The trade war has begun in earnest

Link

Read Xavier Chapard's market analysis for March 05, 2025.

Summary

►A decisive step was taken in the trade war with yesterday's implementation of 25% tariffs on US imports from Mexico and Canada. This was no mere threat from the Trump administration, although it is still possible that these tariffs could be reduced in the future.

►We now have to incorporate these tariffs into our economic scenario, which implies a sharper-than-expected slowdown in US (and global) growth; and higher inflation for the year ahead.

►Another “surprise” impacting our scenario is OPEC+'s decision to gradually increase oil production from April onwards, despite the absence of a recovery in demand. It seems that pressure from the United States has made the cartel accept an oil price a little lower than we thought. Lower oil prices will go some way to offsetting the impact of tariffs on inflation.

►Our scenario for the eurozone remains unchanged. The rise in European military spending is even a bullish factor, but we think it will take time to have a real impact on European growth.

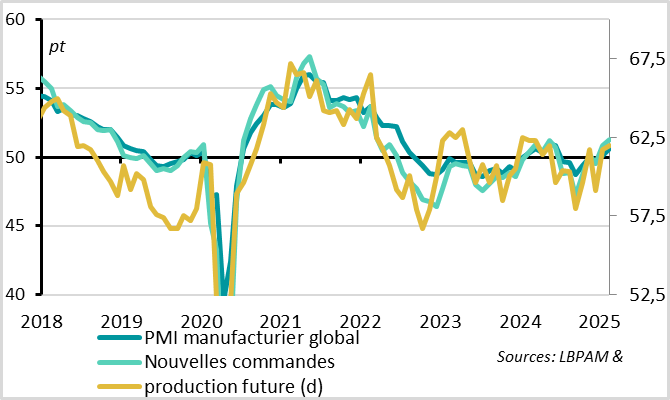

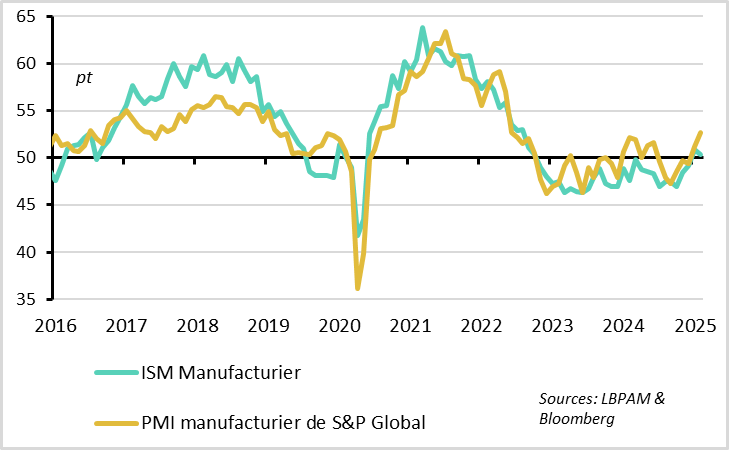

►Before the shock to world trade, the industrial cycle was clearly improving, despite the already high level of uncertainty. Thus, the global manufacturing PMI rose in February to 50.6pt, and leading indicators were trending upwards. It should be noted, however, that US PMIs diverged, with a sharp rise in the S&P global PMI but a fall in the ISM, the latter suggesting an already “stagflationary” impact from the risks of tariffs.

►Inflation slows in the Eurozone in February. Total inflation fell from 2.5% to 2.4%, thanks to a drop in core inflation from 2.7% to 2.6%. The ECB will be particularly reassured to see that inflation in services is finally slowing (from 3.9% to 3.7%), even if it is still too high.

►This paves the way for another ECB rate cut tomorrow (-25bp to 2.5%). But the focus will be on the ECB's communication, which, if it leaves the door open to further rate cuts, could stop saying that monetary policy is still restrictive. From Q2 onwards, the extent and speed of rate cuts are less certain, although we are still expecting two further rate cuts to stabilize the key rate at 2% this summer.

To go deeper

United States: a trade war on a new scale begins

D. Trump has finally made good on his threat to impose 25% tariffs on imports from Mexico and Canada, plus an additional 10% on Chinese imports. By imposing such heavy duties on its North American allies, who account for almost 30% of US imports and are fully integrated into US production chains, the United States has taken a step that we had not included in our scenario.

Admittedly, it is possible that these tariffs will be reduced, or even eliminated, in the future if D. Trump essentially uses tariffs as leverage for negotiations. But it's hard to see what these countries can offer, in the short term, to appease the US administration. Especially as it's always politically easier to raise tariffs than to lower them.

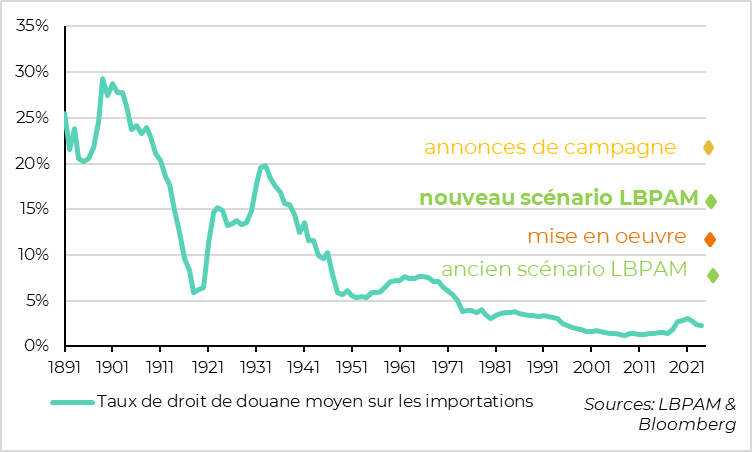

We therefore include these tariffs in our central scenario, in addition to those on China and targeted goods (European cars, etc.) which we had already included. This adds up to a 6pt rise in average customs duties on US imports, on top of the 5pt increase we had already forecast. All in all, tariffs are at their highest level since the Second World War.

This trade war in North America will weigh on US GDP, via higher consumer prices and American production costs, and lower exports, especially as the targeted countries will retaliate. According to our estimates, this will reduce US GDP by around 0.4% over the next 2 years, compared with the previous scenario (and may cause a recession in Mexico and Canada).

At the same time, US inflation should rise by around 0.75%, peaking in a year's time, implying an acceleration of core inflation towards 3.5% by the end of this year.

OPEC+: oil production to rise from April onwards

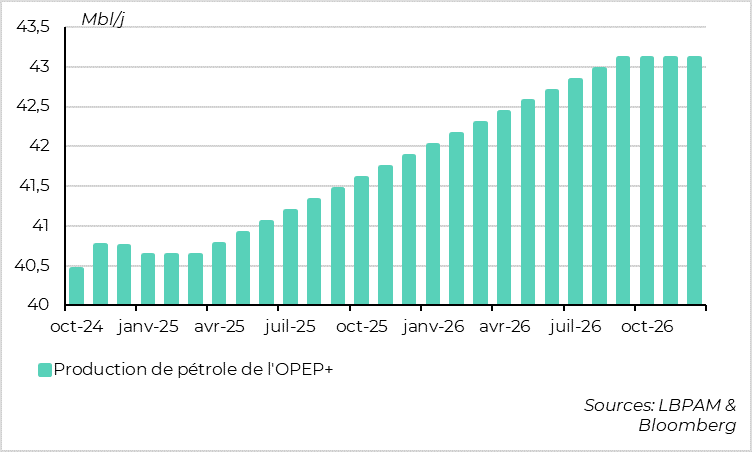

The other surprise in relation to our previous scenario comes from OPEC+, which has decided to increase its production from April onwards (under pressure from D.Trump or Russia?). Producing countries will gradually exit voluntary production cuts over the next 18 months, reaching a level of 2.5mbl/d of oil on the market. This doesn't come as a total surprise, as the cartel had announced it, but we thought they might have postponed this production increase even further, given weak demand.

This is likely to push down oil prices a little, which could fall permanently to 70USD/bl this year, reducing US and European inflation a little. At this stage, we are including a bearish impact of around 0.1pt on inflation on both sides of the Atlantic, for this year and next. This partly offsets the rise in inflation due to customs duties.

In this new scenario, we are not changing our growth forecasts for the eurozone. We continue to anticipate limited but slightly accelerating growth over the coming quarters. The downward impact of lower US and global growth is offset by slightly lower oil prices and the beginning of the impact of increased military spending. This spending could be massive (the European Commission is working on an increase of 800 billion euros over the next 4 years, including 650 billion financed by national budgets). But the impact is likely to be limited in 2025-26, since such capital expenditure takes time to ramp up, and because it will largely be dedicated to imports, at least initially.

Nor are we changing our forecasts for the Fed (i.e. 2 cuts this year and one next), even if the risk is that the Fed will cut rates further. Fundamentally, weaker growth but higher inflation leaves the Fed in a difficult position. Lately, the Fed's bias has been towards its employment mandate, rather than its inflation mandate. If the inflationary shock of tariffs turns out to be largely transitory, this argues in favor of a more accommodating Fed. But rising inflation expectations in recent surveys should prompt the central bank to remain cautious in the short term.

World: Global manufacturing PMI remains buoyant in February

Despite trade and geopolitical uncertainties, the recovery of the industrial cycle continues according to the global manufacturing PMI. It rose from 50.1 to 50.6 pts in February. Although still at a fairly limited level, the increase is widespread (the PMI rose in 75% of the countries covered by the survey), and the leading indicators remain well oriented. For example, the “new orders” component rose to 51.3pt, its highest level since early 2022. This is reassuring for the current global cycle, even if the acceleration of trade tensions could jeopardize this cyclical recovery in the months ahead.

United States: February manufacturing PMI divergence adds to uncertainty

That said, uncertainty about the US cycle is high, and is not helped by the sharp divergence in industrial confidence indicators in February.

The US S&P Global PMI, which is used to calculate the global PMI, rose by 1.1pt in February to 52.7pt. This suggests a fairly clear acceleration in industrial activity.

In contrast, the ISM manufacturing PMI fell from 50.9 to 50.3pt, suggesting stagnation in industry, and the details of this survey are not reassuring. Indeed, the “new orders” and “employment” components fell sharply back into contraction territory in February, while price indicators rose, suggesting a context of “stagflation”.

Euro zone: inflation continues to slow slowly but surely in February

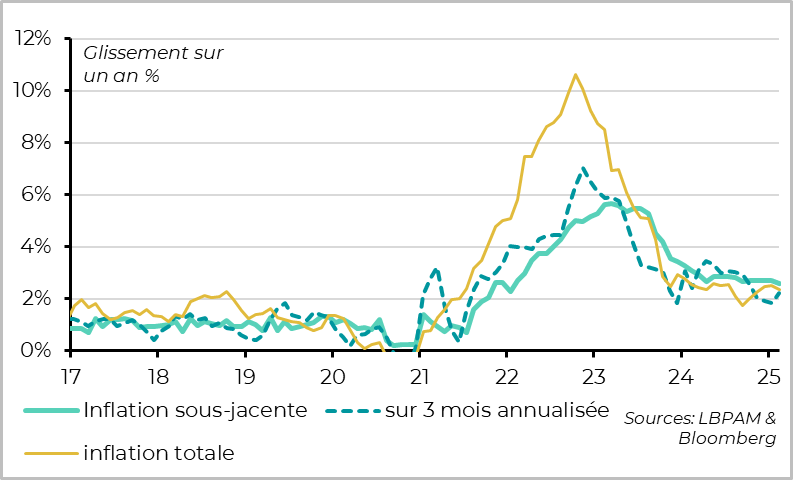

Inflation slowed in the Eurozone in February from 2.5% to 2.4%, thanks to a drop in core inflation from 2.7% to 2.6%. While core inflation remains well above the 2% target, it resumed its decline after stagnating for 5 months and is now at its lowest level since early 2022.

That said, consensus was expecting a slightly sharper slowdown thanks to favorable base effects, but core price inflation remains a little elevated at the start of 2025, with sequential inflation of around 2.5% in the first two months of the year. The surprise comes mainly from food prices and certain goods, which rose more than expected in February.

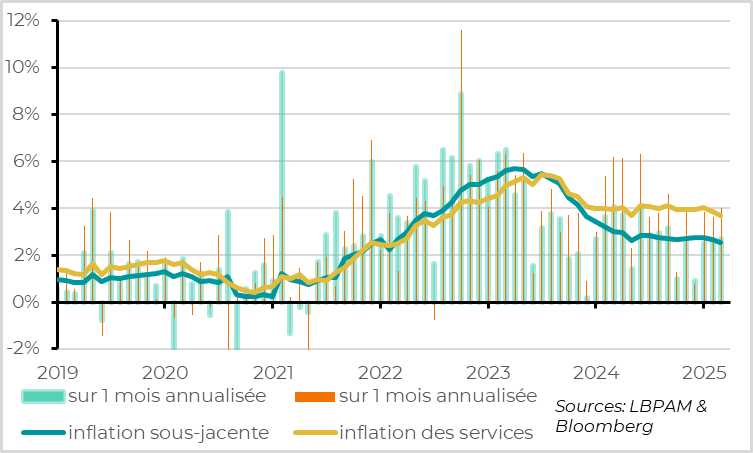

Euro zone: inflation in services finally slows, but remains high

The ECB will be particularly reassured to see that inflation in services finally slowed in February, from 3.9% to 3.7%. Service price inflation remains high in February (at 4% annualized), but is slowing markedly compared with early 2024. This slowdown in domestic inflation is consistent with the easing of wage pressures from the end of 2024, despite an unemployment rate that remains at an all-time low of 6.2%.

This paves the way for a further ECB rate cut tomorrow (-25bp to 2.5%). While this cut is totally expected, the ECB's speech will be closely scrutinized as it could indicate that rate cuts will be less automatic in future, now that the key rate is approaching the neutral rate (which ECB staff estimate at between 1.75 and 2.25%).

We expect the ECB to continue cutting rates at every meeting in Q2, with the aim of bringing the key rate down to 2% by June. But the intensifying debate over whether monetary policy is still restrictive is likely to become more intense, and could increase uncertainty over the scale and speed of rate cuts.

Xavier Chapard

Strategist