The slowdown in the U.S. labor market is becoming more evident

Link

Key takeaways from the september 9 , 2025 market update insights from Sebastian Paris Horvitz

Overview

► As widely expected, F. Bayrou failed to secure a vote of confidence. In fact, given the result 364 votes against, representing over 60% of the assembly it is clear that neither his approach nor his attempt at political compromise as Prime Minister was successful. The most likely outcome is that the President will have to appoint a new Prime Minister. The possibility of a new dissolution appears to be ruled out for now (see Eco of September 29 for scenario analysis).

Nevertheless, France must vote on a new budget and reduce its deficit by at least 0.5 percentage points of GDP to meet its European commitments. We will see how Fitch, which is set to review France’s credit rating this Friday, assesses the current political deadlock. We remain cautious on French sovereign debt.

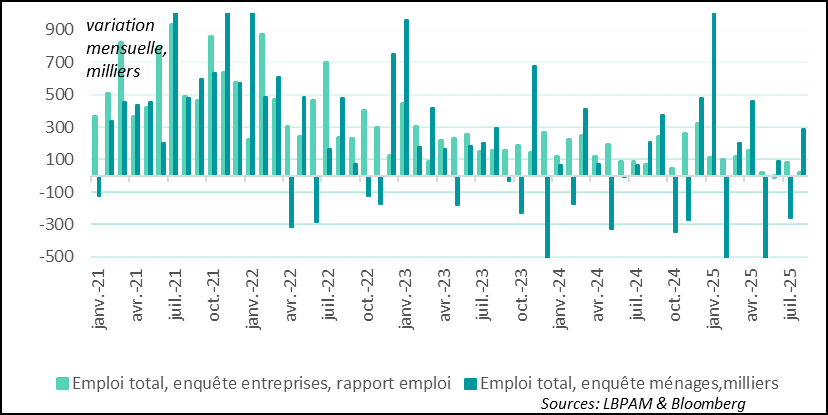

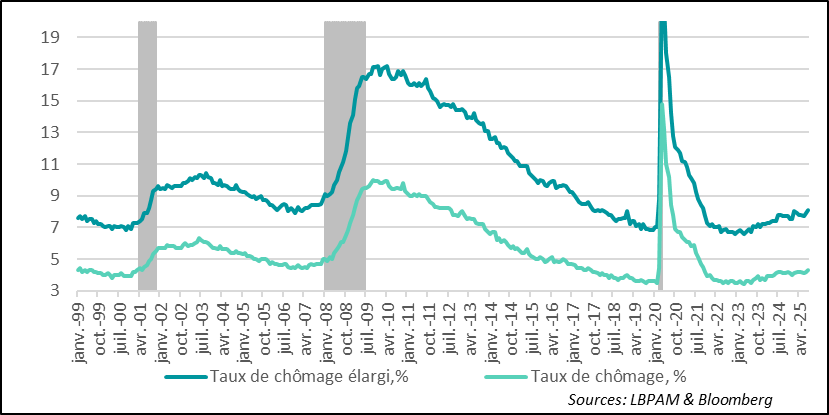

► In the United States, the August jobs report revealed greater-than-expected weakness in the labor market. Nonfarm payrolls increased by only 22,000 jobs, significantly below the forecast of 75,000, and revisions to previous months showed a net loss of 13,000 jobs in June, marking the weakest three-month average job creation (under 30,000) since the post-COVID recovery.

The unemployment rate rose to 4.3%, the highest level since October 2021. While this rate remains close to what economists consider full employment, the trend is clearly deteriorating.

This slowdown is increasingly attributed to President Trump’s economic policies, particularly aggressive tariffs, large-scale federal layoffs, and a crackdown on immigration. These measures have disrupted hiring in key sectors such as manufacturing, construction, and hospitality, and have contributed to a shrinking labor force.

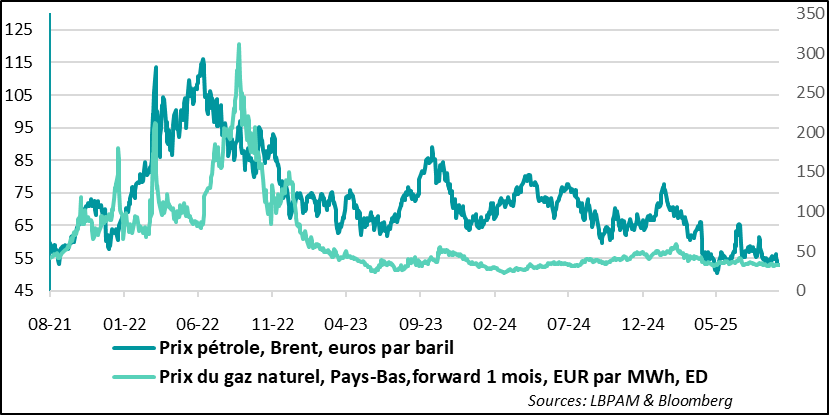

► One of the positive developments for the global economy and especially for Europe has been the reduction in energy costs. Although OPEC+ recently decided to increase production by less than expected (+137,000 barrels per day in October), slightly pushing prices upward, the global oil market remains oversupplied, which should help keep prices low.

We continue to expect oil prices to remain below $70. Combined with the appreciation of the euro, this is particularly favorable for the Eurozone, where oil prices are very low and gas prices also remain subdued.

On the other hand, for U.S. oil production one of President Trump’s key objectives these low prices are not good news.

►The U.S. ISM Services Index, the best coincident indicator of the American economy, clearly illustrates our point. It rebounded more than expected in August, rising to 52.0 points after hovering near the stagnation zone since May. This reduces the short-term risk of recession. However, the details show that this increase still reflects inventory buildup ahead of further expected price hikes, suggesting that the impact of tariff increases is delayed and more gradual than anticipated — but not canceled.

► In Japan, GDP for Q2 2025 was revised upward to 0.5% quarter-on-quarter, mainly due to stronger-than-expected household spending. This resilience in domestic demand should reassure the Bank of Japan (BoJ) and support its ongoing monetary policy normalization—especially as inflation remains well above the 2% target.

However, as he has shown in the past, Governor Kazuo Ueda is likely to take his time before acting, in order to ensure that the trade war with the United States does not derail the growth momentum. This caution is all the more relevant as the country seeks political stability following the resignation of Prime Minister Shigeru Ishiba.

We continue to expect a rate hike by early next year.

In-Depth insights

United States: a stalling labor market raises expectations for the Fed

The labor market is weakening

In fact, the slowdown is affecting all sectors of activity, particularly industry, which has shed 42,000 jobs over the past four months. Only the healthcare and hospitality sectors continue to create jobs.

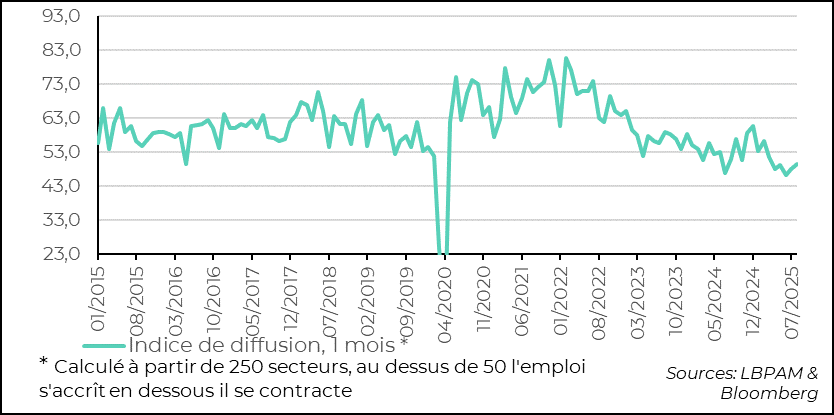

The one-month diffusion index, which measures job creation across sectors, clearly illustrates the loss of momentum that previously characterized the labor market. With the index falling below 50, it indicates that more sectors are cutting jobs than expanding employment.

Weak job creation according to the business survey

The global composite PMI rose again in August, from 52.5 to 52.9 points. This fourth consecutive increase brings the index to its highest level since the first half of 2024 and close to its long-term average, after signaling stagnation in April. This aligns with a global economy that is stabilizing following a notable slowdown in the first half of the year, and which may even be operating near its potential pace this summer.

The rise in business confidence in August may have been overstated due to reduced uncertainty following the late-July trade agreements. Still, it is noteworthy that the PMI rebounded even as the average U.S. tariff continued to rise under those agreements. In any case, this reduces the risk of the economic slowdown seen in the first half intensifying over the summer.

Sector-wise, August’s PMI increase was driven by a rebound in the manufacturing PMI, which reversed its July decline and returned to expansion territory (at 50.9 points). This suggests that the anticipated drag from front-loaded U.S. spending ahead of tariff hikes has not yet materialized this summer. That said, we still expect it to weigh on global industrial activity in the coming months.

Meanwhile, the services PMI remained nearly stable in August after a strong rise in July, holding at a reassuring level (53.4 points). This is less surprising for a sector less exposed to tariffs and benefiting from reduced uncertainty and looser financial conditions.

U.S. Growth: Short-Term Resilience, Medium-Term Uncertainty

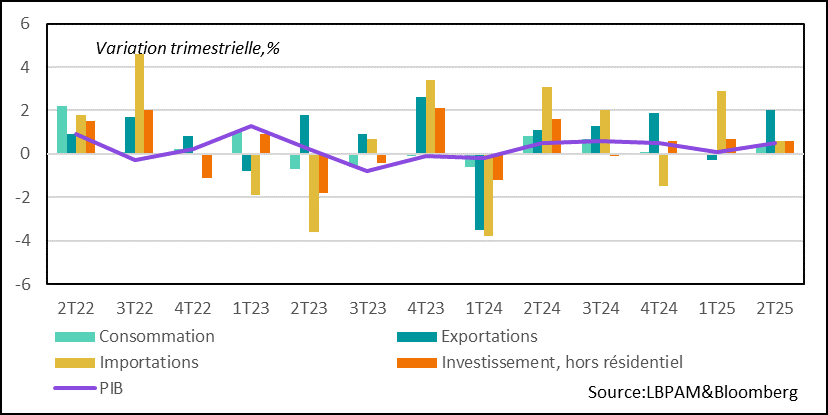

As expected, President Trump’s protectionist policies are beginning to weigh on growth both directly through higher costs and disruptions in supply chains, and indirectly through the uncertainty created by the measures taken.

At the same time, recent data on domestic demand suggest that consumers and investment remain resilient. However, the figures are heavily distorted by the behavior of economic agents following the announcement of tariff hikes, which prompted households and businesses to bring forward spending. As a result, economic growth may hold up better than expected in Q3 2025.

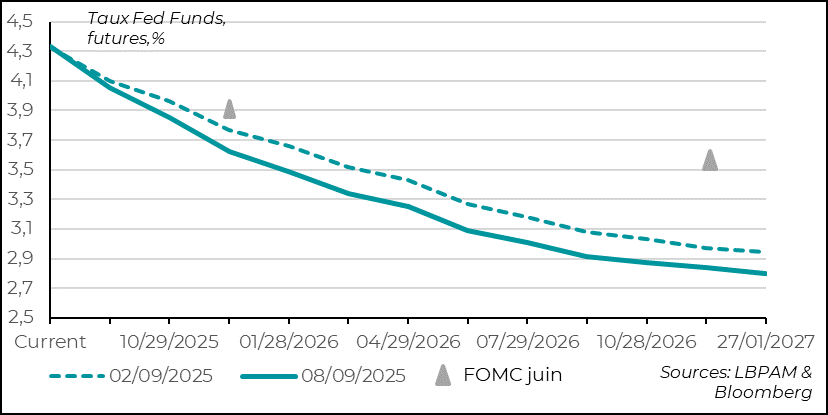

That said, we believe the final quarter of the year is likely to see a more pronounced slowdown. In this context, the weak employment figures have reinforced market expectations for Fed rate cuts. The cut we anticipated for the next FOMC meeting in 15 days is now fully priced in—we expect a 25 basis point reduction in the federal funds rate.

More notably, the market has become increasingly aggressive in its expectations for the end of the year and into next year. Nearly three rate cuts are now expected before the end of 2025, and the average Fed funds rate is projected to fall below 3% by the end of 2026.

The market is pricing in nearly three rate cuts by the end of 2025

Clearly, we do not rule out the possibility of a more aggressive Fed in the coming months. However, we continue to view the shock inflicted by the U.S. administration on the economy as stagflationary.

Not only does it undermine growth prospects, but it also intensifies inflationary pressures. In this context, upcoming inflation data will be crucial in determining how the Fed navigates the deterioration of its dual mandate—full employment and 2% inflation.

Admittedly, the strong political pressure currently facing the Fed could culminate in a loss of independence, potentially shifting its focus from inflation control to supporting economic growth. At this stage, this is not our base case, which is why we remain cautious about the Fed’s room for maneuver should tariff-driven inflation prove more persistent.

Energy: prices remain moderate

German business confidence is at its highest level since early 2022

OPEC+ member countries have decided to continue increasing production, which has already led to the return of more than 2 million barrels per day to the market the same amount that had previously been withdrawn to support prices.

However, the production increase for October was more limited than expected, with an additional 137,000 barrels per day. This smaller-than-expected increase led to a rise in prices, pushing Brent crude close to $67 per barrel.

Despite ongoing concerns about potential sanctions on countries purchasing Russian oil which could reduce available supply the reality is that the global oil market remains oversupplied. As such, we maintain our projection that oil prices will stay below $70 per barrel.

This price level remains good news for oil-importing countries, as well as for households and businesses that consume energy.

Europe continues to benefit significantly, as the price of oil in euros is even lower thanks to the appreciation of the currency. Additionally, gas prices remain very low, which not only supports disinflation but also boosts purchasing power and economic recovery.

Japan: stronger-than-expected in Q2 2025

Japan’s Q2 2025 growth came in stronger than expected

In Japan, GDP growth for Q2 2025 was stronger than expected, with an upward revision to 0.5%. Notably, household consumption was revised higher, indicating that Japanese consumers remain resilient. In addition, non-residential investment continues to contribute positively to growth.

This strength in domestic demand is a very encouraging sign of Japan’s ability to withstand the impact of U.S. protectionist measures. As in other countries, the data for H1 2025 are heavily distorted by export activity, driven by strong U.S. demand ahead of tariff hikes. However, domestic demand appears to be supported by a solid internal environment, with rising real incomes fueling consumption.

These growth figures should reinforce the Bank of Japan’s (BoJ) path toward monetary policy normalization, which remains highly accommodative. This normalization is all the more justified given that inflation continues to run well above the 2% target both headline and core.

Nevertheless, the very gradual approach taken by Governor Kazuo Ueda is unlikely to change. Persistent concerns about the impact of U.S. protectionist measures are likely to maintain a cautious tone. Additionally, political instability triggered by the loss of the parliamentary majority by the LDP-led coalition and the resignation of Prime Minister Shigeru Ishiba should also encourage the BoJ to remain prudent.

We continue to expect another rate hike by early next year.

Sebastian PARIS HORVITZ

Head of research