The euro zone needs more monetary easing

Link

Read Sebastian PARIS HORVITZ's market analysis for January 29, 2025.

Summary

►The shock of Deepseek's “Chinese ChatGPT” on the American stock market seems to have worn off a little. Even so, many questions are likely to continue to haunt the market about the profitability of the very costly investments made to date on the promises of AI, which have notably brought NVIDIA and its GPUs to the top.

►President Trump's repeated threats of tariff hikes for trading partners are likely to continue to unsettle markets. He insists on “significant” tax hikes despite the opinion of his advisors, seeking moderation to avoid negative effects for the US economy. We'll know on February 1 whether the threat of tariffs for China and the USA's neighbors (Canada and Mexico) will be carried out.

►From today onwards, the focus will once again be on the major central banks. The Fed is unlikely to surprise and leave policy unchanged. But it could refine its analysis to guide the markets. The ECB, too, is likely to continue easing its policy.

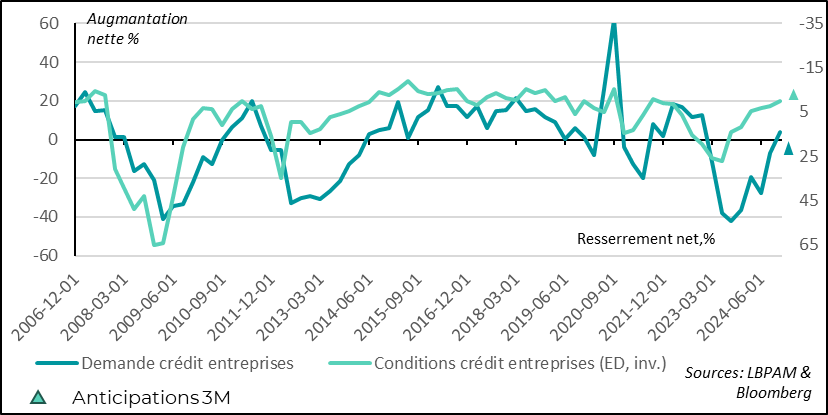

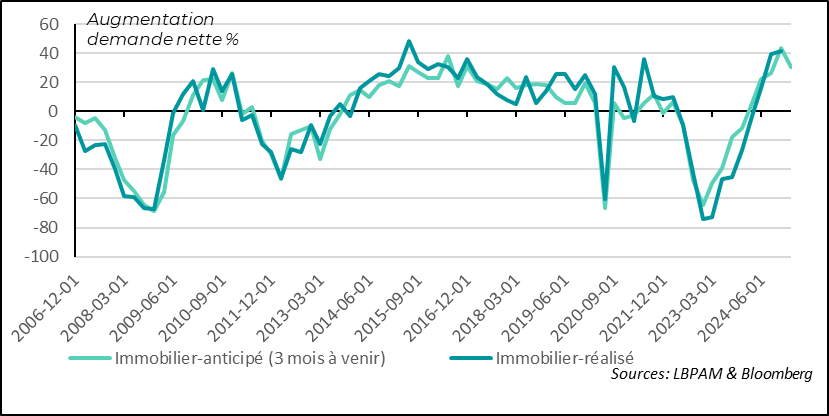

►This easing by the ECB is a key factor in the recovery of European growth. In fact, the ECB's latest survey of eurozone banks showed that lending conditions for businesses have tightened again, with banks becoming more cautious. Although corporate demand for credit improved at the end of 2024, its outlook deteriorated at the start of the year. Lending conditions for mortgages have remained fairly stable, but the future direction has become less favorable. At the same time, demand remains buoyant. All in all, lower key interest rates will be essential to stimulate a new credit cycle, and hence growth.

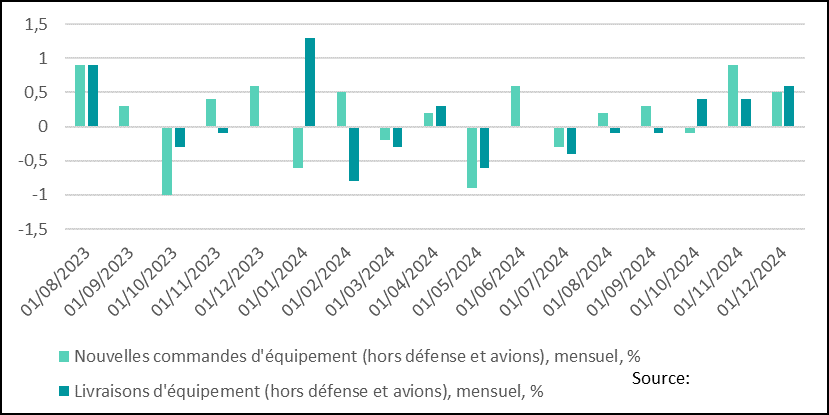

►In the United States, the end of 2024 seems to have been very positive for growth. Capital goods orders and deliveries rebounded strongly in December. This should lead to an upward revision of 4Q24 GDP growth. We still expect it to be close to 3% annualized.

►The Conference Board's survey of consumer confidence across the Atlantic came out less favorable than expected. It also indicated that tensions in the labor market appear to be easing. This is good news for the Fed, in its bid to ease wage pressures.

To go deeper

The ECB's survey of banks on the credit situation in the eurozone came out less favorable than expected. In fact, particularly for businesses, credit conditions were tightened in 4Q24, and the outlook for 1Q25 has also hardened. The outlook is deteriorating at the start of the year, with demand likely to weaken according to the banks.

Eurozone: corporate lending conditions continued to tighten as outlook deteriorates

Among the zone's major countries, lending conditions tightened in Germany and Italy in particular, with banks becoming more anxious and risk appetite falling sharply over the last quarter.

Thus, the fall in interest rates observed since the ECB's monetary easing campaign, while still favorable, has been negatively offset by more restrictive lending conditions imposed by banks.

This dynamic is clearly not conducive to boosting the zone's economic recovery through the credit impulse.

This further underlines the need for continued monetary easing by the ECB in the months ahead. It will create even more favourable credit conditions for businesses, with falling financial costs.

Of course, for these monetary effects to take full effect, political uncertainties within the zone, as well as threats to the economy from outside, such as D. Trump's possible tariff hikes, would have to subside.

Interest-rate cuts and still-favorable job market conditions have led to a genuine recovery in demand for mortgages. Even if the outlook is easing somewhat, this momentum remains buoyant. Here again, further cuts in key interest rates should maintain this favorable trend.

Eurozone: mortgage demand continued to rebound in 4Q24, but outlook for early 2025 is slightly less favorable

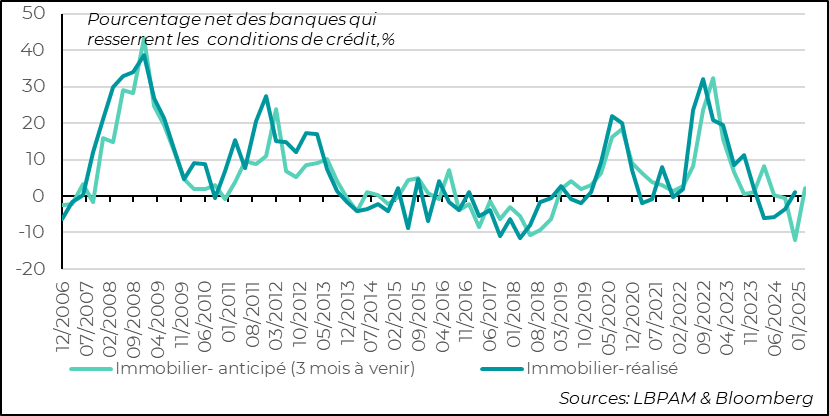

We need to keep a close eye on banks' risk appetite. The outlook for 1Q25 is much less favorable, with banks becoming more cautious in their selection of home loan applications.

The ECB is likely to take this dynamic into account in its decision to cut its key rates this week. While maintaining its focus on fighting inflation, it knows that the eurozone needs this credit boost to stimulate activity.

Eurozone: banks change the dynamics of their mortgage lending by tightening their conditions somewhat

In the United States, the end of 2024 seems to have supported demand in all its dimensions. Indeed, statistics on investment spending for December, as measured by capital goods deliveries and new orders, showed a very clear rebound, continuing the trend already seen in November.

Excluding volatile items, such as the aerospace and equipment sector or the defense sector, which are less linked to the economic cycle, we observe a very sharp rise in capital goods deliveries in the last month of the year. This is consistent with the sharp rise in orders in the previous month. In addition, the good momentum of new orders remained virtually intact in December.

These positive factors are consistent with the PMI surveys, which point to a slightly more favorable trend for industry at the end of the year. However, it remains unclear whether some of these orders reflect companies' fears about the impact of possible tariff hikes on equipment costs in the coming months or quarters. These fears are leading them to anticipate their orders.

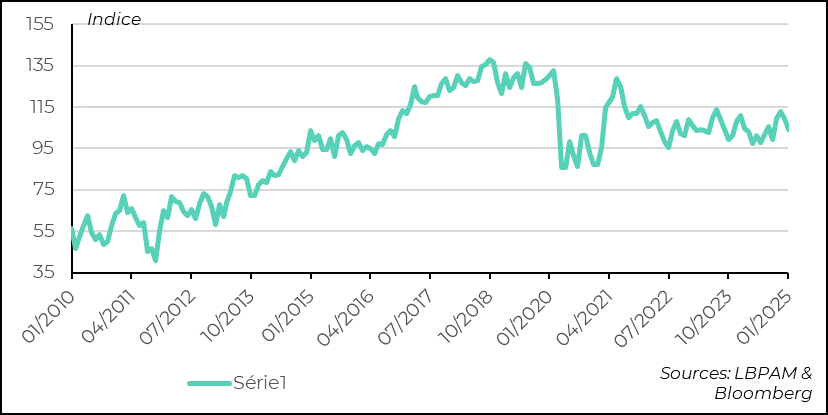

United States: in December, shipments and orders for industrial capital goods continued the positive trend begun the previous month

This business investment data consolidates the optimistic estimates for US GDP growth in 4Q24. The possibility of reaching 3%, or even more, in the final quarter of 2024 is very real, especially after the consumer figures.

Once again, it cannot be stressed enough that D. Trump's arrival in power comes against a very favorable economic backdrop.

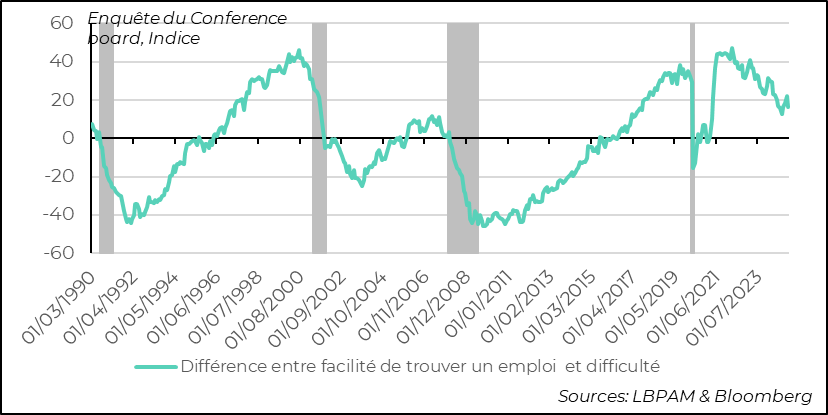

At the same time, the latest consumer confidence surveys show that confidence is not surging, but rather slowing. According to the Conference Board, confidence fell in January.

There is a considerable divide in the US economy depending on the political sensitivity of households. But overall, consumer confidence at the start of the year seems to be slowing.

United States: Household confidence eases in January

In particular, after an extremely favourable employment situation, the gradual normalization observed over the last 1-2 years is still underway.

The overall employment situation remains favourable, even if wage pressures appear to be much less significant. Good news for the Fed.

United States: the job market continues to adjust gradually, but remains very favorable

Sebastian PARIS HORVITZ

Head of Research