The new Fed chair will soon be announced

Link

What to take away from the market news on December 2, 2025?

Insights from Sebastian Paris Horvitz.

Overview

► President Trump stated over the weekend that he has identified the candidate to become the next Chair of the Federal Reserve. However, he did not disclose a name. D. Trump wants someone at the helm of the Fed who is willing to lower interest rates. Among the five potential candidates, persistent rumors suggest that Kevin Hassett has been chosen. He is a close associate of the President, appointed at the start of the administration as head of the National Economic Council. In numerous recent interviews, K. Hassett emphasized the Fed’s independence. Nevertheless, his close ties to the President raise some concerns. That said, we believe he is likely to be confirmed by the Senate and that markets will give him the benefit of the doubt—at least initially. We maintain our view that the Fed will succeed in preserving its independence, even with K. Hassett at its head starting in May 2026.

► In Japan, K. Ueda, Governor of the Bank of Japan (BoJ), delivered the most significant signal in recent months regarding the imminent prospect of another rate hike. He indicated that if economic activity continues to evolve as expected, along with inflation, the BoJ will be able to further reduce the degree of monetary policy accommodation. These statements strengthened the yen, and two-year yields reached 1% for the first time since 2007–2008. We therefore expect the BoJ to act as early as December 19, followed by a gradual series of rate hikes for some time. The yen should follow a slow appreciation trend from its current very low levels.

► K. Ueda’s comments not only pushed Japanese yields higher but also had a ripple effect across global sovereign bond markets, notably driving long-term U.S. and European yields sharply higher. This correlation is far from trivial, especially given that today’s economic data were rather weak, particularly regarding industrial activity. However, it is well known that Japan’s low and stable rates have long served as a source of funding for investments seeking higher yields elsewhere. The market now seems to be partially pricing in the end of this “carry trade.”

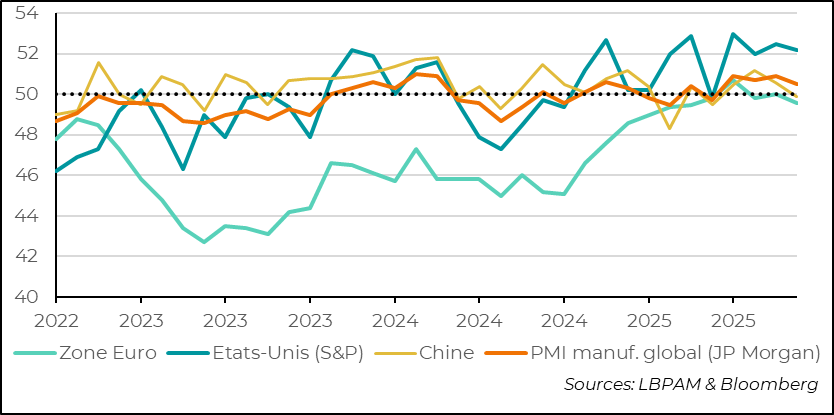

►Global manufacturing activity surveys for November indicate a slowdown. The global index, compiled by JPMorgan based on S&P surveys across a large number of countries, edged lower, hovering just above the threshold separating expansion from contraction. According to S&P’s survey, the U.S. continues to show expansionary activity. Overall, business optimism for the year ahead has improved slightly again.

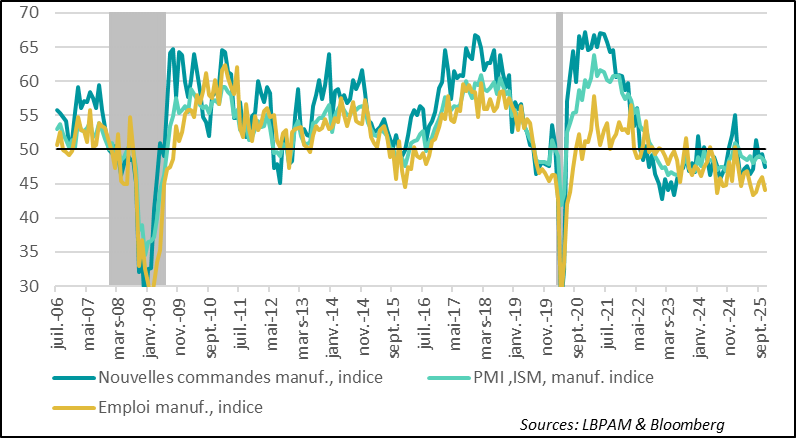

► In the United States, the ISM manufacturing survey delivered a much more mixed message than S&P’s, showing a sharper contraction in activity compared to the previous month. Both new orders and hiring intentions declined at a faster pace than in October. The survey suggests that the industrial sector remains fragile, even though certain segments—particularly those linked to data center construction—are thriving. It is also worth noting that costs rose slightly faster than the previous month.

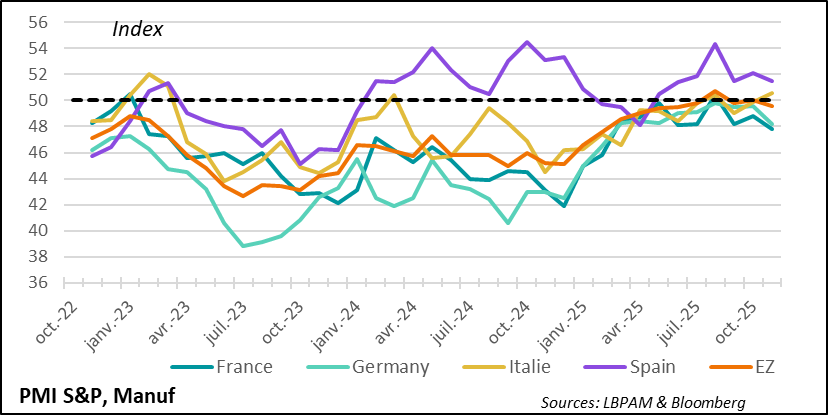

►In the Eurozone, manufacturing activity has not improved since the preliminary survey, remaining slightly in contraction territory. The final survey confirms that peripheral countries are performing better: in Italy and Spain, activity continues to expand, although growth in Spain has slowed. We still believe activity should rebound more strongly in 2026, supported by stimulus plans, particularly in Germany.

►While the outlook may be somewhat brighter, the difficulties facing European industry remain a concern for the ECB as it shapes monetary policy. This is one of the factors we continue to highlight in our analysis, anticipating an additional easing measure in the coming months. In the short term, however, price trends are likely to show inflation stability rather than continued convergence toward 2%, as suggested by preliminary data for several countries and likely to be confirmed by the euro area price index due today. These are generally base effects, and the disinflation trend should persist into 2026. Inflation is expected to fall below 2% in 2026 and remain there through 2027.

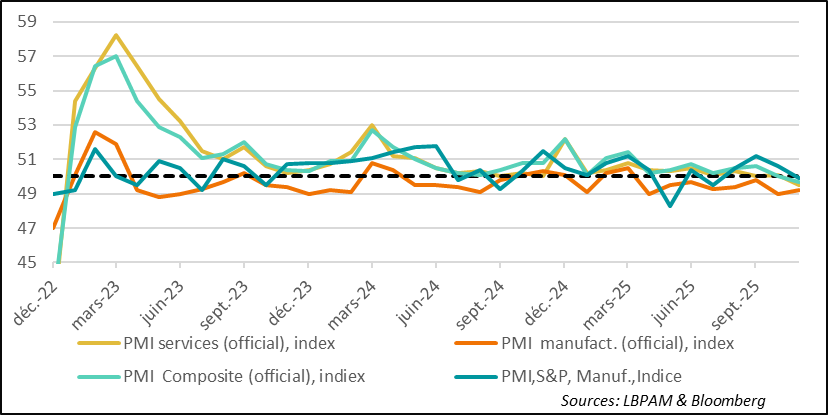

►In China, the first wave of activity surveys for November showed a slowdown. The composite index (services and manufacturing) slipped slightly into contraction territory, with the sharpest decline coming from services. Similarly, S&P’s PMI for manufacturing also signaled a slowdown, despite continued recovery in exports. It appears that domestic activity is weakening again. While authorities may welcome the resilience of the export sector, weak domestic demand should prompt them to take further action to meet the 5% growth target. A stimulus plan in early 2026 seems highly likely.

Going further

Global: industrial activity slows at year-end

Industry Continues to Expand but Moderates Across Many Countries

The global PMI for industrial activity from S&P, compiled by JPMorgan, came in relatively weak in November, indicating that growth in this segment has slowed. All major countries or economic zones recorded a deceleration, notably the euro area and China.

Nevertheless, according to S&P’s PMI, activity in the United States remained more robust than elsewhere, even though it lost momentum during the month. As we will see later in this note, the relative strength of S&P’s PMI still contrasts with the more negative message from the ISM indicator, which continues to paint a gloomier picture of industrial activity.

Overall, it appears that the recovery in industry—particularly after the U.S. tariff shock—remains slow. At the same time, we continue to believe that more supportive economic policies expected in 2026 should enable a more significant rebound in industrial activity, although sectoral differences are likely to persist.

United States: ISM shows a weakened manufacturing sector

ISM Sends a Signal of Weakness for U.S. Industry

The ISM manufacturing index came in weaker than expected in November, signaling deterioration rather than improvement, contrary to market expectations. The decline reflects deterioration across nearly all sub-indicators, notably a drop in new orders and hiring intentions, with the index approaching its lowest level since 2020.

Industrial weakness is a global phenomenon. Everywhere, and particularly in the United States, uncertainty caused by U.S. protectionist policies has further undermined a dynamic that was already relatively weak across many industrial sectors since the end of the boom linked to surging demand during the post-Covid stimulus period.

It is worth noting that the index does not yet appear to capture the significant boost from the artificial intelligence (AI) sector, where investment—particularly in data center construction—is booming.

Conversely, companies continue to report a notable increase in costs, with the prices-paid index rising compared to the previous month. However, these increases appear less pronounced than during the summer. We still expect price hikes to gradually feed through to consumer prices, even though some companies seem to be trimming margins in certain sectors.

Looking ahead, although the situation remains fragile in industry, the combination of a slightly more accommodative monetary policy and upcoming fiscal incentives to stimulate investment should help the industrial sector regain some momentum in 2026. AI-related sectors are expected to remain the main beneficiaries.

Eurozone: industry follows an uneven path

Industrial Activity Weakens and Remains Mixed Across the Region

The final S&P manufacturing PMI for the euro area in November came in slightly weaker than expected, with the index slipping back into contraction territory. It is clear that the recovery momentum in this segment of the economy remains very fragile. This is a message the ECB should factor into its analysis of economic activity in the region, even though the survey highlights upward cost pressures, notably linked to supply chain disruptions.

However, not all countries are in the same position. Among the major economies, southern European countries are performing better, particularly Spain. In Spain, although the PMI indicator eased slightly in November, activity remains well-oriented. Conversely, in France and Germany, the industrial situation is much more deteriorated, notably in sectors such as automotive, which continue to struggle in a very challenging international context.

Nevertheless, we maintain our forecast for renewed momentum in the coming months, supported by the German stimulus plan and increased military spending expected to accelerate.

China: weak activity indicators in november

Official and Private PMIs (Manufacturing) Show a Decline in Activity

The official composite PMI (services and manufacturing) came in weaker than expected in November and slipped slightly into contraction territory. This slowdown was mainly driven by services activity, which fell below 50 (contraction) for the first time since 2022.

Thus, domestic activity appears to be the main driver behind this weakness. Indeed, S&P’s PMI for the manufacturing sector shows that although overall activity deteriorated in November, the export sector continued to hold up and remains in expansion territory.

Chinese authorities may continue to rely on the resilience of the export sector. However, there are concerns that commercial dumping could face limits in the coming months, with growing tensions with certain countries—including the European Union—over the massive influx of Chinese overproduction.

Under these conditions, we believe authorities should implement new stimulus measures to support domestic activity as early as the beginning of 2026.

Sebastian Paris Horvitz

Head of Research