The Fed's room for maneuver is narrowing

Link

Key takeaways from the september 26 , 2025 market update insights from Xavier Chapard.

Overview

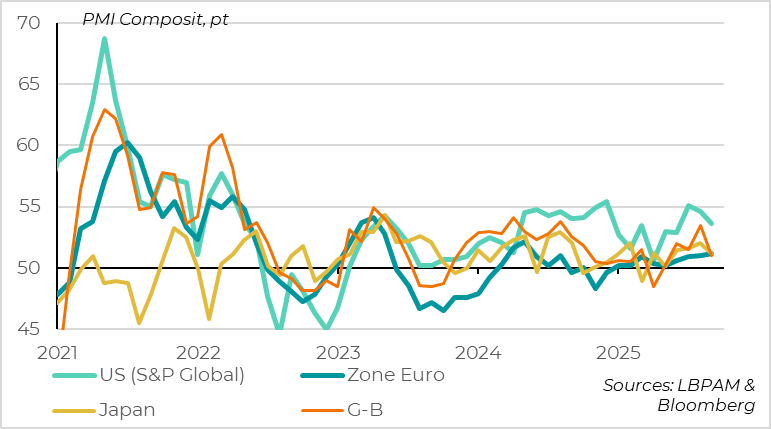

► The composite PMI for developed countries fell by 0.7 points to 52.5 in September, reducing the upside risks it had signaled over the summer, but still consistent with resilient global growth.

► The September decline in PMI is largely driven by a broad-based drop in manufacturing PMIs, suggesting that the trade war may be weighing more heavily on global industry. The services PMI declined only slightly and remains at a solid level, which is encouraging for domestic demand in most countries. Geographically, PMIs converged in September, pointing to positive but limited growth in developed economies over the summer.

► The Eurozone PMI rose slightly again in September to 51.2, its highest level since mid-2024. While reassuring, this masks significant sectoral divergences (with the first decline in the manufacturing PMI this year) and disparities between countries. That said, we believe the sharp rise in Germany’s PMI and the steep drop in France’s should not be overinterpreted, as these shifts are not confirmed by national surveys. A real recovery in Germany will likely require increased public spending, expected next year.

►In the United States, the PMI declined in September but remains high at 53.6. More importantly, Q2 growth was revised upward again, from 3.3% to 3.8%, driven by stronger-than-expected household consumption and even more dynamic business investment. Jobless claims also declined in September, suggesting that labor market easing remains gradual despite slower hiring over the summer. The downside is that inflation was also revised upward for Q2, indicating that inflationary pressures remained elevated even before tariffs began to affect prices. Under these conditions, we continue to believe the Fed will remain cautious and cut rates by only 75bps in the coming months (versus over 100bps priced in by markets).

►The Swiss National Bank (SNB) held its rate at 0.0% yesterday after six consecutive cuts, despite the 39% “reciprocal” tariffs imposed by the United States since August. This shows the SNB’s intent to avoid being the only major central bank to reintroduce negative rates in this cycle, although it stated it would not hesitate to do so if “absolutely necessary.” If the Swiss franc strengthens against the euro or domestic demand weakens more than expected, the SNB may have no choice but to act in December.

In-Depth insights

Global economic conditions remained resilient in September

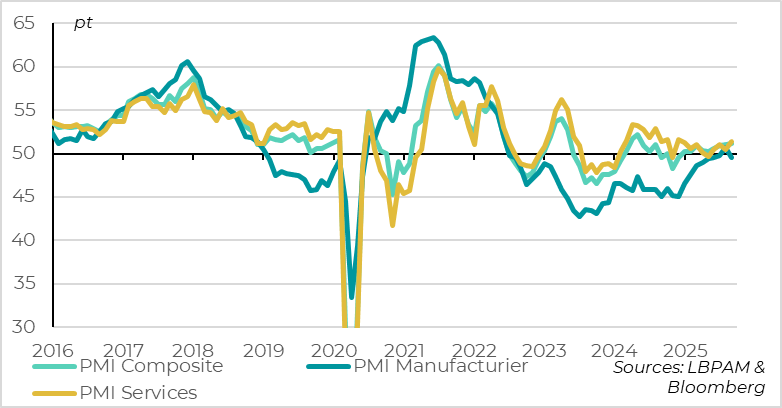

The global PMI is consolidating slightly after its summer increase

The composite PMI for developed countries fell by 0.7 points to 52.5 in September, according to our calculations based on preliminary estimates from S&P Global. It has dipped slightly below its long-term average but still signals resilient global growth.

This consolidation in September is largely due to a decline in the manufacturing PMI, which dropped by more than one point, nearing the stagnation zone for industrial production. The loss of momentum in the industrial sector is widespread, as manufacturing PMIs fell across all countries covered by the preliminary survey. This may be the first clearer signs of the impact of U.S. tariffs on global goods production, now that the situation has stabilized. Indeed, the manufacturing PMI has been volatile but generally trending upward since the beginning of the year, reflecting uncertainty around tariffs and front-loaded demand ahead of rising costs.

On the services side, the PMI consolidated slightly for the second consecutive month but remains solid at 53.0, suggesting that domestic demand remains resilient in major developed economies.

PMIs are converging across countries toward a modest level

Geographically, PMIs are converging to signal positive but limited growth across most regions.

The PMI dropped sharply in the United States, but from very high levels over the summer, so it remains solid at 53.6. It also declined significantly in the United Kingdom and Japan, reversing August’s gains and returning to around 51. In contrast, the Eurozone PMI continued to edge up in September, from 51 to 51.2, which is consistent with quarterly growth of 0.1–0.2%, in line with recent quarters (excluding volatility linked to Ireland).

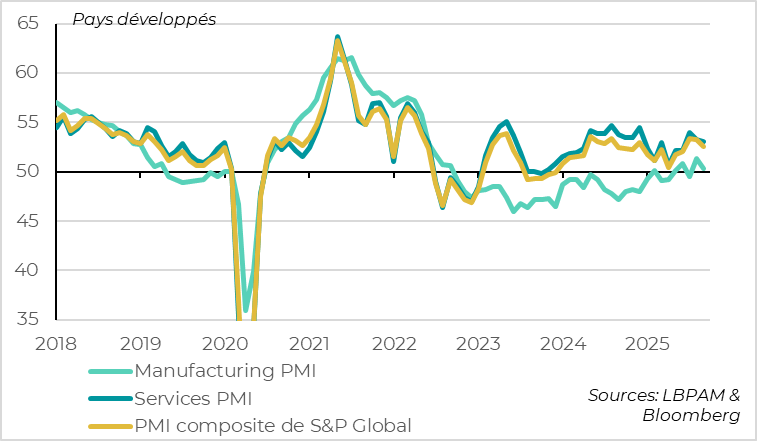

Eurozone: the PMI rises slightly, this time driven by the services sector

The PMI continues to recover despite the decline in the industrial sector

The Eurozone composite PMI rose slightly again in September, from 51.0 to 51.2, marking its highest level since mid-2024 and consistent with quarterly growth of 0.1–0.2%. However, this level hides significant divergences that make the signal more uncertain:

• By sector, the increase in the composite PMI comes solely from services, which rose by nearly one point to 51.4 — the highest level in 2025 so far, though still modest. This aligns with reduced uncertainty, as real household purchasing power improves and the credit cycle begins to recover, supporting domestic demand.

In contrast, the manufacturing PMI fell sharply for the first time this year, dropping back below the 50-point threshold it had finally reached last month (–1.2 points to 49.5).

With the recent increase in U.S. tariffs on the EU in August and the appreciation of the euro, we expect downward pressure on industrial production in the second half of the year, which should limit overall growth.

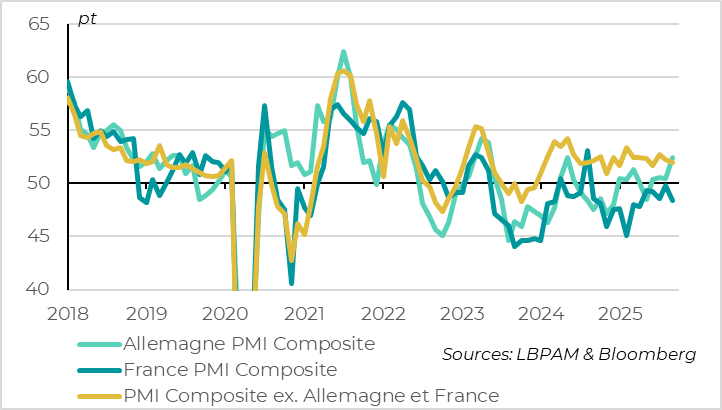

PMIs indicate an acceleration in Germany and a slowdown in France

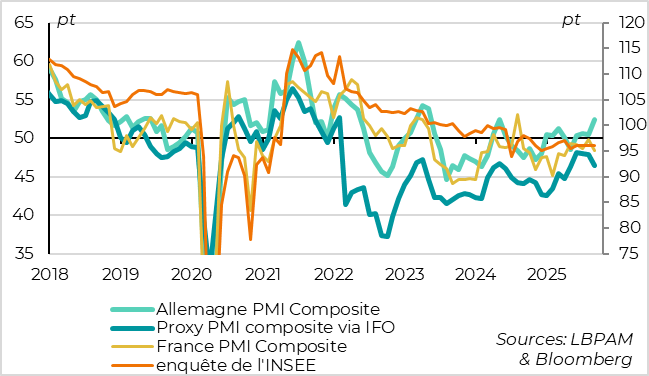

• Geographically, the rise in the Eurozone PMI comes solely from Germany, where the index jumped by 2 points to 52.4 — its highest level in two years and the first time since the start of the trade war with the U.S. that Germany has outperformed the rest of the Eurozone. However, this positive surprise is driven entirely by the services sector, where the PMI tends to be volatile in Germany, and is clearly tempered by the IFO survey, which is less robust.

In fact, the IFO index unexpectedly declined in September, from 88.9 to 87.7. German companies report that their current situation remains weak and that they are becoming more cautious about the months ahead, following the optimism seen over the summer. Unlike the PMI, the IFO deteriorated particularly in services, where it reached its lowest level since February.

• In contrast, France’s PMI dropped back to 48.1, its lowest level since April. While this weakness may reflect the impact of rising political and fiscal uncertainty since late August on business confidence, this is not confirmed by the INSEE survey, which remained stable in September. We continue to expect France to underperform its neighbors in the coming quarters, though not to the point of a full economic downturn.

• Finally, PMIs in the rest of the Eurozone have remained stable around 52 for over a year, suggesting that growth remains resilient in Spain and Italy.

However, national surveys temper this signal

Overall, the September surveys do not change our view that Eurozone growth will remain limited over the summer, but that the recovery beyond that is not in question. The level of the aggregate PMI suggests that short-term growth may suffer less than expected from the impact of tariffs, but the details — and the IFO survey — indicate that businesses remain cautious ahead of the anticipated increase in German public demand later this year.

Where the surveys do align is on the decline in inflationary pressures in the Eurozone.

This is why we continue to believe that the ECB could deliver one final rate cut at the end of the year, even though its current communication clearly signals a preference to keep rates unchanged for now.

United States: Growth and inflation higher than previously reported in Q2

Q2 growth has once again been revised upward

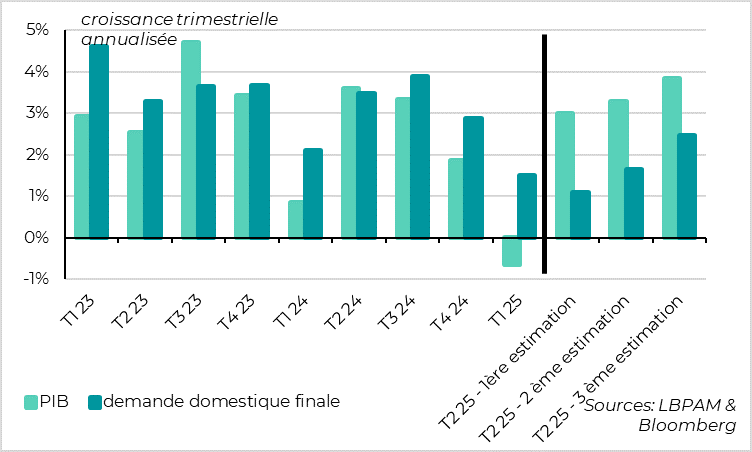

U.S. GDP growth for Q2 has once again been revised upward in the third estimate, from 3.3% to 3.8%. The initial estimate had indicated growth of “only” 3%. Beyond this strong growth figure—which should be put into perspective following a 0.6% contraction in Q1—the details suggest the economy is more resilient than feared.

The upward revision stems from stronger service consumption, revised from 1.2% to 2.6%, and business investment, revised from 5.7% to 7.3%. In contrast, inventories and net exports were revised downward, subtracting 0.3 percentage points from growth, while public demand stagnated.

Overall, final domestic demand (i.e., GDP excluding inventories and net exports) rose by 2.4%, compared to a previous estimate of 1.6% and 1.4% in Q1. It was driven by service consumption and software investment (possibly linked to AI?) in Q2, which is reassuring since these categories are less likely to have benefited from tariff anticipation compared to durable goods consumption or equipment investment.

For Q3, other U.S. data released this week is also reassuring. Jobless claims declined in mid-September after rising in the spring, bringing the total number of claims to its lowest level since May. This suggests the labor market remains resilient, with few layoffs mitigating the impact of slower hiring. Additionally, core durable goods orders remained strong over the summer (+0.6% in August after +0.8% in July), indicating that business investment remains well-oriented.

This doesn’t mean the trade war and uncertainty have had no impact on the U.S. economy. In fact, growth was nearly divided by three in the first half of the year, down to 1.1%, and final domestic demand slowed from 3% to 2%, despite increased spending in anticipation of tariffs. The payback from this early spending and the full implementation of tariffs in the second half of the year will likely weigh more heavily going forward, even though uncertainty has eased. But at least these shocks are hitting an economy that is more dynamic than expected.

Importantly, core inflation was also revised upward for Q2 in the third estimate, from 2.5% to 2.6% annualized (and 2.7% year-over-year). This confirms that inflationary pressures had not normalized—even before the tariff hikes impacted prices. It reinforces the risk that inflation will remain above target even after the direct impact of tariffs on goods prices fades.

In summary, a still-resilient economy, a labor market that is only slightly slowing, and inflationary pressures that hadn’t normalized before the tariff impact should lead the Fed to proceed cautiously with the pace—and especially the magnitude—of rate cuts in the coming months.

Xavier CHAPARD

Strategist