The market under pressure from interest rates

Link

-

Long-term yields have continued to rise in recent days, with the US 10-year yield exceeding 4.80% and the rate on German government bonds approaching 3%. For the US, this is a level that was only reached in 2007, while for Germany, it's a step back 12 years. The combination of resilient US growth and very high public deficits seems to be the main cause. In this sense, uncertainty about the trajectory of economies and public policies is driving investors to take little risk, and to seek refuge in cash, which is currently very well remunerated, given the high levels of key interest rates. Against this backdrop, the world's stock markets are suffering. Obviously, the persistence of these tensions will have negative economic consequences. This could amplify the weak growth we expect. We remain cautious in our allocations, giving priority to quality and maintaining a much higher-than-usual cash position, with good interest rates.

-

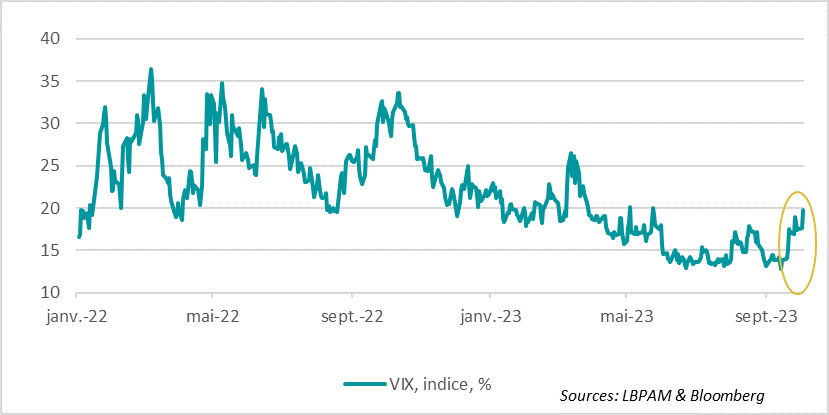

In our view, the robustness of the US economy is partly linked to the fiscal largesse of 2023. The US public deficit is already more than 3 percentage points of GDP lower than last year. This has partly supported the American consumer. For us, this is one of the explanations behind the rise in real rates. At the same time, it seems only now that sentiment on equities is starting to deteriorate, with volatility rising in particular. The so-called fear index, the VIX, or implied volatility on S&P500 options, is approaching 20. This is high, but still relatively low in historical terms. If long rates continue to rise, fear could well intensify.

-

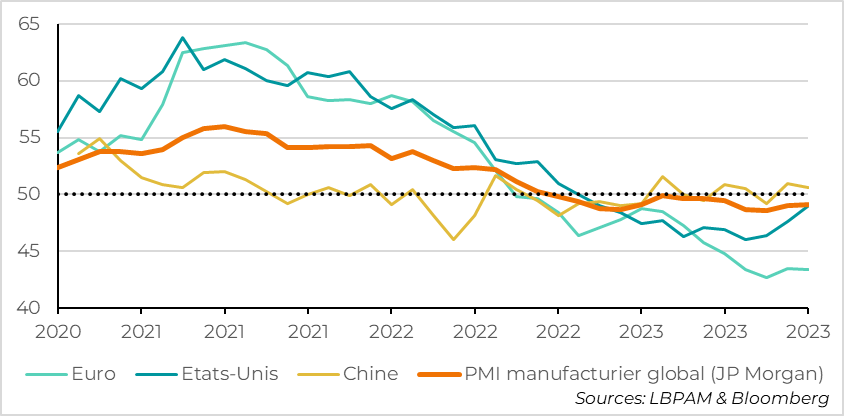

In the latest economic statistics, the resilience of the US economy was underlined by the continued improvement in the industrial sector. Indeed, the ISM manufacturing index came close to the 50 mark that separates expansion and contraction in activity, coming in at 49. This improvement helped JP Morgan's overall index to stabilize. In fact, despite mixed figures in China, the global industrial cycle seems to have stabilized, as is the case in the Eurozone, even if the situation remains very depressed. In part, it seems that the "cleaning up" of inventories has helped. Also, in the United States, the impact of higher oil production and the impetus of investment in sectors associated with public subsidies (CHIPS/IRA) have led to this stronger improvement than elsewhere. However, for this to be sustainable, demand will have to hold up.

-

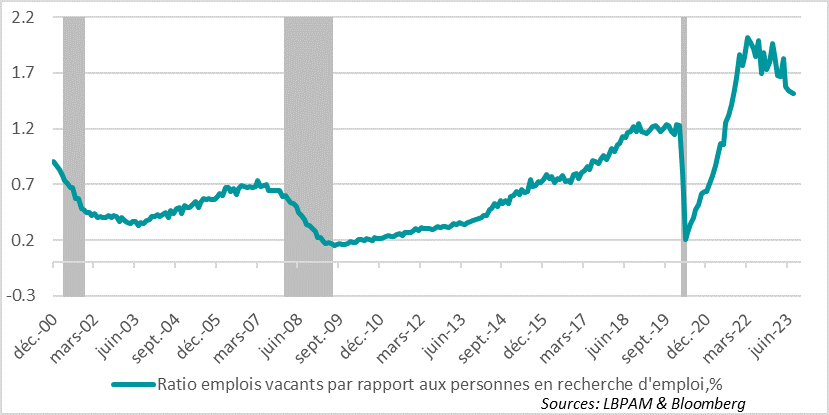

In the United States, stimulating activity in certain sectors, including industry, still seems to be boosting employment, as we saw with the rise in job vacancies in August to well over 9 million. At the same time, given the number of new entrants to the labour market in August, the ratio of job vacancies to job seekers has fallen slightly, although it remains historically high at over 1.5. As it stands, this should go some way to further dampening wage increases in sectors under pressure. Nevertheless, a still robust labor market should further support demand.

-

Still in the USA, accentuating the market's fears for the future, yesterday the leader of the Republicans was impeached by members of his camp, under the impetus of the party's most extreme wing. This follows the Democrat-backed vote to prevent the shutdown of certain public services. We know that in 45 days, without a budget agreement, we'll find ourselves in the same impasse. The situation is likely to be even more unfavorable for reaching an agreement if the right wing of the Republican party, albeit in a minority, opposes any agreement and forces part of the government to shut down, which will have a negative impact on growth if it continues (it is estimated that each week of government shutdown reduces growth by 0.2 points).

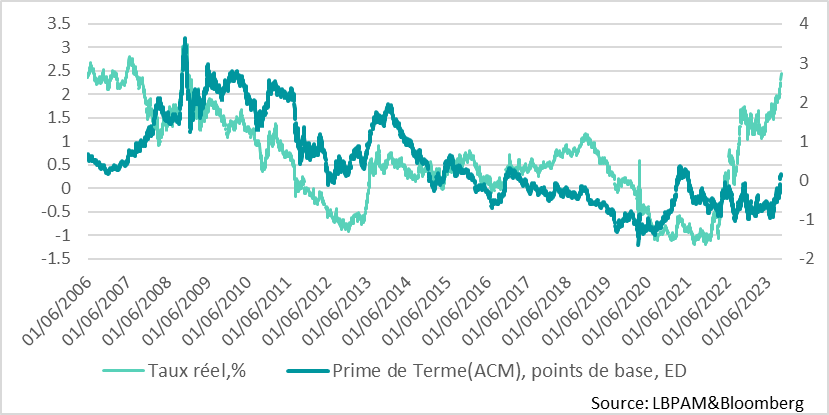

Long-term interest rates continued to rise. The US 10-year sovereign yield has risen by almost 70 basis points in the last month, and its German counterpart by almost 40 ! The rise is largely explained by the rise in real rates, which in the US have reached their highest level since 2007. This can be attributed to the resilience of the US economy, and also to persistently high public deficits. This is reflected in the expectation that central bank policy rates will remain relatively high for longer than expected.

In fact, the very particular economic climate we are experiencing is fuelling uncertainty about the future, and we should expect the bond world to incorporate this into prices. This seems to be happening. Indeed, in theory, the level of interest rates should correspond to inflation expectations and the real rate, itself largely determined by the outlook for economic growth, and, finally, an element of uncertainty that would compensate investors for the risks of these expectations proving wrong - a term premium.

There are many estimates of this premium, which is obviously not directly observable. The Fed produces some of them. As it happens, this premium has been largely negative until now. Thus, investors seemed to want to hold U.S. Treasury bonds without being compensated for the risks to the future.

As we can see, the latest move to raise interest rates has resulted in a surge in this term premium, which has returned slightly to positive territory, reflecting the sense of uncertainty that is gripping the market.

As we can see from the historical perspective (c. Fig 1), if we ever move towards a "normalization" of this premium, we could see rates surge again. Nevertheless, at this stage we don't think that a very significant move will take place, as long as the Fed keeps inflation expectations well anchored. Of course, the fiscal risk remains, but at this stage we do not think we will see a further deterioration in the fiscal imbalance. But this is clearly a point of vigilance.

Fig.1 United States: The rise in long-term interest rates reflects an increase in real rates and term premiums.

Unsurprisingly, this upward movement in interest rates began to dampen risk appetite. As a result, the VIX, the so-called fear index, began to rise sharply. It is now close to 20, which is high compared with levels seen since the spring, but remains relatively moderate by historical standards. Nevertheless, it reflects the anxiety that is beginning to take hold in the market.

The decline in all assets obviously worsens the financial conditions under which the US economy operates, and this is just as true in Europe. If this persists, it will have a negative impact on growth and exacerbate the downward pressure that restrictive monetary policies are already exerting on the economy.

Nevertheless, it seems to us that, given the economic prospects we see ahead, the interest rates achieved are attractive. We are exposed to them, particularly in view of the high level of real interest rates. One uncertainty remains the ability of economies to withstand this deterioration in financial conditions. In the United States in particular, like many others, we can only be surprised at the robustness shown by activity in recent quarters. We continue to believe that part of the "American exception" lies in a fiscal policy that has proved far more stimulating than anticipated, and which has benefited consumers in particular through much lower taxation than the previous year.

This resilience was further underlined by the continuing rebound in the US manufacturing sector. Indeed, the ISM survey for September revealed that activity had continued to improve. The synthetic index approached 50, the level separating expansion and contraction in activity, reaching 49. This was due in part to the surge in oil production, but also to the stimulating effects of the Biden administration's plans to support the semiconductor sector (CHIPS) and activities linked to the energy transition, notably transport (IRA).

The "clean-up" of excess inventories in industry also helped in this improved performance. This was also the case in Europe, where the index for the Euro Zone stabilized, albeit at low levels, in an area of contracting activity.

All in all, thanks in large part to the United States, global industrial activity appears to have stabilized in September, as shown by the global index calculated by JP Morgan.

Fig.3 Manufacturing activity: Worldwide, manufacturing activity appears to be stabilizing, albeit with disparities.

This improvement in industry was also accompanied by a rebound in hiring in the US economy. Indeed, the indicator produced by the U.S. Department of Labor showed that job vacancies in August once again rose well above the 9 million mark.

At the same time, given the large number of new entrants to the labor market in August, the ratio of job vacancies to jobseekers continued to fall, albeit slightly. This could help to further ease wage pressures in the most pressurized sectors. Nevertheless, we will have to remain vigilant about wage trends over the coming quarters. The strikes in the automotive industry, with their demands for substantial wage increases, are proof of this.

Fig.4 United States: The labor market remains robust. Job vacancies are rebounding. But new entrants to the market avoid more tensions