The Fed can hardly be satisfied with overly flexible financial conditions

Link

-

The start of the year was rather quiet in terms of economic surprises.

-

The latest data confirm the trend seen at the end of 2023: the global economy is still holding up well, thanks to the resilience of the US economy and the slowdown in inflation. But the sustainability of growth remains uncertain, given the growing imbalances, both geographically (USA vs. rest of the world) and sectorally (demand for goods remains weak).

-

The markets have corrected their over-aggressive expectations of rate cuts, thanks to the cautious rhetoric of most central bankers. But these expectations remain optimistic, especially for the Fed. At the same time, risky assets remain buoyant, with global equities surpassing their early 2022 highs last week. All in all, financial conditions remain more accommodative than they were last year, which could prove displeasing for central bankers who are not yet sure they have fully won the battle against inflation.

-

The easing of financial conditions during the final months of last year is supporting US developer and household confidence at the start of 2024. Household confidence jumped to its highest level since mid-2021 in January. This reduces the risk of a sharp slowdown in the US economy in the short term, but increases the risk of more persistent domestic inflationary pressures. In these conditions, the Fed is likely to continue to struggle against the market's overly aggressive rate cut expectations.

-

After the still disappointing growth figures for Europe at the end of 2023, the first confidence indicators for January (starting with the PMIs on Wednesday) will be closely watched. We continue to anticipate stagnation rather than contraction in Eurozone activity at the turn of the year, but this scenario could be called into question if the PMIs fail to break out of the contraction zone.

-

Ahead of Thursday's meeting, the ECB will also take a close look at the bank survey to gauge the transmission of monetary tightening. In any case, the ECB is likely to reiterate that it is not yet ready to cut rates immediately, although rate cuts from the summer onwards are likely.

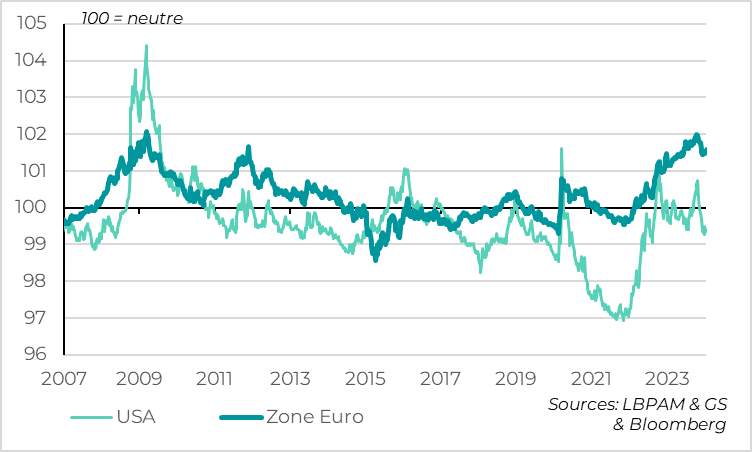

Fig.1 Markets: Financial conditions eased significantly following J. Powell's very accommodating speech in December, especially in the United States.

-USA

-Euro zone

Financial conditions (i.e. the impact of asset price movements on the economy) eased significantly at the end of last year. A slight easing was to be expected after central banks confirmed that the rate hike cycle was most likely over. But this easing was strongly reinforced by the Fed Chairman's speech in December, which fuelled expectations of rapid and sharp rate cuts. This has fuelled the appreciation of most assets over the last period.

Since the beginning of the year, most central banks have been trying to limit this easing by insisting that rate cuts, while expected to begin in 2024, are not imminent and will be cautious. This has helped to reduce aggressive rate-cutting expectations somewhat, and has largely corrected the excess decline in long rates.

But expectations for the Fed remain too optimistic in our view, and risky asset markets remain very high. After consolidating slightly, global equity markets surpassed their highs of early 2022 last week. All in all, financial conditions remain fairly loose, especially in the US.

This is a risk for central banks, as it could support demand and thus growth in the short term, once again fuelling possible inflationary pressures. This would run counter to the very strategy pursued by the Fed to date. This is why we believe that the ECB this week and the Fed next week should emphasize that the battle against inflation is not totally won, and that it will be a few months before the first key rate cuts.

We still believe that significant rate cuts will take place in 2024, as inflation falls. But they should only start in the spring and be gradual, so that monetary conditions will remain more restrictive than the market thinks.

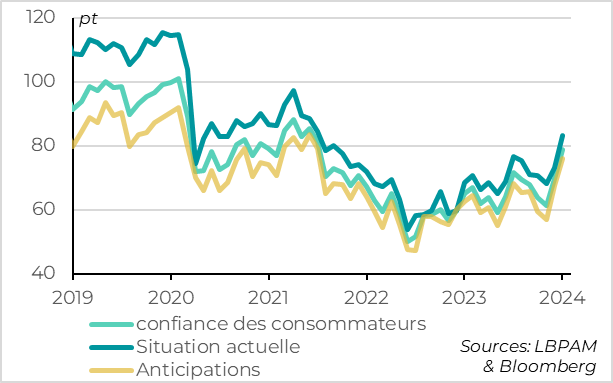

Fig.2 United States: consumer confidence rebounds strongly in early 2024

-Consumer confidence

-Current situation

-Anticipations

US household confidence rebounds to its highest level since the start of the rate hike cycle in early 2024, according to preliminary survey results from the University of Michigan.

The indicator rises from 69.7 to 78.8pt, a level not seen since mid-2021, although it remains slightly below its historical average. This reflects a clear rise in household sentiment regarding both their current situation and their outlook.

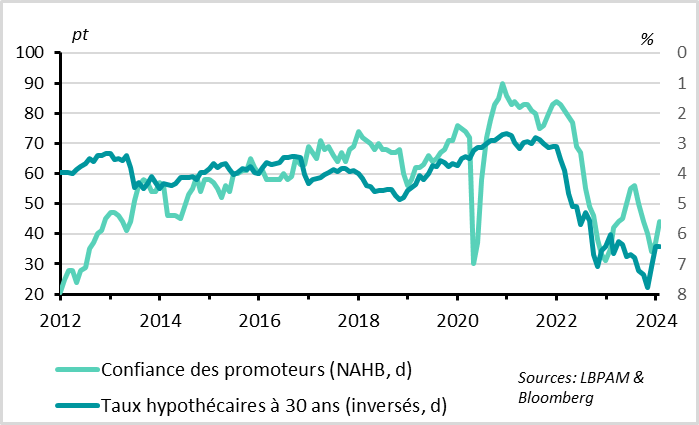

Fig.3 United States: developer confidence also benefits from the easing of financial conditions over the past 2 months

-Promoter confidence (NAHB,d)

-30-year mortgage rates (inverted,d)

U.S. consumer confidence is benefiting from rising asset prices, leading to a favorable wealth and confidence effect. This clearly illustrates the effect of the easing of financial conditions over the past two months. This effect is also clearly visible in the rebound in property developers' confidence over the past 2 months, which is directly linked to the cut in mortgage rates at the end of 2023.

Consumer confidence, and in particular that measured by the University of Michigan, is not a very good indicator of short-term growth. But it is a good indicator of the willingness of households to spend versus save.

After US consumption remained buoyant at the end of 2023, as shown by retail sales in December, the risks of a marked slowdown in the economy at the beginning of 2024 are probably lower than we anticipated.

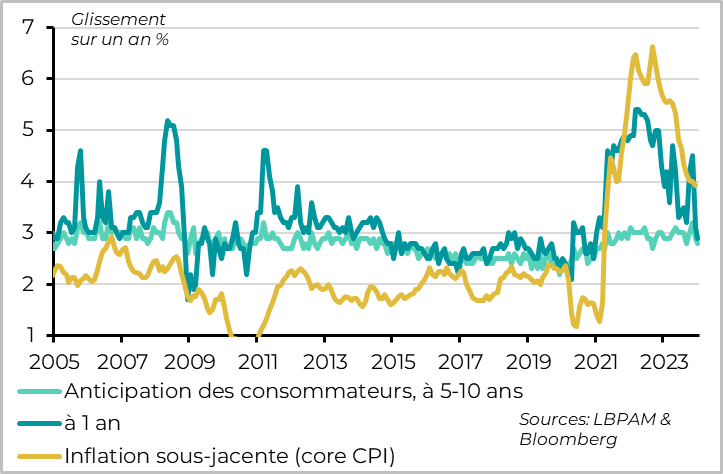

Fig.4 United States: household inflation expectations normalize thanks to slowing inflation

-Consumer anticipation, 5-10 years ahead

-At 1 year

-Underlying inflation (core CPI)

The other main factor underpinning household confidence is falling inflation. One-year inflation expectations are down to 2.8%, their lowest level since 2020, helped by the 20% drop in gasoline prices over the past 3 months. This is supporting household purchasing power. And long-term inflation expectations (5-10 years) have normalized after being a little elevated in the last quarter of last year, coming back in line with their historical average level at 2.8%.

The fact that medium-term inflation expectations are well anchored is a very positive sign for the Fed, as it suggests that inflation should return to the 2% target once the economy is back on a sustainable trajectory, without the need to keep the economy well below potential for some time.

But for inflation to return to the 2% target on a sustainable basis, domestic pressures must normalize, which is not yet the case. Indeed, inflation in domestic services and wages is still far too high to be compatible with sustainable inflation at target. And normalization will take even longer if the economy continues to grow above potential, as has been the case since mid-2023. This is why we believe that core inflation is likely to remain above target for longer than markets and households anticipate, at least until next year.

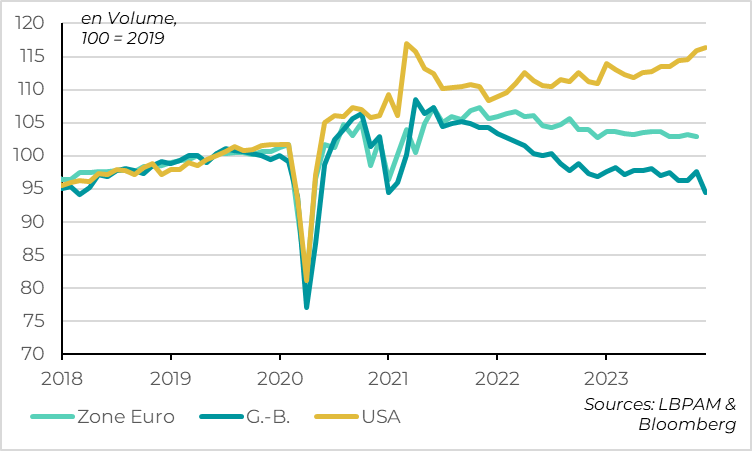

Fig.5 Retail sales: demand for goods remains weak in Europe at the end of 2023

-Euro zone

-G.B.

-USA

In contrast to the USA, retail sales remained weak in Europe at the end of 2023. Combined with the disappointing Chinese activity figures for the end of last year, this suggests that global activity remains mainly driven by the USA. We expect the dynamism gap between the US and the rest of the world to narrow this year. But if it persists, such an imbalance will raise questions about the sustainability of global growth.

Sales in the UK fell by 3.2% in December, following a 1.4% rise in November, so that they fell by 1% in Q4, as in the previous quarter. Given the rebound of UK PMIs into expansionary territory since November, we continue to believe that GDP could stabilize in late 2023/early 2024. Especially as December retail sales were negatively impacted by the timing of sales and weather conditions. But the latest activity figures increase the risk of the UK being in technical recession since mid-2023. The good news is that this should prompt the Central Bank to indicate that it is well and truly finished with rate hikes, like the Fed and the ECB.

For the Eurozone, we do not have sales figures for December. But the drop in retail sales in November, the disappointing car sales figures for December and the fact that the PMI remained in the contraction zone at the end of 2023 are not encouraging. We are forecasting zero growth for late 2023 and early 2024, but the risks seem rather bearish in relation to this forecast. We'll be keeping a close eye on Wednesday's PMI indicators for January to see if they finally improve more markedly in early 2024.