The Fed can be patient given the strength of US employment

Link

-

U.S. employment reports for March were very strong, with another upward surprise for job creation (+303 thousand). And this time it was accompanied by a rise in employment in the household survey, allowing the unemployment rate to reverse some of last month's increase. At 3.8%, the unemployment rate has been broadly stable since mid-2023, below the level the Fed considers sustainable in the medium term (4.1%). The good news for the Fed is that wages are continuing to slow gradually, even if they are still too high.

-

These figures suggest that the US economy is still not slowing down, but also suggest that the risk of inflation not slowing down sufficiently remains significant. Against this backdrop, there is no urgency for the Fed to cut rates, even if the outlook for rate cuts is not in doubt as it stands. Markets are now anticipating only a 50/50 chance of the Fed cutting rates in June, which seems reasonable to us.

-

The strength of the US economy reinforces the importance of the March inflation figures published on Wednesday. After three upward surprises, inflation is likely to slow a little. But another upward surprise would further reinforce the risks of higher rates for longer.

-

In Europe, the latest figures remain mixed (decline in retail sales in February, limited rise in industrial production), but prospects for a gradual upturn in growth remain in place. And inflation slowed well in March, even if pressures in services remain strong. Against this backdrop, the ECB should continue to indicate at its meeting on Thursday that a first rate cut in June is likely, although this will depend on the data. The rise in oil prices towards $90 per barrel is a risk for the ECB, but one which we believe remains under control, as it is not accompanied by rising gas and electricity prices, unlike in 2022. Given the differing economic situations in the USA and the Eurozone, a mismatch between the timing of ECB and Fed rate cuts is increasingly possible, which should keep the dollar high.

-

The Bank of Japan remains in a tricky situation after exiting negative rates last month. On the one hand, the economy is a little weak at the start of the year, and wages paid do not yet reflect the historic rise in negotiated wages. On the other hand, the outlook remains positive, while the yen remains under pressure. This could push the BoJ to raise rates as early as this summer, even if uncertainty remains high.

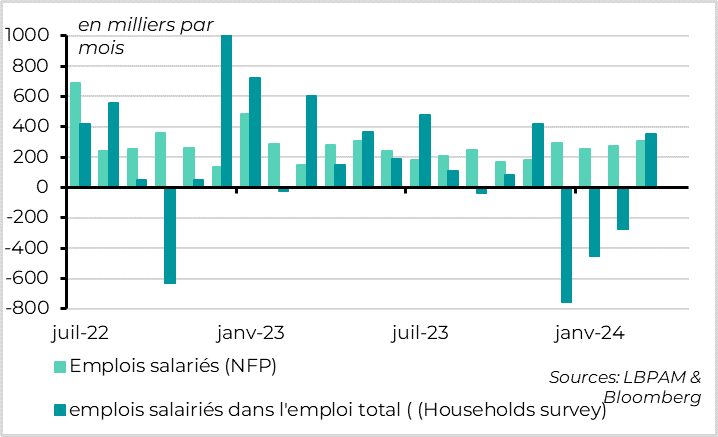

Fig.1 United States: Both surveys point to strong employment growth in March

-Salaried jobs (NFP)

-Salaried jobs as a percentage of total employment (Households survey)

The US job market remained very strong in March.

The US economy created 303,000 jobs in March after 270,000 in February, a level still well above expectations (+214,000) and the highest for a year. And employment was positively revised for the previous two months. In terms of sectors, job creation remains very strong in the public sector, education, healthcare and restaurants. But employment is rising in most sectors, even if the increases are more limited.

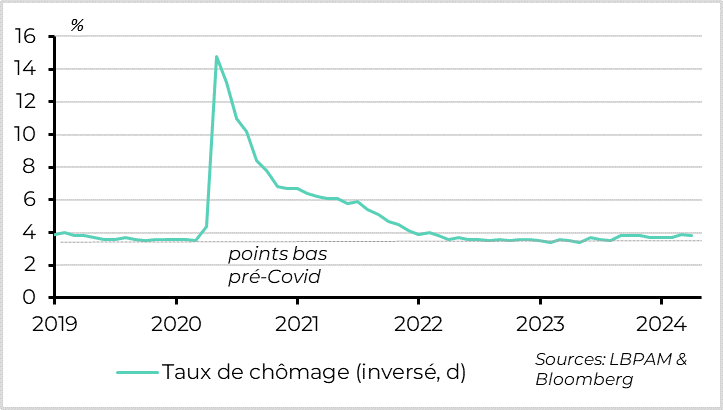

Fig.2 United States: unemployment rate remains stable at a limited level

-Unemployment rate (inverted, d)

Above all, the household survey confirms the health of the US labor market, in contrast to recent months. It shows a 500,000 increase in employment in March, after three months of decline. The gap between the two surveys over the past year and a half remains wide (4.5 million vs. 2.5 million), but it narrowed slightly in March. This allowed the unemployment rate to fall slightly to 3.8%, after rising to 3.9% in February, despite a rise in the participation rate. The unemployment rate has been broadly stable around its current level since mid-2023, above its post-Covid low point (3.4%) but clearly above the level the Fed considers sustainable (4.1%).

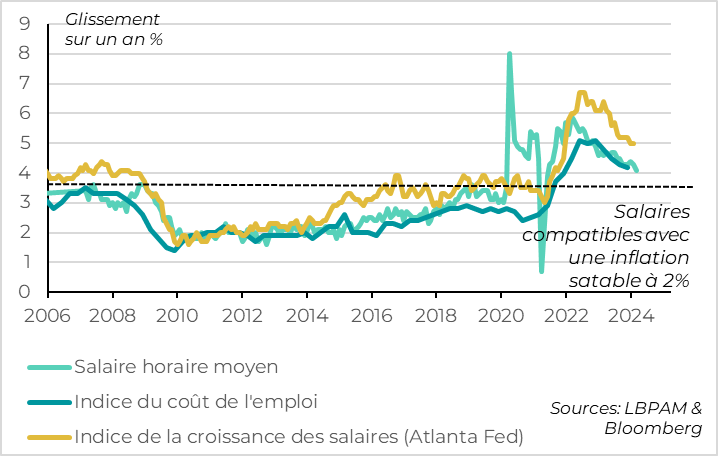

Fig.3 United States: wage trends slow, but not yet sufficiently so

-Average hourly wage

-Employment cost index

-Wage growth index (Atlanta Fed)

In terms of salaries, the trend slowdown seems to be continuing, although the level is still too high. Average hourly earnings rose by 0.3% on the previous month, compared with 0.2% in February. But this fluctuation probably reflects the impact of weather conditions on the number of hours worked. Beyond this noise, the annual rate of wage growth continues to fall, from 4.3% to 4.1%. This measure of wages is always to be taken with caution, as it is volatile and affected by compositional effects, but the trend is favorable. The Atlanta Fed's own measure should continue to slow, even if it remains, at 5% in January, still too high to ensure a sustainable return of inflation towards 2%.

All in all, these job reports suggest that the US economy remains very dynamic, which poses an upward risk to our expectations of US growth (which we see slowing sharply below 2%) and inflation (which we see stabilizing closer to 3% than the 2% target). That said, employment dynamics can change rapidly during cycle reversals, and certain indicators still suggest signs of weakness (rising part-time employment, falling temping, ISM employment indicators in contraction zone...). So an economic slowdown during 2024 is still possible.

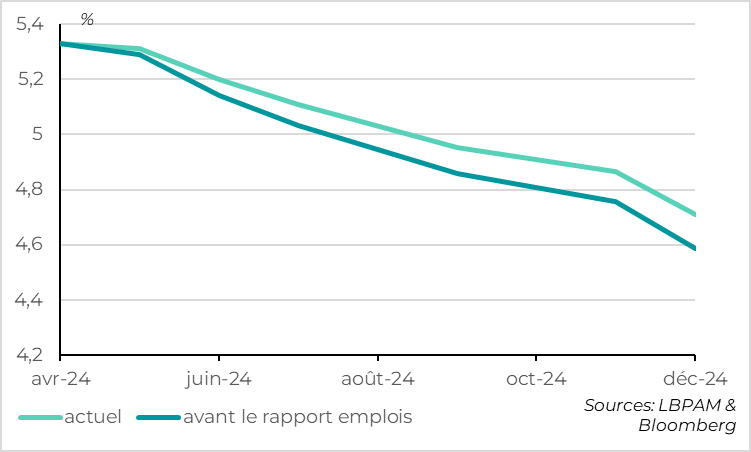

Fig.4 Fed: markets anticipate fewer rate cuts after jobs figures

-Current

-Before the jobs report

For the Fed, these data show that there is no urgency to cut rates, and that the risk of higher rates for longer is increasing.

The slowing trend in wages and signs of a gradual rebalancing between labour supply and demand still justify the prospect of rate cuts in the medium term. But with no signs of a net slowdown in growth, the Fed can be patient. Especially as the stability of the unemployment rate below its equilibrium level and the slowness of the wage slowdown increase the risk that inflation will not slow down to its target, especially after the upward surprises in inflation since the start of the year. If our scenario is for a first Fed rate cut in June and three rate cuts between now and the end of the year (-75bp), the risk of later or even less marked rate cuts rises sharply.

That said, the market is already well aware of this risk, since it now includes only a one-in-two chance of a first Fed rate cut in June, and 61bp of rate cuts between now and the end of the year. This somewhat limits the risks for risky assets, at least as long as the prospects of rate cuts, sooner or later, remain in place. That said, all eyes will now be on Wednesday's March inflation figures, as a continuation of bullish inflation surprises could further delay rate cut expectations.