The global economy continues to demonstrate its resilience

Link

What should we take away from market news on October 31, 2025? Answers with the analysis of Xavier Chapard.

Overviews

► Markets, especially in the U.S., are still being supported by hopes of easing tensions between China and the U.S., following more reassuring comments from D. Trump last week.

Over the weekend, the negotiation team led by S. Bessent said that agreements were close on several key issues, including Fentanyl and export controls. However, the final decision on a potential deal will depend on the two leaders, who are expected to meet this week in Korea. It’s quite likely that both will try to come out of the meeting looking like winners and buy more time to keep negotiating. So, a lasting de-escalation doesn’t seem very likely at this stage.

► The Fed has cut its benchmark interest rates by 25 basis points and confirmed it will stop reducing its balance sheet starting in December, as expected. However, Jerome Powell highlighted differing views within the committee and made it clear that another rate cut in December is far from guaranteed. This more cautious tone led markets to dial back their previously aggressive expectations for further rate cuts, causing U.S. bond yields to rise.

► Jerome Powell’s remarks reinforce our view that the Fed will cut rates more slowly and less sharply than markets currently expect. The persistence of inflation above target supports a more cautious approach, even though further rate cuts remain likely. This will continue to hold true as long as the U.S. economy shows resilience.

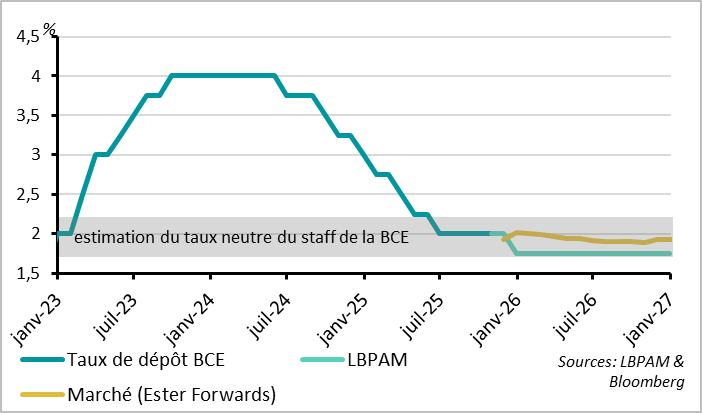

► The ECB, for its part, kept its key interest rate unchanged at 2% for the third meeting in a row.

Christine Lagarde reaffirmed that the central bank is “well positioned” in the face of what she described as balanced risks to growth and inflation. This message, which suggests the rate-cutting cycle is over, seems overly cautious to us. The ECB targets symmetric inflation and is itself forecasting a level below its 2% target over the next two years. In our view, this would justify one final rate cut before year-end. However, that scenario is looking less and less likely, especially as recent economic data has been stronggiving the ECB more room to wait and see.

► Eurozone growth held up better than expected over the summer, reaching 0.2% in the third quarter after 0.1% in the second. The labor market remains strong, with unemployment steady at 6.3%, close to historic lows. In addition, a broad-based rise in confidence in October—according to the European Commission’s survey suggests a slight pickup in activity heading into year-end. These factors support our scenario of a gradual rebound in the European economy over the coming quarters, driven by fading uncertainty and fiscal easing in Germany.

► At the same time, Eurozone inflation for October published this morning may remain slightly above 2% for the second month in a row, following upside surprises in Spain (3.2%) and Germany (2.3%).

While this doesn’t challenge the outlook for inflation to fall below 2% by year-end, the data doesn’t support a swift shift in tone from the ECB.

Going Further

Fed: Limited Preventive Rate Cuts

Despite the latest rate cut, markets are still expecting the Fed’s policy rates to remain higher over the medium term.

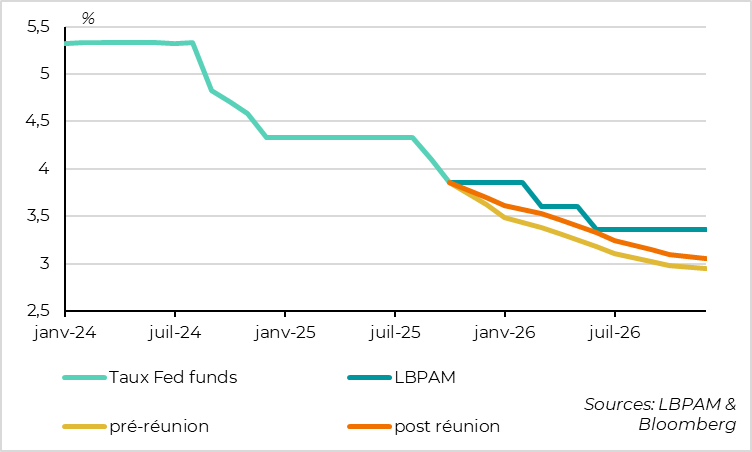

As expected, the Fed cut its policy rates for the second consecutive meeting, lowering them by 25 basis points to a range of 3.75%–4%.

It also announced it will stop reducing its balance sheet starting in early December—a move that had been anticipated following recent mild tensions in the money market. This measure should help reduce liquidity stress risks, although in our view, the Fed’s balance sheet policy will not have a direct impact on risk asset markets.

However, these easing measures were accompanied by less dovish signals regarding the future direction of monetary policy.

First, the decision to cut rates was more divisive than expected: for the first time in six years, the vote revealed disagreements in both directions. While Miran supported a larger 50 basis point cut, as in September, one regional Fed president voted to hold rates steady. Jerome Powell confirmed after the meeting that there are “very different views” within the committee on the future path of rates. Some members remain concerned about the labor market and advocate for further cuts in the short term, while others prefer a pause, citing inflation that remains too high.

In addition, concerns about the Fed becoming politicized particularly the idea that it might cut rates to please the Trump administration have eased. The two governors considered potential successors to Powell next spring did not support a larger cut, and no new discussions have emerged about the possible dismissal of a governor.

Most notably, Powell opened his press conference by stating that “another rate cut in December is far from certain.” This message was clearly aimed at markets, which had been pricing in a near-certainty of another 25 basis point cut in December prior to the meeting.

This more cautious tone does not challenge the idea that the Fed will continue cutting rates during this cycle, nor does it rule out a December cut. Powell even clarified that further cuts will come, but “at some point.” This confirms that the Fed is taking a risk-management approach rather than pursuing rapid monetary easing. Future decisions will therefore depend on incoming data, particularly the balance between inflation and employment.

In conclusion, we maintain our scenario of quarterly rate cuts rather than cuts at every meeting, which would bring rates down to around 3.5%, rather than below 3% as markets still expect.

This more conservative outlook limits the upside potential for equity markets—though it doesn’t eliminate it—as the Fed remains ready to ease further if the economy deteriorates more than expected.

On the other hand, it leads us to adopt a more cautious stance on U.S. bonds and to expect short-term stabilization of the dollar.

ECB Holds Steady: No Rate Change in Sight

The ECB keeps its key interest rate unchanged at 2%

As expected, the ECB kept its policy rates unchanged on Thursday for the third consecutive meeting, confirming that its monetary policy is “in the right place.”

The deposit rate remains at 2%, a level at the heart of the range that both the ECB and we consider consistent with a neutral monetary stance. While the statement reiterated that future decisions will be made “meeting by meeting” and “based on the data,” the overall tone suggests that no rate adjustment is planned in the short term neither upward nor downward.

Christine Lagarde expressed greater confidence in the economic outlook. While she stopped short of saying that growth risks are now tilted to the upside, she emphasized the economy’s resilience and the fading of downside risks, helped by the tariff agreement between the U.S. and the EU, the ceasefire in the Middle East, and easing tensions between China and the U.S.

On the inflation front, the ECB did not change its assessment. It continues to forecast inflation below its 2% target over the next two years, while considering risks to be balanced—justifying the continuation of a neutral monetary policy.

This positioning increasingly challenges our scenario, which still includes one final rate cut by year-end (to 1.75%). Has the ECB returned to a more conservative bias, reminiscent of the pre-Draghi era?

We continue to believe that a slightly more accommodative policy would be justified from a risk-management perspective particularly to offset the euro’s appreciation and the rise in long-term rates, given that inflation remains below target.

This view is further supported by the ECB’s latest bank lending survey, which shows a halt in the easing of credit conditions in the second half of the year, suggesting that credit growth is likely to remain limited.

Eurozone: Stronger-than-Expected Growth by Mid-2025

Consumer confidence picked up slightly in October.

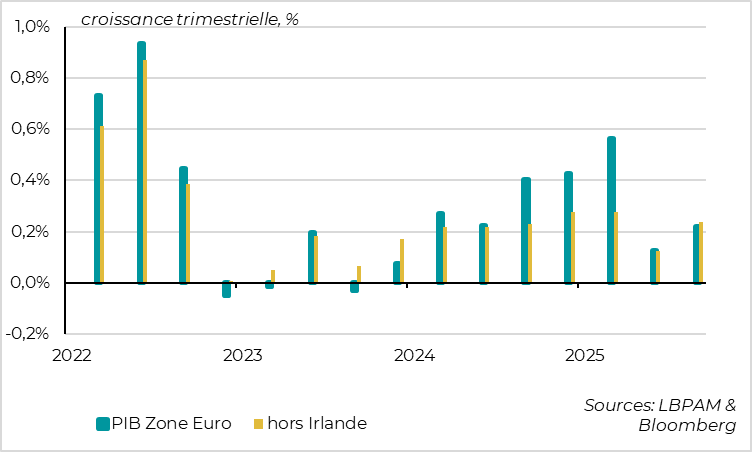

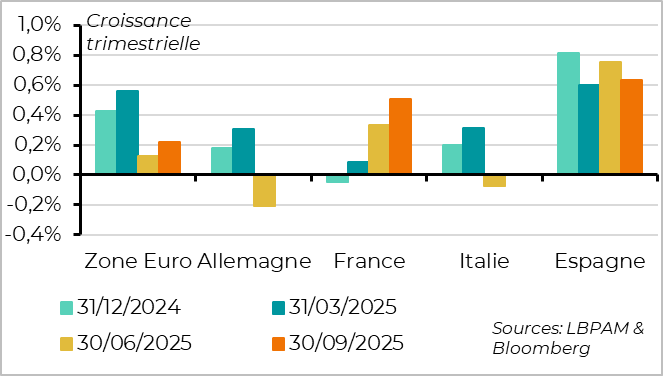

Eurozone GDP grew by 0.2% in the third quarter, following a 0.1% increase in the second quarter, and came in above the consensus forecast of 0.1%.

Growth has clearly slowed by mid-2025, as expected due to the trade war and ongoing uncertainties, falling below 1% on an annualized basis. Nevertheless, it remains resilient and positive.

The breakdown of GDP components is not yet available, as the first estimate only provides the headline figure. This limits the conclusions we can draw at this stage about underlying dynamics.

However, one important point can already be highlighted: this growth is not artificially inflated by volatility in Irish data. In fact, Ireland posted just 0.1% growth in Q3, meaning that—for the first time in two years Eurozone growth excluding Ireland is stronger than the overall figure for the region.

Business confidence in France finally showed a slight improvement in October.

Germany and Italy’s GDP stagnated in the third quarter, after contracting in the second—no surprise given their high exposure to global trade tensions.

Still, both economies avoided a technical recession by mid-2025.

Spain’s growth remains strong (+0.6%), as expected. It is largely driven by final domestic demand, with a clear acceleration in private consumption (+1.2%), public spending (+1.1%), and investment (+1.7%), offsetting the decline in exports.

The real surprise came from France, where growth accelerated to 0.5% in the third quarter, up from 0.3% in the second. This figure is likely boosted by an exceptional contribution from net exports (+1.3 points), following two quarters of decline.

However, domestic demand excluding inventory changes—a more stable indicator—rose by 0.3%, its highest level in a year. While household consumption remains modest (+0.1%) and real estate investment declined (-0.4%), corporate investment jumped by 0.9%, reaching a two-year high despite ongoing uncertainty.

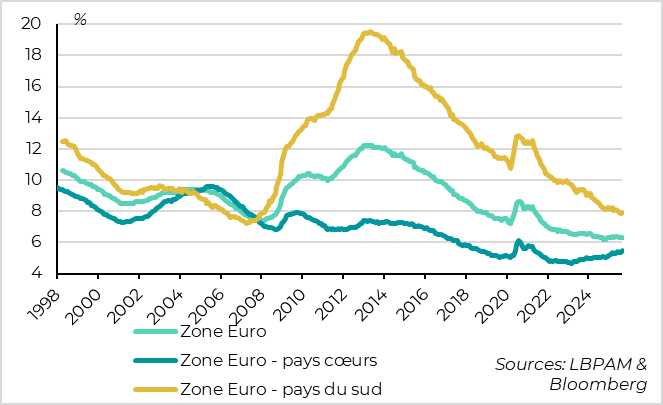

Labor market data confirms the Eurozone’s resilience over the summer.

The unemployment rate remained stable at 6.3% in September, close to its historic low, suggesting that employment continued to grow slightly.

Unemployment rose slightly in France and Germany in the third quarter, but stabilized in Germany in October. Meanwhile, joblessness continued to decline modestly in Italy and Spain.

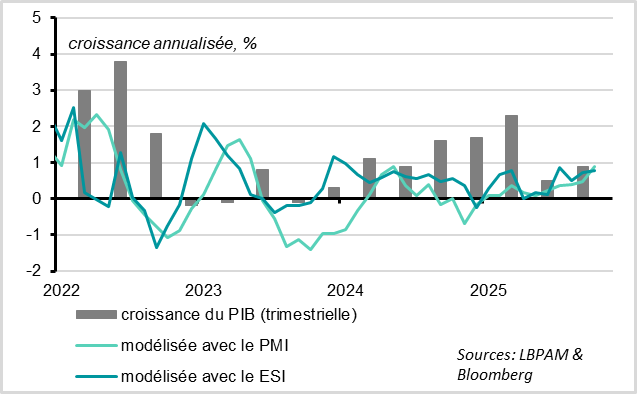

October surveys suggest that Eurozone growth is not slowing at the start of the fourth quarter it may even be picking up slightly. Following last week’s rise in PMI indices, the European Commission’s survey now shows positive signs as well, with a 1.2-point increase in October.

Although the indicator remains below its historical average at 96.8 points, it has reached its highest level in a year and a half.

This survey, broader than the PMIs as it covers a wider range of sectors, reveals a relatively widespread improvement in confidence—both across sectors and geographies, including in France, unlike the PMI results.

Overall, the October surveys are consistent with quarterly growth in the range of 0.2% to 0.3%, in line with our scenario of a slight acceleration in economic activity by year-end.

Xavier Chapard

Stratégist