The risk of an oil shock is resurfacing, but remains limited

Link

What should we take away from market news on October 24, 2025? Answers with the analysis of Xavier Chapard.

Overview

► Amid a macroeconomic calendar that is traditionally lighter mid-month, the absence of official U.S. data due to the government shutdown, and the quiet period ahead of next week’s Fed and ECB meetings, macro newsflow has remained limited in recent days. This calm is expected to end today with the release of flash PMIs for October across developed economies, as well as the U.S. inflation figures for September, due this afternoon. In this context, financial markets have remained broadly stable since the beginning of the week, driven mainly by microeconomic factors, notably the acceleration of the corporate earnings season.

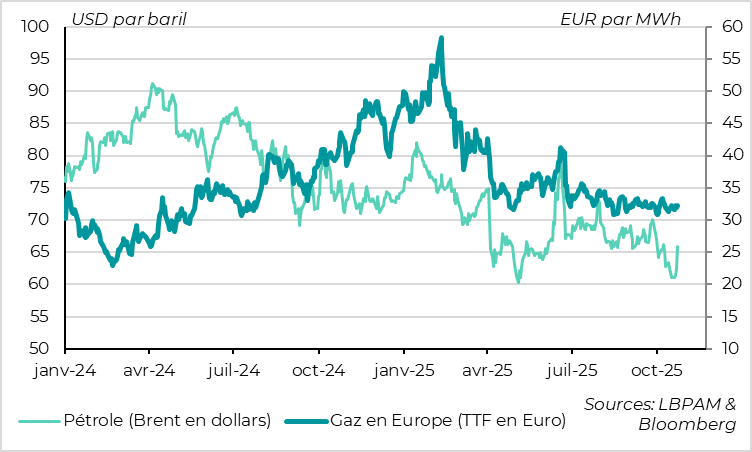

► That said, volatility remains high in commodities this week. Gold has dropped by 5%, which is not surprising after its recent surge it is still up 55% since the beginning of the year. Oil, meanwhile, has rebounded by 5% following the announcement of new sanctions against Russia.

► Indeed, the United States has imposed the most significant sanctions since Donald Trump's return to the White House, targeting Russia’s two main oil producers. These companies export the equivalent of 1.5% of global consumption via maritime routes. These sanctions could have a more substantial impact than previous ones, especially if they prompt countries like India or China to reduce their imports of Russian oil. We believe this helps rebalance the risks surrounding oil prices, which had recently been trending downward. However, the risk of a sharp rise in energy prices remains limited.

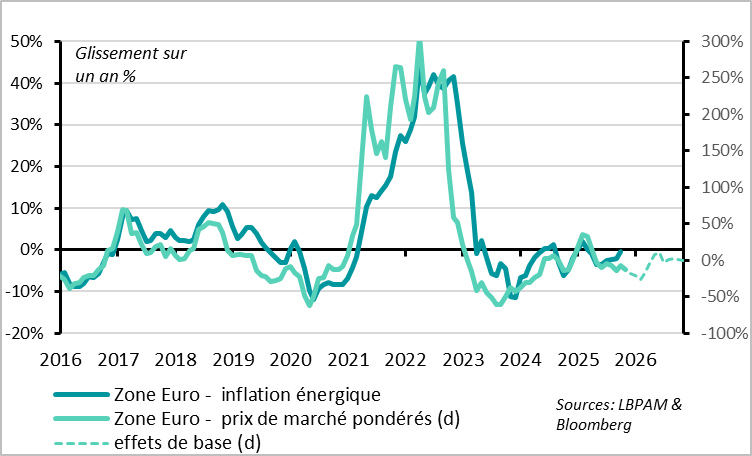

► The EU has also adopted a new package of sanctions against Russia — the 19th since the start of the war in Ukraine — bringing forward the ban on Russian LNG imports by one year, to 2027. Nevertheless, gas prices have remained unchanged, and energy prices in euros continue to be favorable for the European economy.

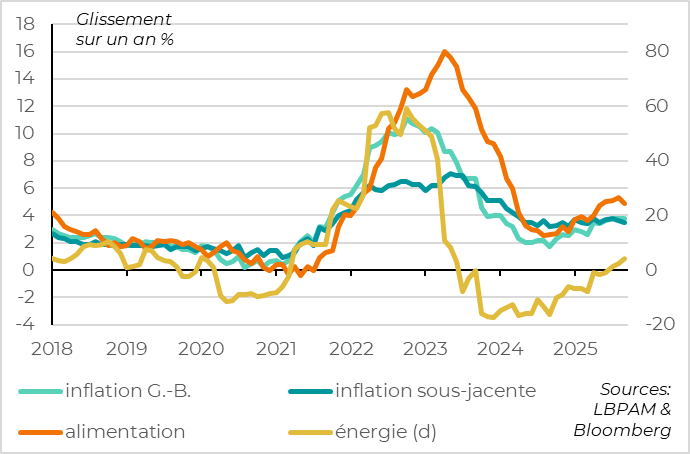

► In terms of macroeconomic data, the surprise this week came from the UK, with September inflation coming in lower than expected. Headline inflation remained stable at 3.8%, while core inflation edged down to 3.5%. Following recent downside surprises in employment and wage data, this new indicator strengthens our view that the Bank of England may cut rates more aggressively than markets currently anticipate in the coming months.

► In the Eurozone, after a series of disappointing economic data over the summer, the first October surveys are somewhat reassuring. Consumer confidence is showing signs of recovery, and business sentiment in France has slightly improved after five months of stagnation at a depressed level. These developments help reduce the risk of a reversal in the European recovery, although the still modest level of these indicators suggests that growth remains weak in the short term.

Going Further

Oil: New Sanctions Against Russia Reduce Downside Risks

Oil prices rebounded following the announcement of U.S. sanctions targeting Russia.

Oil prices have surged nearly 10% from their recent low, surpassing $65 per barrel, following the announcement of U.S. sanctions targeting Russia. However, prices remain below the levels seen this summer.

The United States announced the most severe sanctions against Russia since Donald Trump's return to the White House, just days after hinting at a possible meeting with Vladimir Putin in Europe. These measures target two of Russia’s main oil producers, which account for around 5% of global output (5.3 mb/d) and nearly half of Russia’s maritime exports equivalent to 1.5% of global consumption.

If these sanctions succeed in significantly reducing Russia’s maritime exports something previous measures have failed to do since 2022 prices could, according to our estimates, climb back toward $80 per barrel, the average seen last year. A sharper short-term spike remains possible if a geopolitical risk premium emerges, but over the longer term, the impact would likely be limited by the expected supply surplus in 2026, estimated at 4 mb/d by the International Energy Agency more than Russia’s seaborne exports.

Among Russia’s main oil importers, India (accounting for 40% of Russian exports) and Turkey may reduce their purchases due to fears of secondary U.S. sanctions or in hopes of negotiating more favorable tariffs. China (45%), on the other hand, appears less responsive to U.S. pressure.

The European Union has also adopted a 19th package of sanctions, stricter than previous ones, but it is the U.S. decision that has had a direct impact on the market. The EU has moved up the ban on Russian LNG imports to 2027, prohibited transactions with two Russian producers and five banks, and imposed sanctions on additional ships and companies suspected of helping Russia circumvent existing measures. Nonetheless, gas prices have remained stable, and energy prices in euros continue to support the European economy.

Energy prices in euros continue to contribute to disinflation

Overall, we continue to believe that oil prices should remain within a range of 60 to 70 dollars per barrel over the coming months. New sanctions help rebalance risks, which had previously been tilted to the downside, but in our view, the risk of an oil shock has only slightly increased.

In the Eurozone, energy prices in euros remain on a downward trend, although the decline has been less pronounced in recent days. They are therefore expected to continue contributing to disinflation and supporting economic activity over the coming quarters.

United Kingdom: After the labour market, inflation also surprises to the downside

Inflation stabilizes in September

While both the consensus and the Bank of England (BoE) were expecting inflation to peak at 4% in September, it ultimately remained stable at 3.8%. Unfavourable base effects on energy prices and certain volatile services did exert upward pressure, but this was offset by a decline in food inflation from 5.3% to 4.9% and, more importantly, by a drop in core inflation from 3.6% to 3.5%.

Although food inflation remains high, it is slowing for the first time in 16 months.

This should reassure the BoE, which has repeatedly warned in recent months that rising food prices could fuel household inflation expectations.

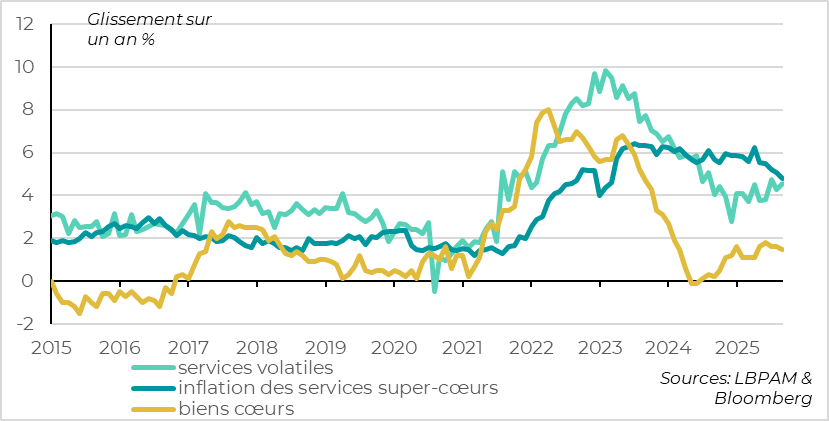

Service price pressures are finally beginning to ease

Most importantly, the unexpected slowdown in core inflation is fairly broad-based, suggesting that inflation could begin to decelerate more clearly in the coming months.

The increase in manufactured goods prices eased slightly, from 1.6% to 1.5%, confirming that price pressures on goods remain limited—aside from the regulated price hikes seen in April. This trend aligns with the lack of tariff retaliation against U.S. duties and the appreciation of the pound sterling since the beginning of the year.

Service inflation remained stable at 4.7% in September, despite the expected rebound in travel and transport services due to unfavourable base effects. This indicates that non-volatile services, which have historically been very dynamic, are beginning to slow: inflation has fallen below 5% for the first time in two and a half years.

Following signs of the economy operating below potential and a normalization of wage pressures, the September figures suggest that price pressures are weaker than expected and are starting to ease.

This should encourage the Bank of England to continue cutting rates at a pace of -25 basis points per quarter in the coming months. However, it may postpone the next cut from the November meeting to December, in order to await more clarity on the government budget, which will only be presented at the end of November.

Market expectations have shifted: the probability of a rate cut by year-end has risen from one in two to two in three. However, in our view, these expectations remain somewhat conservative.

Eurozone: Some more encouraging signs ahead of the PMIs

In October, consumer confidence shows signs of recovery

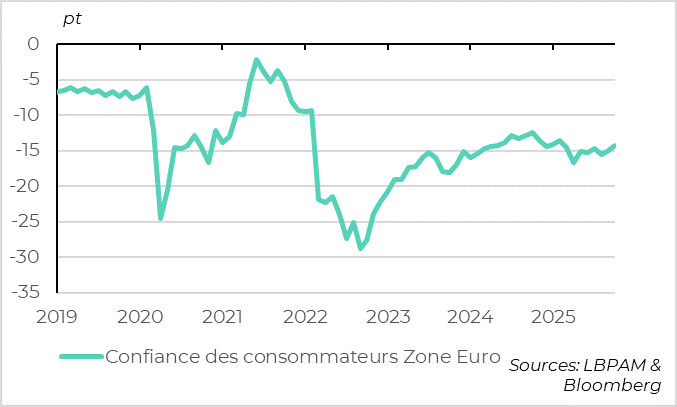

Since the end of summer, economic data from the Eurozone had consistently surprised to the downside—pushing macroeconomic surprise indicators into negative territory in October. However, the first surveys of the month offer some relief. This helps limit the risk of a reversal in the recovery, even though short-term growth remains weak.

Consumer confidence improved more than expected in October, while still remaining modest, according to preliminary results from the European Commission’s survey. The indicator rose from -14.9 to -14.2 points, reaching its highest level since March, at the onset of the trade war.

This is an encouraging signal, given the potential for a recovery in consumption, supported by high household savings and rising purchasing power across Europe.

That said, confidence remains 3 points below its historical average, despite falling energy prices and improving credit conditions. This suggests that political uncertainties—both domestic and international continue to weigh on household sentiment and are holding back the economic recovery.

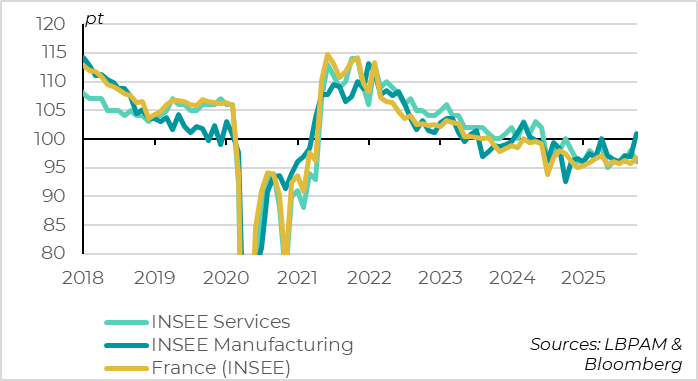

French business confidence is finally starting to rise slightly

French business confidence slightly improved in October, reaching 97 points after stagnating at 96 points for five months, according to the INSEE survey.

This increase is driven by a strong rebound in the industrial sector, where confidence rose above its historical average for the first time in a year and a half, and in retail, where it normalized at 99 points after two months of significant weakness. In contrast, confidence in the services sector declined again, remaining weak at 96 points, weighed down by falling demand in business services.

This sectoral divergence suggests that the slight easing of political instability risks is not the main driver of the improved business climate understandable given the high fiscal uncertainty for next year—but rather the resilience of the broader economy.

Overall, the INSEE survey is consistent with slightly positive growth at the start of autumn.

Another reassuring signal: the business employment indicator rose in October, offsetting the sharp declines of the previous two months, although it remains at a modest level of 96 points.

This reduces the risk of a significant deterioration in private employment, without yet indicating a recovery.

Xavier Chapard

Stratégist