The euro hits an all-time high ahead of the central bank meetings

Link

The market rally two weeks ago, in the wake of a receding in US inflation, has given way in recent days to a wait-and-see stance prior to this week, which will be busy with macroeconomic releases.

While the euro has levelled off slightly below 1.12 vs. the dollar, it has continued to gain vs. other currencies and, on the whole, has hit a new high since its inception. The ECB is therefore feeling less pressure, as this will rein in growth and imported inflationary tensions. But it will also weigh on earnings of European listed companies, which are far more open than their US peers. In the short term, the euro looks a little overvalued, as we don’t expect the policies of the Fed and ECB to diverge significantly this year. This is also pushing us to a neutral stance between US and European assets, although European equities are far more attractively priced.

This week will, of course, be highlighted by the meetings of the three largest central banks. Rate hikes of 25bp by the Fed and the ECB have been priced in by far for this week, which would raise their key rates to more than 15-year highs (to, respectively, 5.5% and 3.75%). The main focus will be on what they say. While we believe that these rate hikes could be the last of this cycle, we also believe that the Fed and, especially, the ECB will stick to a restrictive bias in suggesting that: (1) other rate hikes remain possible after summer; and that (2) they won’t lower their rates for some time to come. In light of market expectations, the risk of surprise looks greater for the Fed than for the ECB.

The greatest uncertainty this week is around the Bank of Japan (BoJ), which could at last move to a slightly tougher stance in allowing a wider fluctuation in its 10-year yield. However, the latest language from its governor and the June pull-back in core inflation for the first time in a year and a half is likely to push the BoJ to stick to its ultra-accommodative policy for a little longer.

Overall, we think that consumption will slow to around 1-2% in mid-2023, after growing by more than 4% in Q1. The resilience of consumption, which accounts for 2/3 of US GDP, virtually guarantees that growth will remain positive in Q3 and limits the risk of a sharp recession thereafter. But we still expect activity in the US to slow after the summer, as consumption growth is likely to remain weak while companies are likely to cut back on spending.

As for economic data, flash PMIs for July are expected to remain low after falling in June, particularly in Europe. This would confirm that the global economy is slackening as summer begins. In the United States, GDP is expected to continue expanding in line with its trend of around 2% and the Fed’s favourite measure of inflation is expected at last to have slowed a little in June (after flatlining between 4.6 and 4.7% on the year to date), while remaining more than twice higher than the Fed’s target. We will also be watching closely the ECB bank lending survey, due out tomorrow, as it is likely to continue to suggest that monetary tightening is indeed being transmitted to the economy by dampening supply and demand for lending to both businesses and households.

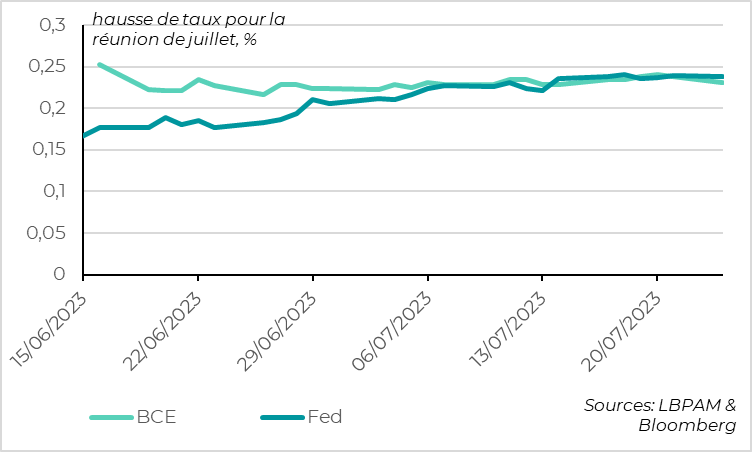

Fig. 1 – Fed and ECB: The markets price in almost unanimously a 25bp key rate hike this week.

The markets are pricing in a probability of more than 90% that the Fed and ECB will raise their rates by 25bp this week. Since the June meetings, almost all Fed and ECB members have supported a rate hike for July. For the ECB, this would mean continuing to tighten at a pace of 25bp, while for the Fed it would mean resuming its rate hikes after the June pause.

While rate hikes this week are almost certain, the question is what the Fed and ECB will then do. Post-meeting communiqués and the Powell and Lagarde press conferences will be dissected accordingly. Both central banks are very likely to stick to their restrictive biases (the risk being for new rate hikes) and state that their coming decisions will be data-dependent. But the market (like us) will be trying to detect the slightest hint that the central banks are headed for a pause or one more rate hike at their September meeting.

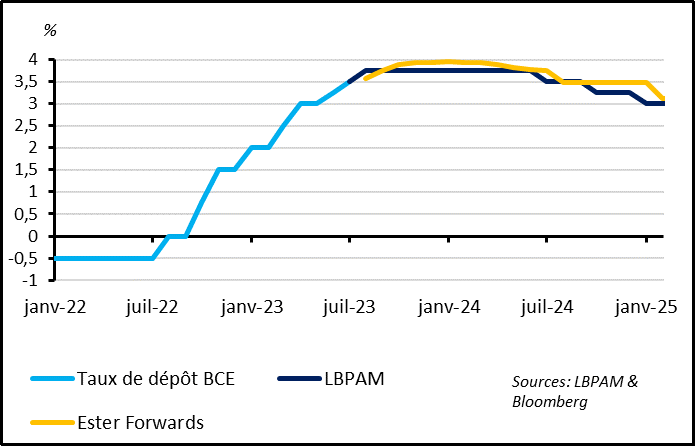

Fig. 2 – ECB: ECB rate expectations for the coming quarters look reasonable

Annualised quarterly growth Estimate based on current monthly figures

GDP/ household consumption

Market expectations are reasonable or even slightly high for ECB rates in the coming months. They are pricing in an 80% probability that the ECB will raise its rates by another 25bp after this summer and that it will not begin lowering its rates until the second quarter of 2024. This is a little higher than our scenario, which projects a stabilisation of ECB rates after this week and until mid-2024. That said, we believe that the risk to our scenario is on the downside. Growth is likely to remain very muted in the Eurozone this summer but the slowdown in core inflation is unlikely to truly show up until after summer, based on our projections.

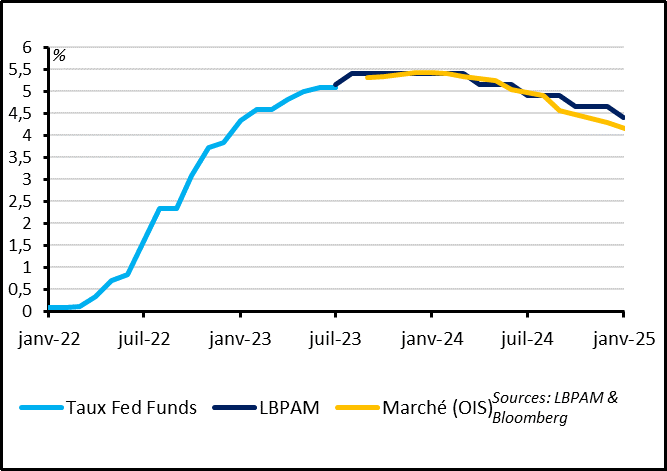

Fig. 3 – Fed: Fed expectations once again look a little low, especially for 2024.

Market expectations look a little low for the second half of the year and especially for 2024. The markets see just one chance out of three for an additional rate hike by yearend and, most of all, they see significant rate cuts as early as the start of next year. While our baseline scenario does not assume any additional rate hikes after this week, we do see a significant risk of additional hikes after summer and especially that the Fed will have to keep its rates in highly restrictive territory next year. Indeed, we still expect inflation to decline slowly to its 2% target and this will probably require a greater slowdown in the job market.

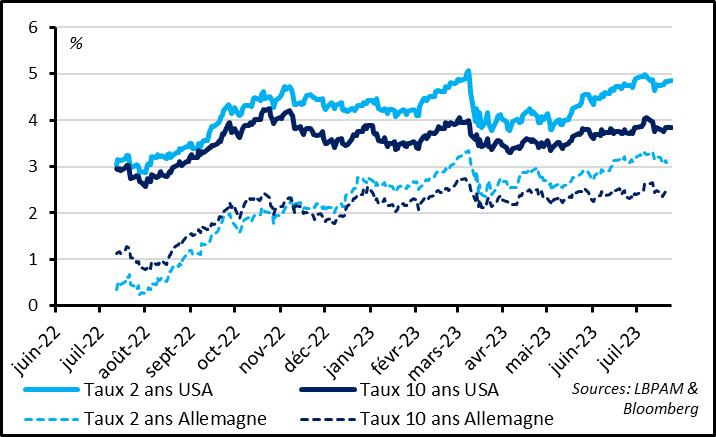

Fig. 4 – Government bonds: long bond yields look a little low before the central banks’ meetings, particularly in the US.

Jun. Jul. Aug. Sept. Oct. Nov. Dec.

2y US yield 10y US yield 2y German yield 10y German yield

Interest rates consolidated in early July after the first signs that inflationary pressures are receding in developed countries. And long-term yields look a little low in the run-up to central bank meetings, which is why we are merely neutral, although we believe that key rate hikes are probably over.

The reason for this is that, after US and UK core inflation, it was the turn of Japanese core inflation to slow last week for the first time in a year and a half. But core inflation remains high in Japan (3.8%), and even higher in the English-speaking countries. The receding of inflation in the Western world is still being driven mainly by the prices of goods, while inflation in services and wages remains far too high. As long as job markets do not ease more, we expect central banks to remain prudent and to suggest that they are willing to keep rates higher for longer.

With this in mind, we expect long-term rates to remain, on the whole, stable in the short term, despite the trend decline in inflation, the global economic slowdown, and the likely end of the cycle of key rate rates.

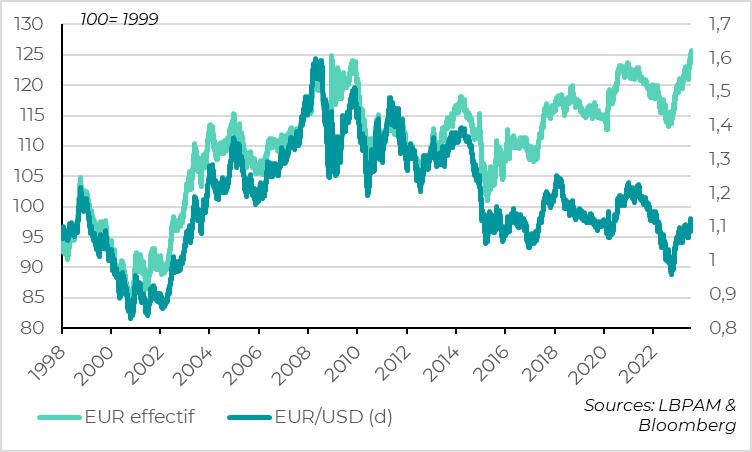

Fig. 5 – Euro: the euro is at an all-time high vs. its trading partners’ currencies.

The euro rallied strongly vs. the dollar in early July to about 1.12, a high since the start of the war in Ukraine. And while the euro has consolidated a little vs. the dollar over the past week, this was driven more by a dollar rally. In reality, the euro has continued to gain ground vs. a basket of the other currencies and is at a high since the creation of the Eurozone. The euro’s trade-weighted exchange rate has actually exceeded its highs of 2009 and 2020.

This is good news for inflationary pressures, as it reduces imported inflation, and good news for consumption. On the other hand, it will weigh on economic activity, manufacturing in particular, and on corporate earnings. Although the exchange rate is not the overriding factor in the economic outlook or for the ECB, it should allow it to be a little less restrictive, all other factors being equal.

Based on market expectations and economic data, we believe that the euro’s strength is probably overdone, although it does retain strong upside potential vs. the dollar in the medium term. Indeed, expectations look lower for the Fed than for the ECB. So, if the Fed and ECB have rather similar language this week, we believe that could weigh on the euro-dollar. Meanwhile, US 2Q GDP figures, due out this week, are likely to confirm that US growth is holding up well in the run-up to the summer, while Eurozone confidence indicators (such as PMI, IFO, etc.) could very well confirm weakness in economic activity a summer begins. Lastly, inflation figures released late in the week are likely to indicate that the Fed’s favourite measure of inflation (personal consumption expenditures deflator) is only slowly receding and that Eurozone core inflation has indeed begun to slow somewhat over the past three months. We believe that all this could limit the euro’s gains this summer.