The global economy is improving, and not just in the United States

Link

-

Long-term interest rates rose significantly at the start of the 2nd quarter, putting some pressure on risk appetite. This reflects increased uncertainty about inflation and Fed rate cuts, against a backdrop of solid growth and persistent inflationary pressures, while oil prices are rising (above 88 dollars per barrel for the first time since October).

-

The Fed's target inflation indicator slowed in February, from 0.5% to 0.3% over the month, confirming that a large part of January's strong acceleration was due to temporary factors. But inflationary pressures remain too high, with the sequential rate closer to 3% at the start of 2024 than to the Fed's 2% target. Against this backdrop, the Fed should not question its expectation that inflation will continue to slow over the medium term, but should wait for more favourable figures before starting to cut rates.

-

Especially as the US economy continues to surprise on the upside, with growth holding up above potential at the start of the year. Consumer spending rebounded in February after a dip in January (+0.4% after -0.2%), labour market flows stabilised in February at still solid levels and the ISM manufacturing index rose above 50pt in March for the first time since 2022.

-

Beyond the United States, the recovery in the industrial cycle is being confirmed. The global manufacturing PMI rose for the third consecutive month, reaching 50.6pt in March, its highest level since mid-2022. The global recovery is therefore becoming more widespread, even if it remains sluggish in Europe.

-

The latest data from Asia are particularly encouraging. Chinese PMIs rose sharply in March and across the board, reaching their highest levels since the rebound that followed the end of the Zero Covid policy a year ago. The recovery in foreign demand and the delayed impact of public support are enabling Chinese growth to be satisfactory in the first half of the year, even if the outlook beyond remains more uncertain. In Japan, the Tankan survey shows that domestic conditions are still improving despite the weakness of activity at the start of the year, which should reassure the Bank of Japan, which came out of negative interest rates in March.

-

In the Eurozone, national inflation figures surprised on the downside, so that core inflation in the Eurozone published today should finally fall back below 3% for the first time in 2 years. We continue to believe that core inflation should return to around 2% by the end of the year, giving the ECB more scope than the Fed for rate cuts.

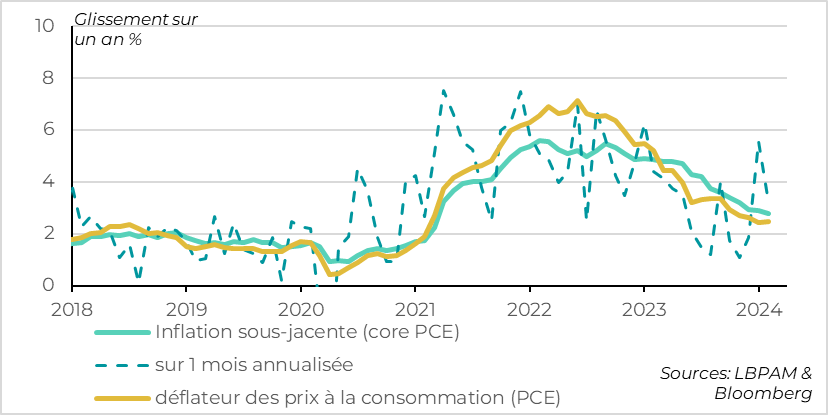

Fig.1 United States: inflation slows compared with January but remains high

The Fed's inflation target slowed in February, confirming that a large part of January's strong acceleration was due to temporary factors. But inflationary pressures remain too high.

The underlying consumer price deflator slowed from 0.5% to 0.3% in February (0.45% to 0.26%). This allows year-on-year inflation to continue to slow to 2.8%, after being revised to 2.9% for January. Total inflation rose slightly, from 2.4% to 2.5%, but this was due solely to the rise in energy prices during February.

But the dynamics of this measure of underlying inflation are not converging towards 2%, unlike at the end of 2023. The pace of price rises over 1, 3 and 6 months has accelerated again over the past 2 months, and is closer to 3% than to the Fed's target of 2%.

In terms of components, the details of the report confirm that housing prices are continuing to slow gradually, but that the price of manufactured goods is no longer falling, which was one of the main contributions to disinflation over the past two years.Fig.2 United States: super-core inflation does not accelerate, but indicates persistent tensions

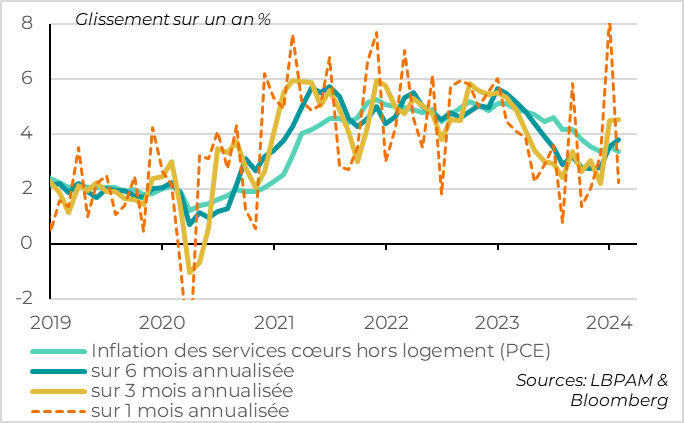

Fig.2 United States: super-core inflation does not accelerate but indicates persistent tensions

Above all, 'super-core' inflation (the price deflator for services excluding energy and housing) slowed sharply in February, from 0.7% to 0.2%. This is largely due to the more normal rise in the prices of health and financial services, which had exploded in January. This is reassuring for the Fed, as it confirms that domestic tensions are not re-accelerating.

However, "super-core" inflation remains too high, at around 3.5%, and is no longer slowing significantly on trend. This is in line with our scenario, which anticipates that core inflation should continue to slow slightly until the summer, but is likely to stabilise above the Fed's target in the second half of the year.

Looking beyond prices, activity indicators in the US suggest that growth will remain above potential at the start of 2024. The latest figures published have boosted the Atlanta Fed's growth estimate for the first quarter from 2.1% to 2.8% over the past week.

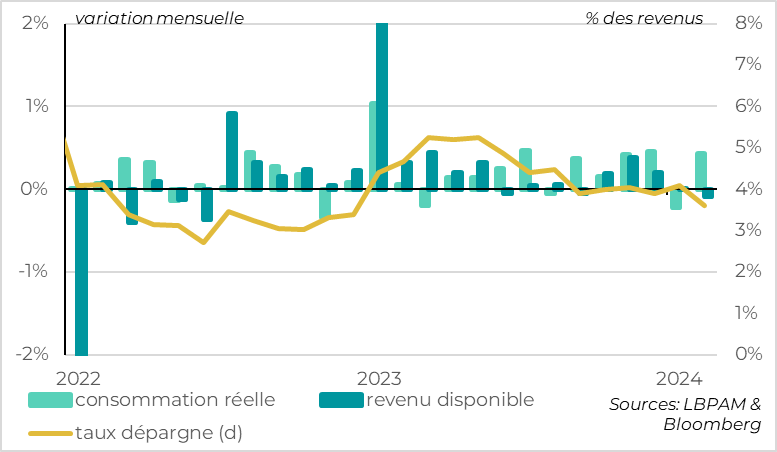

Fig.3 United States: consumption rebounds in January thanks to a fall in the savings rate

- Consumer spending rebounded by 0.4% in February after falling by 0.2% in January. Beyond the volatility of the month, which is mainly due to car sales and the unfavourable weather in January, consumption remains dynamic and continues to drive activity in Q1. It is benefiting from a still buoyant demand for services. It should be noted, however, that this consumption is being financed by a fall in the household savings rate, which is now at its lowest level since 2022 (3.6%). This partly reflects the wealth effect following the sharp rise in the markets. However, with the level of savings normalised, the continued dynamism of consumption will rely increasingly on employment growth, hence the importance of keeping a close eye on the labour market

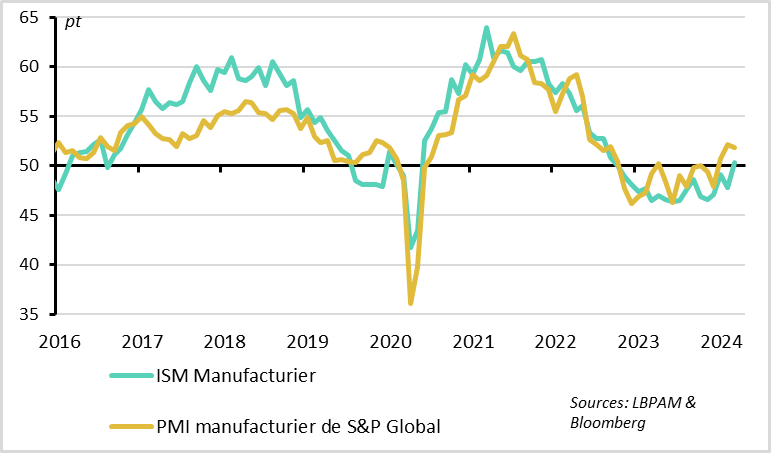

Fig.4 United States: ISM manufacturing index moves back into expansion zone in March

- The ISM manufacturing index jumped from 47.8 to 50.3 points in March, putting industrial activity back in the expansion zone for the first time in a year and a half. And the details of the survey are encouraging, as they point to an improvement in demand, with a rise in new orders and progress in destocking.

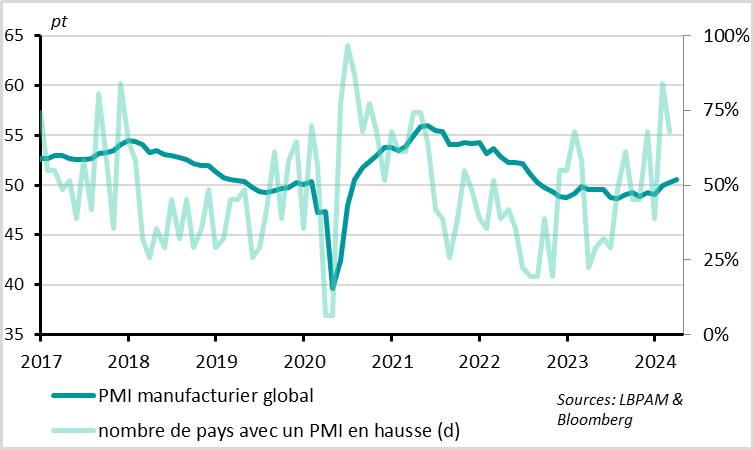

Fig.5 World: global manufacturing PMI continues to rebound into positive territory

The industrial recovery is being confirmed beyond the USA. The global manufacturing PMI continued to rise in March, after returning to the expansion zone in February, reaching 50.6pts. The details of the global PMI are encouraging, with production and new orders rising and industrial employment finally stabilising. The rise in the PMI is also fairly widespread in geographical terms, affecting almost three-quarters of the countries covered by the survey.

This supports our expectation that the industrial cycle will pick up in the first half of the year, even though production fell in January. However, this recovery still seems to be slow in Europe, with the Eurozone PMI falling less sharply than expected but still dropping to just 46.1pt in March.

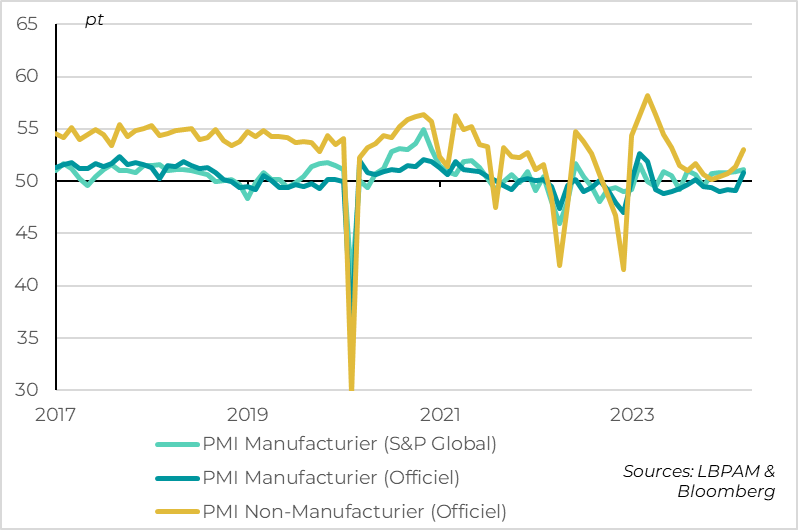

Fig.6 China: PMIs rise sharply in March

China's official PMIs rose sharply in March and across the board, suggesting that growth is satisfactory at the start of 2024. However, there are still questions about the strength and sustainability of this growth.

The manufacturing PMI rose above 50pt for the first time in 6 months. At 50.8pt, it converges with the overall S&P manufacturing PMI, which also rose to 51.1pt in March. This is consistent with the recovery in the global industrial cycle that has been visible in export figures since the start of the year.

More surprisingly, the non-manufacturing PMI also rose sharply in March, from 51.4 to 53.0pt. This is still slightly below its historical average level, but is still the highest since the post-Covid Zero reopening of H1 2023. This indicates that domestic demand, China's main weak spot last year, is picking up a little.

However, the rise in the Non-Manufacturing PMI is exaggerated by the sharp rise in the Construction PMI, which reflects the authorities' support for infrastructure investment while residential activity continues to decline, as well as seasonality. Also, the components of the non-manufacturing PMI are less encouraging in terms of the outlook, as new orders and employment continue to contract.

All in all, we believe that growth should be satisfactory in the first half of the year thanks to the improvement in the global economy and the support measures that the authorities put in place at the end of 2023/beginning of 2024. This should enable growth to approach the authorities' target this year (i.e. around 5%). But growth is likely to slow in the second half of the year if the authorities do not do more to stabilise the property sector, support local government finances and boost confidence among private agents.

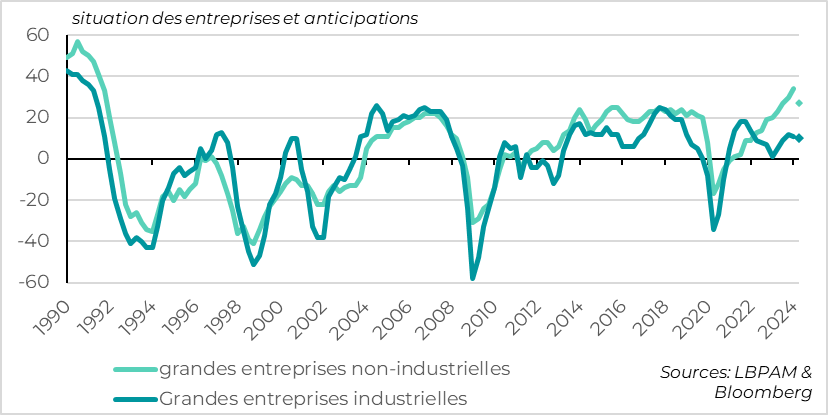

Fig.7 Japan: domestic business confidence at its highest for 30 years

Tankan, the quarterly survey conducted by the Bank of Japan (BoJ), indicates that the Japanese economy remains fundamentally well orientated, even if activity is weak at the start of this year.

Confidence among major manufacturers fell only marginally in Q1 after four consecutive rises, from 12 to 11pt. It is encouraging to see that industrial confidence remains positive despite the problems with car production at the start of the year. Although the manufacturing PMI is recovering only slowly (to 48.2pt in March), the weakness of the yen and the external recovery argue in favour of a rebound in industrial production in the coming months.

Above all, the confidence of large non-manufacturing companies continues to rise, reaching its highest level since the early 1990s in Q1, at 34pts. This suggests a fundamental improvement in the domestic outlook. This is particularly true for the property and tourism sectors, which have long been a drag.

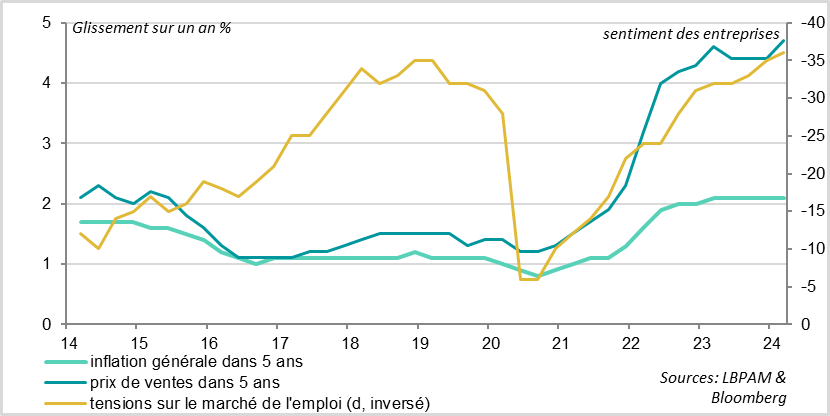

Fig.8 Japan: companies support the idea of an exit from deflation

Japanese companies are also indicating that progress is continuing to be made on the road out of deflation, which should reassure the Bank of Japan, which came out of negative interest rates last month.

Companies expect inflation to reach the government's target of 2.1% over the next 5 years, and believe they will be able to raise their selling prices in the medium term. They also indicate that tensions on the labour market will increase again in H1 2024, with the labour market conditions indicator even exceeding its pre-Covid level. This is encouraging for wages, which the central bank wants to see rise more sharply to ensure that the momentum out of deflation is sustainable.

All in all, the Tankan survey seems to validate the BoJ's decision to finally move away from conventional monetary policy. In fact, it suggests that monetary normalisation will continue over the coming months. However, the BoJ can be patient and wait to see the economic improvement materialise before changing its rates, especially as the Tankan survey was carried out before the negative interest rates came out. If this is the case, a further rate hike could be possible over the summer.