The equity markets are trying to fight the central banks

Link

- Equity markets have held up relatively well, even as the two main central banks, the Fed and the ECB, have steered their language towards more tightening or at least towards keeping their monetary policies restrictive for some time to come. As a result, the old saying “Don’t fight the Fed” (or the ECB) now looks worn out. This saying is, first, based on historical experience, but also on the simple idea that if monetary conditions tighten, there will be less liquidity, and macroeconomic activity will be constrained, thus undermining earnings. Accordingly, generally speaking, going against the grain of central bank action has often been a losing bet.

In part, equity market resilience has been due to the views of financial analysts, who have begun to raise their earnings forecasts. That seems paradoxical, given that tight monetary policies, among other things, are trying to restrict demand. So, it’s hard to see how margins or sales volumes will improve, unless one assumes that the markets will continue to be driven by a small number of stocks. This seems unlikely, despite good news from the tech sector. In fact, a certain complacency does seem to have taken hold. Given that the central banks have not yet reached their terminal rate, too much risk-taking looks unwise. Nevertheless, it is also unwise to try to outsmart the market. Better to accept that risk appetite has been very much with us over the past few months. In our view, this justifies not being excessively underweight in risky assets, while keeping in mind the atypical character of this economic cycle.

- This week, the Bank of England (BoE) will be the last central bank to show the market that the battle against inflation has not yet been won and that monetary policy must remain tight. Like the consensus, we expect a 25 basis point (bps) hike. That being said, the bond markets appear to have overreacted somewhat to stubborn tightness on the job market in pricing in another 100 bps in key rate hikes by the start of 2024. A far slower-than-expected decline in inflation would be necessary to justify such a sledgehammer approach. True, this could result from a job market that does not ease up at all. However, despite the Brexit-related structural constraints on employment, we expect far more moderate rate hikes to be enough to ease pressures, especially as market interest rates have risen to extreme levels, by more than 110 bps over the past three months – the steepest increase of all the major economies. To head off an excessively hard landing in the economy, the BoE will have to try to throw cold water on excessively aggressive forecasts.

- On the statistics front, US consumer confidence improved slightly in June, according to the University of Michigan survey. No wonder, given the decline in energy prices, while the job market remained tight. Keep in mind, however, that jobless claims did stay high last week, which could point to a slight worsening in employment. The survey also revealed that 1-year inflation expectations pulled back to 3.3% from 4.2% the previous month. This seems to be due to falling energy prices. They nonetheless remain in the upper end of their 10-year range.

- On the markets, much is expected from this weekend’s visit to China by Anthony Blinken, the US Secretary of State, to meet with his Chinese peer, Qin Gang. Since the US’s downing of the spy balloon in February, geopolitical concerns have had the collateral effect of sending many foreign investors, US ones in particular, rushing for the exits in Chinese financial markets. As a result, despite the economic recovery and solid results of certain companies, Chinese equities have underperformed. Blinken’s first comments on his visit look encouraging. An additional sign of a relaxation in tensions would be an invitation to meet with President Xi before Blinken leaves China. No such meeting has been announced. Moreover, in what appears to be an attempt by the White House to deescalate tensions, President Biden made a remark that almost seemed to excuse Chinese leaders for the spy balloon incident, suggesting that high leaders were not in the loop. He added that he hoped to meet President Xi in the coming months. A true relaxation could provide a short-term boost to Chinese equities, which are still steeply undervalued.

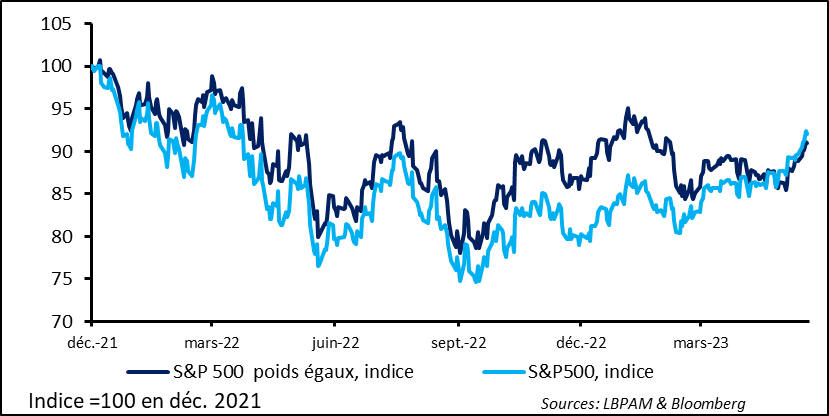

The equity markets seem to be defying the central banks. Despite central bank language to the effect that they must stick to monetary tightening or, at least, maintain a restrictive policy, equity markets continue to march onward and upward. In the United States, driven by tech stocks, the flagship S&P 500 seems to have shrugged off the Fed’s announcement that the most likely outcome is that key rates will continue rising, despite this month’s pause.

Fig. 1 – US: The S&P 500 still rallying from last autumn’s low, driven by its heavy tech component

S&P 500, equally weighted S&P index

Dec. Mar. Jun. Sept. …

Base = 100 in Dec. 2021

Last week, Jerome Powell said only that the pause merely marked a new stage in the slowing of the ongoing monetary tightening and not a halt to it. He said that, despite some good news recently on the inflation front, momentum in the US economy showed that inflationary pressures had not vanished and that demand would have to be reined in a little more.

Reining in demand a little more does not mean driving the economy into a steep recessive phase. Powell believes that a recession, even a moderate one, can be avoided. We believe that a slight contraction in demand will surely be necessary. This will come from a weakening in the job market in order to keep wage pressures from rising too fast.

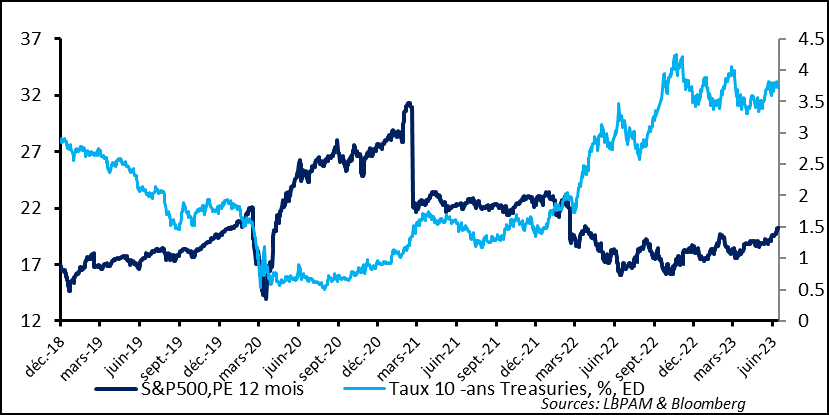

On the other hand, the markets appear to be pricing in an improvement in companies’ prospects in the coming quarters. Analysts have begun to raise their earnings forecasts in a number of sectors, including, most obviously, technology, led by artificial intelligence. All in all, while the central bank intends to stick to, or even step up, its tightening stance, we are in an unusual situation in which not only are earnings forecasts being raised, but stocks are being repriced, i.e., the number of years of earnings that investors are willing to pay for.

Hence, while inflation has disrupted valuations, higher interest rates do not appear to have dented investors’ optimism.

Fig. 2 – US: The market is being repriced on price/earnings ratios, even as interest rates rise.

S&P 500, 12-month P/E 10y Treasury yield, %, right scale

Dec. Mar. Jun. Sept. …

The economic cycle that we are going through is quite unusual, with unprecedented shocks and shifts in global dynamics that could transform the way in which economic adjustments can occur. With this in mind, the possibility that some economic sectors could hold up better than what would normally be expected cannot be ruled out completely. This is one reason for our decision to merely stick to a slight underweighting of equities, not just in the US but also in Europe, rather than being steeply underweighted.

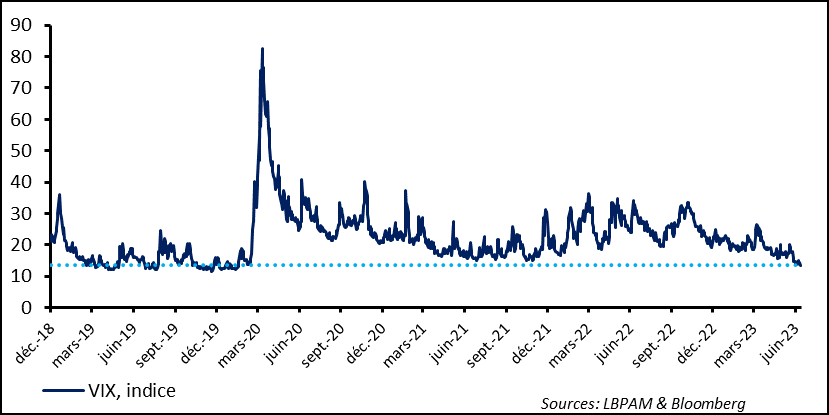

That being said, we see excessive complacency, particularly in the US. This is apparent in several technical indicators, such as the VIX, the index of implied volatility on S&P 500 options, often call the “fear index”, which keeps approaching its lows.

Fig. 3 – US: The VIX, the “fear index” continues to approach its lows

VIX Dec. Mar. June. Sept. ….

Not only is growth likely to be reined in by tight monetary policies, liquidity could also become an additional obstacle for the markets in the coming months, as the major central banks continue to shrink their balance sheets.

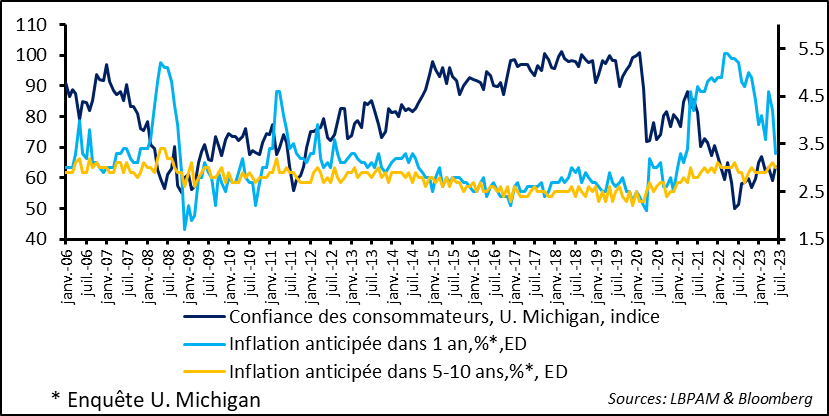

In the US, given the major role that consumers play in the resilience of growth, it is important to keep close track of their behaviours. The flash University of Michigan survey for June shows us that consumer confidence has improved slightly, while remaining relatively low.

This recovery in confidence has come not just from current conditions, but also from expectations. This can be put down mostly to the improvement in purchasing power on the month, driven by lower energy prices, but also to a stubbornly tight job market, not to mention the capital gains from the rally on equity markets.

Lower energy prices have also made it possible to bring down one-year inflation expectations to 3.3% from 4.2% the previous month. Obviously, this figure is highly volatile and is still well above its average of the past 10 years. Longer-term expectations remain at a 10-year high of 3%.

Fig. 4 – US: Consumer confidence remains low but is improving, helped in part by lower energy prices

U. Michigan consumer confidence

1y inflation expectations, %, right scale

5-10y inflation expectations, %, right scale

U. Michigan survey

Jan. Jul. …

Obviously a worsening in the job market would have a very negative impact on consumer confidence. Based on the jobs reports of recent months, employment appears to be holding up very well. Despite a weakening in demand, companies continue to hire.

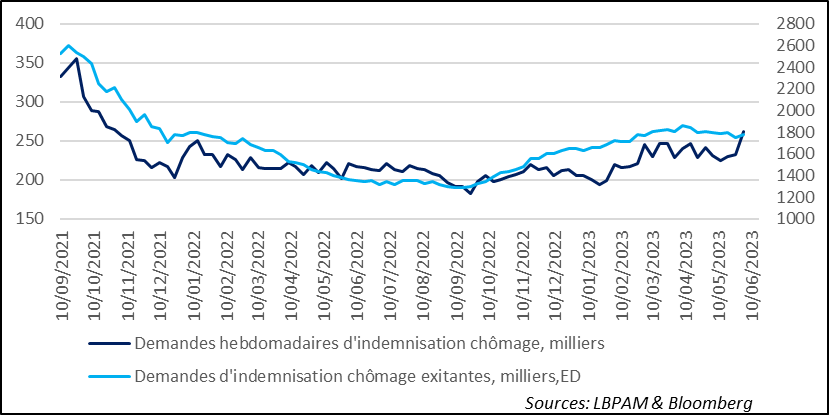

Nevertheless, it is entirely possible, and would not be unusual, that signs of weakness begin to appear. Indeed, jobless claims have clearly turned back up over the past two weeks. But only time will tell whether this trend continues.

Be that as it may, this is surely the best leading indicator of the economic cycle in the very short term. The ongoing increase in jobless claims, reflecting the increase in layoffs, would indeed be a sign that companies are beginning to adjust to weaker demand and to protect their margins. This would be a sign of “normality” in this economic cycle that has hitherto been so disrupted and hard to grasp in full.

Fig. 5 – US: Job claims are turning back up: a sign the job market is worsening?

Weekly jobless claims, ‘000

Existing jobless claims, ‘000, right scale