The most difficult decision for the ECB in 1 year

Link

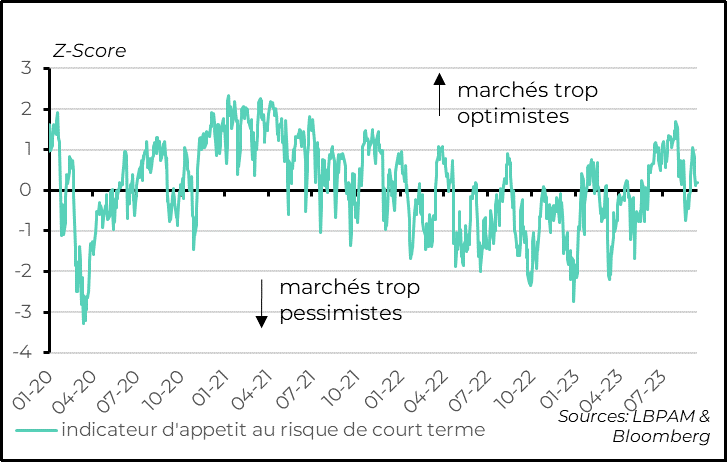

- Risk appetite floundered again in the autumn week after several weeks of rebound, returning to neutral territory according to our short-term measures. Global and European equities lost over 1%, credit spreads widened slightly and the dollar appreciated against most currencies.

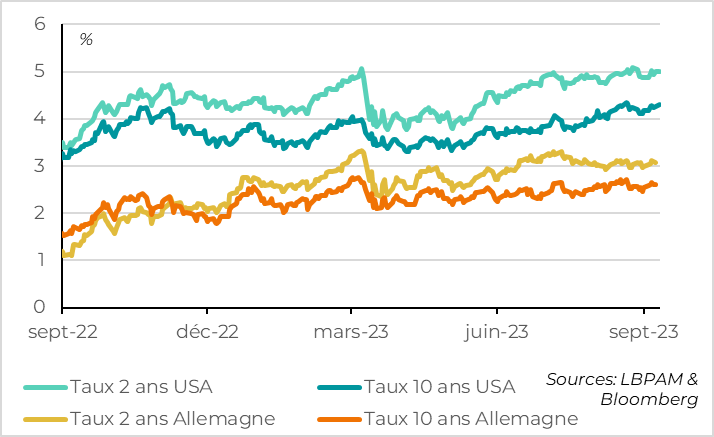

- This is largely due to the rise in interest rates, both short and long, in the face of a resilient US economy, rising oil prices and the record volume of corporate bond issuance this autumn. Pressure on equities was reinforced by the underperformance of market-driving sectors in the US (tech) and Europe (luxury goods).

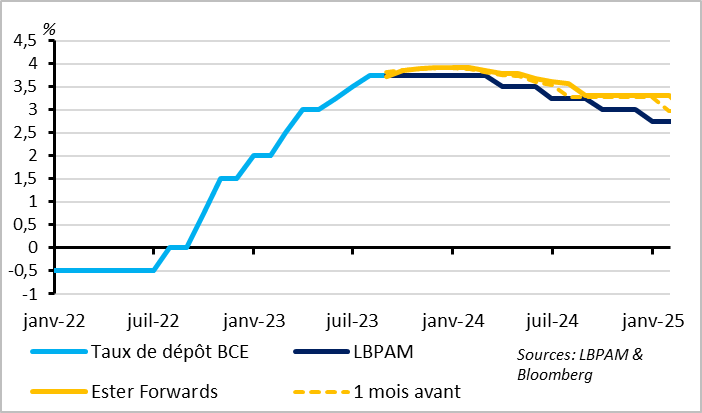

- Attention will turn again to central banks in the coming days, with the ECB meeting on Thursday before those of the Fed, BoE and BoJ next week. The data available since the ECB's July meeting suggest that inflation is evolving in line with June forecasts, even if wage pressures are a little stronger, while growth is much weaker. Against this backdrop, we believe the ECB should pause in its rate hikes, while indicating that it remains ready to raise rates further if necessary, and above all that it will keep rates high for some time. The risk of a final hike this week remains significant, however, and market expectations (which attach a probability of more than a third to a hike) seem reasonable.

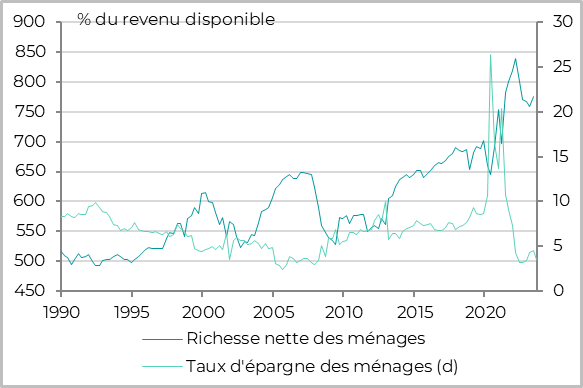

- In the United States, household wealth rose sharply again in Q2, surpassing its high point of early 2022 at $155 trillion. The wealth effect may explain the fall in the household savings rate since Q2 (to 3.5% in July), which has supported consumption. That said, we do not believe that the savings rate can remain so low as the job market slows and monetary policy remains restrictive, which should lead to a net slowdown in consumption in the coming quarters.

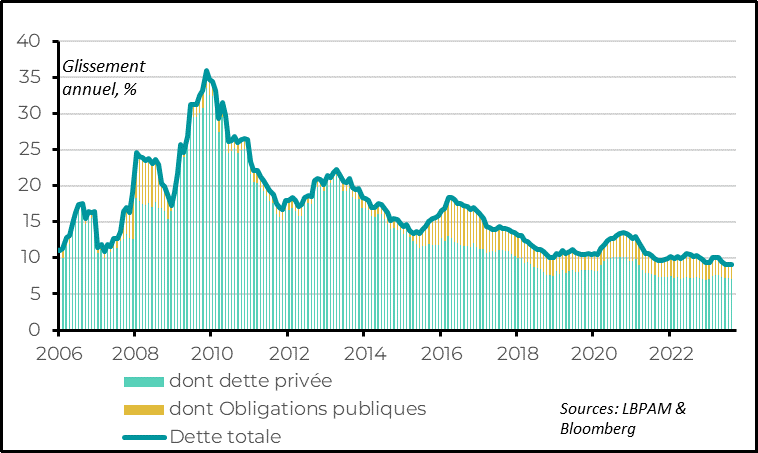

- The latest Chinese data are a little more reassuring, with slightly positive inflation in August and, above all, a rise in credit growth thanks to increased government bond issuance. A clear rebound in Chinese growth is a long way off, but at least it limits the risks of a continuation of China's marked slowdown.

Fig.1 Markets: Risk appetite falls back into neutral zone after end-August rebound

-Markets too optimistic

-Markets too pessimistic

-Short-term risk appetite indicator

Risk appetite floundered again for the back-to-school week after several weeks of rebound, returning to neutral territory according to our short-term measures. Global and European equities lost over 1%, government and corporate bonds fell slightly and the dollar appreciated against most currencies.

Fig.2 Markets: Interest rates approaching their mid-August highs

2-year rate USA - 10-year rate USA

2-year rate Germany - 10-year rate Germany

This is largely due to the rise in interest rates, both short and long. Good news on the US economy (rebounding ISM services and falling jobless claims at the end of August) has raised fears that the Fed may have to raise rates further, while rising oil prices are pushing up inflation premiums. Corporate bond issuance also hit a record high during the back-to-school week, as companies took advantage of the window between the end of the vacations and central bank meetings to secure financing. This is competing with large-scale government issuance and putting additional pressure on long rates.

Pressure on equities was reinforced by the underperformance of market-driving sectors in the USA and Europe. US Tech suffered from renewed Sino-American tensions, while European luxury goods were impacted by slowing demand, particularly in Europe and China. Reflecting the latter, the Yuan hit a 17-year low against the dollar last week (above 7.30) before stabilizing this morning.

Fig.3 Eurozone: Markets give a one-in-three chance of a final ECB rate hike this week

At its July meeting, the ECB stated that it had moved into a phase where its decisions would be totally dependent on published data after nine consecutive rate hikes. However, the available data suggest that inflation is evolving in line with the June forecasts, even if wage pressures are a little stronger, while growth is much weaker. We believe that the ECB's new economic projections will point to significantly weaker growth for 2023 and 2024 and broadly unchanged inflation, with the stronger rise in oil and wage costs offsetting the effect of the weaker economy. Against this backdrop, we believe the ECB should pause in its rate hikes, while indicating that it remains ready to raise rates further if inflation does not slow down at least as fast as in its projections, and above all that it will keep rates high for some time to come.

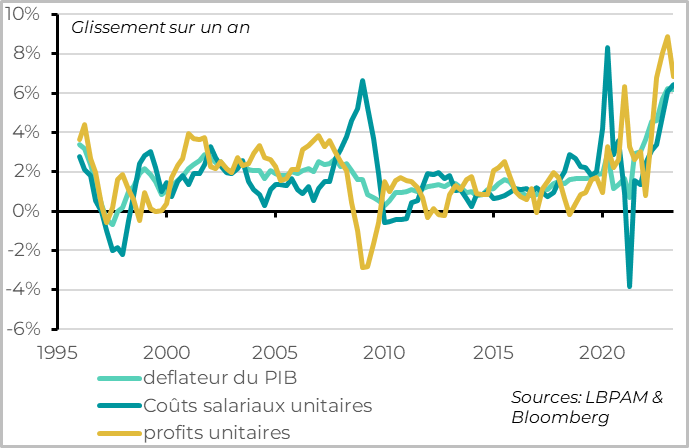

Fig.4 Eurozone: pressure on labor costs remains very strong as wages and employment rise

GDP deflator

Unit labor costs

Unit profits

The risk of a final rise this week remains significant, however, and market expectations (which attach a probability of over a third to a rise) seem reasonable.

The main arguments for a final rate hike by the ECB are that inflation expectations are a little high and wage pressures are not yet slowing down. The ECB may fear that inflation expectations, which are already at the upper end of their historical range, could become unanchored if the ECB's credibility is called into question, while core inflation is expected to remain above target until the end of 2024.

On the wage cost front, Q2 GDP figures reveal that unit labor costs accelerated again in Q2, from 6.1% to 6.4% year-on-year. However, they are supposed to rise at a rate of 2% to be compatible with the inflation target. This rise in costs reflects the still dynamic growth in average wages (6% in Q2 as in Q1) and the fall in productivity (as employment is growing faster than activity). It should be noted, however, that wage costs are a lagging variable in the cycle, and are likely to slow sharply with wages and employment next year, if activity remains weak. It should also be noted that corporate margins began to contract sharply in Q2, with unit profits slowing from 8.9% to 6.8%, which should contribute to disinflation even if wages remain a little too dynamic.

Fig.5 United States: Household wealth rises again in Q2, temporarily supporting consumption

% of disposable income

Household net wealth

Household savings rate (d)

In the United States, household wealth rose sharply again in Q2, surpassing its early 2022 peak at $155 trillion. At 575 as a % of GDP, it is 50ppt below its 2022 highs, but still 50ppt above its pre-Covid level. This reflects the rebound in financial assets, while property prices rose slightly. This may explain the fall in the household savings rate since Q2 to 3.5% in August, which has supported consumption even though the savings accumulated during the Covid have already been largely spent. That said, we do not believe that the savings rate can remain so low as the job market slows and monetary policy remains restrictive, which should lead to a net slowdown in consumption in the coming quarters.

Fig.6 China: credit growth picks up slightly in August thanks to the public sector

Year-on-year, %

of which private debt

of which public bonds

total debt

The latest Chinese data are a little more reassuring, suggesting that public support is starting to percolate through the economy and could, in our view, stabilize growth in Q4 at a limited level. Inflation edged back into positive territory in August, at 0.1% after -0.3% in July, and producer prices contracted less sharply (-3% after -4.4%). While this mainly reflects less negative base effects on commodity prices, it does suggest that domestic demand is a little less weak. And credit growth picked up a little in August thanks to increased government bond issuance, offsetting still-weak demand for private debt. A clear rebound in Chinese growth is far from imminent, but at least the support of the authorities and signs of stabilization on the industrial production side limit fears of a continuation of China's marked slowdown.