. It fell only slightly in the first quarter, but the banks expect it to start growing again in the spring. This can largely be explained by the resilience of employment, but above all by the moderation we have seen in mortgage rates.

Fig.3 Eurozone: demand for home loans picks u

- Real estate - anticipated (3 months ahead)

- Real-estate

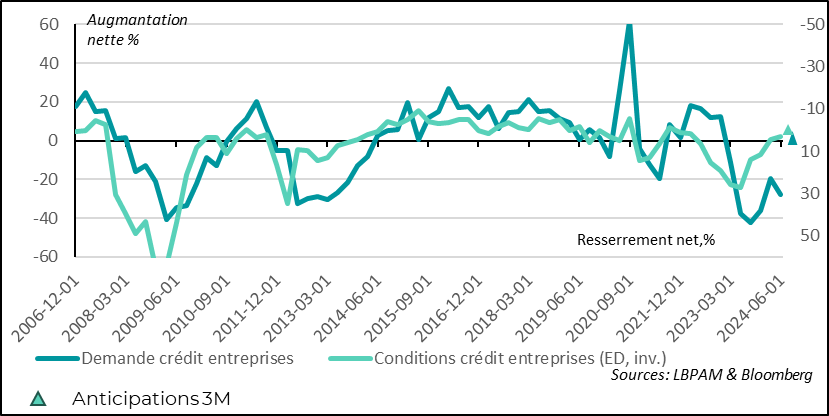

The situation among businesses is less encouraging. In particular, the improving momentum, with demand seemingly trending less negatively, was interrupted by a further fall in 1Q24. The good news, if it holds, is that the banks expect demand to pick up again in the spring.

Banks have also eased lending conditions for the first time in almost 3 years, and the outlook is for this easing to continue gradually.

Fig.4 Eurozone: bank lending to businesses remains restricted

- Business credit application

- Corporate credit conditions (ED, inv.)

Our scenario for an improvement in the European economy over the course of the year is based in particular on an improvement in bank lending conditions in the region. In this respect, we believe that if our expectations of disinflation continue to hold true, the ECB will be able to take action in June and start easing its monetary policy. Wage trends will be one of the keys to reassuring the ECB that inflation is decelerating, particularly in services.

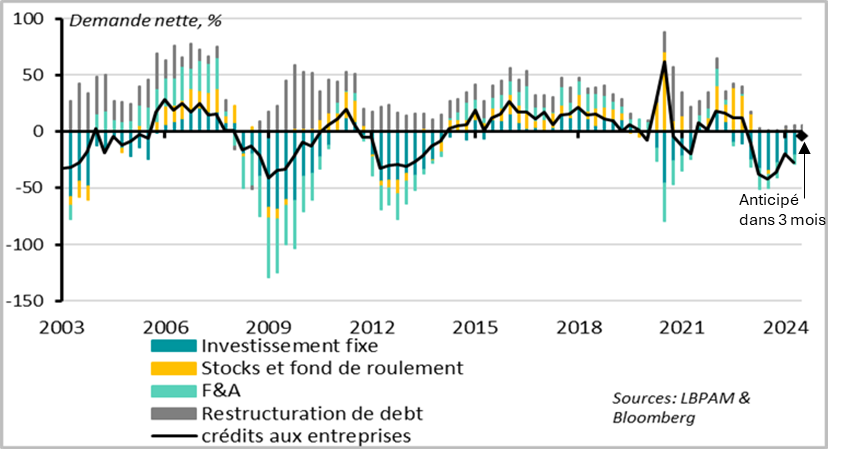

The data from the credit conditions survey should well be one of the factors stimulating this easing of monetary policy. Indeed, the survey clearly shows that, given current conditions, companies are cutting back on investment in particular. This shows that demand for credit to finance investment is continuing to fall. The ECB knows that investment is one of the keys to stimulating potential growth in the eurozone.

---

Fig.5 Euro zone: demand for loans to finance investment continued to contract in 1Q24

-Fixed investment

- Inventories and working capital

- M&A

- Debt restructuring

- business loans

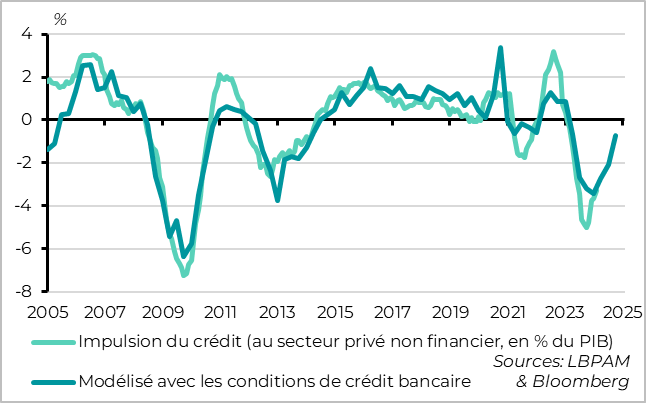

At this stage, given the evolution of credit conditions, we do see an improving trend, i.e. a boost to economic growth, but this remains insufficient to stimulate growth significantly. Hence the importance of ECB action and our view that it could act before the Fed.

Fig.6 Euro zone: credit conditions are moving in the right direction but are still insufficient

to provide a strong stimulus to growth

- Credit impulse (to the non-financial private sector, as a % of GDP)

- Modelled with bank credit conditions

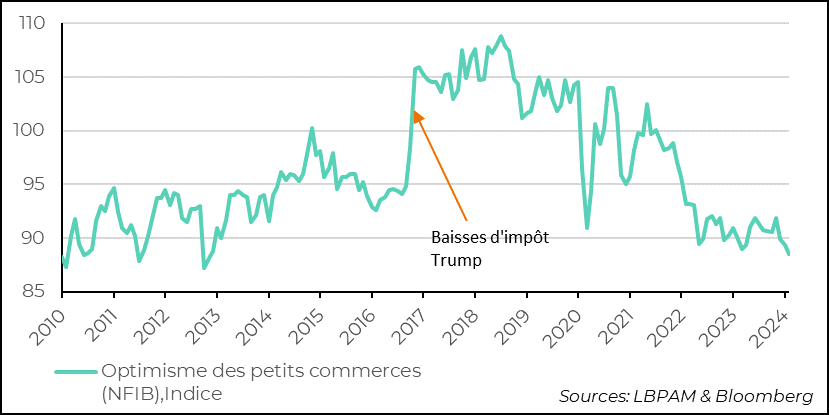

In the United States, the survey of small retailers (NFIB) gave a rather negative message, contrasting with the rather positive messages received in recent weeks. Indeed, sentiment among retailers reached its lowest level for over 10 years in March.

Fig.7 United States: small business optimism at its lowest for over 10 year

- Small Business Optimism (NFIB), Index

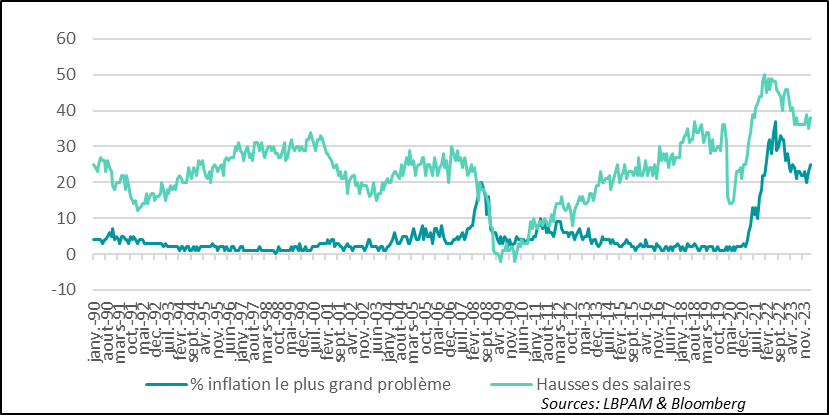

In part, this is due to a situation that remains difficult in terms of costs, with inflation still one of the main problems they face, and rising wage costs that are not slowing down fast enough.

Fig.8 United States: for small retailers, inflation remains one

of the main problems and wage costs remain high

- % inflation the biggest problem

- Wage increases

It is clear that wage trends will continue to be one of the key factors that the Fed will have to take into account when deciding whether or not to ease monetary policy. At the same time, the negative message given by the retail sector on the state of the economy could fuel the feeling among some that monetary policy should be eased to avoid damaging growth too much.