The Fed is once again ready to support the markets

Market analysis

26.08.2024

Link

Xavier Chapard's in-depth analysis of the Fed's support for the markets can be found in the August 26, 2024 Market Decrypt.

In summary

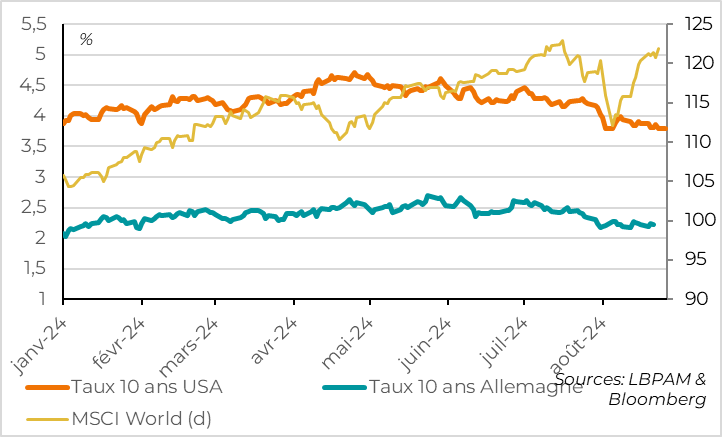

►We hope you had a good vacation and didn't follow the markets too much in August. It will have saved you from getting too scared. Equities fell by more than 8% at the start of the month on fears of recession in the United States following the rise in the unemployment rate and the unwinding of speculative positions, but this fall has been totally reversed this morning. On the other hand, the sharp fall in rates that accompanied this volatility persists, thanks to expectations of aggressive rate cuts by the Fed. The US 10-year yield is now at a one-year low of 3.8%, almost 50 bp below its mid-July level.

►In his Jackson Hole speech on Friday, Powell confirmed that the Fed would finally start cutting rates in September, as the downside risks to employment equal, if not outweigh, the upside risks to inflation. More structurally, his speech indicates that the Fed believes it is finished with its anti-inflation campaign and now wishes to avoid an abrupt slowdown in the economy. The return of Fed support is clearly positive for the markets in the medium term.

►That said, markets have already priced in aggressive rate cuts by the Fed, with the key rate set to fall by more than 1 bp by the end of the year. In the absence of a financial shock or a clear sign of recession, we think it unlikely that the Fed will cut rates by more than 75 bp over the next three meetings. In the end, however, financial conditions eased significantly this summer with the rate cut, the depreciation of the dollar and the rebound in risky assets. And the latest economic data do not point to an imminent recession. So the market may have taken on board a lot of good news, which is prompting a degree of caution in the short term.

►For the Eurozone, the latest economic data are rather reassuring after the signs of stagflation at the start of the summer (i.e. persistent inflation and a marked slowdown in the economy). Indeed, the PMI rebounded in August after two sharp falls, and remains in expansionary territory. Also, negotiated wages slowed sharply in Q2, after reaccelerating in Q1. This suggests that the central scenario remains one of gradual recovery and slow disinflation. In this context, we believe that the ECB should be able to continue cutting rates gradually, starting in September.

►Tensions in the Middle East re-escalated this weekend, particularly between Israel and Hezbollah. This is pushing up oil prices a little, but they remain limited to $80 per barrel overall.

To go deeper

Markets: August was a turbulent month, as usual

Equities and interest rates fell sharply at the beginning of August. This risk aversion was triggered by July's disappointing US employment figures, which point to a growing risk of recession. But this movement was reinforced by the unwinding of speculative positions financed in yen following the Bank of Japan's rate hike, and by the usual low liquidity in mid-summer. The rather reassuring figures published in August on the US economy (retail sales, jobless claims, PMI, etc.) calmed economic fears, enabling risky assets to rebound. Markets are also buoyed by expectations of a Fed rate cut (see below). Indeed, US risk-free rates were at their lowest level for a year this morning.

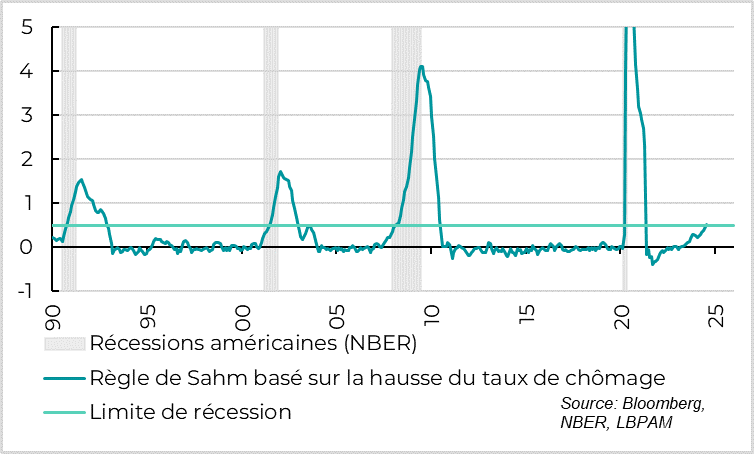

United States: rising unemployment rate increases the risk of recession

The rise in the US unemployment rate in July, from 4.1% to 4.3%, and the slowdown in job creation are increasing the risk of recession, although our central scenario for the time being remains a significant slowdown but not a recession. The unemployment rate is up by more than 0.5 pts on its low point of the last twelve months, which is the limit that has historically always marked the start of a recession. This is the rule of thumb found by economist Sahm. It makes economic sense, as employment is the most important variable for the US economy, which depends mainly on consumption. But this 0.5 pt level is empirical, and many historical relationships have not been respected since the Covid shock. What's more, July's employment figures were impacted by the hurricanes, which prevented several thousand workers from getting to work in mid-July. Fears about US employment were reinforced by the revision of past data. Indeed, payroll employment was revised down by 818,000 for March 2024 (or -0.5%), which is the biggest downward revision since the 2008-2009 financial crisis. But employment is still up, even after revisions, at +1.3% year-on-year versus 1.9% according to the initial data. Finally, jobless claims, published weekly, remain low. In fact, for the time being, the slowdown in employment is due to a slowdown in hiring, but the level of redundancies remains very low.

We are not downplaying the signs of deterioration in the US economy, of which employment is the most important variable. Especially as other indicators, such as rising defaults and the steepening yield curve, are also sending negative signals. As it stands, however, we believe that these figures are in line with our scenario of a net slowdown, but not a collapse, in the US economy. Especially as consumer spending remains solid and business confidence positive (the composite PMI at 54.1 points in August). And that the Fed is ready to help the economy again now that disinflation is on a firm footing.

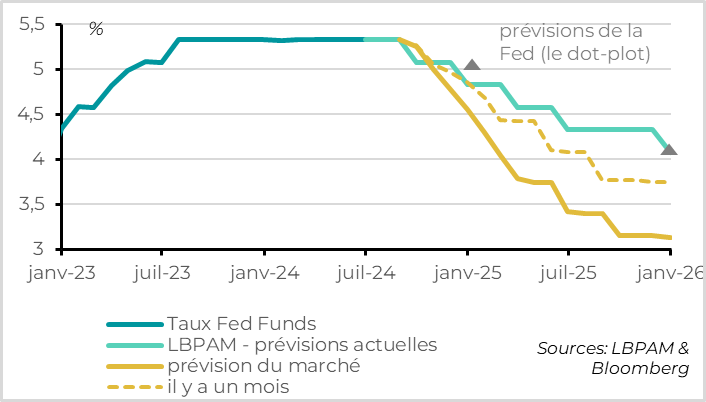

United States: Fed to start cutting rates in September

After Powell's much-anticipated speech at Jackson Hole, there is no longer any doubt that the Fed will start cutting rates at its next meeting on September 18. Indeed, Powell made it clear that “the time has come to adjust monetary policy”. This marks a clear evolution from the last press conference, when Powell repeated that he was waiting for more data before being confident about further disinflation.

But Powell went further in this speech, confirming that the Fed had finished the anti-inflation campaign it began two years ago. Powell had used this Jackson Hole conference in 2022 to say that the Fed was then ready to accept a recession if necessary to reduce inflation. This time, Powell said that the central bank intends to act to avoid a further weakening of the US labor market. And he made it clear that: “We neither seek nor wish to see the labor market slacken further”.

And it's not just Powell who wants to cut rates at the Fed. Indeed, the Fed was almost ready to cut rates at its July meeting, according to the minutes of its last meeting. Indeed, “a large majority” of Fed members said that “it will probably be appropriate to ease monetary policy at the next meeting”. And “several members” even considered that recent progress on inflation and rising unemployment meant that a 25bp rate cut could be considered as early as the July meeting. However, these discussions took place before the publication of the July inflation and employment figures, which surprised on the downside.

Markets: financial conditions ease significantly in the U.S.

Although the markets had already priced in, as we had, that the Fed would cut rates in September, Powell's confirmation supported all assets. This probably reflects the Fed's renewed support for the markets, as it is ready to react to any negative surprises on the economy. All in all, financial conditions have already eased significantly, even before the Fed began cutting rates. This reflects expectations of rate cuts, as well as the rebound in risky assets and the depreciation of the dollar. This easing of financial conditions is probably welcomed by the Fed, as it is already supporting the economy and means it does not have to act in a hurry.

On the other hand, Powell gave no indication of the size or pace of future rate cuts. “The timing and pace of rate cuts will depend on data releases, the evolving outlook and the balance of risks". However, the market is already anticipating very aggressive rate cuts in our view, with more than 1 point of rate cuts between now and the end of the year. With only three meetings left between now and the end of the year, the market scenario assumes that the Fed will cut rates at least once by 50 bp instead of the usual 25 bp (or that it will cut rates outside its scheduled meetings). This seems unlikely to us, in the absence of a financial shock or a figure that would make a recession certain.

All in all, after this hectic summer, we believe that the Fed will cut rates at every meeting between now and the end of the year, starting with the September meeting. This implies three cuts of 25 bp (compared with two in our previous scenario). This is considerably more than the Fed forecast in June (a single cut this year), but less than the market has already priced in.

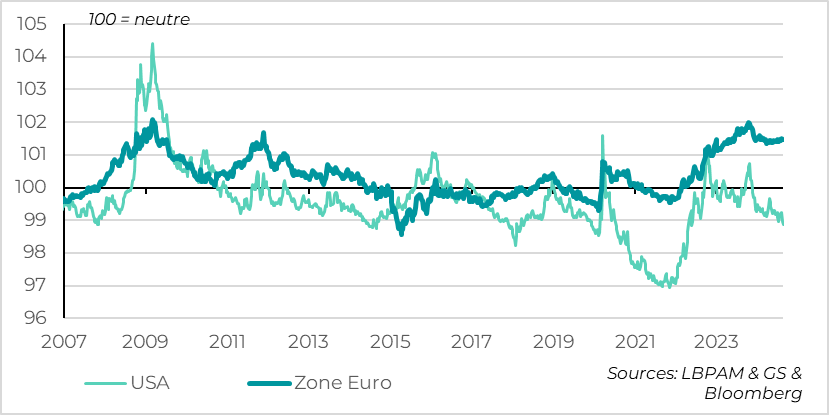

Eurozone: economic situation remains positive in August despite weakness in industry

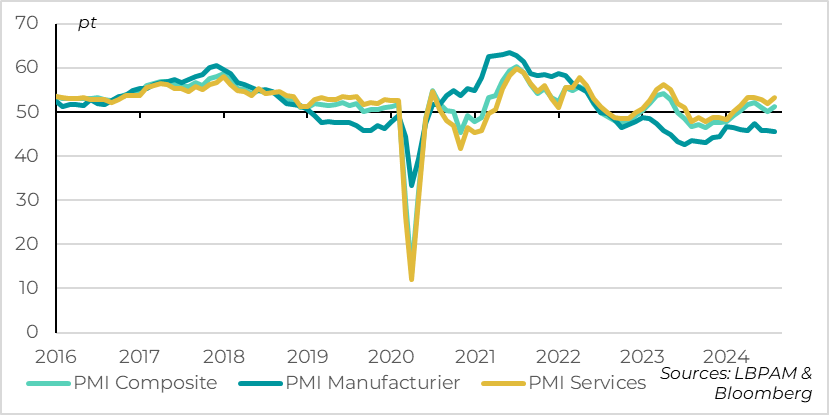

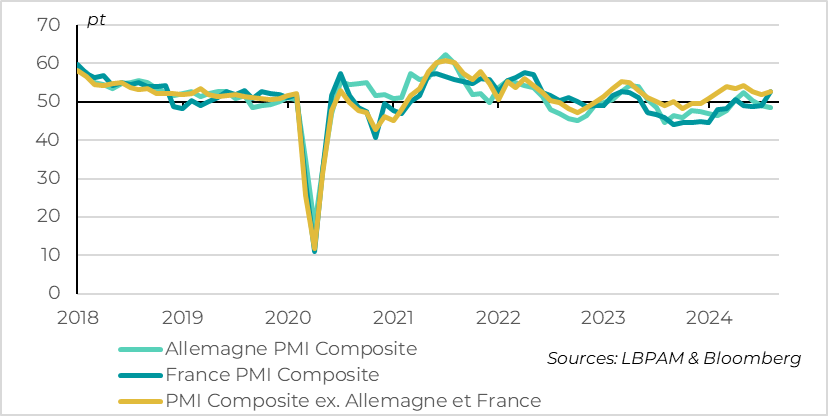

For the Eurozone, the latest data are reassuring after the signs of stagflation at the beginning of the summer. The PMI rebounded in August after two sharp falls, so that it remains in expansion territory (51.2 points). This was due to a rebound in services activity, helped by the effect of the JO in France, but also to solid activity in peripheral countries. On the other hand, industrial activity remains depressed, weighing particularly on the German economy.

Euro zone: Germany continues to lag in August

In France, the composite PMI returned to expansion for the first time in 4 months, and even reached its highest level since mid-2022 (at 52.7 points). The dynamism of the French economy in August is probably largely due to the effect of the Olympic Games. Indeed, the services PMI jumped to 55 points, whereas it had been indicating stagnation in the sector for 3 months. In contrast, the manufacturing PMI is at its lowest point of the year at just 42.1 points. While the PMI rebounded in the rest of the eurozone, the German economy remained weak, with the PMI slipping back into contraction this summer (to 48.5 in August). It continues to be weighed down by weakness in industry, as shown by the manufacturing PMI at just 42.1 points. The services PMI also fell in August, but remains in the expansion zone (51.4).

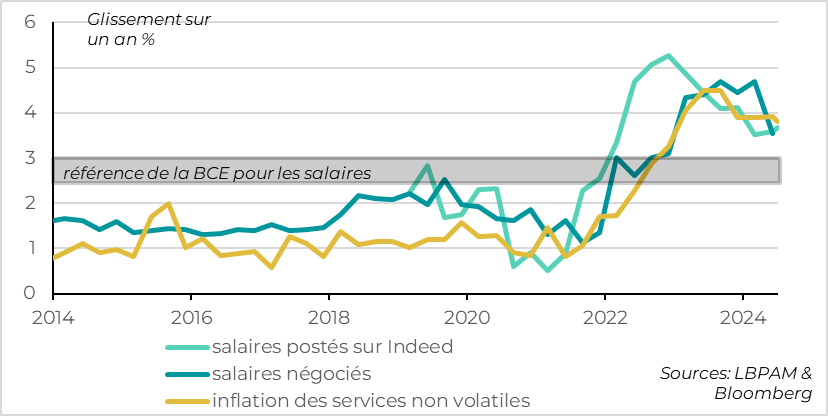

Euro zone: wages finally slow slightly

On the inflation front, the latest figures show that inflation remains persistent, especially in services, but the trend towards disinflation is not in doubt. In particular, negotiated wages slowed sharply in Q2 according to the ECB, from 4.7% to 3.6% year-on-year. This slowdown is exaggerated by the timing of bonus payments, especially in Germany, and wage growth remains high. Indeed, wages in Germany slowed from 6.2% to 3.4% due to lower bonus payments, but wages excluding bonuses remain high at 4.3%. But it is beginning to slow, as expected given the time lag between the slowdown in inflation and wages in the eurozone. This should reassure the ECB, which, like us, is forecasting a sharper slowdown in inflation next year. That said, the ECB is likely to remain very gradual, in the absence of a marked deterioration in the economy, as underlying inflation and wage pressures are only slowly receding. Thus, the minutes of the July meeting indicate that the board repeatedly mentioned that it would proceed “cautiously” pending further confirmation that disinflation was on track, while not wanting to “unduly harm the economy”.

Xavier Chapard

Strategist