The Fed should remain patient for a while

Link

Read Sebastian Sebastian PARIS HORVITZ's market analysis for February 12, 2025.

Summary

►Following D. Trump's announcement of higher tariffs on aluminum and steel, the European Union (EU), through the President of the European Commission, declared that it had to retaliate. A series of U.S. products are expected to be targeted between now and the implementation of the 25% U.S. tax on March 12. D. Trump, during his first term, had already taken similar measures, and the EU had reacted. Nevertheless, in the end, an agreement was reached in 2021, setting up a quota mechanism and easing tariffs. This time, D. Trump seems less inclined to dialogue. If this is the case, the feeling of a potential trade war will only grow, and will be negative for the global economy. At this stage, we are maintaining a “reasonable” economic scenario on possible protectionist measures. The market seems to be doing the same, but concern is growing.

►This context of uncertainty contrasts for the time being with the state of the US economy, which remains solid. Fed Chairman J. Powell told Congress that, in his view, the economy remains robust, with a very strong job market, albeit better balanced than in previous years. Also, inflation remains rather high and is still not on a definite trajectory towards convergence with the 2% target. Today's inflation figures for January are likely to confirm the slow deceleration. In this context, according to J. Powell, there is no need for the Fed to rush into further rate cuts. This message has been heard by the market, with long-term interest rates edging upwards.

►While the latest opinion polls give the new president a high level of popularity (53% in the CBS poll), it is interesting to see that the NFIB's January survey of its members shows a reversal in the assessment of economic uncertainty. This has risen sharply this month. Also, future investment intentions wiped out the previous rebound. Nevertheless, overall confidence, while declining in January, remains fairly high. All in all, the persistence of popular support could encourage the President to maintain his fairly aggressive domestic and foreign policies, but the risk is that confidence will disintegrate in the face of uncertainty.

►In Europe, in addition to the potential fear of higher tariffs from the United States, the region is facing a fairly substantial rise in gas prices at the start of the year. This rise seems to be linked to fears of a trade war, but also to falling inventories in the region, with demand having been high over the winter. Nevertheless, inventories remain close to historical averages, albeit below last year's levels. Barring a shock, it's hard to see prices rising much higher. But this rise will weigh on inflation figures and therefore on household purchasing power. Its effect should gradually dissipate, and the ECB is unlikely to change course and continue its monetary easing.

To go deeper

Gas prices in Europe have reached their highest level since the beginning of 2023. Since the beginning of the year, prices have risen by over 12%. Nevertheless, prices are obviously still much lower than those reached at the start of the war in Ukraine.

European Union: Sharp rise in gas prices since the beginning of the year

This increase will have an impact on electricity prices. Indeed, the system for setting electricity prices in Europe is currently under review, and therefore still depends on the last marginal producer of electricity, i.e. gas-fired power stations.

Obviously, rising energy prices are not good news. At a time when the region is suffering from a lack of growth, this rise in energy costs will weigh on household purchasing power and therefore possibly on consumption.

At this stage, it's hard to see gas price pressures rising much further. Admittedly, inventory levels fell more than expected at the start of the year, with demand stronger than expected due to a harsher winter in the region. But inventories remain close to the historical average of the last ten years, albeit below last year's high levels.

At the same time, at this stage, manufacturers seem reluctant to increase gas purchases to fill their tanks, as the structure of future prices is not very favorable.

All in all, in the absence of a shock, the most likely outcome is that prices should gradually calm down as winter ends.

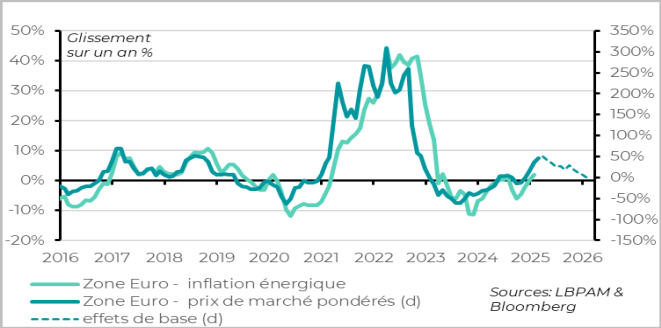

However, if prices continue to rise at current levels, this will have an impact on consumer prices in the eurozone in the short term, weighing on purchasing power. Nevertheless, this effect on inflation should gradually dissipate, even if gas prices remain at current levels. We believe that the possibility of a price decline remains very likely, which would further dissipate the impact of this rise in energy prices.

European Union: the impact of rising energy prices on inflation, should prices remain at current levels, should gradually dissipate.

This trend in energy prices is not good news for the trajectory of inflation. Nevertheless, it should be seen as a negative supply shock that will affect demand, and not as an inflationary shock. This will surely be the ECB's interpretation, even if some of the more orthodox members of the Governing Council will call for caution in the face of fears of possible second-round effects.

We believe that, at this stage, the rise in energy prices should not fundamentally alter the downward trajectory of the ECB's key rates. We still expect the key rate to converge towards 2% this summer.

In the United States, the latest opinion polls give very favorable views of the policies pursued by President Trump since his inauguration. Indeed, the latest polls, including CBS News' 53% favorable opinion, show strong support for the President. Of course, this may seem surprising given the uncertainties provoked in the rest of the world by the protectionist policies pursued by the new American administration.

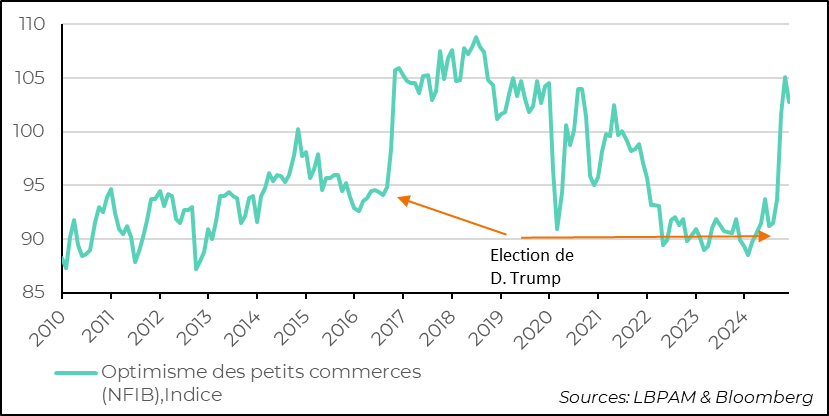

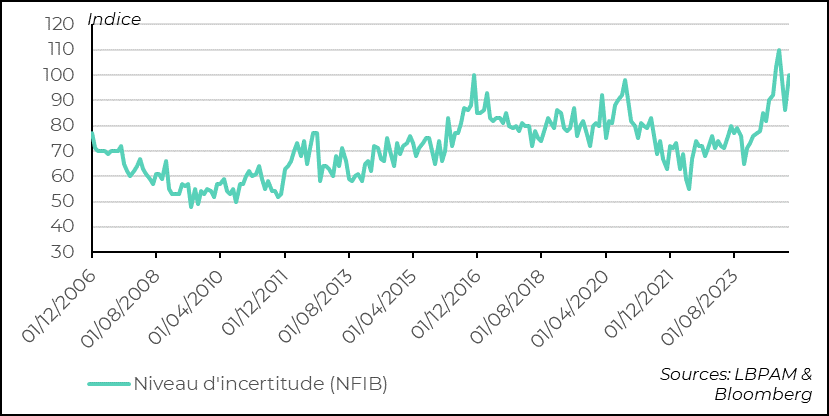

In this sense, the latest survey conducted by the Independent Business Association is a little surprising. Indeed, while the election of D. Trump had generated a great deal of excitement among its members, the January survey reveals that uncertainty has risen sharply over the course of the month. Nevertheless, member optimism remains high, albeit down on the previous month.

United States: NFIB January survey shows merchant optimism remains high, albeit declining

Despite this favorable opinion of the President, it would seem that the economic decisions taken so far are beginning to arouse some concern among these players, with this clear shift in their opinion on the uncertainty of the economic context.

United States: The sharp decline in uncertainty following D. Trump's election came to a halt in early January with a very strong rebound in uncertainty among retailers

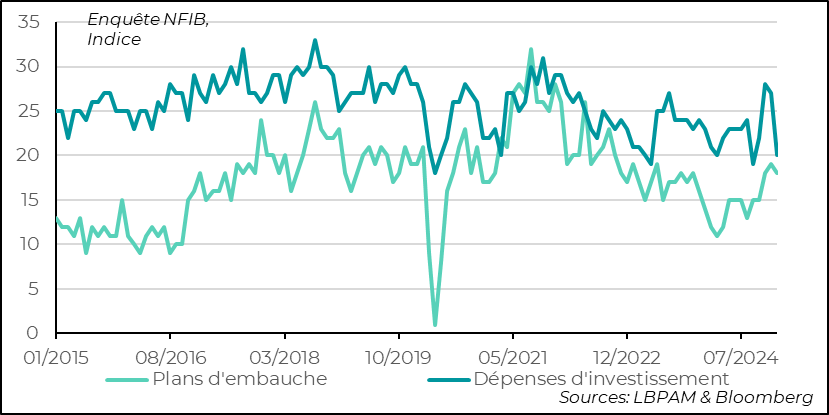

EThe most tangible impact of this uncertainty can be seen in the fairly radical change in opinions on investment intentions. Indeed, almost all the previous month's rebound was wiped out in January. We're back to the lowest point since last autumn.

United States: Rising uncertainty seems to have had a strong impact on retailers' capital spending intentions

Obviously, these figures should not be over-interpreted. But it is important to realize that, for some groups, the uncertainty created by certain economic policy decisions is creating a climate that could prove counter-productive, and begin to erode the confidence of groups that are a priori very supportive of the current government.

As we all know, given the enormous expectations, a sharper-than-expected deceleration in growth or an acceleration in inflation over the next few months could radically change opinion. But would this have an impact on D. Trump's policies? Nothing is less certain.

Sebastian PARIS HORVITZ

Head of Research