The selective ear of the market

Link

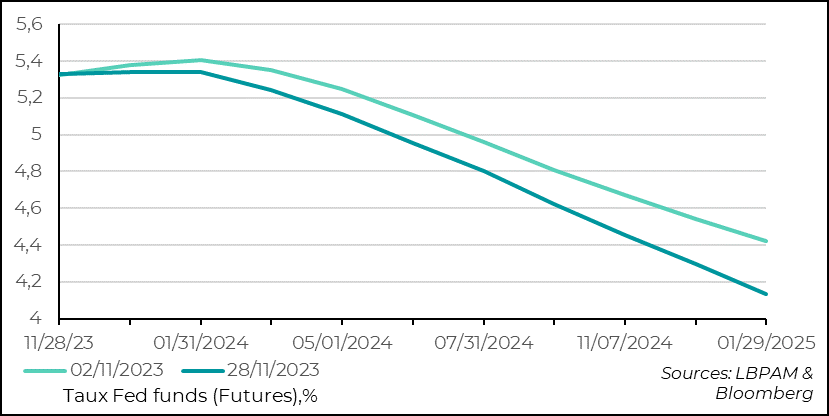

- Yesterday, the market's selective ear took what it wanted from Fed Governing Council member Christopher Waller's speech. Indeed, the market simply retained that he considered the Fed to be in a "good position" to bring inflation back to 2%. The market's translation was that a continuation of the pause was certain in December, and that more rate cuts were on the horizon for 2024. This is driving rates down across the US yield curve, especially at the shorter end. This move seems highly exaggerated in view of C. Waller's caution and the possibility of a further hike mentioned by Ms. Bowman, another Fed governor, in another speech at almost the same time.

- Market operators seem to have switched unambiguously to a scenario of rapid rate cuts and equally rapid convergence of inflation towards 2%. And all this against a backdrop of growth which, for the time being, is only moderating slightly. In line with C. Waller's comments, we agree with him that the "victory" against inflation will require a sharper than expected deceleration in activity. Without this, rapid rate cuts will be much more difficult. As a result, the US stock market is delighted with the rate cut, but does not foresee a marked slowdown in demand in the profit outlook. The months ahead will tell us how the US landing is really shaping up.

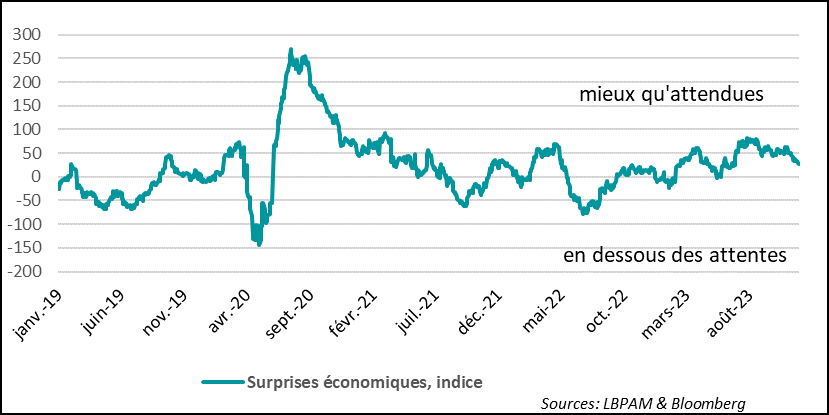

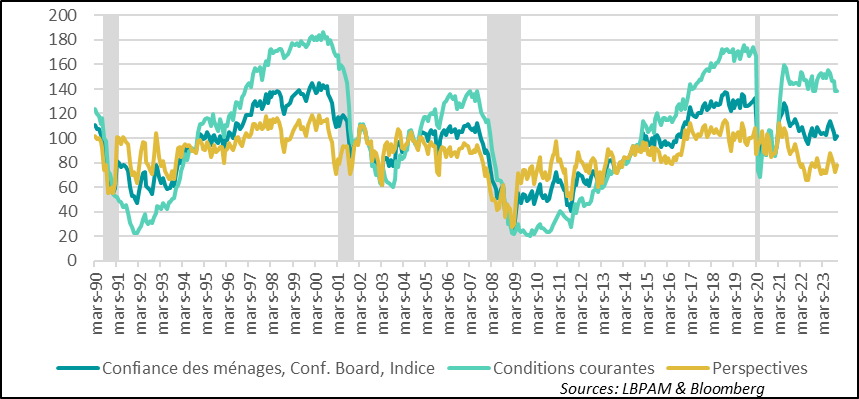

- There have been marked signs of a slowdown since November, contrasting with the rebound of 3Q23. We can see that economic surprises, which used to be very favorable, are becoming less so. At the same time, this less buoyant wind is obviously not without its nuances. The Conference Board survey showed a slight rebound in household confidence in November, as far as expectations are concerned. This is positive, but the level of confidence in the outlook remains very low compared with the historical average. Also, the survey reveals that conditions are becoming slightly less favorable on the job market according to households.

-

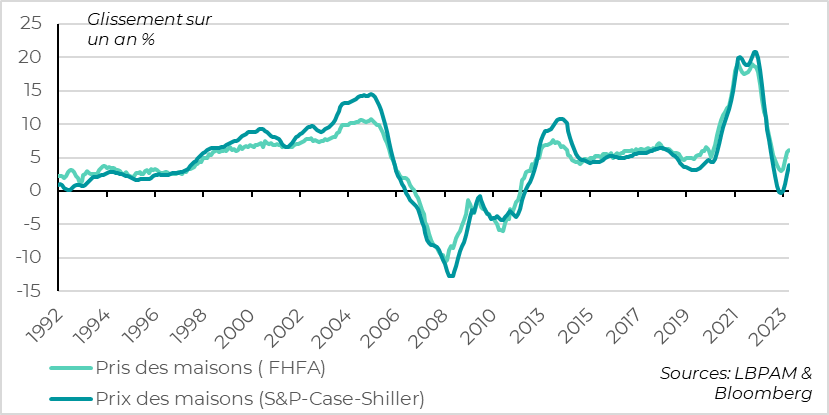

There are still some trends that are far less intuitive in this phase of restrictive monetary conditions. It is clear that high long-term interest rates, even if they have fallen recently, have played an important role in dampening the real estate market. Paradoxically, however, the shortage of homes for sale seems to be putting pressure on prices. The main indices for real estate prices have been on the rebound since the beginning of the year. High prices and historically high borrowing costs are making home ownership even more difficult. Most likely, this price rebound will subside.

- While surveys in France have been rather unfavorable recently, it was somewhat reassuring to see that household confidence was recovering in November. Nevertheless, it remains well below its long-term average. Almost all categories recovered. Unfortunately, fears of rising unemployment were also on the rise again. The months ahead will give us a clearer picture of the French economy's ability to withstand what remains a mediocre trend.

It's hard to imagine that C. Waller, one of the members of the Fed's Board of Governors, thought his speech yesterday would result in a sharp cut in interest rates. Indeed, up until now, he has been one of the Fed's most conservative governors, advocating the maintenance of a restrictive policy. Yesterday, he simply said that he considered the Fed to be in a "good position" to bring inflation back to the 2% target. This was interpreted by the market as a radical change of tone, and seems to have strongly contributed to a new and very significant movement of interest rate cuts across the yield curve, particularly on the shorter maturities.

2-year rates lost more than 10 basis points. The market took this speech as evidence that the end of key rate hikes was becoming a certainty, and that more rate cuts were on the cards for 2024.

Fig.1 United States: After C. Waller's speech, the market amplified its assumptions about key rate cuts in 2024.

However, in terms of substance, C. Waller's speech was not very different from what he has been saying up to now. He continues to believe that demand pressures, reflected in particular in the job market, must ease if the Fed is to be convinced that the "victory" against inflation is well within reach. Thus, the latest figures on the deceleration in job creation and the rise in the unemployment rate, even if it remains historically low, are a step in the right direction. But this is not enough.

He is not yet completely convinced that this deceleration trend will continue, and that monetary policy will not need to be tightened further if economic trends change.

Mirroring these remarks was the speech of another governor at almost the same time. Michelle Bowman, explaining her views on the evolution of the US economy and its implications for monetary policy, reiterated that she still thought a further rate hike was probably necessary.

The market seemed to have taken on board only what was in line with recent developments. This seems to us to be relatively complacent, and could prove counterproductive.

Indeed, lower interest rates continue to stimulate risk-taking and push up equity prices, which in turn eases financial conditions and runs counter to the Fed's objective of keeping them restrictive. In this sense, C. Waller stressed in his speech that he was not sure that financial conditions should be considered as doing the Fed's "job". They should be a consequence of it. This was a reference to the comments made by many Fed members, who had pointed to the strong tightening of financial conditions at the last MPC meeting as a reason not to raise key rates further. As we all know, financial conditions have since eased considerably.

For us, who believe that a more marked deceleration of the economy is likely to emerge in early 2024, key rate cuts must indeed be built in for next year, which should lead to rate cuts across the curve and more so on the short end. Nonetheless, the evidence of a significant deceleration in the economy, necessary for inflation to converge towards the target, is not yet in place, and any runaway momentum now could nip the desired economic adjustment in the bud.

Over the past month, we have seen economic figures come out less favorably than analysts had anticipated, after the strong positive surprises of the summer. This is in line with the deceleration in the economy that was to be expected after the very strong figures for 3Q23.

Nevertheless, we shouldn't expect a trend that won't see exceptions.

For example, the household confidence survey for November showed that confidence remained resilient, thanks in particular to an upturn in confidence about the outlook. On the other hand, perceptions of current conditions once again declined.

Despite the very slight rise in expectations regarding the outlook, the level of this indicator remains very low compared with its historical level.

Fig.3 United States: Consumer confidence stabilizes as expectations rise slightly, but remain historically low

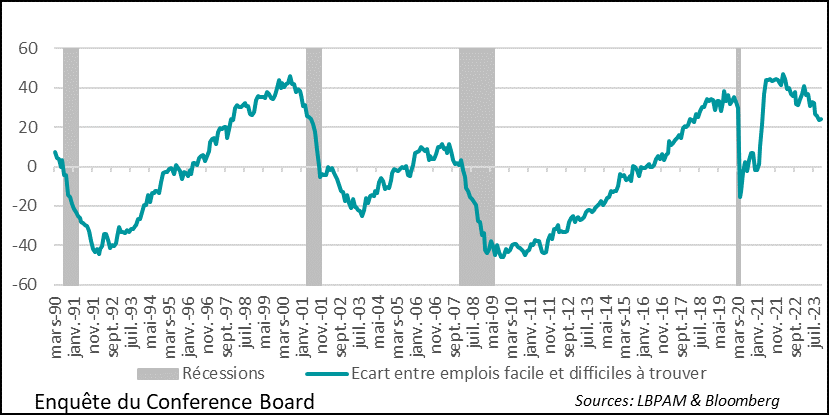

The further decline in the index of current conditions, which nevertheless continue to be seen as favorable, seems to have been partly due to a slightly less buoyant labor market. In fact, the indicator we are looking at is the net balance of responses from households considering it easy to find a job versus those who, on the contrary, think it's more difficult.

This indicator continues to fall, in line with labor market figures which show that job creation is slowing down and the unemployment rate is rising. This is surely good news for the Fed, and suggests a gradual adjustment in the labor market.

Fig.4 United States: The situation on the job market looks set to become progressively less favourable

The real estate market rebounded at the beginning of the year, after a sharp adjustment in 2022, following the boom triggered by very favorable financial conditions the previous year in the midst of the fight against the Covid epidemic. This rebound was due, in part, to interest rates that had remained low, with the market mistakenly anticipating that the Fed would quickly halt its monetary tightening.

Thus, since the summer, we have seen a further downward correction in this market, following the sharp rise in interest rates, with mortgage rates reaching 8% for 30-year loans. This was reflected in the sharp fall in the property developers' confidence index.

Nevertheless, the continuing lack of properties coming onto the market, given the sharp rise in financing costs, seems to be keeping prices on the rise. A rise which also began at the start of the year. Thus, after the sharp fall of 2022, property prices are once again on the rise year-on-year. The September increase was 3.9% on the S&P Case-Shiller index for the country as a whole.

Fig.5 United States: House prices have rebounded since the end of 2022, partly reflecting the lack of homes for sale

Even though mortgage rates for 30-year loans have fallen back below 8%, it seems to us that the persistence of restrictive monetary conditions should weigh on the market in the months ahead, and squeeze prices. At the same time, these price rises are making it even more difficult to become a homeowner.