The Fed adopts a risk management approach.

Link

Key takeaways from the september 19 , 2025 market update insights from Xavier Chapard.

Overview

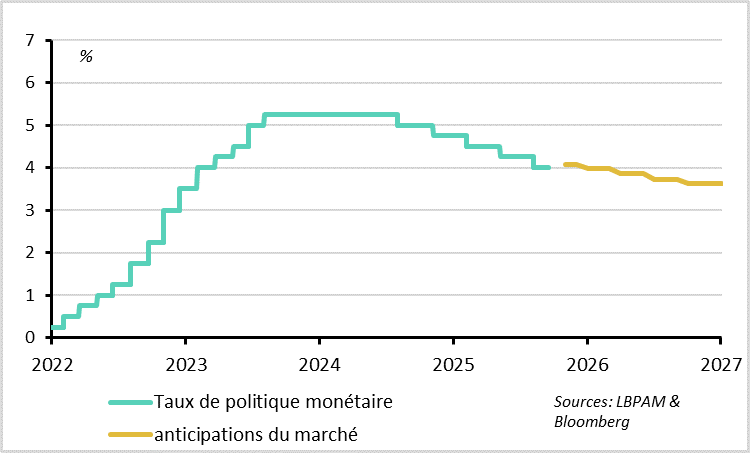

► As expected, the Fed cut rates by 25bps to 4.0–4.25% after a nine-month pause, and signaled that further rate cuts are likely in the coming months. A majority of Fed members now anticipate two additional rate cuts by year-end, compared to just one in the June projections. The Fed justifies these cuts by the summer slowdown in the labor market, which has led to a rebalancing of risks between its dual mandate of full employment and inflation control.

► That said, the Fed is not as dovish as markets had hoped, due to the still significant risk of persistent inflation. Only one member supports a rapid rate cut (unsurprisingly, the newcomer Miran). Moreover, the Fed’s baseline scenario is not compatible with a more accommodative stance, given the upward revisions to growth and inflation forecasts for next year. Finally, Powell stated that the Fed is “in risk management mode” rather than in a rush to ease policy.

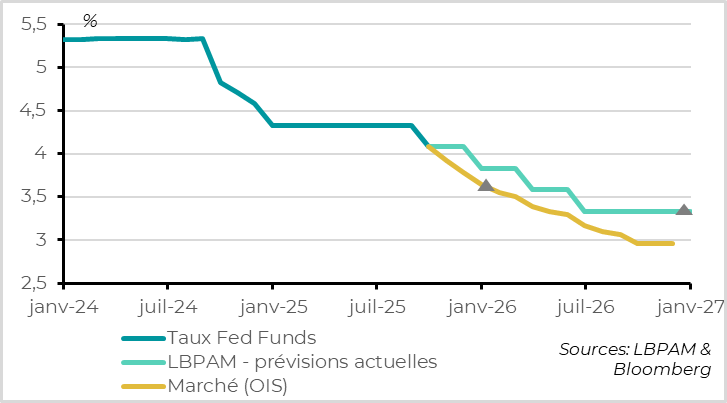

► Overall, we continue to believe that the Fed may only cut rates once more before year-end, and that it will maintain a slightly restrictive policy stance next year (with the policy rate ending 2026 at 3.4%), contrary to market expectations, which are below 3%. In this context, we see limited room for further declines in U.S. bond yields.

►Recent U.S. data also support the resilience of the economy. Retail sales remained strong in August despite the labor market slowdown and weak consumer confidence, and industrial production posted a slight increase. In addition, jobless claims declined in early September after rising earlier in the summer.

► The Bank of England (BoE) kept its policy rate unchanged at 4%, as expected. It remains concerned about persistent inflationary pressures but reiterated its intention to continue its “gradual and cautious” rate-cutting cycle. At the same time, it reduced its gilt sales less than expected under its Quantitative Tightening program. These decisions may support short-term rates but weigh on long-term yields, in our view.

► The Bank of Japan (BoJ) also held rates steady at 0.5%, as expected. However, two members voted in favor of a rate hike, and the BoJ announced it will begin selling its holdings of Japanese equities. These hawkish signals suggest the BoJ is progressing in its monetary policy normalization and may raise rates again in October, especially as core inflation remained high at 3.3% in August. We remain cautious on Japanese equities and bullish on the Yen.

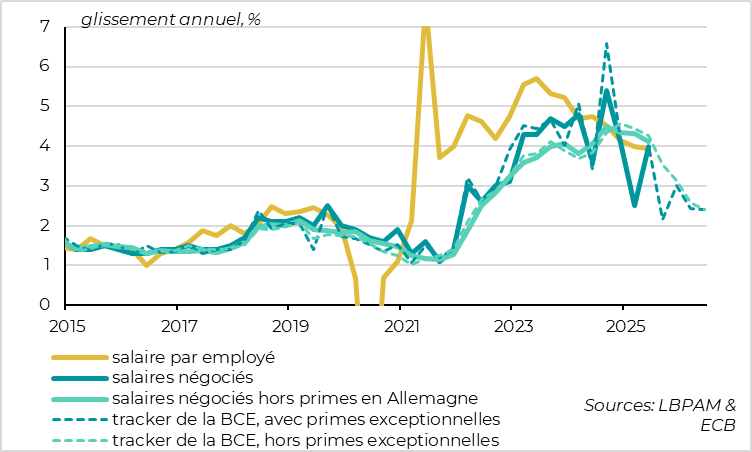

► Eurozone inflation was revised down from 2.1% to 2.0% for August, due to slightly lower energy prices. While headline inflation has reached the target in recent months, core inflation has stopped declining and remains slightly above target at 2.3%. The slow end to disinflation is mainly due to still-elevated services inflation. That said, we remain confident that core inflation will return fully to target—or even slightly below—in the first half of next year. Indeed, ECB wage indicators continue to point to a clear slowdown in wage growth in the second half of the year and into early 2026, falling toward 2.5% from over 4% currently. This should significantly ease price pressures in the services sector, which is the most labor-intensive.

In-Depth insights

The Fed adjusts its policy to manage risks.

The Fed has indeed resumed its rate cuts.

As expected following the summer jobs reports and Powell’s August speech, the Fed cut its policy rates for the first time this year on Wednesday, lowering them by 25bps to 4.00–4.25%.

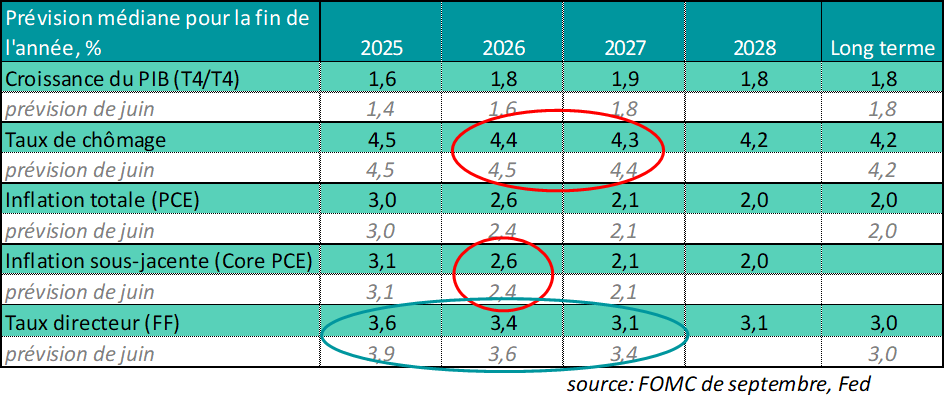

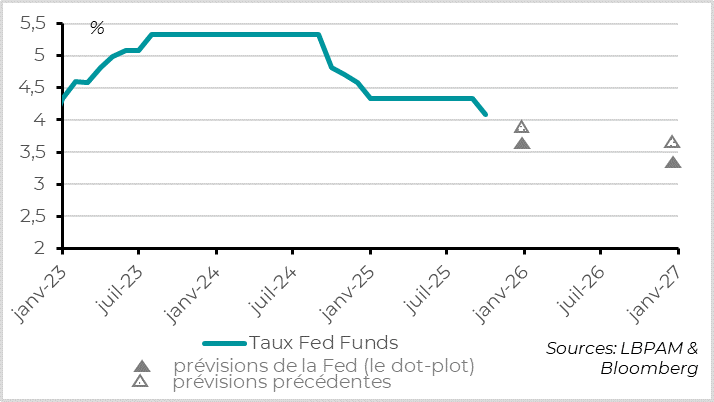

The Fed’s median projections now indicate three rate cuts in total for this year—two more after this week’s move. In June, only two cuts were projected, and consensus was split between two and three. Fed members still foresee one rate cut per year in 2026 and 2027, bringing the policy rate 25bps below previous projections over the period (3.6% by end-2025, 3.4% by end-2026, and 3.1% by end-2027).

The Fed’s statement justifies the resumption of monetary easing by noting that the “balance of risks” between its dual mandate—employment and inflation—has shifted, warranting a move toward a less restrictive stance. The Fed stated that “risks to employment have increased” as “job growth has slowed” and the unemployment rate has “edged up.” Powell clarified during the press conference that while both labor supply and demand have declined, the slight rise in unemployment suggests demand has softened more than supply recently. Given that inflation risks remain largely unchanged, the Fed considers it prudent to adopt a less restrictive policy (it still estimates the neutral rate at around 3%, well below the current level).

However, both the Fed and Powell appeared more cautious about the pace and extent of future rate cuts than markets had anticipated.

Powell framed this week’s rate cut as part of a “risk management” approach, while emphasizing that risks remain. This does not point to a rapid move toward an accommodative stance. The statement also noted that “inflation has increased and remains somewhat too high.” This is concerning given that “uncertainty remains elevated” and “the unemployment rate is still low.” Powell explained that while risks are becoming more balanced between inflation and employment, they are not yet fully balanced, and the inflationary risks linked to tariffs remain present. This marks a more balanced tone than the one he adopted at Jackson Hole.

The Fed’s baseline scenario does not justify a significant easing.

The Fed’s baseline scenario does not support aggressive monetary easing. The revisions to the Fed members’ median projections were limited and, if anything, slightly hawkish. The unemployment rate is now expected to rise less, while both growth and inflation are projected to be higher next year. Notably, core inflation for end-2026 was revised up from 2.4% to 2.6%, clearly above target (although the 2027 forecast remains unchanged and close to target at 2.1%).

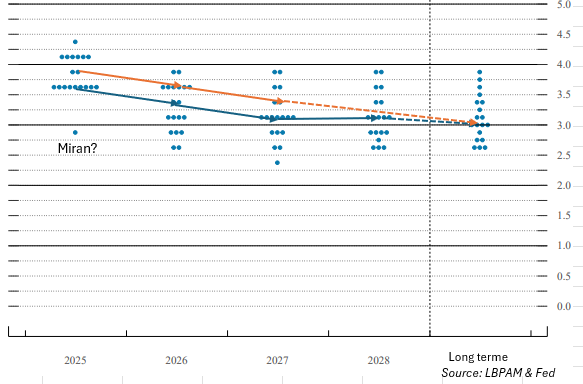

Moreover, there was broad consensus in favor of a gradual pace of rate cuts—unlike a year ago. Only one member, the newcomer Miran, voted for a larger 50bps cut. Even the two Fed members appointed by D. Trump, who had supported a rate cut as early as July, did not back a more aggressive move. Powell also clarified during the press conference that there had been little discussion around the possibility of a cut larger than 25bps.

The Fed’s baseline scenario does not justify a significant easing.

Finally, the Fed committee is highly divided on the path ahead. While the median projection—which markets tend to focus on—does indicate two additional rate cuts this year, in reality, 9 out of 10 members foresee only one more cut at most. Projections for next year are also widely dispersed, highlighting significant uncertainty around the timing and magnitude of future rate cuts. Notably, one member (likely Miran) is forecasting two additional 50bps cuts this year.

Our scenario is closer to the Fed’s than to the market’s.

Overall, the Fed’s message was more in line with our expectations than with those of the market. The Fed is factoring in the clear deterioration in the labor market over the summer, while the rise in inflation remains very gradual for now. As a result, it is cutting rates, which had remained high, to limit the risk of a sharper slowdown leading to recession. With the policy rate at 4.1%, the Fed still has some room to lower rates without entering accommodative territory (even though we believe the neutral rate is closer to 3.5% than the 3% estimated by the Fed).

However, we believe the risk of a sharp deterioration in employment—i.e., a rapid rise in the unemployment rate well above 4.5%—remains limited. This is supported by the solid activity data in August and the recent stabilization in jobless claims. At the same time, inflation is expected to continue rising in the coming months due to tariff effects and will likely remain well above target next year, even if the tariff shock proves to be temporary. In this context, the Fed can only cut rates cautiously and to a limited extent, so as not to fuel medium-term inflation risks.

We maintain our forecast of one rate cut this year and two next year, which would bring the policy rate to 3.4% by the end of 2026—consistent with the Fed’s median projection. It is entirely possible that the Fed accelerates its rate cuts with two moves this year. But in that case, we believe it would only cut once next year. In any scenario, we think the market is overestimating the extent of easing by pricing in policy rates below 3% next year, even in a scenario where the U.S. economy holds up. These expectations are already supporting very accommodative financial conditions, which should not encourage the Fed to ease further.

United Kingdom: The Bank of England stays the course.

The Bank of England kept its policy unchanged in September

As expected, the Bank of England (BoE) kept its policy rate unchanged yesterday, following its controversial rate cut in August. While two members voted for an additional cut, a clear majority of seven preferred to hold the rate at 4%. This was fully anticipated and remains consistent with the BoE’s pace of 25bps cuts per quarter since the beginning of this cycle.

The BoE has become more cautious about inflation risks since the summer, as core inflation and wage growth have slowed less than expected since the start of the year, and inflation expectations are starting to rise again. In its statement, it reiterated that “upside risks to medium-term inflation remain significant.” Given the increase in regulated prices and wage-related costs in April, inflation is expected to remain elevated until next spring. This could lead the BoE to delay and limit future rate cuts.

That said, the BoE maintained the key phrase that has guided its policy for the past year, indicating it remains in a rate-cutting cycle: “A gradual and cautious approach to withdrawing monetary tightening remains appropriate.” This week’s data supports that stance, as inflation stopped surprising to the upside in August and wage growth slowed more noticeably over the summer.

We continue to believe it is reasonable to expect a rate cut by year-end, although the risk remains that the BoE may wait until next spring to act. Given the market’s limited expectations, this would support the short end of the UK yield curve.

However, the BoE announced a smaller-than-expected reduction in the pace of its government bond portfolio runoff, which could add pressure to long-term yields. It plans to reduce its holdings by £70 billion over the coming year, compared to £100 billion over the past year. While this headline figure is lower, the actual amount of bonds maturing in its portfolio over the next year is falling even more sharply. In fact, the BoE will actively sell more bonds over the coming year than it did in the previous one—around £20 billion.

Eurozone: Wage trends support confidence in the end of disinflation.

Underlying inflation has been stagnating slightly above 2% for the past three months.

Eurozone inflation was revised from 2.1% to 2.0% in August in the final figures, placing it exactly at target for the third consecutive month (in fact, at 2.04%). However, this revision is solely due to energy prices.

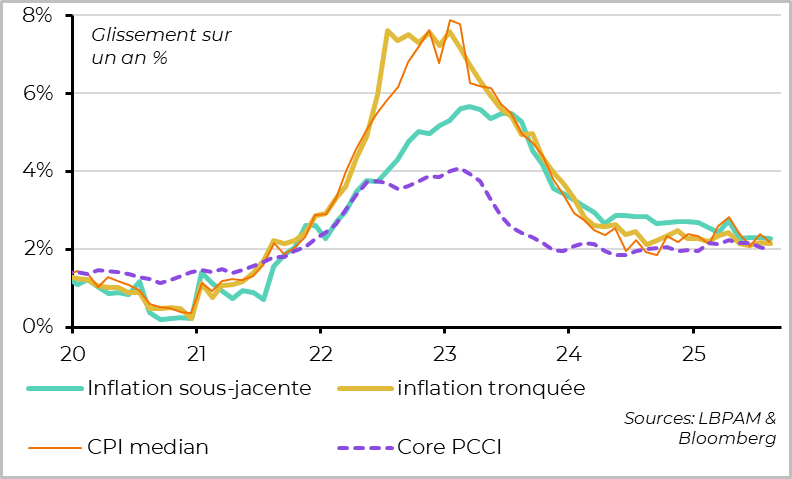

Core inflation was confirmed at 2.3%. While this is the lowest level since early 2022, it has stopped declining over the past four months and remains slightly above target. The breakdown of the final data also allows us to calculate other measures of underlying inflation (such as median inflation and trimmed mean inflation). These indicators reversed their July increase but also remain slightly above 2%.

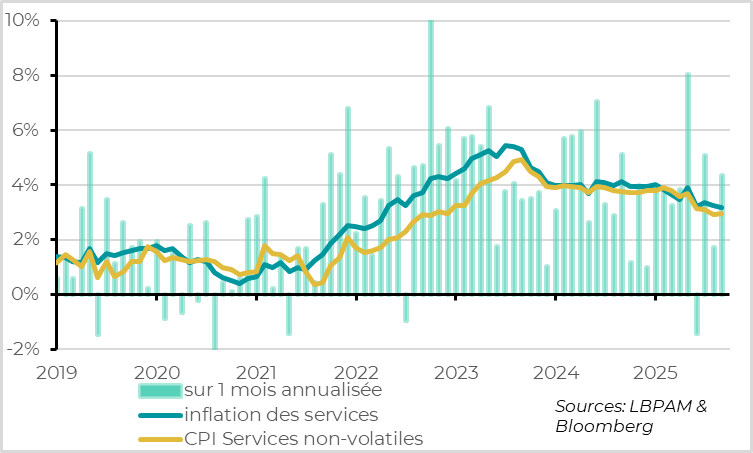

The lack of further progress in bringing core inflation fully back to target stems from the still slow and incomplete decline in services inflation. While services prices did slow from 3.2% to 3.1% in August, this was solely due to a drop in tourism-related prices, which are typically volatile. In reality, non-volatile services inflation has remained stable at 3% for the past three months, after beginning to slow in Q2. Sequential price increases do not point to any meaningful deceleration in the coming months.

While the slow normalization of services inflation is often cited by central bankers as a reason to pause rate cuts, the outlook still clearly points toward inflation returning fully to target—or even slightly below—next year.

Wages have remained strong in the Eurozone, which helps explain the slow decline in services inflation, given the sector’s high labor intensity. Average compensation per employee has slowed from its peak two years ago (above 5.5%), but still grew by 4% in the first half of the year. Negotiated wages, which are not affected by compositional effects, remain close to their highs above 4% (after smoothing bonuses in Germany).

However, the ECB’s leading indicator for negotiated wages continues to point to a clear slowdown in the second half of the year, toward 3% by year-end and 2.5% in early 2026. This is consistent with the easing labor market and the usual lag between headline inflation and wage dynamics. At this pace, real wages would remain positive (above inflation), which is supportive for consumption—but they would no longer generate inflationary pressures. Indeed, wage growth between 2% and 3% is compatible with 2% inflation, assuming productivity growth of around 0.5% per year.

This should allow for a more pronounced slowdown in services inflation. With goods inflation already normalized and likely to decline further due to the appreciation of the euro, core inflation should return to 2%—or slightly below—by early 2026. Given the risk of inflation falling below target within six months and the lagged impact of monetary policy on the economy and prices, we continue to believe the ECB should deliver one more rate cut in this cycle—even if that is not its current stance.

Xavier CHAPARD

Strategist