The new US security strategy sees Europe in decline

Link

What are the key takeaways from the market news on December 9, 2025? Sebastian Paris Horvitz provides some insights.

Overview

► At the end of last week, the White House published its National Security Strategy. This document marks a break with the approach taken by previous US administrations. It “clarifies” what “America First” means. Unsurprisingly, as Donald Trump's speeches suggest, the main objective remains the domination of US power. But beyond this aspect, the text breaks with the past by condemning all forms of multilateralism, insisting on national trajectories, and omitting any reference to the defense of democracy. The terms used to describe Europe are particularly harsh: its economic decline is no longer considered the main danger, which has been “overshadowed by the real and darker prospect of civilizational decline.” It is in this context that Europe will have to try to assert itself, or even resist, in the face of American ambitions.

►On the markets, there is little concern about growing tensions with the United States in the short term, including a possible intensification of the trade war with Europe. Nevertheless, in the coming years, we will have to factor in episodes of stress that are likely to affect European integration... under American influence.

►Furthermore, the new strategy reflects what could be described as a neo-colonialist vision, particularly with the return of the Monroe Doctrine (5th President of the United States, 1817-1825), which considered Latin America to be the preserve of the United States. The Trump administration's involvement in the recent legislative elections in Argentina and presidential elections in Honduras may be a sign of things to come. Meanwhile, Trump is threatening to intervene in Venezuela and a full-scale war is being waged against the cartels, with attacks on boats attributed to traffickers. Once again, in the short term, it is difficult to anticipate any immediate impact on the markets, other than an advantage for populist political offerings in the region and for certain sectors likely to benefit from preferential treatment from the United States.

►On the markets, this week will be dominated by the Fed's decision on Wednesday. It seems certain that key rates will be lowered by 25 basis points (bp). The debate centers on the tone of the message: will the Fed be cautious or more aggressive in its easing trajectory? We remain cautious. The decision will be made with few recent statistics (no official employment or inflation data), but we believe that inflation is likely to remain high while employment should stabilize in a resilient economy. What is certain is that long-term rates have tightened in recent weeks, pretty much everywhere.

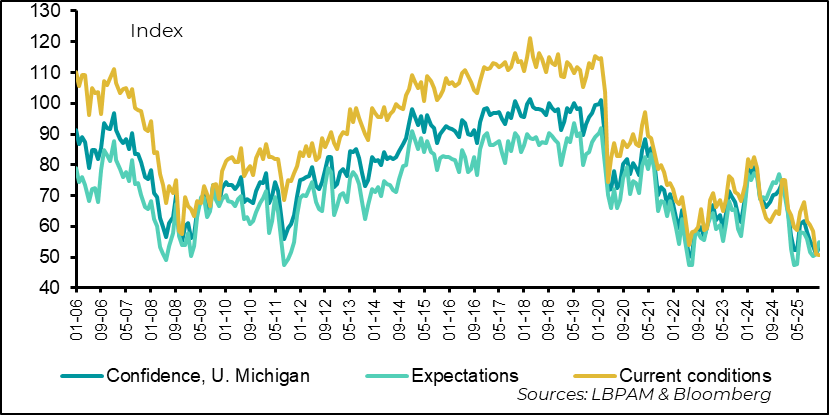

►It will therefore be important to know the Fed's diagnosis of the US economy. We know that sector momentum remains very mixed, with artificial intelligence (AI) continuing to contribute strongly to growth. Nevertheless, the key factor remains consumer behavior, especially with the labor market losing momentum. Everything suggests that consumption is holding up, even if it is expected to weaken in the fourth quarter of 2025. For now, the relationship between confidence and consumption remains weak: the University of Michigan survey shows that the overall index remains close to historic lows, despite a slight rebound in early December.

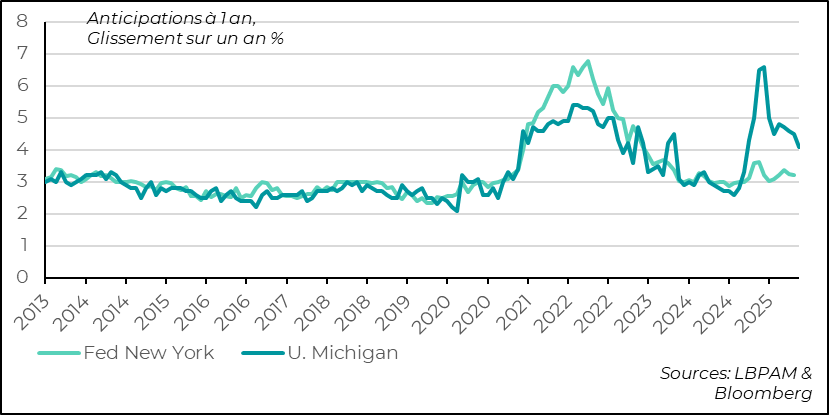

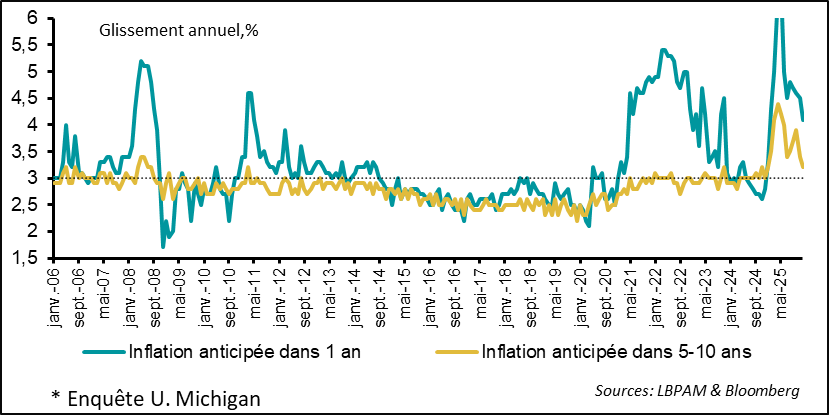

►One positive point in the University of Michigan survey is that inflation expectations have finally fallen slightly, although they remain historically high (4.1% for 1 year and 3.2% for 5 years). The New York Fed survey paints a less alarming picture, even though expectations remain high, particularly for 2026.

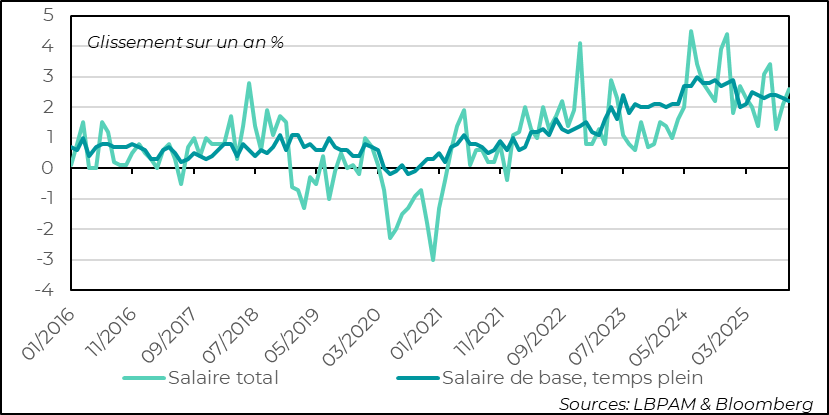

►In Japan, wage statistics have probably reassured the BoJ about the possibility of raising key interest rates as early as December 19. Total wages rose 2.6% year-on-year, a trend that remains solid.

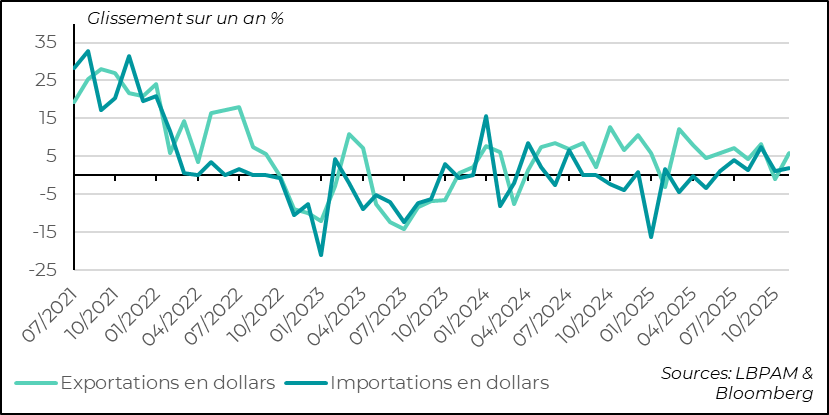

►In China, international trade data continues to surprise. Despite tariffs and the decline in Chinese exports to the United States, total exports in dollars rose by nearly 6% year-on-year in November, while imports grew only very moderately. These figures confirm that the export sector remains an important driver of Chinese growth and reduce the incentives to stimulate domestic demand. Nevertheless, it is likely that at the turn of the new year, more measures to support the domestic economy will be put in place by the authorities.

Going further

United States: Although confidence is very low, the economy is holding up well

Consumer confidence remains very low

The University of Michigan's consumer confidence survey came in slightly better than expected at the beginning of December. While the index of current conditions reached a new all-time low, expectations improved for the first time in several months, albeit remaining at a low level. This improvement seems partly linked to the reopening of government activities after the longest shutdown in history.

Nevertheless, weak confidence contrasts with US consumers, who remain relatively resilient. Despite the lack of official data, delayed by the shutdown, it appears that consumer appetite remains strong at the end of the year, even if it has moderated compared to the third quarter of 2025. This moderation can be explained both by the effects of the paralysis of certain government activities and by a less dynamic labor market.

Consumer confidence remains very low

Furthermore, as the transmission of rate hikes remains relatively slow, this is leading to a gradual decline in inflation expectations. As a result, the one-year and five-to-ten-year forecasts from the University of Michigan survey have fallen, although they remain high.

These expectations could also be amplified by the deep political divide that currently dominates American society. Indeed, the alternative survey conducted by the New York Fed on inflation expectations indicates much more moderate levels for the future.

For the Fed, the moderation in medium-term expectations is undoubtedly good news. Inflation figures for the coming months will give us a better understanding of how the price shock is spreading. We know that part of this shock appears to be absorbed by corporate margins, but this seems unsustainable. We continue to believe that inflation will remain too high, prompting the Fed to remain cautious in 2026. In other words, it is likely to cut its key rates less than the market anticipates.

Japan: BoJ expected to raise key interest rates in December

Strong wage growth in October should reassure the BoJ

Wage growth in Japan was stronger than expected in October. Total wages rose 2.6% year-on-year. At the same time, base wages moderated slightly, but their 2.4% increase remains solid.

However, this increase remains below inflation, which reached 3.0% year-on-year in October.

In this context, and with the yen still weak, the BoJ is expected to resume its gradual rise in key interest rates by the end of the year, especially as Ms. Takaichi's government has launched a substantial fiscal program to support the economy.

We therefore anticipate that the BoJ will raise its key interest rates by 25 basis points on December 19. The latest statements by Governor K. Ueda point in this direction. In the medium term, the cycle of increases is likely to continue in order to normalize monetary policy, but within a gradualist framework.

China: exports remain strong

Exports accelerated in November

The rebound in Chinese exports in November was much stronger than expected. They rose 5.9% year-on-year (compared with 4% anticipated), offsetting the previous month's decline. These figures confirm that China, despite tariffs, is managing to maintain its export capacity and, for the time being, preserve one of its key drivers of growth.

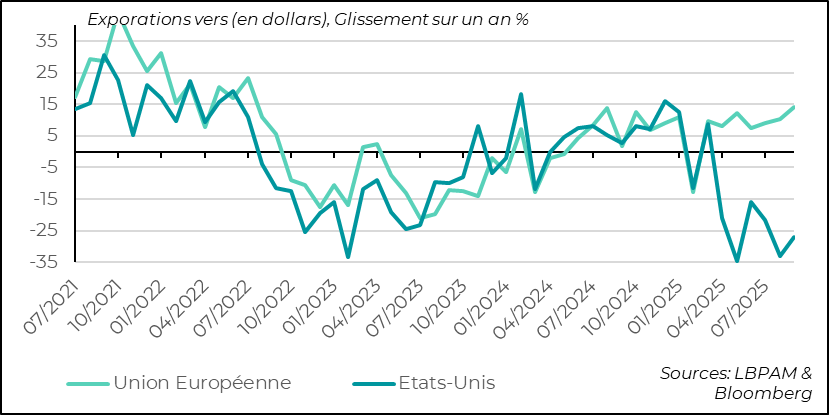

Exports are picking up everywhere

The strong export performance is due to a rebound in almost all destinations. Even to the United States, the year-on-year decline in November is slightly less pronounced.

However, the most striking point is that China has managed to redirect its exports to other areas, offsetting losses in the US market, although it is very likely that Chinese companies will continue to access the US via third countries.

Furthermore, the strength of the export engine allows the Chinese authorities to remain patient in their support for domestic demand. Nevertheless, we believe that more significant support for the domestic economy should come into play from the beginning of 2026.

Sebastian Paris Horvitz

Head of Research