The economy according to Trump... What impact?

Link

-

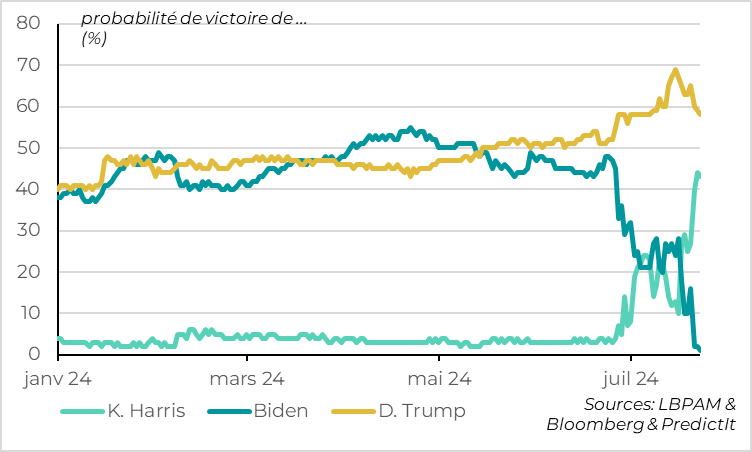

Following President Biden's withdrawal from the presidential race, support for Vice President Kamala Harris' candidacy has been growing. It therefore seems highly likely that she will be officially declared the Democratic Party's nominee at the Convention on August 19-22. But she will need to step up her campaign quickly to catch up with D. Trump, who remains the overwhelming favorite in the polls and on the betting platforms.

-

The markets are beginning to wonder what impact a new Trump presidency could have, especially if the Republicans also win the Senate and retain the House. We believe that the main impact of the policies pushed by D. Trump and even more so by his running mate would be inflationary for the US, while weighing on European growth. This would be negative for US bonds but positive for certain sectors of the US equity market and for the dollar. On the contrary, it would probably be less negative for European bonds, but rather negative for European equities.

-

We (and the market) will be paying particular attention to the Flash PMIs for July published today, especially to gauge the economic situation in the eurozone. They are expected to be stable after their June slowdown, which would be compatible with our scenario of a continuing limited economic recovery. A further significant fall would suggest a more fragile European recovery than a mere pause, reinforced by French political uncertainty in June. While a rebound in PMIs would be a welcome surprise, too strong a rise could prompt the ECB to be even more patient before cutting rates further. The rate cut expected in September could then be postponed.

-

The good news is that, unlike business confidence, consumer confidence continues to rebound this summer in the Eurozone. This is reassuring, given that the eurozone recovery is expected to be driven by a pick-up in consumption now that real wages have turned positive.

-

In China, the conclusion of the 3rd Plenum shows the continuity of President Xi's choices. National security and risk control feature prominently in the long-term reform plan, not just economic growth. The focus remains on the supply side, in particular on improving self-sufficiency in high-tech industries. Measures to stimulate demand, especially consumption, are still rare. A few measures to help local government finances and real estate are proposed, but they seem very limited compared to the size of these challenges. This is not encouraging for China's long-term growth prospects.

-

In the short term, we'll have to wait for the Politburo meeting at the end of the month to see whether the authorities take more cyclical measures after the economy slowed more sharply than expected in Q2. If not, the 5% growth target for this year will be difficult to achieve. It's worth noting that the Central Bank unexpectedly cut some of its key rates on Monday, for the first time in a year. This may be a sign of more cyclical support to come this summer.

Fig 1 United States: Trump's probability of victory drops a little but remains high

According to the online betting sites, it is now almost certain that Kamala Harris will be the candidate for the Democrats in the US presidential election. Biden's withdrawal and K. Harris' entry into the campaign have lifted the Democrats' chances of victory from their low point just after D. Trump's assassination attempt last week (from 35% to 43% according to Predictit data).

However, D. Trump remains heavily favored, with a probability of victory close to 60%. This is even higher than after J. Biden's failed debate in June.

Fig.2 Etats-Unis : Les hausses de droits de douane proposées par Trump sont massives

Markets therefore continue to wonder what impact a second Trump presidency would have. At the risk of oversimplifying, we can list four main sets of policies pushed by D. Trump and even more so by his running mate J.D. Vance: (1) a sharp rise in tariffs; (2) low taxation, (3) lower immigration and (4) deregulation of certain sectors such as finance and energy.

In particular, D. Trump has proposed imposing a 60% tariff on all imports from China, but also a 10% tariff on other American imports, even those from America's allies. These would be far greater tariff increases than in his first term. As for tax cuts, the proposals are imprecise at present, but Trump's supporters have spoken of further corporate tax cuts. At the very least, Trump would like to extend all the tax cuts he made in his first term, many of which normally expire in 2025.

It should be noted that tariff reduction policies (1) and certain deregulation measures (4) can be largely implemented even if Congress is not totally Republican. Tax changes, on the other hand, require a Republican majority in both chambers.

These proposed policies would clearly be inflationary for the USA in the short term. Higher tariffs would directly increase the price of imported goods, raising consumer prices and the price of intermediate goods. And it would increase the pricing power of domestic companies by reducing competition. Price rises would have a recessionary impact on activity, but this would be partly offset by a more accommodating fiscal policy. Lower immigration would also increase business costs, while reducing potential growth.

In the current context of full employment and above-target inflation, such inflationary policies would greatly complicate the Fed's work. It would be difficult for the Fed to cut rates by more than 1pt next year, as the market expects. What's more, the prospect of an even higher public deficit would justify a higher risk premium on long rates. All in all, this would be negative for US bonds.

Normally, these policies would also be favorable to the dollar, as US interest rates would be higher and the dollar would benefit from the rise in global risks. However, D. Trump and especially J.D. Vance are in favor of a weak dollar to boost US exports, which could limit the dollar's rise somewhat.

For US equities, sector differences would probably be reinforced. Tax cuts and massive budgetary support would be very favorable. But this support would be partly offset by the negative impact of likely retaliation by trading partners, lower potential growth and higher interest rates. Above all, the impact of these policies would be highly differentiated by sector, benefiting highly domestic and regulated sectors but weighing on highly globalized sectors.

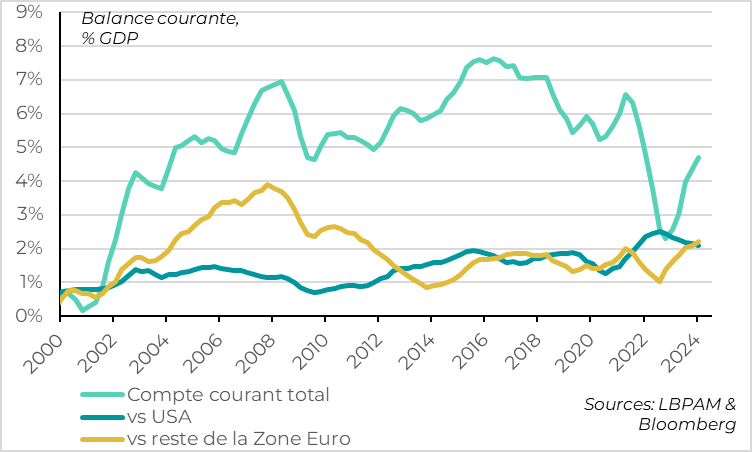

Fig.3 Allemagne : près de la moitié de l’excédent courant allemand est fait avec les USA

For Europe, D. Trump's policies would probably have a fairly neutral impact on inflation, but a markedly negative one on growth. Indeed, Europe is more dependent on foreign demand than the United States. It would also suffer from the retaliatory measures it would surely impose on the United States, and would suffer from the tightening of US financial conditions. As far as inflation is concerned, however, the rise in import prices would be limited, especially if the dollar does not appreciate too much, and would be partly offset by weaker domestic pressures.

If anything, such impacts should push the ECB to be more accommodating. Combined with rising risk aversion, this could benefit European bonds, even if the rise in US rates will spread to European rates to some extent. European equities, on the other hand, would suffer from the weaker economy and their heavy dependence on profits generated outside the Zone (over two-thirds if we consider the Eurostoxx). This would only be partly offset by a weaker euro.

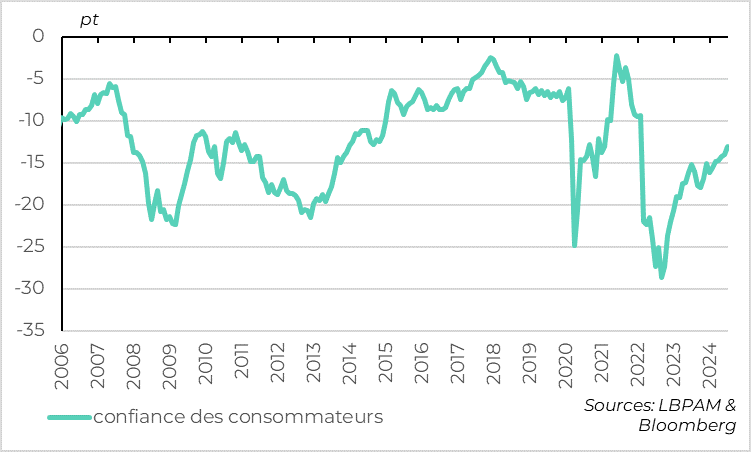

Fig.4 Zone Euro : la confiance des consommateurs continue de rebondir en juillet

Unlike business confidence (June PMI) and investor confidence (June and July ZEW), consumer confidence in the Eurozone continues to rebound at the start of summer.

Consumer confidence rose by 1pt in July, its biggest increase since December. At -13pt, it reached its highest level since the start of the war in Ukraine, even though it remains slightly below its long-term average. This is consistent with the slowdown in inflation and inflation expectations, which are enabling a rebound in households' real purchasing power. The resilience of the job market is also providing support.

This is reassuring, as the Eurozone's recovery will need to be underpinned by consumption, which remained limited in the first quarter (+0.2%), especially in a more uncertain context for external demand.