The situation is also becoming more complicated for the US economy

Link

Read Sebastian Xavier Chapard's market analysis for February 24, 2025.

Summary

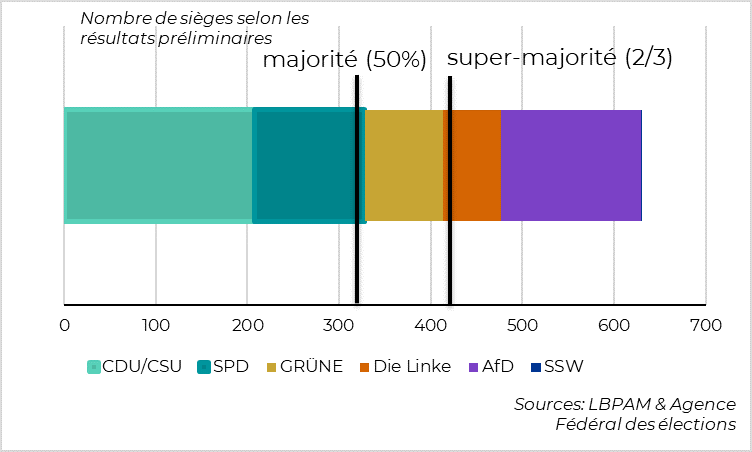

►The preliminary results of the German federal elections are broadly in line with expectations, reassuring the markets this morning. The CDU/CSU won by a wide margin, but still failed to win a majority of seats, and the Afd doubled its score from the previous elections, but will not play a role in the new government. It will probably be 2 months before a government coalition agreement with the SPD is in place, but a two-party coalition (rather than a 3-party coalition with the Greens) maintains the hope of a pro-business government capable of taking action. That said, the three main centrist parties do not have the super-majority needed to change the constitution, which may complicate the expected easing of fiscal policy.

►Beyond Germany, these elections will open the way for negotiations between Europeans, particularly with regard to the role they can play in peace negotiations in Ukraine and the roadmap for European defense policy. In the short term, the market will react to the likelihood of lower energy prices in Europe (thanks to reduced uncertainty and the potential return of Russian supply), and to the speed and scale of the increase in Europe's military and reconstruction spending.

►These two elements are positive for European assets, even if market expectations already seem very high to us. Indeed, the chances of European sanctions on Russian energy being relaxed or withdrawn seem limited to us in a scenario of peace imposed on Ukraine (and largely on Europe). Furthermore, the increase in European military spending is likely to be gradual and of limited effectiveness (due to a lack of coordination between countries and the intensity of its spending on imports).

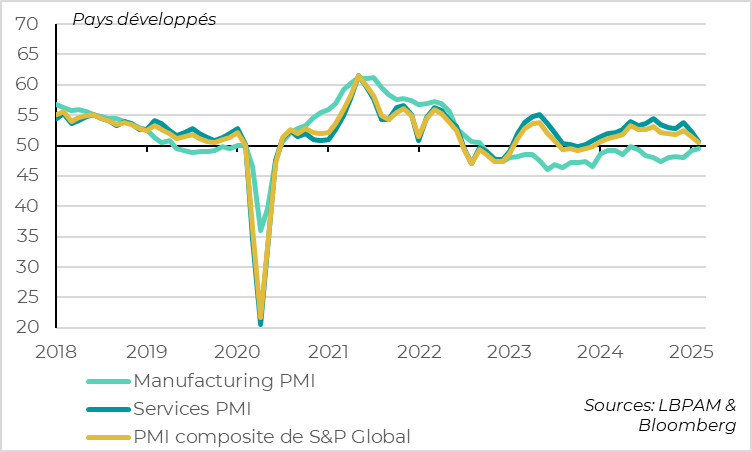

►The latest economic data suggest that global growth is a little less dynamic at the start of the year, but also a little less unbalanced, which reduces the risks. PMIs in developed countries fell by a further 1pt overall in February, to their lowest level since 2023. However, they remain in slight expansion territory (at 50.5pt), and are still improving in areas (Europe) and sectors (manufacturing) that were still down last year.

►The big surprise was the sharp drop in the US Services PMI, which fell into contraction territory for the first time in 2 years. This weakening of the economy is confirmed by the weakening of other indicators, notably household confidence, so that economic surprises turn negative for the first time since last summer. This suggests that the slowdown in the US economy, which we had been expecting later in the year, may come sooner. Indeed, the measures being pushed by the new US administration since its inauguration are faster and bigger, and less pro-business than during the first Trump administration.

►At the same time, household inflation expectations are rising sharply, according to the latest survey from the University of Michigan. Long-term expectations, those most closely monitored by the Fed, have risen to 3.5% for the first time since 1995. This complicates the Fed's stance, which is likely to remain cautious in the short term.

►In the Eurozone, the PMI was stable just above the 50 pt mark in February, suggesting positive but still limited growth. PMIs continue to recover in Germany, thanks to industry, and remain solid in the periphery. By contrast, the French PMI fell to just 44.5pt, which raises questions, even though the INSEE business survey is less alarming.

To go deeper

Germany: Towards a two-party grand coalition without a super-majority of centrist parties

World: PMIs fall sharply in services but rise again in industry

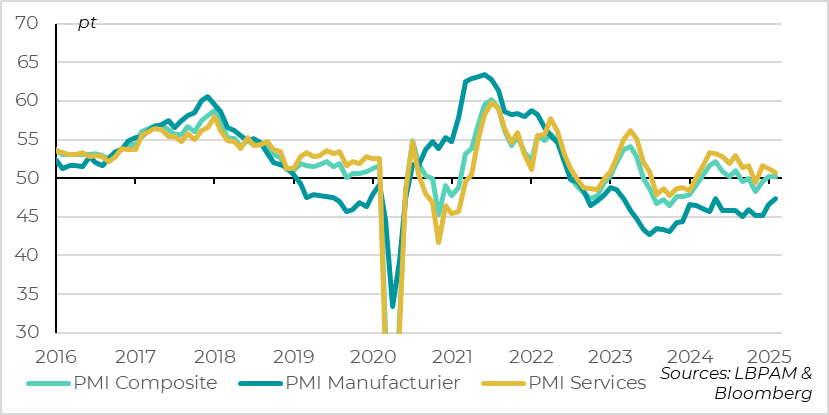

PMIs in developed countries fell by 1pt in February to 50.5pt, the lowest since 2023. This suggests that global activity is slowing a little at the start of the year after accelerating at the end of 2024. This is consistent with signs of a slight slowdown in household consumption, which is suffering from persistent inflation at the start of the year, after having accelerated sharply at the end of last year.

However, this downturn came solely from the US service sector, which is reassuring for the economic cycle.

In particular, it is reassuring that manufacturing PMIs continue to recover, suggesting an improvement in the global industrial cycle despite the risks to world trade. The PMIs rose slightly again in February, reaching a 9-month high overall, even though they remain in the contraction zone for industrial activity (at 49.5pt). This is an encouraging sign, as manufacturing PMIs are less volatile by the month than those for services, and because industry is a particularly cyclical and globalized sector. And the leading indicators are positive (rising orders and falling inventories), suggesting that the industrial recovery goes beyond possible short-term spending increases ahead of tariff hikes.

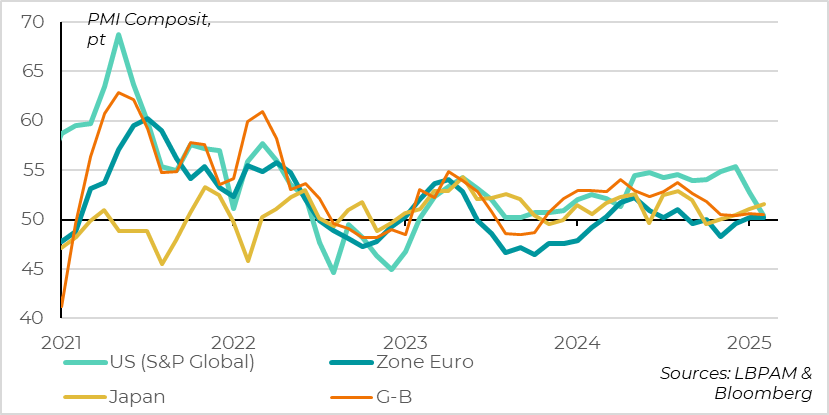

World: US PMIs fall back into line, very quickly

The drop in the US services PMI (Cf. Inra) brings the US PMI back into line, with PMIs just above 50 points in all developed zones in February.

Outside the US, the PMI is stable after having risen back above 50pt in January. This reflects the stability of European PMIs just above the stagnation zone (at 50.2pt in the Eurozone and 50.5pt in the UK), while Japanese PMI continues to rise slightly to 51.6 points.

All in all, the further decline in the global composite PMI in February does not call into question the decline in overall economic risk outside the US, but it does point to the risk of a faster and sharper slowdown in the US economy in the months ahead.

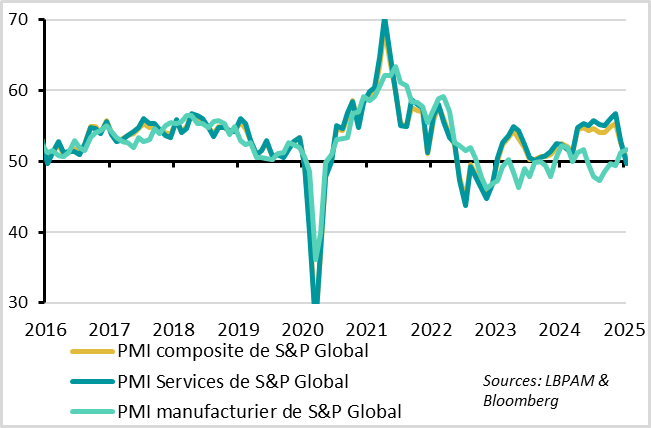

United States: Services PMI falls below 50pt for the first time in 2 years

S&P Global's US PMIs disappoint again in February, indicating near-stagnation in activity due to services. While we didn't want to overreact to the drop in the services PMI in January, the further decline in the PMI in February and the weakening of other confidence indicators suggest that the slowdown in the US economy, which we had expected to occur later in the year, could come sooner. This could stem from the uncertainty created by the new US administration, which has been pushing more radical and less pro-business measures faster since its inauguration than during the first Trump administration.

The US PMI fell for the second consecutive month to 50.4pt, after hovering close to 55pt in the second half of last year and reaching a 2-year high in December after the presidential elections (at 55.4). However, as in the rest of the world, the US manufacturing PMI continued to rise in February, after climbing back above 50pt in January.

The decline reflects a further sharp drop in confidence in services, for which the PMI fell below 50pt for the first time in 2 years (to 49.7pt). Domestic activity therefore appears to be slowing sharply at the start of 2025, after having been very strong at the end of 2024. This suggests that consumption is no longer as strong as it was last year.

United States: Household inflation expectations rise sharply in February

On the US household front, the final survey from the University of Michigan indicates that confidence has fallen twice as much as initially estimated in February, to a more than one-year low (64.7pt), due to fears of renewed inflation following tariff hikes.

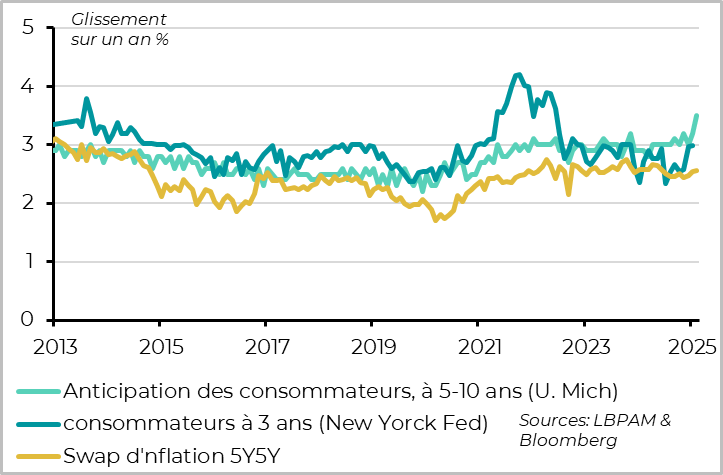

Household inflation expectations, both short- and especially long-term, continue to rise sharply, moving out of the fluctuation band in which they have oscillated since inflation became firmly anchored. 1-year expectations have reached 4.3% for the first time since 2023. Above all, 5-10 year inflation expectations - those most closely monitored by the Fed to gauge the anchoring of expectations - reached 3.5% for the first time since 1995.

We are still taking this survey with a grain of salt, given the divergence in confidence between Republicans and Democrats. Indeed, the former's confidence remains at its highest level since Trump 1.0, as he anticipates that inflation will disappear this year and remain permanently below target (1.3% over 5-10 years). On the contrary, the latter are less confident than at the worst of the Covid shock, anticipating inflation to remain durably above target (4.4% at 5-10 years). And other surveys, like the markets, are not as alarming as the University of Michigan's with regard to inflation expectations.

That said, the Fed is likely to be very cautious in the face of rising long-term expectations (which broke out of their historic 2.8%-3.2% fluctuation band in February). The situation is therefore becoming more complex for the Fed, with the economy slowing and the risk of inflation remaining persistently above target rising. Our scenario remains that the Fed will take a pause in the coming months before two rate cuts in the middle and at the end of this year. But it will need to be ready to react to surprises in either direction, especially depending on the economic policies to be implemented by the US government.

Eurozone: services PMI remains positive and manufacturing PMI improves slightly

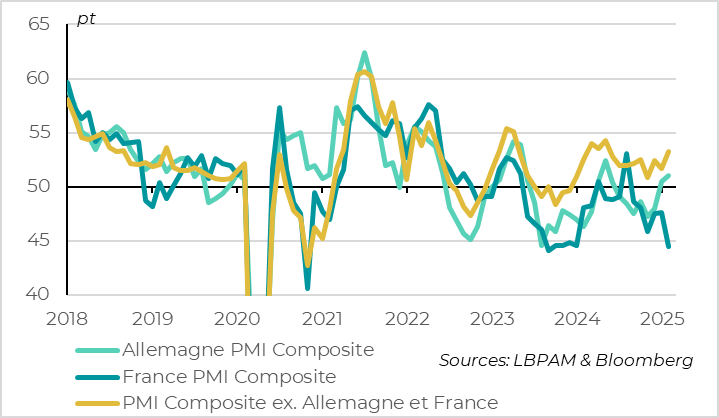

For the Eurozone, the PMI stagnated in February after rebounding at the turn of the year, indicating limited but positive growth. Whereas it was in contraction zone in the second half of last year and had fallen after D. Trump's election, the PMI stabilizes just above 50pt in early 2025 (at 50.2pt). This suggests that tariff risks are being offset by hopes of a ceasefire in Ukraine and, above all, by even a gradual easing of domestic economic policies.

In terms of sectors, the Services PMI unexpectedly fell, while remaining in the expansion zone (-0.6pt to 50.7). But this is offset by a continued recovery in industrial confidence, with the manufacturing PMI still rising to a 9-month high. That said, the manufacturing PMI remains at a deteriorated level (47.3pt).

Euro zone: PMI rebounds in Germany and the periphery but falls in France

In terms of countries, the German PMI continues to recover, having moved back into positive territory in January, to 51pt, before the elections. This reflects the rise in confidence in industry, which, although still low at 46.1pt, is still the lowest in 2 years. Meanwhile, the services PMI held up well after the rebound of recent months, remaining solid at 52.2pt. Activity is thus stabilizing after a further drop in GDP at the end of 2024.

PMIs are also rising in the rest of the Eurozone, suggesting that the periphery continues to outperform in early 2025. The PMI excluding France and Germany rose in both services and industry, reaching a 9-month high of 53.3pt.

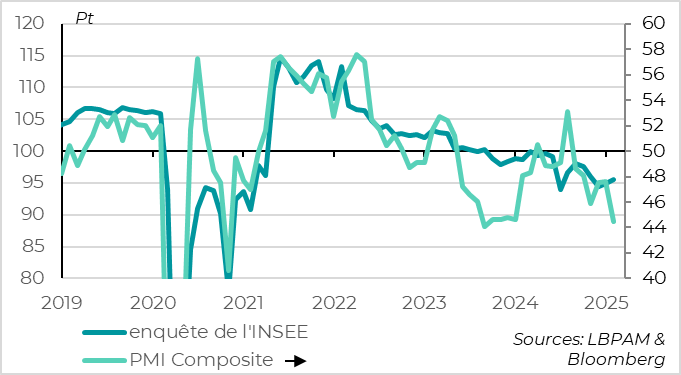

Eurozone: INSEE survey not as alarming as PMI for France

On the other hand, the PMI fell sharply in France in February (-3.1pt to 44.5pt) to return to its 2023 lows, due to activity in the services sector. This comes as a nasty surprise, even though we were anticipating weaker growth in France this year due to worsening budgetary and political conditions. It should be noted, however, that INSEE's confidence indicator is more reassuring, rising from 95 to 96pt February, which is below its historical average but still consistent with slightly positive growth.

Xavier Chapard

Head of Research