The Fed Must Decide Now

09.09.2024

Link

Xavier Chapard provides an in-depth analysisfocused on the expected cut in the Fed’s key interest rates.

In summary

►This evening, the Fed will finally address the question that has dominated the markets for several weeks: will it begin its rate-cutting cycle with a standard 25 bp cut or a more significant 50 bp cut, after keeping rates at 5.5% for over a year? Market uncertainty regarding this decision is the highest it has been in over 15 years.

►We still believe that a 25 bp cut is slightly more likely than a 50 bp cut, but anything is possible. Beyond the Fed’s decision on rates today, it is the signaling effect of this decision that will be crucial for the markets. This will be complemented by the new rate forecasts from Fed members for the coming years (the dot-plot) and the tone of Jerome Powell during the press conference. What is important for the markets is that the Fed shows it is ready to quickly ease its monetary policy if necessary, but does not currently believe that the U.S. economy is deteriorating significantly.

►Recent activity data for the United States also suggests that growth remains solid this summer. Retail sales are accelerating, indicating consistently strong consumer spending. And annual industrial production increased from July to August, which is reassuring as the manufacturing ISM indicated a marked decline.

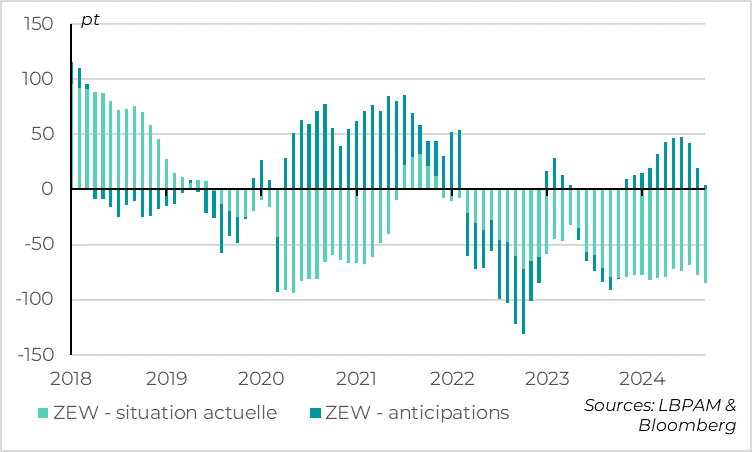

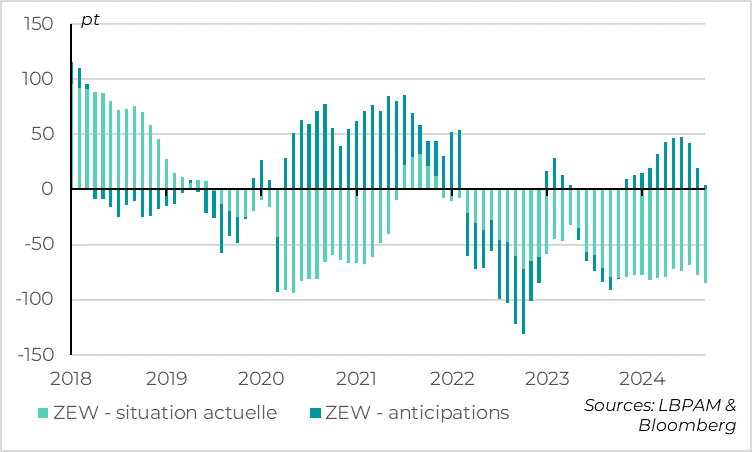

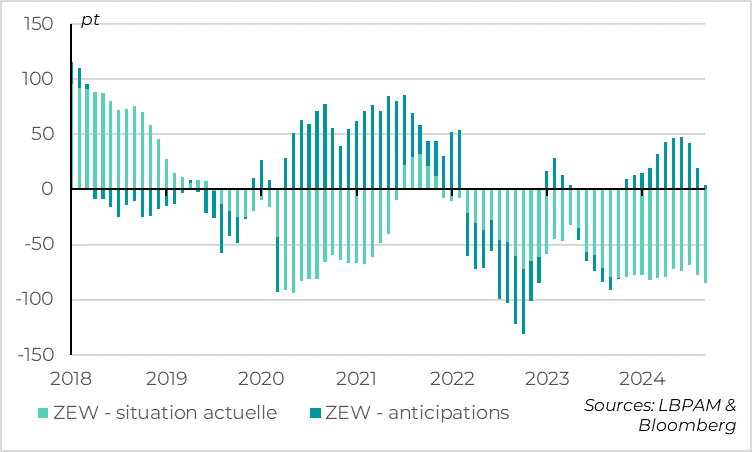

►Across the Atlantic, the ZEW survey on investor expectations for Germany fell much more than expected in September. Clearly, investors are losing hope in a German recovery. This partly reflects concerns about the global economic cycle (Eurozone, China…) but also the structural weaknesses of the German economy.

►In addition to the economic malaise, Germany is facing a political malaise that could be further highlighted by the regional elections in the state of Brandenburg on Sunday. That said, these difficulties are less pressing than in France, where a government is still awaited while budgetary adjustment needs are immediate.

►For the Eurozone, the ZEW is another element indicating downside risks, but it is not decisive in our view. We will wait for the PMI data to be published next week to see if, beyond the setback related to the Olympic effect in France, we need to revise our gradual recovery scenario in Europe.

►Hezbollah has accused Israel of orchestrating an attack that killed at least nine people and injured thousands in Lebanon and Syria, through the explosion of a beeper. This increases the risk of escalating tensions in the Middle East, even though oil prices remain limited by demand concerns (at $73 per barrel).

Go deeper

United States: The Fed to Surprise a Divided Market Ahead of the Meeting

This evening, the Fed will finally address the question that has dominated the markets for several weeks: will it begin its rate-cutting cycle with a standard 25 bp cut or a more significant 50 bp cut?

Whatever the Fed’s choice, it will be the biggest surprise relative to market expectations in over 15 years. Indeed, the market anticipates a 40 bp rate cut, with a probability only slightly above 50% for a 50 bp cut rather than 25 bp. Therefore, the surprise will be more than 10 bp, either up or down, on short-term rates in the coming days. The Fed had better guided market expectations even when it raised rates by 75 bp four times in a row in 2022.

That said, it is mainly the signaling effect of this decision that will be important for the markets, complemented by the new rate forecasts from Fed members for the coming years (the dot-plot) and the tone of Jerome Powell during the press conference. In itself, a 25 bp difference in day-to-day rates over the next month is not really significant.

Our scenario, as you know, is that the Fed will cut rates by 25 bp this evening, but clearly indicate that it will continue to cut rates at upcoming meetings and is ready to increase the size of its rate cuts if the economic situation requires it. Such communication would limit the negative impact of a smaller-than-expected rate cut.

That said, it is entirely possible that it will cut rates by 50 bp today. But in that case, it must clearly indicate that this is a preventive cut and not the new normal rate of cut, and especially that it is not a reaction to a massive deterioration in economic prospects. Poor communication could increase risk aversion in the markets, despite a larger-than-expected rate cut.

In any case, the easing of financial conditions over the past month and the solid activity this summer in the United States do not put the Fed in a hurry to massively cut key rates immediately.

United States: retail sales and industrial production increase in august

This summer, consumer goods consumption remains very strong in the United States. Indeed, retail sales continued to rise in August, by 0.1%, whereas they were expected to decline after their 1.1% surge in July. This reflects the more limited decline in car sales.

More importantly, core retail sales, which are used to calculate goods consumption in GDP, increased by 0.3% in August, after a 0.4% rise in July. The carryover effect for the third quarter (i.e., if sales stagnate in September) amounts to 5.1% after a 3.3% increase in Q2. And as the prices of goods slightly decrease, the growth in goods sales volume is actually higher than this.

U.S. industrial production also surprised on the upside in August, at +0.8%, canceling out the previous month’s decline, which had been affected by hurricanes. This is reassuring as the manufacturing ISM indicated a further decline in production in August. Industrial production is not very strong, as it has stagnated for a year, and the carryover effect remains slightly negative for Q3. But at least it is not declining, unlike in the Eurozone.

Overall, with this activity data for August, the Atlanta Fed’s growth estimate for the third quarter increases to 3.0% (vs. 2.5% before the data), which is above expectations and far from indicating the start of a recession, at least for now.

Eurozone: german investor confidence plummets in september

The ZEW survey shows that investor expectations in Germany fell much more than expected in September, dropping from 19.2 in August to 3.6. And while expectations remain marginally positive, the ZEW indicator of the current situation fell to its lowest level since the lockdown (-84.5). The ZEW is not a survey of businesses and is not an accurate indicator of the level of activity in Germany. However, it has historically been a good leading indicator of trend changes. Clearly, investors are losing hope in a German recovery.

The ZEW survey also declined for other countries (rest of the Eurozone, United States), but to a much lesser extent. This suggests that part of the decline in investor confidence stems from global economic cycle uncertainty. But it also indicates that part of it is more specific to Germany and is probably structural. This is not surprising given the accumulation of headwinds for the strategy pursued by Germany since the early 2000s: rising energy prices, slowing Chinese demand, uncertainties about global trade, and difficulties in certain sectors such as the automotive industry.

In addition to the economic malaise, Germany is facing a political malaise. On Sunday, regional elections in the state of Brandenburg (which surrounds Berlin) could further increase pressure on the largest party in the governing coalition. Historically, it has been a stronghold of Chancellor Olaf Scholz’s Social Democratic Party (SPD), which has led it continuously since reunification in 1990. But the AfD is ahead of the SPD in the latest polls. While early elections remain unlikely in our view, the government’s ability to make important decisions before the 2025 federal elections is in question.

For the Eurozone, the ZEW is another element indicating downside risks to the economy, but it is not decisive in our view. We will wait for the PMI data to be published next week to see if, beyond the setback related to the Olympic effect in France, we need to revise our gradual recovery scenario.

Xavier Chapard

Strategist