The Japanese Prime Minister strengthens her power

Link

What are the key takeaways from the market news on february 10, 2026? Sebastian Paris Horvitz provides some insights.

Overview

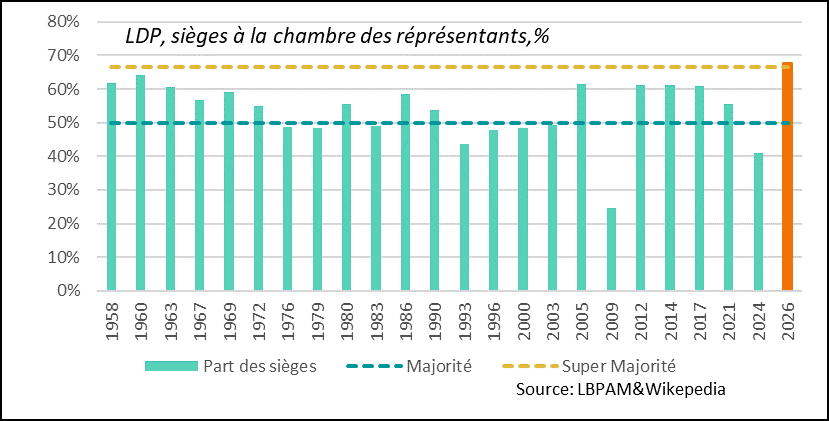

► Sanae Takaichi, the Japanese Prime Minister, buoyed by her strong popularity, won a historic victory in Sunday’s parliamentary elections. For the first time in history, the LDP secured a nearly two‑thirds majority in the House of Representatives. In the House of Councillors (the upper house), the LDP, even with its partner, the Innovation Party Ishin, did not achieve an absolute majority. Nevertheless, this victory strengthens Ms. Takaichi’s political power.

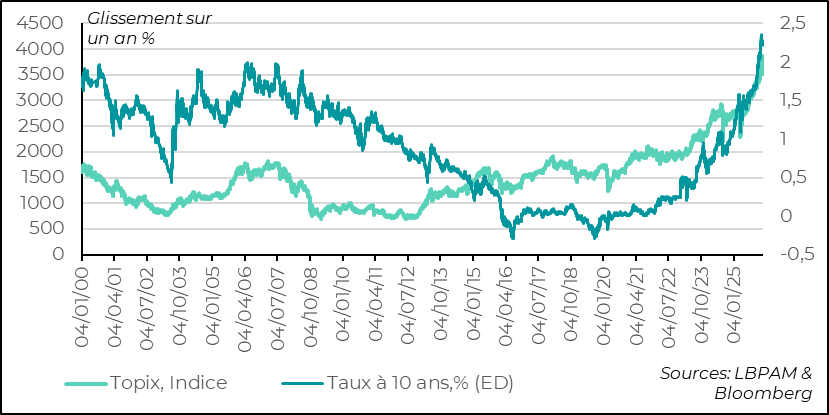

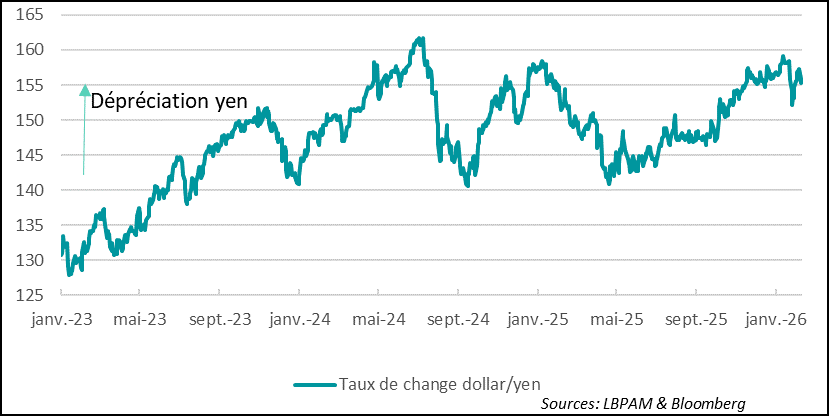

►Her pro‑growth policy has supported the Japanese stock market and put upward pressure on 10‑year sovereign yields, while the yen continued to appreciate. We still believe that domestic stocks should benefit from government policy, but the continued appreciation of the yen could slow the overall performance of the Japanese equity market. However, the market should remain supported by the normalization of monetary policy and already‑high interest rates.

► Donald Trump’s decision to initiate talks with the Iranian authorities over the weekend, particularly regarding the nuclear program, helped ease tensions over oil prices. However, new tensions emerged as early as yesterday, when Trump issued a message urging caution about maritime traffic in the Suez Canal, suggesting that a U.S. intervention in Iran remains possible. Overall, oil prices remain close to 70 dollars per barrel, an increase of more than 10% since the start of the year. Most experts believe that a military intervention on Iranian soil is unlikely, but uncertainty remains high.

► In an environment that remains uncertain, and despite positive economic news in the United States—aside from the labor market—the dollar has remained relatively weak. The greenback has depreciated against all major currencies since the beginning of the year, particularly against the Australian dollar, which strengthened further after the central bank raised interest rates.

As for the euro, we had anticipated a more modest appreciation, with an exchange rate around 1.17 dollars. It now exceeds 1.19. This rise eases Europe’s energy bill but could push inflation lower than expected. Such a development would increase the likelihood of one final interest rate cut by the ECB.

►In the United Kingdom, pressure on Prime Minister Keir Starmer to resign has intensified in recent days, following several departures from his cabinet and a loss of support within his party. This situation stems from the repercussions of the Epstein case and the latter’s links with former government member Peter Mandelson. At this stage, it is difficult to know whether Keir Starmer will have to step down. What is certain is that Labour has seen its support drop sharply since the last elections, which clearly weakens the current government.

Nevertheless, strict budget constraints severely limit the room for manoeuvre available to any incoming Labour Prime Minister. In our view, without a change in fiscal policy, the Bank of England should continue its monetary easing and slightly reduce the pressure on long‑term rates, especially after their recent rise.

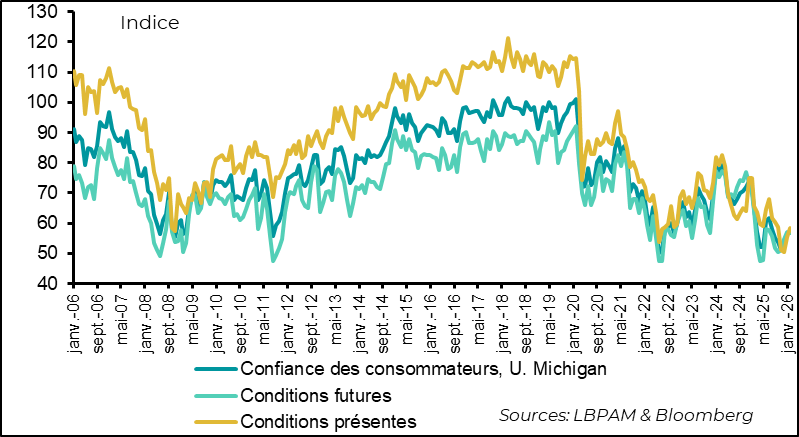

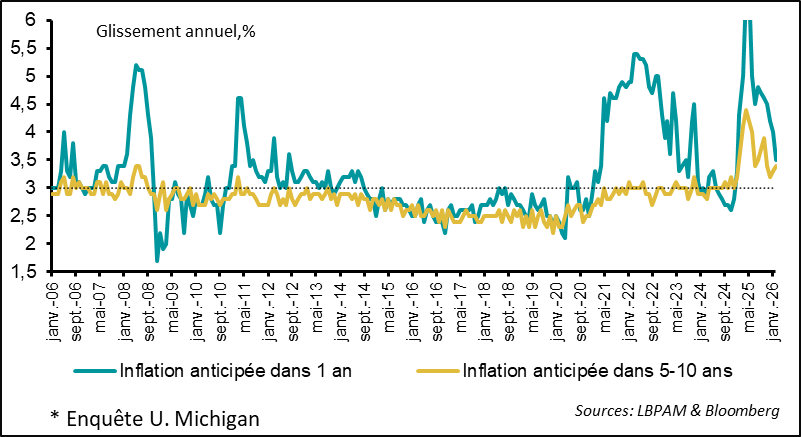

►In the United States, on the cyclical front, consumer confidence as measured by the University of Michigan recorded a notable rebound — a rare occurrence — even though its level remains historically low. This preliminary result was surprising, especially in a context of heightened political tensions. Last month’s moderation in energy prices led to a downward revision of short‑term inflation expectations, improving perceptions of purchasing power. However, concerns related to employment remain strong, and medium‑term inflation expectations are still elevated.

It is worth noting that despite very low confidence levels, consumer spending has remained quite solid so far. The retail sales data for December, released today, will show whether signs of a slowdown are beginning to emerge.

Going Further

Japan: S. Takaichi emerges significantly strengthened after a historic victory

Since 1958, the LDP had never won such a resounding victory

Sanae Takaichi’s decision to call early parliamentary elections proved successful. The LDP scored a historic victory, achieving extraordinary gains in the House of Representatives and securing a two‑thirds majority — its highest level ever. Together with its coalition partner, the Innovation Party (Ishin), Ms. Takaichi’s government now enjoys parliamentary support well beyond even the most optimistic pre‑election forecasts.

This new political landscape gives the government significant leeway to implement its pro‑growth strategy without major obstacles. Ms. Takaichi’s reform agenda could even go far beyond spending measures or economic initiatives. It may now include a revision of the Constitution, particularly Article 9. This article, inherited from the post–Second World War era, strictly limits Japan’s security policy, caps its military capabilities, and sets the framework for defence cooperation with the United States. In her speech following the electoral victory, Ms. Takaichi indicated that constitutional reform should be considered. This development highlights once again the scale of the ongoing geopolitical shift. It is also worth noting that, under the Prime Minister’s spending plan, defence expenditures are already set to reach 2% of GDP.

Japanese assets are being revalued as the country emerges from deflation

On the markets, this victory — which far exceeded expectations — was greeted by a further rise in Japanese equities. The Topix continued to climb and is now up more than 5% since the beginning of the year. The re‑rating of the market is therefore ongoing, supported by Japan’s emergence from decades of deflation. The government’s pro‑growth agenda is also reinforcing this momentum.

However, the revaluation of Japanese assets has already gone quite far: the Topix now trades at more than 19 times the earnings of its constituent companies. While we believe government policies should support the

Japanese economy, particularly domestic‑oriented stocks, much of the good news already appears to be priced in.

It is also worth noting the revaluation of Japanese government bonds, following historic increases in yields over the past year. This reflects the rise in inflation, now clearly close to the Bank of Japan’s target, a development that should continue pushing the central bank toward a gradual normalization of its monetary policy. We still expect at least two policy rate hikes this year.

The yen remains very weak but is expected to appreciate

Thus, we are tactically adopting a cautious stance on the Japanese market. This view largely reflects our expectation of a continued appreciation of the yen, which is likely to weigh on Japan’s export‑oriented sectors. The yen remains extremely depressed, and we expect its appreciation trend to accelerate in the coming months as monetary policy normalization progresses and economic growth continues to be supported by fiscal policy.

United States: Consumer confidence rebounds but remains subdued

An improvement in confidence, but still at a historically weak level

The preliminary University of Michigan survey for February showed an improvement in consumer confidence. This uptick comes mainly from the component measuring current conditions: this sub‑index rose by 3 points over the month. This improvement is largely explained by a decline in short‑term inflation expectations, linked in particular to the drop in energy prices, which boosts perceptions of purchasing power.

At the same time, it is important to remember that overall confidence remains historically low and that concerns about employment, in particular, remain high.

Short‑term inflation expectations decline

As noted, the main reason for the improvement in households’ perception of recent conditions lies in the decline in short‑term inflation expectations. This appears to stem from the view that tariff increases will have a more limited impact than previously expected, but above all from the drop in energy prices. On this point, however, the recent rise in oil prices, linked to tensions with Iran, could once again generate a degree of anxiety among households.

At the same time, medium‑term inflation expectations remain elevated and even increased in the latest survey. This highlights the fact that concerns about purchasing power are still significant for American households, and that these concerns are one of the factors behind President Trump’s sharp decline in popularity.

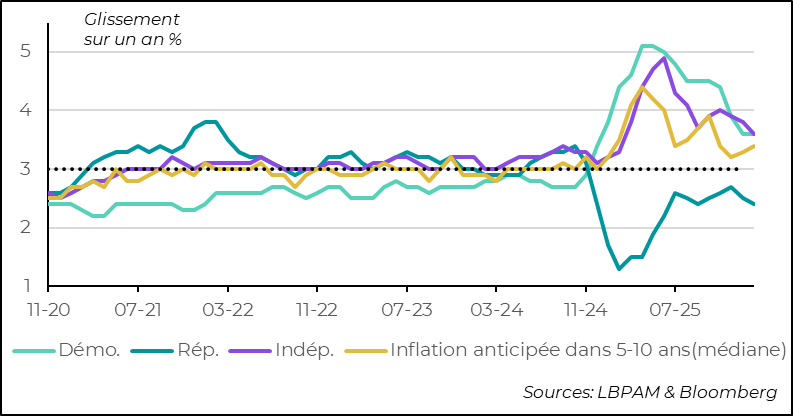

A persistent divide along political lines

Nevertheless, perceptions of the economy and inflation prospects remain sharply divided along political lines. However, these views have begun to converge somewhat in recent months. In particular, households identifying with the Republican Party now appear to have a more realistic view of future inflation trends, and are therefore noticeably less optimistic about the expected outcomes of the government’s economic policy.

Even so, this depressed confidence has not yet been clearly reflected in U.S. household spending behaviour. In fact, consumption has made a solid contribution to GDP growth over the past three quarters. The retail sales data released today will indicate whether the first signs of a slowdown are beginning to emerge.

Sebastian Paris Horvitz

Director of Research