The trade war is not over

Link

Que retenir de l'actualité de marché du 07 juillet 2025 ? Réponses avec le décryptage de Sebastian Paris Horvitz.

Summary

► While President Trump was celebrating the victory of the passage of his budget bill (“the Big, Beautiful, Bill”) and Independence Day, he once again decided to light the fuse of the trade war with the sending of letters, this Monday, to 12 trading partners announcing the tariffs they would face if they did not meet the demands of the American government.

► The tariffs proposed in the letters range from 10-20% at the low end to 50-70% at the high end. If no agreement was reached by the July 9 deadline, these tariffs would apply from August 1. Apparently, S. Bessent is conducting urgent negotiations with certain countries.

► It is difficult to predict the outcome of these negotiations. But D. Trump is once again stirring up trouble, which could further damage confidence, while creating undesirable effects on global production chains. Nevertheless, the market may maintain its now Pavlovian reflex not to believe that D. Trump will follow too extreme a course.

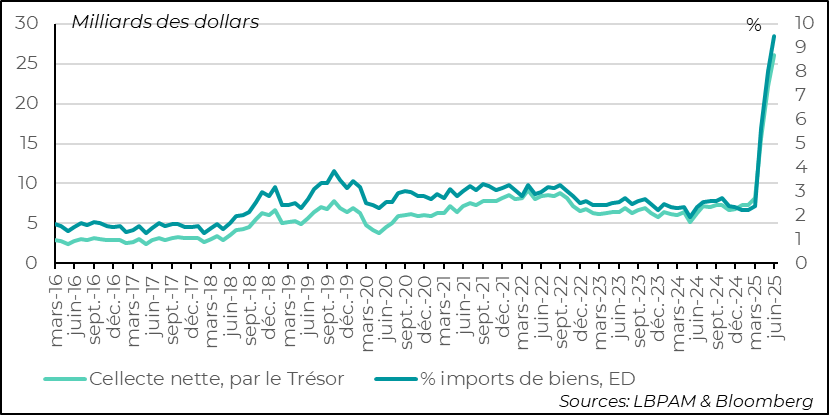

►This latest episode adds to the uncertainty of the months ahead. But, at this stage, the market still seems to be betting on a very moderate impact of tariffs on both growth and inflation. A view not necessarily shared by the consensus of economists. On an annual average basis, US GDP growth is set to lose more than a percentage point compared with the previous two years. And the vast majority see inflation rising. What is certain is that someone is already paying for these tariffs with increased tax revenues, which already present a little less than 10% of imports.

► The market may be right about a weak impact from protectionist policies, especially if the resilience of the US economy is stronger than we think, particularly in the 2nd half of the year. We remain cautious.

►The emerging trade tensions between the European Union and China are not likely to reassure investors. The restrictions imposed by the EU on Chinese medical equipment, and China's retaliation by excluding European countries from tenders for medical products, are undermining the negotiations scheduled for July 24.

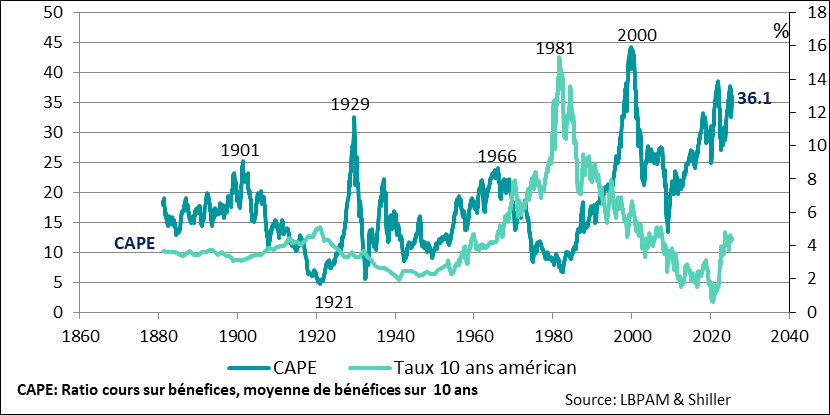

►In any case, equities on the US market have returned to extreme valuations. It may be that the bet is that the air pocket will be very temporary and that growth will pick up quickly, thanks in particular to the Trump administration's highly pro-cyclical policy, which will significantly increase the public deficit in 2026.

► We know that valuations are not an indicator of investment timing, but they are a call for caution. It is remarkable to see that R. Shiller's indicator is once again close to all-time highs. This factor, combined with our slightly more negative economic outlook, is prompting us to be a little conservative in our equity exposure, particularly in the US. We maintain a preference for European credit in our allocations.

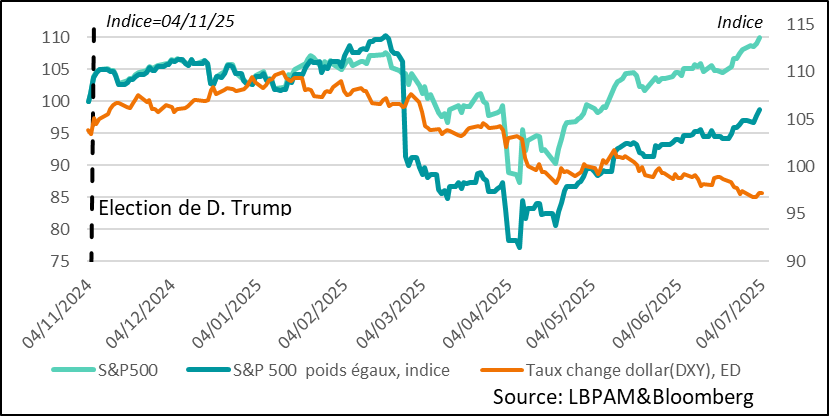

►It's also important to point out that in the recent market distortions, the dollar's decline remains a very important factor in allocations. For example, the dollar's decline gives a stability advantage to emerging markets, while in the United States, it mainly benefits large-cap companies, especially technology stocks, as their earnings are much more exposed to global markets.

►A positive factor for the global economy is the resumption of the decline in oil prices, following the tensions caused by the war in Iran. This decline is exacerbated by the weekend announcement by OPEC+ countries that they will increase their oil supply more than expected. Starting next month, 548,000 barrels of oil will be injected, compared with the previously announced 411,000 barrels. A similar increase is expected in September. This is due to OPEC+‘s very optimistic assessment of demand, which surely reflects the Gulf countries’ commitments to the US President.

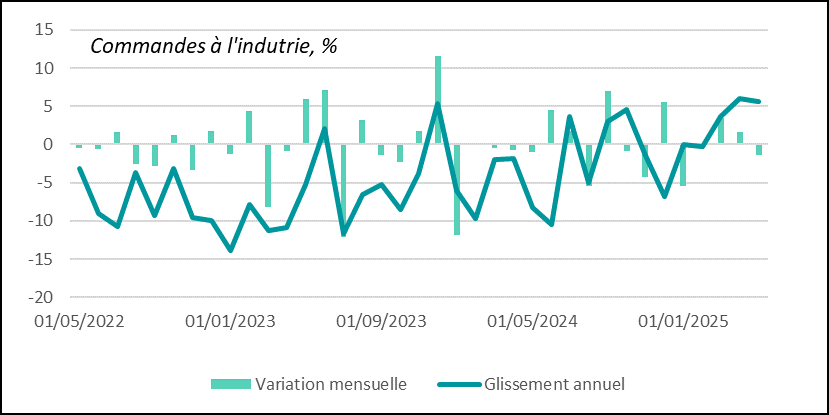

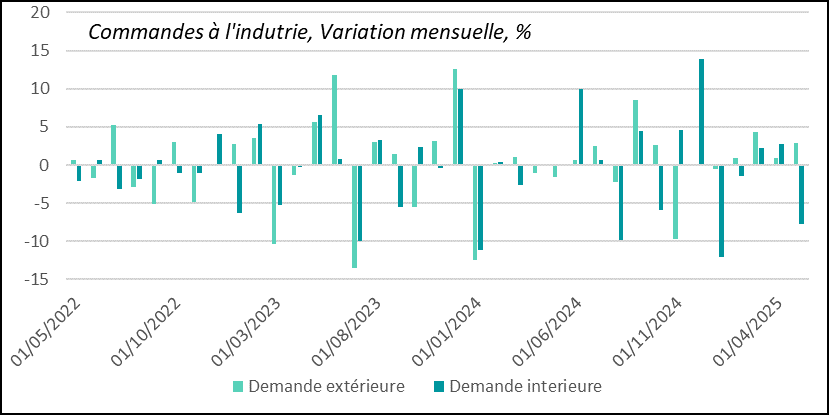

► In terms of economic statistics, the only thing to note is the continuing weakness of German industry. Indeed, new orders for German industry fell sharply in May (-1.4%), whereas stagnation was expected after the slight increase of the previous month. Domestic investment orders in particular fell the most, while foreign orders held up well. At the same time, year-on-year, they are still rising, in line with the very gradual improvement in the industrial sector since the beginning of the year.

To go deeper

At the end of last week, D. Trump announced that the US government was preparing to send letters to 12 trading partners, announcing the level of tariffs to which they would be subject if they did not come up with proposals to satisfy US demands. These letters are due to go out today, and if proposals are not forthcoming, the new tariffs will apply from August 1.

US pressure on its trading partners is therefore high, given that, according to the President, the proposed tariffs range from 10-20% for the low end to 50-70% for the high end.

It had been clear since the start of negotiations in April that it would be impossible for the US to negotiate trade treaties with all the countries affected by the tariffs, i.e. almost 90. Nevertheless, with only a handful of agreements finalized, and with details never completely clear, one might have expected uniform treatment for all the other countries. In particular, a rate close to 10%, i.e. the rate currently imposed on a large number of countries, could have become the norm.

Reintroducing trade tensions is certainly not a good thing for stabilizing the global economy.

Above all, the levels announced, if implemented, could push the average tariff level much higher than the consensus level of around 15%.

This would affect economic projections, reducing growth and increasing inflation.

Already, rekindling the trade war fuse is likely to further dent industrial confidence and damage the economic outlook.

As we know, the market has taken the view that, on the one hand, D. Trump would have to back down in the face of any overly radical demands that would harm the economy, and on the other hand, that in any event the Fed would come to the rescue to support activity.

These assumptions may not be wrong, but the risks of a more negative shock to the global economy, and the U.S. of these policies, don't really seem to be in the pricing.

Above all, like some economists, the market seems to be betting on a weak impact from the protectionist shock, particularly in the USA. This is based on the weak response of consumer prices so far, and on certain economic statistics which show that certain segments of the US economy remain fairly resilient.

We believe that the US economy should withstand the shocks as estimated today, i.e. avoid a recession. But the loss of demand momentum should become even more apparent in the second half of the year. In addition, the risks of a more severe slowdown remain, especially if the trade war intensifies.

As far as inflation is concerned, we continue to believe that its impact will gradually become visible, despite the considerable uncertainties as to its scale and whether or not it will be temporary.

Also, the impact of the tariffs is already visible in the Treasury's coffers, with a very significant rise in customs revenues since their introduction. In June, we estimate that customs revenues already exceeded 10% of the value of imported goods.

USA: customs revenues have already risen sharply

So these taxes are being paid by someone. It is possible that some exporters and distributors will take some of these tariff increases out of their margins, cutting into their profits. But it's also likely that some of it will be passed on in final prices. Whatever the case, the impact will be negative for the US economy, as for the rest of the world.

Nonetheless, the market - and the US market in particular - remains resilient, with the main equity indices reaching new all-time highs.

In fact, despite economic worries and an uncertain outlook, notably with public debt set to continue drifting, the market has not only held up, but has returned to very high valuations.

R. Shiller's once-popular estimate, which attempts to adjust earnings for the economic cycle, once again places the S&P500 at historically high valuations. At current levels, based on past trends, the 10-year expected gain on equities would be 0%.

We continue to expect a gradual recovery across the region, driven by German infrastructure and defense spending towards the end of the year. Nevertheless, in the very short term, the effects of tariffs and the uncertainties surrounding them remain a handicap for the sector.

United States: US equity valuations according to R. Shiller's indicator are still close to all-time highs

As we all know, this indicator is far from being predictive of short-term market trends. Nevertheless, it should prompt a degree of caution.

Admittedly, part of the rebound in US equities is due to the very marked outperformance of technology stocks, which are still surfing on the current technological revolution led by the accelerating development of artificial intelligence (AI). Nvidia, in particular, with its near-monopoly on chips used in large data center servers, remains the quintessential player in this movement, with a capitalization approaching $4,000 billion.

The US market's performance in dollars is also due to the dollar's sharp depreciation. This phenomenon is of particular benefit to the major US technology companies, which generate a significant proportion of their revenues abroad. Thanks to the currency effect, their dollar-denominated earnings are mechanically boosted.

This is clearly reflected in the fact that the S&P, dominated by large-cap stocks, is at its highest level, while the S&P, with equal weightings, is lagging a little behind. The latter is still lower than the level reached on April 2, when D. Trump announced reciprocal tariffs

United States: in addition to the strength of AI, the fall in the dollar also contributed to the outperformance of US technology majors

On the economic front, German industrial order statistics disappointed sharply in May, with a much steeper than expected decline of -1.4%. This breaks the growth momentum of the last two months. Nevertheless, this does not call into question the recovery seen since the start of the year, with orders up by 5.3%.

Eurozone: German industrial orders fall sharply in May, but maintain year-on-year growth

Weak domestic demand was the main reason for the downturn in May. In fact, domestic orders fell sharply (-7.8%), particularly for capital goods (-12.7%).

Foreign demand, on the other hand, held up well, rising again over the month

Eurozone: domestic industrial orders suffer, while foreign orders continue to grow

We are still betting on a gradual recovery in domestic demand, as the government's spending plan is implemented towards the end of the year. Indeed, in business surveys, optimism about the future remains high. On the other hand, there are still concerns about the trade war and the impact it may have on the dynamics of German industry.

Sebastian PARIS HORVITZ

Head of research