The global economy continues to demonstrate its resilience

Link

What should we take away from market news on October 28, 2025? Answers with the analysis of Sebastian Paris Horvitz.

Overviews

► Markets, particularly in the U.S., continue to be supported by the prospect of easing tensions between China and the United States, following more reassuring statements from D. Trump last week. Over the weekend, the negotiation team led by S. Bessent indicated that agreements were close on several issues, notably Fentanyl and export controls. However, the final decision regarding a potential deal will depend on the two leaders, who are scheduled to meet this week in Korea. It is highly likely that both will seek to emerge as winners from this meeting and buy more time to continue negotiations. Therefore, a lasting de-escalation seems unlikely to result from these discussions.

► The market nevertheless appears to be focusing primarily on positive signals. Temporary trade easing, strong Q3 2025 earnings from U.S. companies, and expectations of further monetary easing by the Fed are all supporting risk-taking. At the same time, the continued rise in valuations of risk assets raises questions about the sustainability of the bullish cycle.

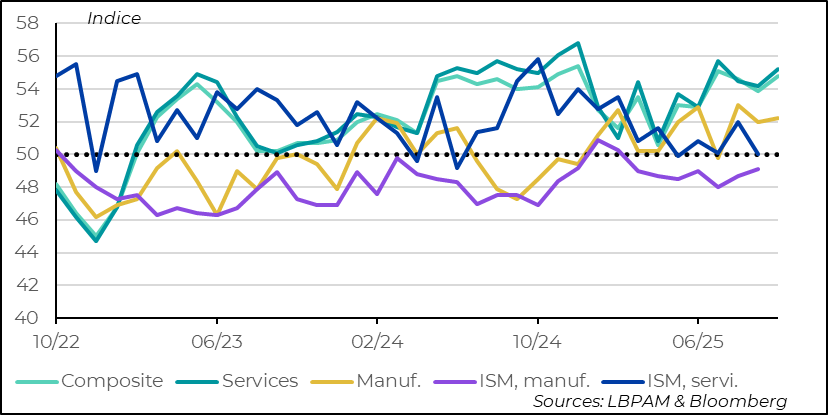

► Assessing the U.S. economic cycle is becoming increasingly complex. The government shutdown is limiting access to essential data, making it difficult to monitor activity. Despite this, the preliminary S&P survey on October PMIs sends a reassuring signal, with high indices in both services and manufacturing. This positive message, which has been recurring for several months, contrasts with the more cautious ISM surveys. The Federal Reserve’s regional Beige Book confirms this trend: after two strong quarters, growth appears to be slowing.

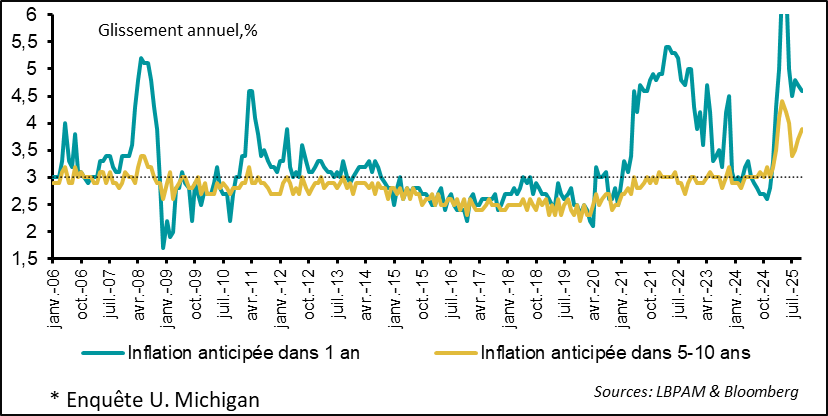

► The difficulty in tracking U.S. growth momentum is increasing, particularly due to persistently deteriorated household confidence. The University of Michigan’s final October survey confirms this trend, with confidence levels nearing the lowest observed in the past 20 years.

Yet, consumption remains relatively strong, driven mainly by higher-income households. Moreover, inflation expectations remain elevated, reaching 3.9% year-on-year for long-term inflation.

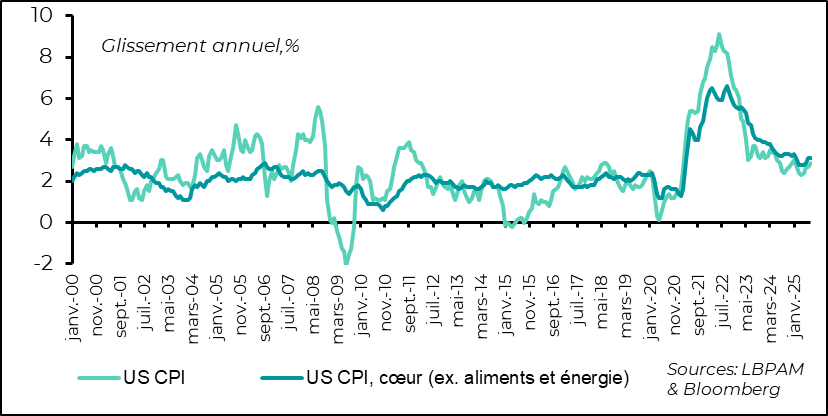

► Despite these expectations, the September inflation report turned out slightly better than anticipated. Headline inflation accelerated to 3.1% year-on-year, while core inflation slowed slightly to 3%. This slowdown is mainly due to a sharp deceleration in rent increases, which carry significant weight in the index. Moreover, trend indicators suggest that the disinflation phase may be coming to an end. On the goods side, the effects of tariff hikes are beginning to be felt. We continue to believe that their transmission to prices will be gradual — possibly slower than expected — but that they will contribute to upward pressure on prices in the coming quarters. The central question therefore remains the persistence of this inflationary shock.

► Although the activity indicators published by S&P are relatively robust, most members of the Fed’s monetary policy committee are concerned about the slowdown in the labor market and the rise in unemployment, even if the increase remains moderate. In this context, the persistence of elevated but contained inflation in October seems to support the committee’s decision to lower interest rates again this week. We anticipate a 25 basis point cut. Given our projections on the impact of tariffs on prices in the coming quarters, we continue to believe that the Fed will face challenges in significantly reducing rates in 2026, unless there is a marked economic slowdown.

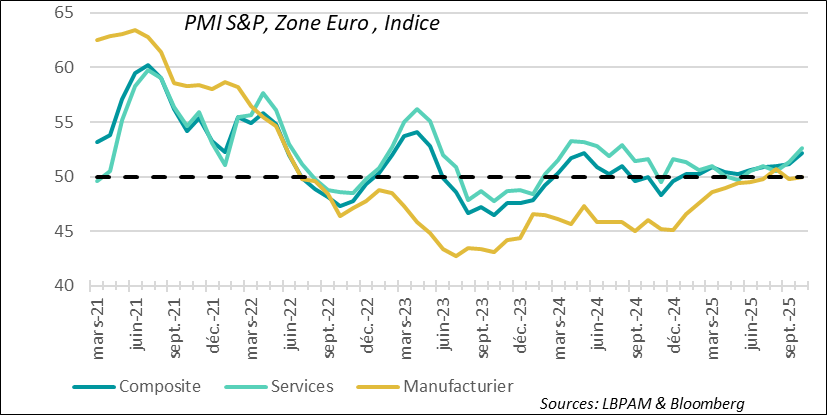

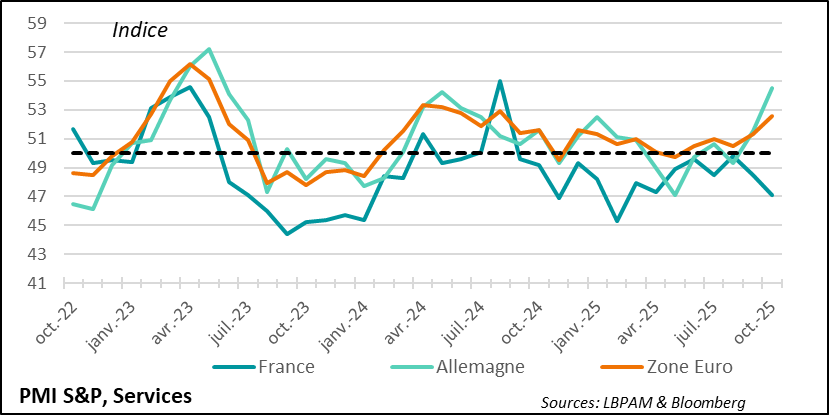

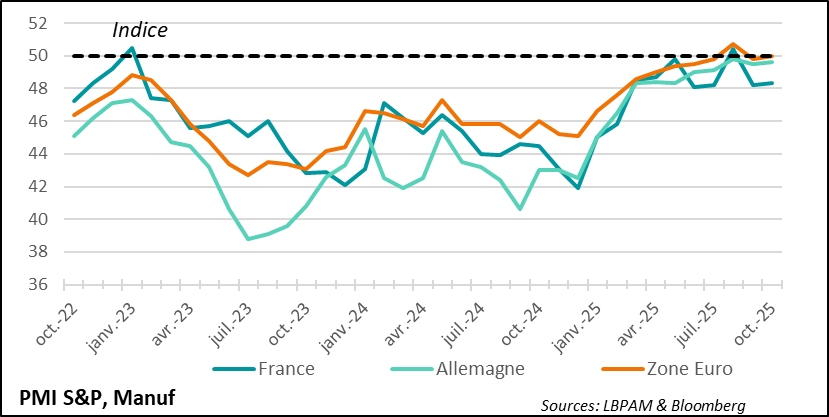

► In the eurozone, S&P’s preliminary PMI surveys for October turned out more favorable than expected. A strong rebound was observed in the services sector, while manufacturing remains stagnant. This trend is visible across most countries in the zone, except for France, where activity declined in both sectors. Political instability continues to weigh on confidence there. In contrast, the stimulus policy initiated by the German government is proving to be a key lever for restoring confidence, as reflected in the continued improvement of the IFO indicator.

Going Further

United States: an economic outlook marked by mixed signals

The S&P PMIs present a very flattering picture of the economy.

As the U.S. government shutdown continues, economic statistics are becoming scarce, making it difficult to monitor the country’s economic conditions. In particular, labor market data—key indicators for the Fed in assessing its policyare currently unavailable.

However, some private statistics are still being published, such as the S&P PMI surveys. Preliminary results for October paint a mixed picture.

While activity indices in both services and manufacturing are relatively high and have improved over the month, the underlying data offer a more nuanced reading. Companies in both sectors appear to have increased their production levels, with a rise in new orders, but they also report a decline in exports and, more notably, an accumulation of inventories at historically high levels.

Moreover, firms are showing less confidence about the future due to rising tariffs, even though they welcome the renewed rate cuts from the Fed.

For several months now, the S&P survey has contrasted with the insights from ISM surveys in both major sectors of the economy. Similarly, the Beige Book published by the regional Federal Reserve Banks portrays an economy that is stagnating.

A clearer picture of the economic situation will likely emerge with the ISM surveys expected later this week.

For now, the U.S. economy seems to exhibit a near-dual dynamic: on one side, parts of the economy are suffering from the effects of tariffs and trade uncertainty; on the other, there is significant expansion driven by massive investments in the artificial intelligence sector. However, this latter sector is not the main driver of job creation. And the strength of the labor market remains essential to sustaining growth through consumer spending.

Consumer confidence indicators remain discouraging.

In this context, the release of final data from the University of Michigan’s consumer sentiment survey continues to paint a very bleak picture of household sentiment. Confidence deteriorated further in October and remains at historically low levels.

Nevertheless, consumption has held up well since the second quarter. Data suggests that, in recent months, wealthier households have contributed relatively more to consumption growth than in the past. It is also evident that lower-income households are showing signs of strain, particularly when looking at the rise in financial difficulties within this segment.

Inflation expectations remain elevated.

This deteriorated confidence is also explained by the persistence of historically high inflation expectations among households, particularly in the medium term (3.9% year-on-year).

It is also worth highlighting that the survey reveals a strong distortion in the perception of the economic situation depending on respondents’ political affiliation: Republican supporters view the economy very favorably, while Democrats and independents adopt a significantly more pessimistic outlook.

Inflation remains elevated but is showing signs of stabilizing.

The release of the price index, the only significant statistic published since the start of the government shutdown, was perceived by many as reassuring. It revealed a slight deceleration in core inflation, which stands at 3% year-on-year, down from 3.1% the previous month.

Most notably, the impact of tariffs remains relatively moderate, even though prices of goods excluding energy continue to rise. For the first time in several months, imputed rents (calculated based on a smoothing of recently signed leases) slowed, increasing by only 0.1% over the month, compared to 0.4% previously.

This point is particularly important, as these rents account for nearly one-third of the overall index and therefore contribute significantly to total inflation.

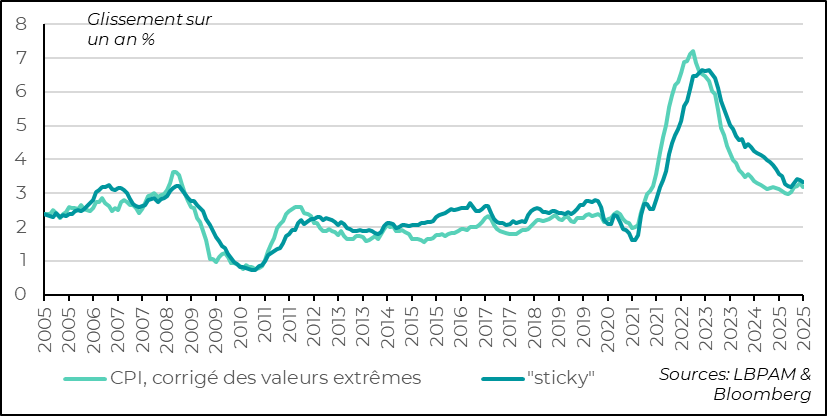

Trend indicators do not suggest any real turning point.

At the same time, trend-based statistics—such as the indices published by the Cleveland Fed, which exclude extreme price variations, or the Atlanta Fed’s index, which tracks the most persistent prices—do not suggest a favorable turnaround in the short term.

Most importantly, there remains significant uncertainty about how tariff increases will spread through the economy. Some continue to believe their impact will be very limited. From our perspective, we expect it to be significant, even if the transmission to consumer prices may be gradual. The real issue lies in the persistence of this inflationary shock. We believe it should gradually ease, but it remains difficult to be certain.

While there is little doubt that the Fed will cut its policy rate by 25 basis points this Wednesday, we remain far more cautious than the market regarding the extent of future rate cuts.

Eurozone: overall resilient activity, with the exception of France.

The S&P survey highlights a gradual recovery in activity across the euro area.

The preliminary S&P PMI survey for October in the eurozone turned out to be much better than expected. The composite index (covering both services and manufacturing) reached 52.2, its highest level since spring 2023. This improvement is mainly driven by a rebound in the services sector, observed across the region — with the notable exception of France.

The preliminary S&P PMI survey for October in the eurozone turned out to be much better than expected. The composite index (covering both services and manufacturing) reached 52.2, its highest level since spring 2023. This improvement is mainly driven by a rebound in the services sector, observed across the region — with the notable exception of France.

The rebound in services across the euro area is being held back by France...

The rebound in services activity has been particularly strong in Germany. This momentum can partly be explained by the launch of major infrastructure spending planned in the federal budget.

In contrast, the situation in France has deteriorated once again, according to the survey. It seems clear that the political climate continues to weigh on business sentiment.

…as is observed in the manufacturing sector.

In the industrial sector, the situation is less favorable, with activity stagnating in the region. In part, the shock from U.S. tariffs is weighing on activity. Once again, France shows a much more deteriorated situation compared to its European neighbors.

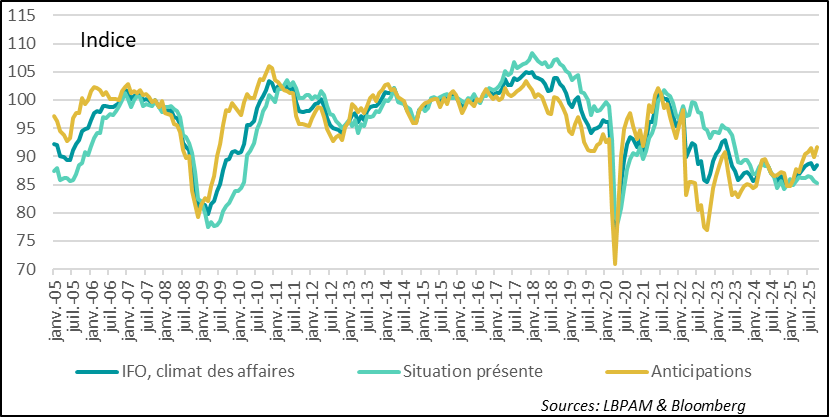

Germany: The IFO index confirms favorable economic prospects.

The positive signal sent by the S&P indicator for Germany is confirmed by the IFO index, which continues to rise. Expectations have now reached their highest level in over three years.

This marked optimism is largely explained by the launch of the German government's historic stimulus plan, as well as the more accommodative stance of the ECB's monetary policy.

France: savings remain strong despite a renewed sense of confidence.

In contrast, in France, political uncertainty continues to hinder the transmission of the economic momentum coming from Germany and other European neighbors.

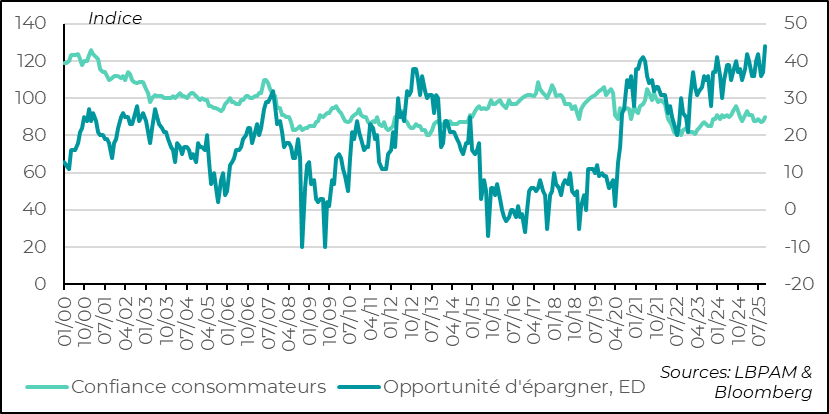

Thus, despite a slight improvement in October according to the INSEE survey, household confidence remains well below its long-term average. Faced with a perceived uncertain economic climate, households remain cautious and favor saving over consumption, thereby limiting support for domestic demand.

It is to be hoped that the government will at least manage to pass a viable budget for 2026, a necessary condition to restore a minimum level of confidence. Failing that, France risks remaining on the sidelines of a more favorable regional economic environment, despite the negative shock linked to U.S. tariffs.

Sebastian Paris Horvitz

Head of Search