The ECB firmly in wait-and-see mode

Link

Key takeaways from the september 12 , 2025 market update insights from Xavier CHAPARD, Strategist

Overview

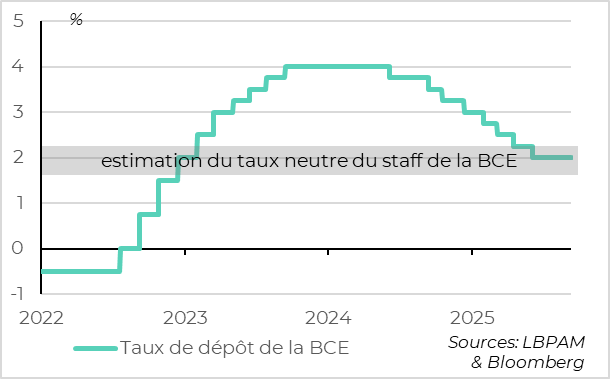

► As expected, the ECB kept its key interest rate at 2% yesterday and does not appear ready to lower rates further for the time being. In its scenario, which has not changed much since June, the ECB forecasts resilient growth and inflation just below the 2% target over the next two years. In this context, it believes it is in a good position to “wait and see.”

► The ECB's stance, which has been fully priced in by the markets, is putting pressure on our scenario, which forecasts a final rate cut at the end of the year (to 1.75%). This is particularly true given that our scenario remains close to that of the ECB. However, we still believe that, from a risk management perspective, it would be justified for the ECB to adopt a slightly more accommodative policy to offset the appreciation of the euro and the rise in long-term rates, given that inflation remains below target and the risks to growth are skewed to the downside.

► US inflation rose slightly more than expected in August, with core inflation returning above 3% for the first time in six months. That said, the rise in inflation in August was exaggerated by temporary effects. In fact, the spread of tariff increases is real but gradual, and inflation in services remains too high but is not clearly accelerating. In any case, a return of inflation to the 2% target is still not in sight, even in the medium term.

►At the same time, data still indicates that the US job market is significantly less dynamic. The Bureau of Labor Statistics reports that job creation was half as much as initially estimated between April 2024 and March 2025 (74,000 per month), and unemployment claims continued to rise in early September, reaching their highest level since the post-COVID recovery.

► Under these conditions, the Fed will be able to resume its rate cuts next week in order to ease monetary tightening, even though its rates remain high at 4.25-4.5%. However, it is likely to do so gradually (in 25bp increments) and, contrary to market expectations, we believe it will keep rates in slightly restrictive territory next year (above 3%).

► The appointment of Sébastien Lecornu as Prime Minister has not moved the markets, which continue to demand a premium of nearly 75 basis points to lend to France rather than Germany over 10 years. This is understandable, as it does not resolve uncertainties regarding political stability or the adoption of next year's budget. Fitch's review of France's rating this evening could create some volatility, but we continue to believe that French risk is already well priced in by the markets. That said, we continue to favor southern European debt, which offers spreads comparable to those of French debt (for Italy) while benefiting from improved fundamentals.

In-Depth insights

The ECB is in a wait-and-see mode

The ECB keeps its key interest rate at 2%

The ECB kept its rates unchanged yesterday for the second consecutive meeting, a unanimous decision that had been widely expected since the July meeting. It also reiterated in its statement that it is not “committing in advance to any particular path for interest rates” and that its future decisions would be taken “meeting by meeting,” “based on the data.”

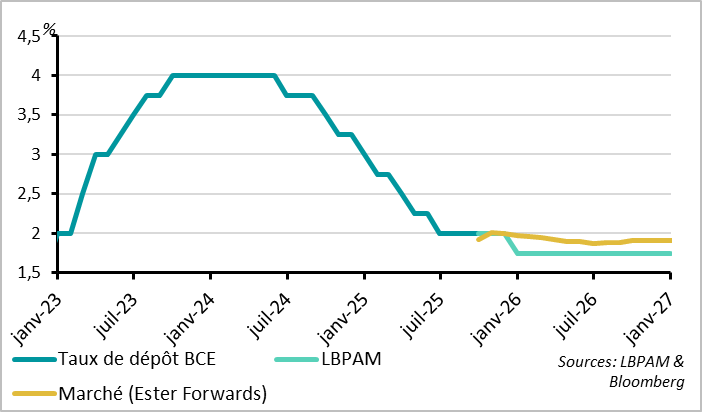

The ECB's key interest rate has returned to 2%, which is in the middle of the range that the ECB (like us) considers to be consistent with a neutral monetary policy. With inflation returning to around the 2% target and growth holding up, the ECB considers itself in a good position to wait and see. This suggests that the ECB does not plan to change its rates in the short term, either up or down.

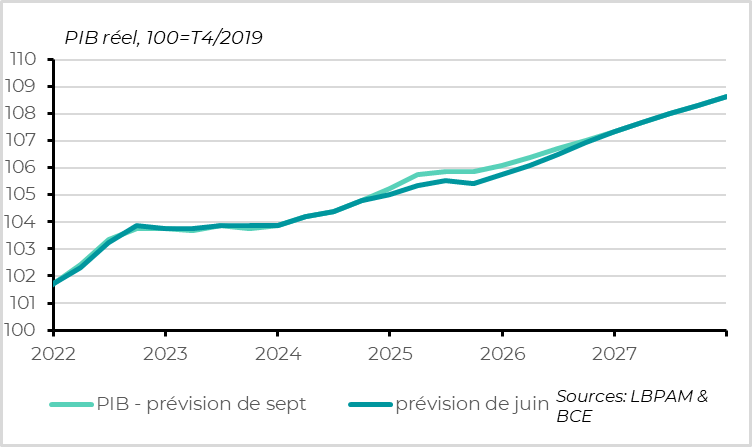

The ECB forecasts inflation just below target and a gradual recovery

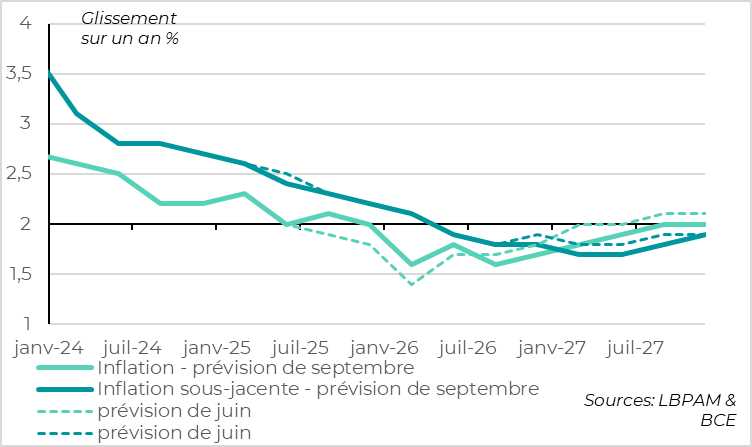

The ECB's economic forecasts are largely unchanged from its June forecasts. It has marginally revised its growth forecast for this year upwards to take account of the strong performance of the European economy in the first half of the year (from 0.9% to 1.2%) and revised its inflation forecast for 2027 downwards (from 2.0% to 1.9%), probably due to the stronger euro and the slightly faster slowdown in wages.

It considers that the slightly higher US tariffs following the summer agreements (13.1% compared with 10.2% estimated in June) are offset by the reduction in uncertainty. This seems reasonable to us, even though we believe that the cost of the trade war could be slightly higher than it estimates (due to the likely introduction of tariffs on pharmaceutical products and the backlash from US imports brought forward in anticipation of price increases).

Conversely, however, the ECB's scenario factors in limited support from the German fiscal stimulus plan, which leads us to be slightly more optimistic about European growth next year (1.2% versus 1.0% for the ECB).

Our inflation scenario is very close to that of the ECB, which forecasts inflation just below the 2% target next year.

The market no longer expects the ECB to cut interest rates

The market has aligned itself with the ECB's statement following yesterday's meeting and no longer anticipates any further rate cuts in the future. Clearly, the current stance is not in line with our scenario, which includes one final rate cut at the end of the year, bringing the deposit rate down to 1.75%, despite a fairly similar economic outlook. That said, we continue to believe that it would be appropriate for the ECB to adopt a marginally accommodative policy from a risk management perspective.

Above all, this would reduce the risk of inflation falling below target. Indeed, the ECB itself forecasts inflation of 1.9% in the medium term, while its official target is symmetrically set at 2%. But perhaps the ECB is maintaining a conservative German bias. This would also offset the tightening of financial conditions represented by the appreciation of the euro and the rise in long-term rates (and also French rates, but the ECB cannot say so officially). Finally, it supports the recovery while inflationary risk is limited, but the ECB is not the Fed...

U.S. inflation rises slightly in August

Core inflation accelerates and rises above 3% again

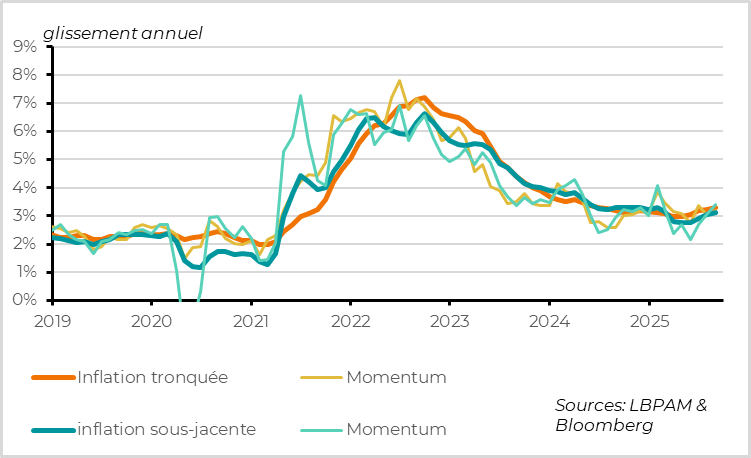

US inflation rose slightly for the second consecutive month in August, without accelerating sharply as it did in 2021-2022.

Prices excluding energy and food rose 0.35% over the month, compared with an expected 0.30%, the sharpest increase since January, pushing core inflation up from 3% to 3.1% year-on-year. This is far from the 6-7% reached in 2022, but inflation is still not converging towards the 2% target. Other measures of trend inflation, such as sequential inflation, confirm that inflationary pressures have been rising slightly for the past two months before returning to normal.

The acceleration in prices is somewhat exaggerated by temporary effects.

That said, the acceleration in inflation in August is exaggerated by a number of temporary effects. Inflation remains too high but is not accelerating sharply.

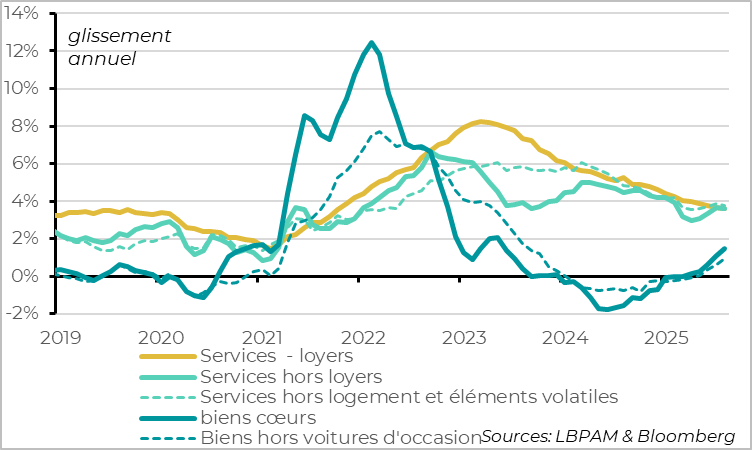

Goods prices are rising sharply (+0.3% over the month), but more than half of this increase is due to the price of new cars (+0.3%) and used cars (1.0%), which had fallen surprisingly in the second quarter. The spread of price increases to goods is therefore actually more gradual than the August figure suggests, even if it is very real and will continue to support inflation in the coming months.

On the services side, which is less affected by customs duties, prices rose sharply for the second consecutive month (by 0.35% over the month and 3.6% over the year). However, in August, this increase was exaggerated by the rebound in tourism prices, which had fallen sharply recently. Hotel prices rose by 2.6% and airline tickets by 5.9%. Rents are also slightly more dynamic, although they are on a downward trend. Apart from these volatile factors, service prices actually slowed in August after two months of sharp increases, which is reassuring.

Overall, the latest inflation figures suggest that US inflation is likely to rise in the coming months, albeit to a limited extent, as the spread of cost increases linked to tariffs is real but gradual. However, this delays the return of inflation to target, which we do not expect to happen before at least 2027.

Under these conditions, and given the slowdown in the labor market, the Fed may ease monetary policy by lowering rates slightly starting next week, but only to a limited extent so as not to adopt an accommodative monetary policy that would reinforce inflation in the medium term.

Xavier CHAPARD

Strategist