The ECB may hasten slowly to lower rates

Link

Market Analysis for October 16, 2024 by Xavier Chapard.

In summary

►The risk premium on oil is declining following reports that Israel has abandoned its plans to target Iranian oil production sites. Although the risk of an energy shock has not been ruled out, this reduces the risk to global growth.

►On the eve of the ECB meeting, two surveys concerning the Eurozone send a reassuring message about the economic cycle, which is in line with our scenario which anticipates that, even if growth is weaker than expected in the middle of the year, the risk of the Eurozone falling into recession remains limited.

►The ZEW survey of German investors remained downgraded in October, but the expectations component rebounded after two sharp falls.

►Above all, the ECB's quarterly bank survey indicates that the credit cycle continues to pick up after the summer, with a recovery in credit demand and a stabilization in credit supply. This confirms that the impact of past monetary tightening has been diminishing since the end of last year, and suggests that the credit cycle should now begin to support growth in the Zone.

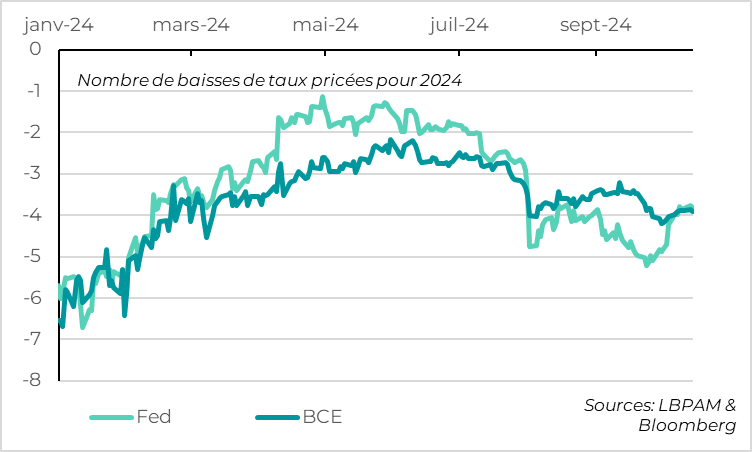

►With European growth falling this summer, inflation lower than expected in September and the Fed cutting rates by 50bp, we still expect the ECB to cut rates by 25bp tomorrow. But in the absence of any clear sign of a turnaround in the cycle, and with inflationary pressures in services and wages remaining high, we do not expect the ECB to change its stance towards a much more accommodative monetary policy. It should leave the door open to further rate cuts at its next meetings (including December), but make it clear that the speed of rate cuts is not automatic and remains data-dependent.

►Like us, the market and almost all economists surveyed by Bloomberg are anticipating a 25bp cut in the ECB rate to 3.25% tomorrow, before another cut in December. What's interesting is that, for the first time since early August, the market has aligned itself with our central scenario, which predicts as many rate cuts by the Fed and the ECB in the coming quarters. In our view, the risk is that the Fed will ultimately cut rates less than the ECB.

►In other news, the first Chinese data for September (exports, credit) confirm the weakness of activity and the need for more public support. In addition, the UK job market is still gradually slowing, as are wages, which should enable the BoE to cut rates for a second time this year in November, while remaining cautious about what comes next.

To go deeper

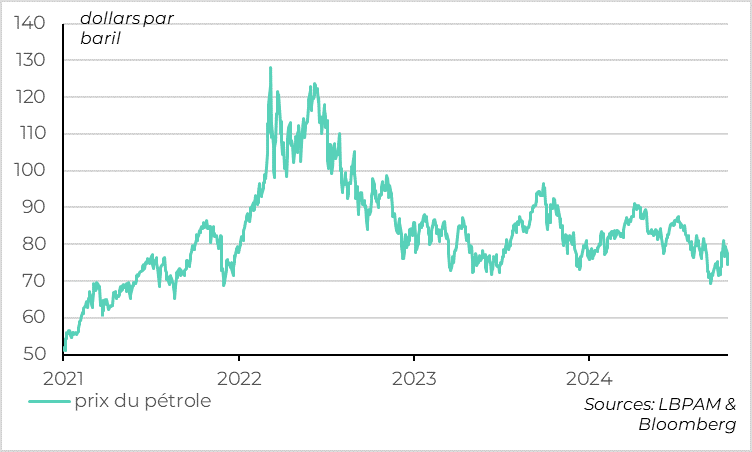

World: oil price premium eases this week

After a sharp rebound in early October, the price of oil this week is falling back towards $75 a barrel, which is our forecast for the coming months. This follows reports that Israel has abandoned its plans to target Iranian oil production sites (which export 1.6 mb/d, mainly to China). In addition, Libyan production is rapidly normalizing, and the reduction in production in the Gulf of Mexico due to the hurricanes should be very limited. These developments reduce the risk premium on oil, which is good for short-term growth.

The risk of an oil shock cannot be ruled out in the short term, but conditions on the oil market are favorable for the global cycle in the medium term in the central scenario. Thus, the International Energy Agency states in its monthly oil report that “for the time being, supply continues to flow and, in the absence of major disruptions, the market faces a considerable oversupply for next year”. And this while OPEC+ maintains significant production cuts and has historically high spare capacity.

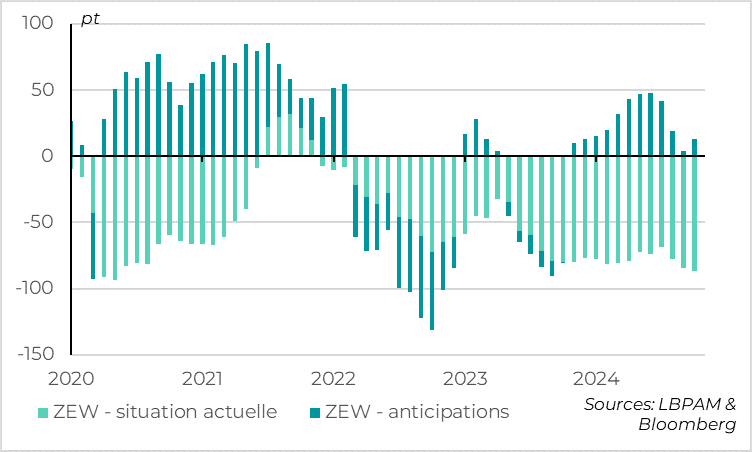

Germany: investor confidence recovers slightly in October

The ZEW survey of German investors picked up slightly in October after two sharp declines, although it remains at a very low level. The component on the current state of the economy is still falling, and is at a level historically reached during recessions. But the growth expectations component is rebounding and is in positive territory.

While we're taking investors' opinions with a grain of salt, and will wait for the German business surveys (PMI and IFO) to really judge the level of activity in Germany, the upturn in expectations in the ZEW is reassuring, as it is historically a good indicator of cycle reversals. This is in line with our scenario, which anticipates that, even if growth is weaker than expected in the middle of the year, the risk of the Eurozone falling into recession remains limited.

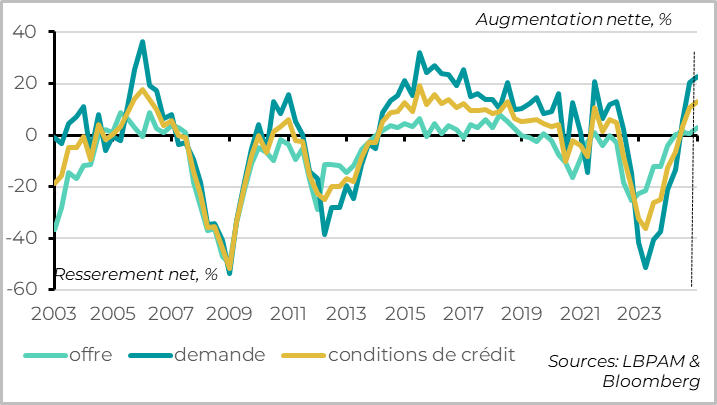

Eurozone: banks point to further recovery in the credit cycle

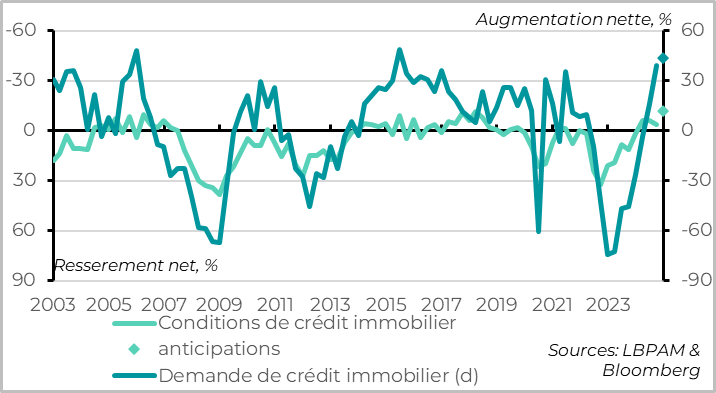

The ECB's bank survey shows that the credit cycle continues to improve markedly in Q3, after turning positive for the first time since early 2022 this summer. Household and business demand for credit is rebounding, while banks' supply of credit has ceased to shrink, allowing credit conditions to improve further than since Covid.

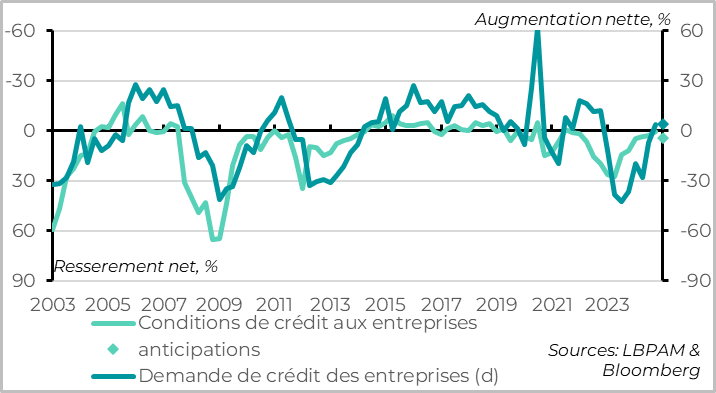

Euro zone: corporate credit demand finally turns positive again

Corporate demand for credit is rising for the first time in 2 years, thanks to the stabilization of fixed investment, although demand for mergers and acquisitions remains weak. At the same time, bank lending to businesses is stabilizing after 3 years of decline, which has been more limited than the fall in demand in this cycle, although banks remain cautious for the end of the year.

Eurozone: mortgage demand and supply continue to recover

Household demand for credit accelerated sharply in the second half of the year, after returning to positive territory in the summer, particularly for mortgages. This reflects the stabilization of the outlook for residential property and, above all, the effect of lower interest rates. On the banks' supply side, mortgages are becoming more accessible, while access to consumer credit is still declining.

Euro zone: the credit cycle should support growth from now on

Bank credit conditions are a very good leading indicator of the cycle in the Eurozone, an economy where credit to the private sector remains highly intermediated by banks (as opposed to the more widespread market financing in the US). Its improvement therefore suggests that the risk of the cycle turning into a full-blown recession remains limited.

Growth in credit to households and businesses has stabilized since the end of last year, even if it remains limited, so that the contribution of credit to growth in activity is neutral after having weighed heavily against it in 2023. The bank survey is consistent with a slightly positive contribution to growth from the end of this year.

Market: the Fed and ECB are set to cut rates by the same amount in 2024

Xavier Chapard

Strategist