The gap between US and European equities is extreme, but justified as it is

Link

While the American markets are influenced by the anticipated policies of the Trump administration, the Eurozone is facing internal political uncertainties, with tensions over French debt and less favorable economic prospects. Xavier Chapard provides more insights in his market analysis on November 27, 2024.

In summary

► The markets continue to be strongly guided on a day-to-day basis by expectations of what the Trump administration will do from January onwards. They rose sharply at the start of the week following the nomination of Bessent for the post of Treasury Secretary, as he is seen as pro-growth and above all as fiscally orthodox. But they then consolidated after Trump's first message on social networks since the election, announcing tariff hikes as soon as he took office. He threatened to raise them by 25% on Mexico and Canada and by 10% on China to force governments to stop opioids and illegal migrants entering the US. The return of trade policy as a means of exerting pressure in international negotiations reinforces the outperformance of US assets relative to those of the rest of the world, particularly Europe.

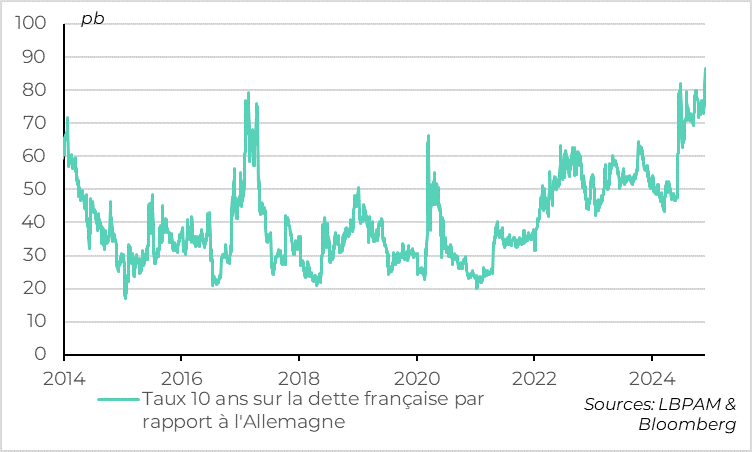

►But beyond US politics, the Eurozone is suffering from domestic political uncertainties. Stress on French debt is at its highest since the zone's sovereign debt crisis of the early 2010s, with an interest rate differential against German debt in excess of 85bp. The risks remain high as the end of the year approaches, with the budget looking difficult to pass and the Barnier government likely to fall.

And while the European Commission has decided to give France the benefit of the doubt regarding next year's budgetary adjustment, this may not be the case for S&P, which is reviewing France's rating on Friday (and is expected to lower its outlook to negative like the other agencies).Apart from France, hopes of political progress at German and European level are low ahead of the German elections in February, and probably at least until next spring.

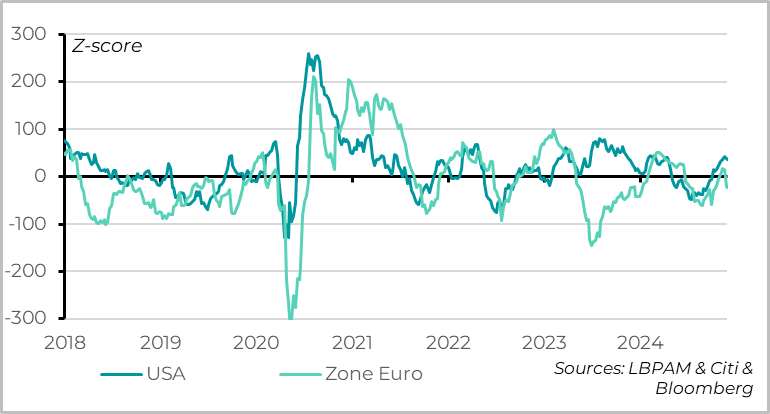

►Beyond politics, macroeconomic data point to a strengthening of American exceptionalism in relation to Europe. Following the divergence of PMIs in November, macroeconomic surprises have returned to negative territory in Europe, whereas they remain very positive in the United States.

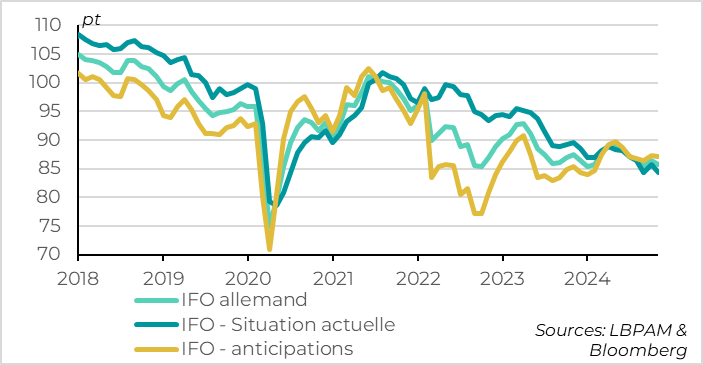

►The latest data reinforce these trends. In the Eurozone, the German IFO fell in November, reversing last month's rebound, with the current state of the economy seen as the weakest since the post-Covid rebound. The only good news from the survey is that business expectations are not deteriorating further, suggesting that the European economy is stagnating but not collapsing.

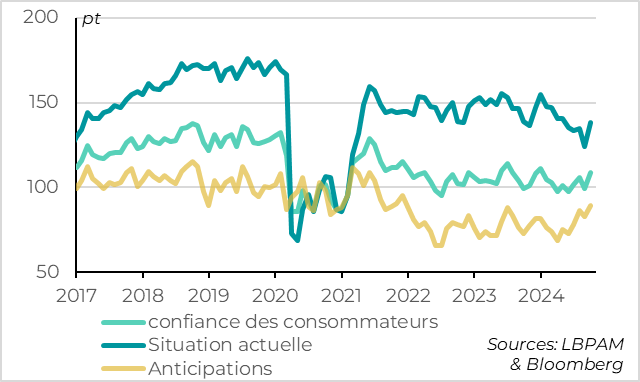

►On the contrary, consumer confidence continues to rise in the US, thanks to a sharp increase in the survey's “expectations” component.

The optimism of households and businesses alike following the election of D. Trump could support spending in the short term, thanks to the rise in “animal spirit” and wealth effects

►All in all, we believe that activity in the eurozone stagnated again in Q4 and that, while our scenario remains that of a gradual recovery next year, the downside risks for the European economy are increasing in the short term. In contrast, the US economy should remain buoyant at the turn of the year. And while the Fed could limit its rate cuts, we think it is more likely to do so next year rather than in December.

►Against this backdrop, we believe that the extreme valuations of US equities versus the reasonable valuations of European equities could persist in the short term, due to the gap in economic performance and political outlook. This is why we are tactically favoring US equities in the coming weeks. That said, American exceptionalism is already strongly embedded in asset prices, making European equities quite attractive in the medium term. That's why we think it's a good idea to remain exposed to European equities and to strengthen these positions over the next year, at least if US policies are not too extreme. Especially if the European and German authorities finally react.

To go deeper

USA vs. eurozone: macroeconomic surprises diverge after the elections

The eurozone's economic surprises indicator, i.e. the gap between published data and economists' forecasts, turned negative again after PMIs fell below the 50-point mark in November and consumer confidence fell to its lowest level since the spring. This marks a change from the surprise indicator, which had stabilized after the summer following the acceleration in growth in Q3 (+0.4% over the quarter) and the slight improvement in confidence indicators in October.

Germany: IFO falls again in November, returning to cycle lows

The latest indicator to disappoint in the eurozone is Germany's IFO, which is at a post-Covid low even though it does not point to a collapse in activity at the end of 2024.

According to the IFO, German business confidence reverses its October rebound in November, as companies indicate that their current situation is the worst since the Covid shock. In terms of sectors, industry and foreign trade remain the weakest, but construction and services are also slowing down. The only reassuring point in the survey is that business confidence regarding their outlook remains stable and slightly above their current situation, albeit at a limited level. This suggests that the German economy is stagnating, but not about to deteriorate much further.

France: the cost of debt relative to Germany rises again

In addition to the indicators for eurozone activity stagnating again in Q4, downside risks are increasing for the European economy in the short term due to external and internal political uncertainties.

Of course, the election of D. Trump is not good news for the eurozone due to the impact of Trump's proposed protectionist policies. But on top of this, confidence in the eurozone is suffering from France's highly unstable fiscal and political situation. With the risk of the Barnier government falling sharply higher, and the budget still to be voted on, the cost of financing French public debt relative to Germany has surged since the start of the week, to over 85 bp above its summer highs. The France-Germany yield spread is now at an all-time high outside the peak of the eurozone sovereign debt crisis of 2011-2012. Although the current level of French yields looks attractive, we remain cautious on French debt as the end of the year approaches, given the risks of budgetary and political deadlock.

At the same time, the political situation in Germany is frozen until the elections next February, which will probably lead to negotiations to form a coalition. This could take several weeks, so a functioning government is unlikely to be in place before spring. Despite the need, there is therefore little hope of progress in European construction or German budgetary support before at least the middle of next year.

All in all, we expect the eurozone to stagnate at the turn of the year, before returning to slight growth next year thanks to ECB rate cuts.

United States: consumer confidence rebounds post-election

US consumer confidence continues to rebound in November according to the Conference Board survey, benefiting from post-election optimism.

Consumer confidence remains above its long-term average, even reaching its second-highest level since the post-Covid rebound. This comes on the back of a sharp rise in the “expectations” component of the survey, suggesting that the majority of households are optimistic following D. Trump's election, as are businesses. This suggests upside risks to spending in the short term, thanks to the rise in “animal spirit” and wealth effects. That said, household expectations can be volatile and do not always correlate well with consumption in the short term.

More fundamentally, the current household situation component is progressing, reaching a six-month high, even if it remains slightly below its 2021-2023 and pre-Covid levels. We attach greater importance to this component, which is less volatile and less affected by sentiment, and is a good reflection of the state of the economy in which households operate. It is therefore reassuring that this component remains high and has stopped slowing down over the past two months.

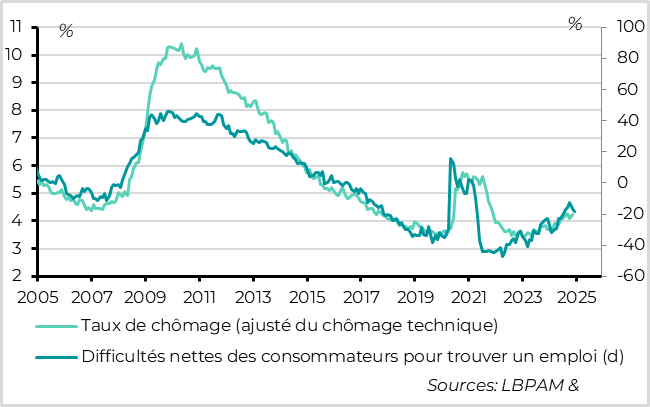

USA: households report that the labor market remains buoyant

In particular, households report that labor market conditions remain solid, albeit less tight than in 2022-2023. Thanks to a drop in the number of households finding it difficult to find work, the labor market strength indicator improved in November for the second consecutive month, after falling sharply in the middle of the year. It remains in positive territory, albeit at a much lower level than during the post-Covid recovery.

This is consistent with an unemployment rate that would remain broadly stable just above 4%, a level that is not as extreme as just before and after Covid, but remains historically low.

This should not prevent the Fed from cutting rates in December, but it does suggest that the economy remains solid, and that fears about rising unemployment this summer were exaggerated. Against this backdrop, we expect the Fed to slow down and limit its rate cuts next year, cutting rates two or three times at a rate of 25 bp per quarter.

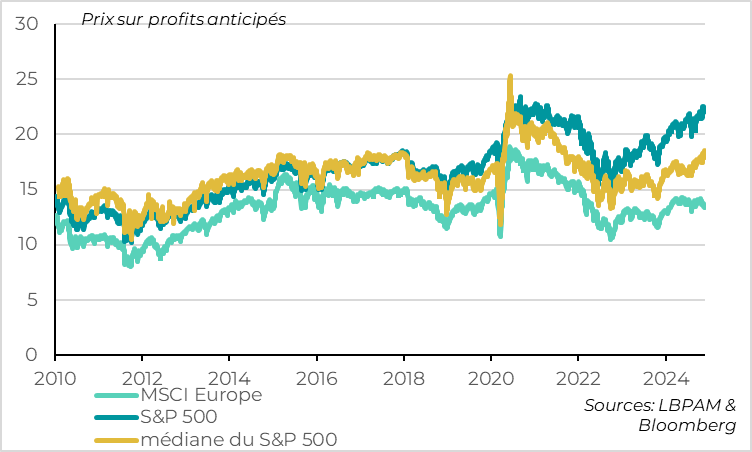

Markets: valuation gap between US and European equities reaches extreme levels, but seems justified in the short term

Since D. Trump's election, US equities have risen sharply, so that their valuations are approaching their 2021 highs. And unlike the first part of the year, this is not due to the performance of Tech and the “Magnificent 7”. The rise in the US market is more generalized, such that the median valuation of US equities is also at its highest since the start of Fed rate hikes.

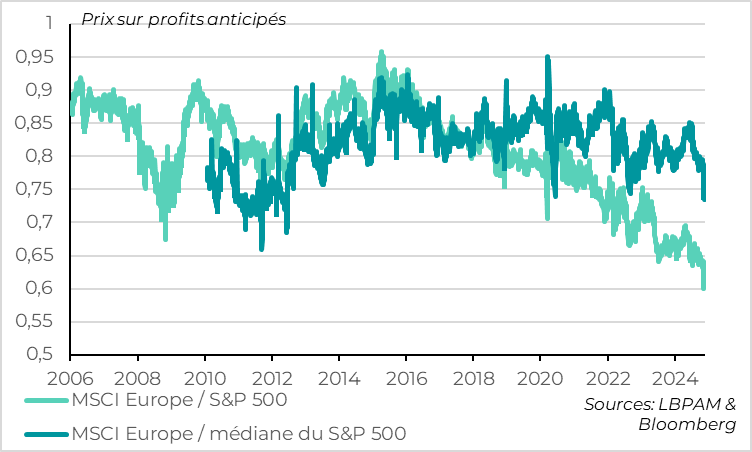

In contrast, European equities have consolidated a little since the election, so that their valuation is at an all-time low compared to US equities. And unlike in the last two years, the discount in European equities is not due solely to the absence of major tech companies from European indices. In fact, European equities have been the most discounted relative to the median of US equities for over 10 years.

On the one hand, the extreme valuations of US equities versus the reasonable valuations of European equities suggest that US exceptionalism is already strongly embedded in US share prices, and that European equities could deliver more attractive relative returns in the medium term. That's why we think it's a good idea to remain exposed to European equities, and to strengthen these positions over the next year, at least if US policies are not too extreme, especially if the European and German authorities react.

But in the short term, this valuation gap is supported by the economic performance gap and the political outlook gap. This is why we are tactically favoring US equities in the coming weeks.

Xavier Chapard

Strategist