The Fed continues to support markets at year-end

Link

What are the key takeaways from market news on November 28, 2025? Find out with Xavier Chapard’s analysis.

Overview

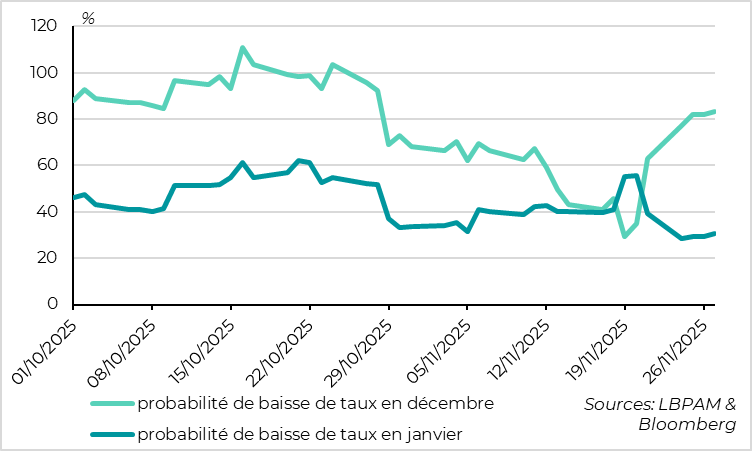

► Equities rebounded sharply during this Thanksgiving-shortened week, almost erasing their November losses. This seems to confirm our view that the early-November consolidation was primarily a healthy pause following the strong performances in September and October, rather than a trend reversal—especially as data continue to show that the global economy remains resilient. However, this rebound is also driven by hopes of a Fed rate cut as early as December.

► We share this expectation and now believe the Fed will cut rates by 25 bps on December 10, even though we continue to think it will ease less than markets anticipate next year. The fact that no Fed member attempted to discourage markets from pricing in a rate cut before the start of the blackout period this weekend, combined with the release of the Beige Book, has reinforced our conviction.

►Indeed, the November Beige Book, published by the Fed on Wednesday, supports the case for rate cuts, as it indicates that risks to employment have increased slightly while the risks of a significant inflation surge remain contained. The Beige Book will carry more weight than usual in the Fed’s decision, as employment and inflation data will only be released after the meeting.

► The UK budget presentation, long feared by markets, helped reduce short-term fiscal and political risks, which supported UK assets this week. Despite weaker growth prospects and higher spending, the government has increased its fiscal headroom relative to budget rules through tax hikes, albeit deferred until 2028. Lower short-term risks and further rate cuts ahead lead us to remain positive on short-term UK government bonds, even though economic and fiscal uncertainties remain significant over the longer term.

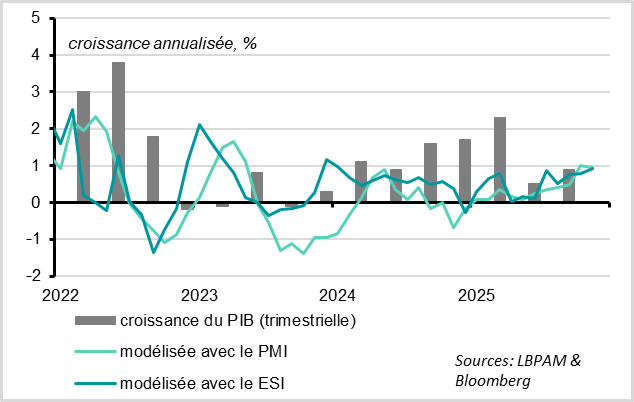

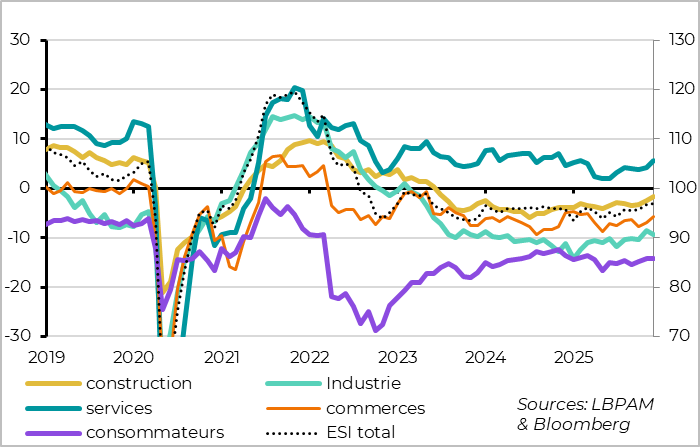

► In the Eurozone, the European Commission’s Economic Sentiment Indicator rose more than expected in November, reaching its highest level since early 2023 at 97 points. Like the PMIs, this indicator is consistent with a slight acceleration in eurozone growth in Q4. This acceleration does not come from Germany or the industrial sector, where confidence remains weak, suggesting that the support from German fiscal easing is still ahead. In this context, we remain optimistic about the eurozone economy and equities in the coming months.

► As for the ECB, the minutes of the October meeting confirm that the ECB is comfortable with rates at 2%, but indicate it remains open to considering another cut, particularly if inflation risks staying durably below 2%. We continue to believe that one final rate cut would be appropriate, even though this move now seems more likely in early 2026 than at the end of 2025, as we previously expected.

► In Japan, Tokyo inflation remains well above target in November (at 2.8%), and industrial production surprised to the upside in October. Combined with the weakness of the yen, this increases the likelihood that the central bank will raise rates as early as December.

Go further

United States: The Beige Book likely to convince the Fed to cut rates

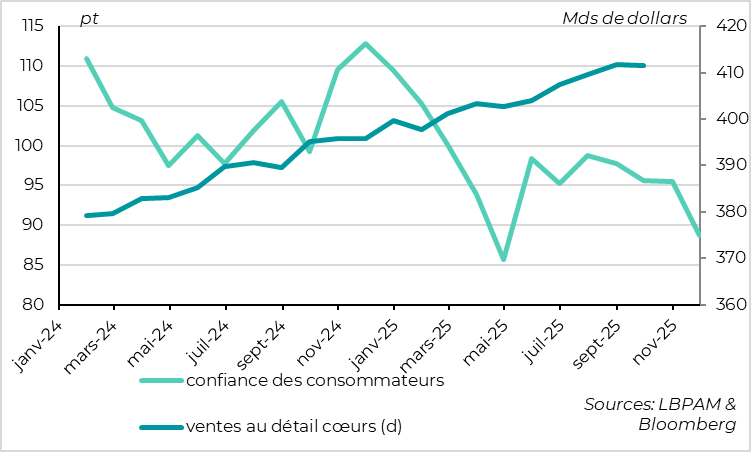

Consumption slows in Q4

The Fed’s November Beige Book indicates that the risk of rising unemployment is now greater than that of higher inflation at year-end.

The report, based on anecdotal evidence, highlights that U.S. economic activity remained relatively unchanged in November, as in October’s Beige Book. However, the tone of the report is even more cautious.

In particular, consumer spending appears to have declined slightly according to the November report, which aligns with the sharp slowdown in retail sales in September and the deterioration in consumer confidence in October and November.

This is not surprising, as the November Beige Book was compiled during the government shutdown, which is expected to temporarily weigh on Q4 consumption. However, it suggests that short-term risks to activity are tilted to the downside, especially as the report again underscores the fragility created by the gap between resilient spending by wealthier households and the difficulties faced by lower-income households.

Labor market uncertainty persists

Most notably, the Beige Book indicates that employment continued to slow. The report states that “employment edged down” in November, whereas it was considered “stable” in October. That said, the labor market remains in a “low hiring, low firing” mode, with hiring limited to replacing departures while layoffs remain contained. This is consistent with recent jobless claims data, which show that the number of claimants is rising slightly, but new claims remain low (in fact, at their lowest since April). This does not suggest that the labor market is contracting, but rather that it lacks momentum, reinforcing downside risks.

At the same time, the Beige Book notes that price increases remain “moderate.” Business costs are rising sharply, particularly due to tariffs, but these costs are being passed through only gradually and partially to selling prices because of concerns about demand. This points to a negative impact of tariffs on margins, but controlled risks of a rapid inflation surge.

Markets again price in a december rate cut

With official data limited and delayed (to be released after the Fed’s December 10 meeting for November employment and inflation reports), the Beige Book will likely have a greater-than-usual influence on the Fed’s decision. It suggests that the risk of rising unemployment outweighs short-term inflation risks, supporting the case for another rate cut in December.

The Beige Book has convinced us that the Fed is likely to cut rates again in December, whereas we had previously expected a pause. This cut was already becoming increasingly likely after Williams’ speech last weekend, in which the New York Fed President supported a rate cut “in the near future.” Moreover, no key Fed member has attempted to counter the market’s growing expectations for a rate cut before the start of the Fed’s blackout period this weekend. It would now be surprising for the Fed to choose to surprise markets by not cutting rates on December 10.

That said, we expect the Fed’s communication to remain cautious so as not to encourage markets to price in further rate cuts for next year. We continue to anticipate, contrary to market expectations, that the policy rate will remain well above 3% next year.

United Kingdom: the budget calms markets

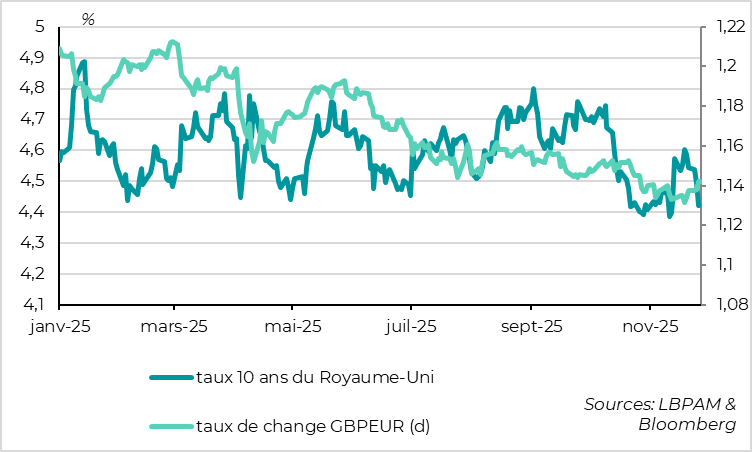

Yields fall and sterling rebounds after the budget announcement

As expected, the presentation of the new budget by the UK government reassured markets, which had priced in a significant risk premium on UK assets due to political and fiscal concerns. While the economic and fiscal outlook remains challenging in the medium term—likely limiting sterling’s rebound—the reduction in short-term political and fiscal risks could continue to support UK government bonds, in our view.

Fiscal headroom increases more than expected

In the short term, the budget announcement brings positive news for markets.

First, the mere fact that the government presented a reasonable budget (unlike in 2022), without triggering a revolt within Labour ranks despite rolling back key campaign promises, removes a risk that had weighed on markets since late summer.

Second, the budget unveiled on Wednesday increases the margin relative to fiscal rules by twice as much as expected, from £10 billion to £22 billion. Downward revisions to potential growth by the OBR (the independent fiscal watchdog) and higher expected spending do reduce this margin. However, this is offset by stronger-than-expected upward revisions to inflation and by medium-term tax hikes. This shows that the government remains focused on containing fiscal risks and reduces the likelihood of new austerity measures being announced next year.

Importantly, the UK Debt Management Office simultaneously announced a reduction in long-dated gilt issuance, increasing Treasury bill issuance and shortening the average maturity of bonds to be issued in the coming months. This is good news for long-term yields, as investors will have to absorb less duration risk. And it does not materially weaken the UK’s debt profile, which remains much longer than that of other major countries (13.5 years versus less than 9 years for comparable peers).

Finally, this budget should be broadly neutral for the Bank of England, which should still be able to cut rates further in the coming quarters. On one hand, fiscal tightening will be slightly less rapid than previously expected, supporting demand. On the other hand, this stems from lower energy taxation, which reduces inflationary pressures. Overall, the demand-inflation balance is little changed.

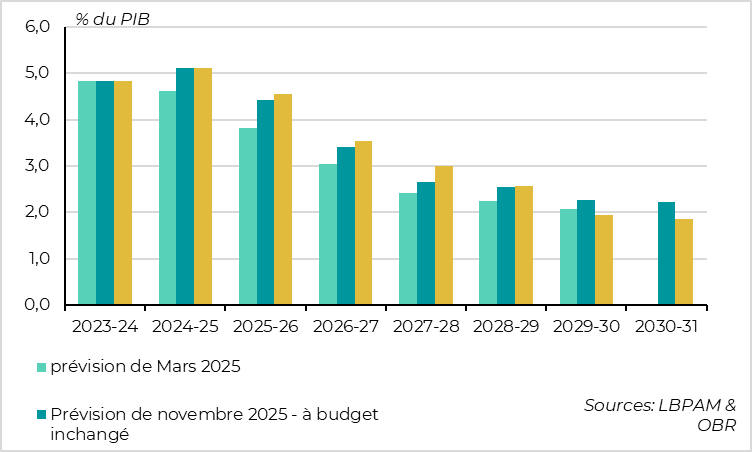

Deficit will decline slowly and from a higher level

That said, this budget does not resolve the UK’s economic and fiscal challenges over the medium term.

It relies on growth and spending restraint assumptions that we view as optimistic, making it likely that deficit adjustment and fiscal headroom will be revised down over time. This will require further difficult decisions in the coming years.

Moreover, fiscal adjustment is pushed back, reducing its credibility. The budget deficit will remain higher than expected until 2028. Only then—just ahead of the next elections—will new tax hikes and spending cuts deliver more significant improvement.

Finally, the mix of higher taxes and lower spending does not appear very “pro-growth,” especially as the UK’s potential growth has been repeatedly downgraded since the financial crisis and Brexit. Taxes are set to rise from 35% to 38% of GDP over the next five years, a historic high for the UK. That said, this is still well below France’s level (45%).

Eurozone : a slight reacceleration appears to be confirmed

Business surveys at their highest in two years in Q4

Economic sentiment in the euro area continues to improve slowly but steadily, according to the European Commission’s survey.

This survey, more comprehensive than the PMIs and recently the best coincident indicator of growth, reached 97 points in November. While still below the long-term average (100 points), this marks the highest level in two and a half years. At its current level, the Economic Sentiment Indicator is consistent with GDP growth of 0.3% in the fourth quarter, similar to the PMIs. This supports our scenario of a gradual euro area reacceleration since this summer (after 0.25% growth in Q3) and is above the ECB’s projection (0.2%).

Labor market continues to hold up well

The details of the Commission’s survey are also reassuring.

The slight acceleration in growth is driven by domestic demand (services and construction) and by southern European countries, as has been the case for several quarters. Business confidence also improved in France in November, although it remains very low, suggesting a limited impact from fiscal uncertainty in the short term. Conversely, confidence among German businesses and in the industrial sector erased part of October’s rebound and remains weak. This indicates that support from German fiscal easing is still ahead, which should help sustain growth acceleration in the coming quarters.

Consumer confidence stagnated in November after several months of improvement and remains subdued. However, the labor market remains resilient, which should support household spending in the medium term. Hiring intentions have stabilized since the summer and remain at a level consistent with a slight increase in employment.

Xavier CHAPARD

Strategist