The Fed should remain cautious in the face of persistent wage pressures

Link

-

After ending last year with a bang, the markets have been consolidating a little since the New Year. In the first week of the year, long yields rose by 15bp, returning to their mid-December level, and equities consolidated by 1.5%. At the end of 2023, the consensus had quickly incorporated a scenario close to perfection, in which the Fed would rapidly cut its key rates thanks to the rapid fall in inflation, while at the same time US growth would remain high. Given these expectations, the market is at risk in the event of a sharper slowdown in growth or a less rapid decline in inflationary pressures.

-

The US employment data for December appear solid at first glance, with an acceleration in payroll job creation (+216 thousand) and a stable unemployment rate at a low level (3.7%). But the details are less reassuring, given the downward revisions to employment over the previous months and the fall in the participation rate. All in all, the data suggest that US employment is slowing, but without making it possible to decide whether the slowdown is gradual or more abrupt. The sharp fall in the ISM services index in December (from 52.7 to 50.6) indicates that the risks of a sharper slowdown in US activity are increasing, but this slowdown needs to be confirmed, as this indicator can be volatile month-on-month.

-

Where the US jobs data send a clear message is on wage pressures, which remain high. Hourly wages accelerated for the first time in 5 months and, at 4.1%, remain above the level compatible with a sustainable return of inflation to its target (~3-3.5%). And the unemployment rate remains below the level that the Fed considers to be the equilibrium (i.e. 4.1%).

-

In these conditions, the Fed should remain cautious before starting to cut rates. We continue to believe that the Fed will wait until early summer, barring an abrupt slowdown in the economy, while the market is still anticipating a first rate cut in March.

-

In the Eurozone, inflation rebounded from 2.4% to 2.9% in December due to less favourable base effects on energy. However, this rebound was weaker than expected (the consensus was for 3.0%) and core inflation continues to slow fairly rapidly (to 3.4%). Total inflation should remain above 2.5% in the first half of 2024 due to base effects, but core inflation should continue to slow towards the target by the summer. This would allow the ECB to start cutting rates in Q2.

This fear of more persistent inflation is all the stronger now that the Fed Chairman has helped to ease financial conditions considerably by fuelling expectations of sharp rate cuts, which in turn have fuelled the appreciation of most assets over the last period. This could support demand and therefore growth in the short term, once again fuelling possible inflationary pressures. This would run counter to the very strategy that the Fed has pursued to date.

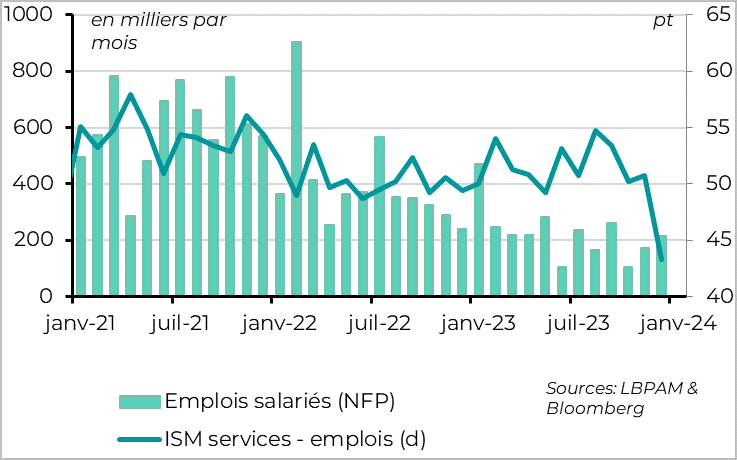

Fig.1 United States: mixed employment data for December

According to the official survey, payroll employment rose by 216,000 in December, higher than expected and higher than the previous month (175,000). In addition, job creation was more widespread in terms of sectors than in recent months, when all job creation came from the public sector, healthcare and the hotel and catering industry. This suggests that the job market remains solid.

However, the trend in job creation is slowing and has been revised downwards fairly sharply over the past year. Over the previous two months, they were revised downwards by -71,000. After these revisions, and despite December's good figure, job creation slowed considerably in Q4 compared with previous quarters, though without collapsing (to an average of 165,000). And private job creation has been revised downwards by 600,000 over the course of 2023 compared with the figures initially published, which raises questions about the quality of this survey for judging short-term employment dynamics.

Above all, the other surveys are far less reassuring. The household survey, which has not been revised and which is used to calculate the unemployment rate, indicates a fall in employment of almost 700,000 in December. More fundamentally, given the volatility of this survey and the possible distortions at the turn of the year, employment would have fallen in Q4 2023 for the first time since the start of the post-Covid recovery. This is consistent with the ISM services survey, which indicates a sharp deterioration in employment in this sector in December (at 43.3pt, the job creation component is at its lowest since mid-2020).

All in all, the US employment surveys suggest that employment is slowing, but the question remains open as to whether this slowdown is gradual, as the Fed and the market expect, or more marked, as we expect. We will have to wait for more data to get a clearer picture of the US economy.

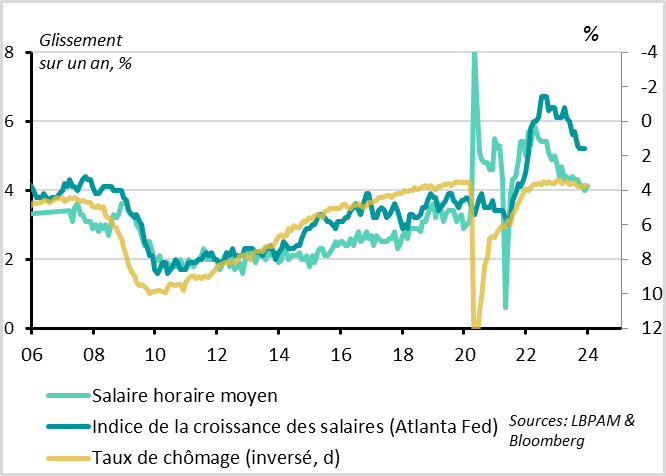

Fig.2 United States: wage pressures remain high

On the other hand, all the US employment surveys indicate that wage pressures remain high, which should prompt the Fed to remain cautious before starting to cut rates.

Hourly wages rose by 0.4% over the month in December, the highest level for a year and a half. Over a year, wages accelerated slightly from 4.0% to 4.1%, following 6 consecutive months of slowdown. They therefore remain above the level of growth that the Fed considers compatible with a sustainable return of inflation to its target (~3-3.5%).

In addition, the unemployment rate remained stable after falling sharply in November to 3.7%. This was due to the sharp fall in the participation rate, which offset the fall in employment in the household survey. Even if the unemployment rate remains low for the wrong reasons (fewer workers available), the fact that it remains below the equilibrium level estimated by the Fed (4.1%) risks keeping wage pressures too high.

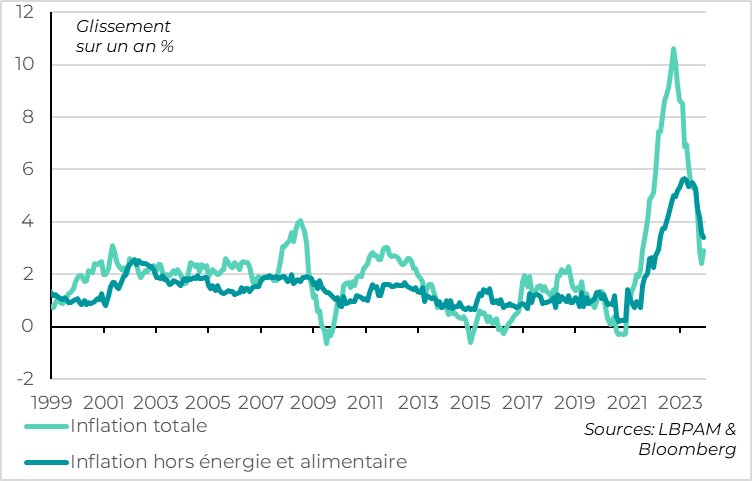

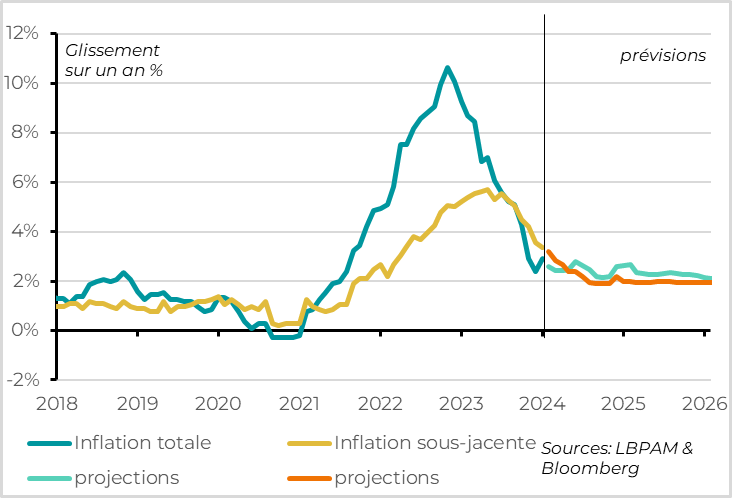

Fig.3 Eurozone: core inflation continues to slow sharply at the end of 2023

Eurozone inflation rebounded in December, from 2.4% to 2.9%. However, this rebound was due solely to less favourable base effects on energy, and was actually slightly less marked than had been expected (consensus of 3.0%).

More fundamentally, core inflation continues to slow as expected, from 3.6% to 3.4%, despite unfavourable technical effects on certain services. While core inflation is still well above the 2% target, it is at its lowest level for almost 2 years.

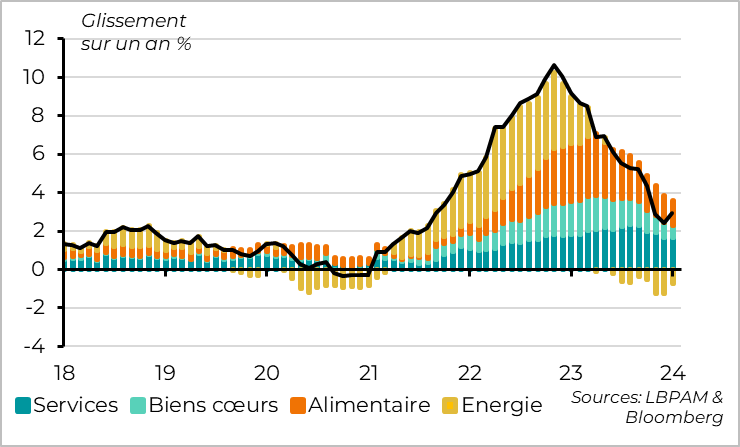

Fig.4 Euro zone: Excluding energy, all inflation components are gradually coming down

In fact, inflation is on a downward trend in all categories excluding energy.

Food inflation continues to ease, falling from 6.9% to 6.1% in December. Inflation in industrial goods also continues to fall sharply, from 2.9% to 2.5%. Overall, goods inflation is back to its level before the start of the war in Ukraine, and should continue to fall sharply over the coming months.

Inflation in services remains more persistent, holding steady in December at 4.0%. That said, it has slowed markedly since the summer and was affected by unfavourable technical effects in December, particularly in Germany. This does not therefore call into question the gradual fall in inflation in services.

Fig. 5 Eurozone: Inflation could converge towards the ECB target in the second half of the year

Overall, we expect headline inflation in the Eurozone to oscillate between its November level (2.4%) and its December level (2.9%) in the first half of 2024, due to the gradual decline in favourable base effects on energy. But core inflation should continue to fall sharply over this period, and could approach the ECB's target from the summer onwards. While the ECB will probably wait for confirmation of this slowdown and, above all, the start of the wage slowdown before starting to cut rates, we believe that this could happen from the 2nd quarter of this year.