The trade war is set to continue

Link

What should we take away from market news on October 14, 2025? Answers with the analysis of Sebastian Paris Horvitz.

Overview

► Sébastien Lecornu resigned from his position as Prime Minister, then returned, reappointed by President Macron. A new government is in place. Its task is to pass a budget for 2026 before the end of the year. Already, the RN and La France Insoumise want to censure the government. The path is therefore narrow for passing a budget that shows that the adjustment of public finances is continuing. Nevertheless, this adjustment should be minimal. Everything suggests that a compromise on the pension law and an increase in taxation for the wealthiest will be the highlights of this budget. The markets remain relatively calm.

► With the spread between French and German 10-year government bonds at around 83 basis points – below recent highs but still above Italy's – the relative calm in the political situation seems to be reassuring investors... for now. We remain cautious on French sovereign debt given the volatility and continue to favour southern European countries.

► In Japan, Sanae Takaichi, the new leader of the Liberal Democratic Party (LDP), finds herself in difficulty after her ally, the Komeito party, decided to leave the coalition that had united them for 26 years. Komeito leaders reportedly failed to obtain commitments from the LDP regarding political financing. Ms Takaichi is therefore engaged in a race against time to try to build a new majority coalition in Parliament so that she can be appointed Prime Minister at the extraordinary meeting on 15 October. This climate has obviously wiped out the initial euphoria in the market following her election.

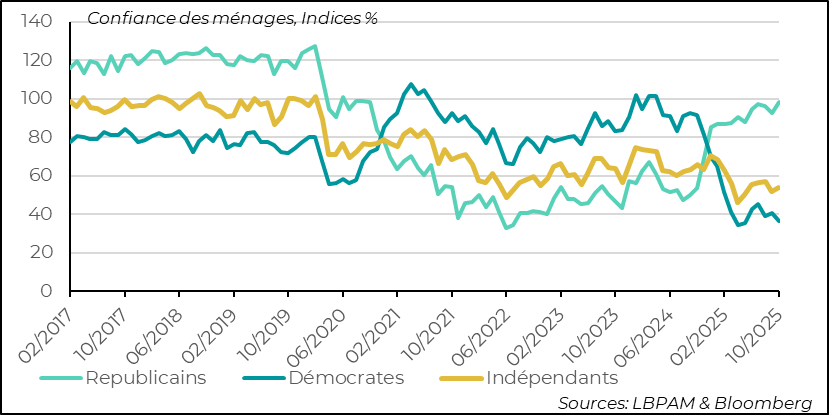

► In the United States, the deadlock over the shutdown remains total. As a result, many public services are still at a standstill. Compounding the economic cost of this paralysis in the public sector, President Trump's administration has decided to lay off staff in several departments. This is unprecedented: normally, all employees are reinstated once the shutdown is over. If these layoffs continue, they will have a much more significant negative economic impact than in previous episodes. This climate of anxiety continues to negatively affect household confidence, as shown by the University of Michigan's preliminary survey for October. Confidence remains very low, with significant disparities depending on the political affiliation of those surveyed.

► In addition, President Trump suddenly announced on Friday that he would impose 100% tariffs on Chinese goods. This decision was reportedly motivated by the implementation of stricter controls on rare earth exports to the United States. Furthermore, President Trump cancelled his meeting with President Xi.

► These announcements destabilised the markets. The US stock market fell sharply, and investors rushed to safe-haven assets: US government bonds and gold. After a U-turn over the weekend, the president posted on social media saying that there was nothing to fear and that negotiations with China were continuing. Yesterday, the indices recovered slightly, but it is today, after Columbus Day, that we will see if confidence is fully restored.

► It is clear that trade tensions with China will continue. Nevertheless, the two countries need each other at this stage. President Trump's extreme threats therefore seem unrealistic. Furthermore, Chinese foreign trade data shows that the export machine is far from broken. Year-on-year, exports rose more than expected (+8.3%). This increase is mainly driven by exports to countries other than the United States. Exports to the US remain depressed, down 27%. Exports to the European Union and, above all, to other Asian countries are up 14%. We are still waiting for exports to slow down, which would force the government to provide more support for domestic demand.

Going Further

United States: household confidence remains low

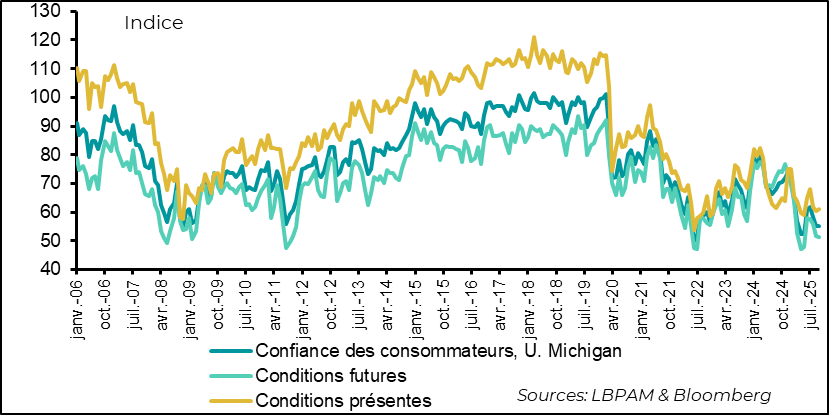

Consumer confidence remains low at the beginning of October

According to the University of Michigan's preliminary survey of consumer confidence for October, consumer sentiment remains very depressed. Nevertheless, the index remained relatively stable compared to the previous month. Concerns about employment and inflation remain important factors explaining this very low level. It is also likely that the government shutdown is adding to the anxiety, particularly with the threat of mass layoffs in the civil service, which are gradually becoming a reality.

At the same time, weak confidence has not translated into a further deterioration in consumer spending. On the contrary, the last few months have been marked by robust consumption. The coming months, with the effects of price increases likely to be more noticeable, will tell us whether the dichotomy between confidence and consumer appetite will continue. In particular, we will see whether a slightly less buoyant labour market will further dampen the morale of American households.

The differences between political affiliations remain incredible

One explanation for this dichotomy between confidence and consumption can be found in the incredible dispersion of household sentiment towards the economic situation according to their political affiliation. Indeed, Republican-leaning households remain very optimistic. The index even gained ground in the survey. In contrast, Democratic household confidence has fallen again. We had already observed these significant differences during the first Trump administration and the Biden presidency.

Admittedly, it is difficult to conclude that Republican consumers are the bedrock of consumption today. What is certain is that economic developments, particularly inflation in the coming months, will play a key role in whether or not household views align, and will be decisive for consumption trends. Our projection remains one of clear moderation in the fourth quarter of 2025.

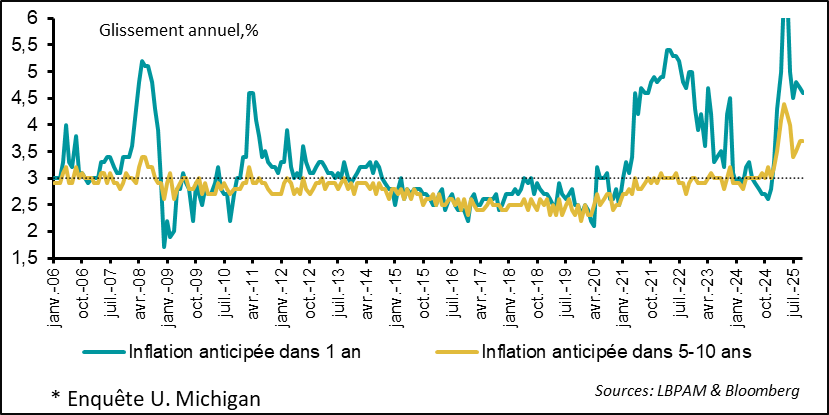

Inflation expectations remain high

In fact, the survey still shows that inflation expectations remain very high, particularly in the medium term. As we know, purchasing power has been one of the factors that has most influenced negative sentiment towards President Biden's administration.

Therefore, these high inflation expectations, even if, once again, they vary greatly depending on political affiliations, are a cause for concern for the Fed.

However, the debate within the central bank is now focusing more on the deterioration of the labour market, even though interpreting the data is complicated by the sharp decline in immigration since Donald Trump came to power.

Thus, the sharp decline in immigration will negatively affect US growth (after a very positive contribution in recent years), which should steer the Fed towards a more accommodative monetary policy.

At the same time, the imbalances in the labour market that this policy could create could maintain stronger wage growth, hindering the slowdown in inflation and requiring a degree of caution in monetary strategy.

This is all the more true given that the risk of the effects of tariff increases proving more persistent is far from negligible.

The Fed is expected to cut rates in October, but this will not completely resolve the dilemma. Donald Trump's policies are stagflationary, and the Fed will undoubtedly encounter difficulties in managing their effects.

China: foreign trade withstands tariffs

Chinese exports rebound in September

Last Friday, Donald Trump threatened China with imposing 100% tariffs on Chinese goods (China currently faces tariffs of around 30%). This statement was in response to regulatory restrictions that China is reportedly imposing on rare earth exports to the United States. China did not escalate the situation, merely clarifying its policy on controlling sensitive exports.

Since then, Trump has reassured everyone that everything will return to normal and that trade negotiations with China are continuing. However, the planned meeting with President Xi has been postponed for the time being.

This episode is a simple reminder that the trade war is far from over. More fundamentally, the technological confrontation with the United States, which has been going on for more than a decade, will continue. Nevertheless, trade relations between the two countries are likely to remain strong. The two giants remain highly dependent on each other. At the same time, President Trump is convinced that he will be able to severely damage China's export capacity.

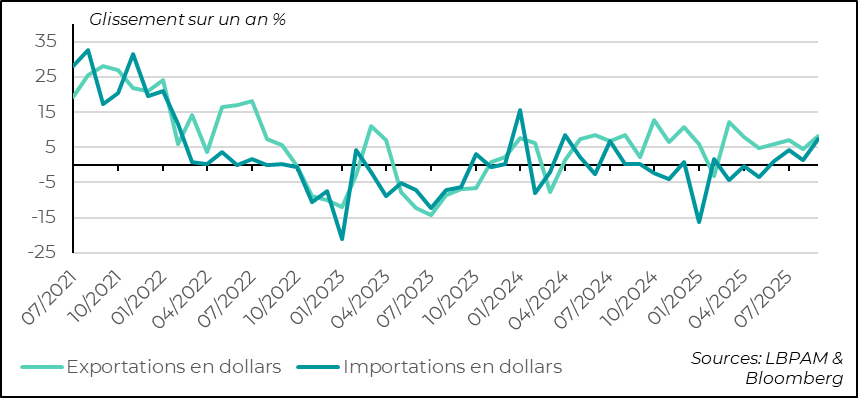

- A review of China's foreign trade statistics for September shows that exports are performing much better than expected. In fact, they have rebounded compared to the previous month. Year-on-year, they are up 8.3%. At the same time, imports also recovered (+7.4%), particularly for a number of minerals, but also for certain goods, perhaps indicating stronger domestic demand.

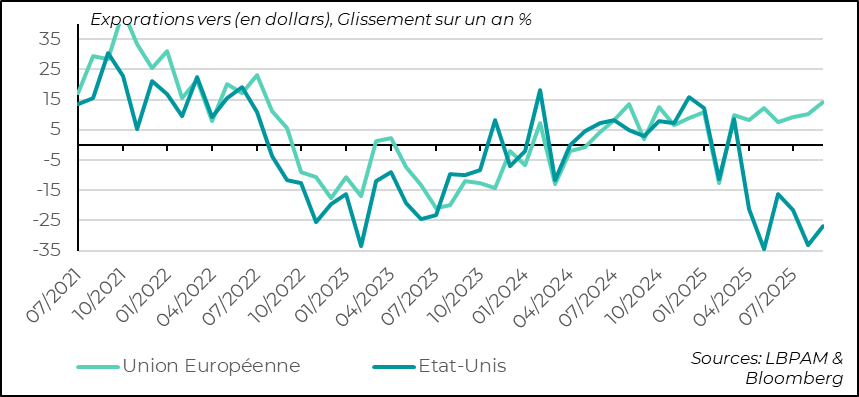

The decline in exports to the United States is offset by other countries

When we look at the evolution of exports from a regional perspective, we see that exports to the United States have fallen sharply, especially since the huge surge in demand at the beginning of the year in anticipation of the introduction of tariffs. The year-on-year decline in September was 27%.

However, this decline has been more than offset by exports to other countries and regions. In particular, exports to the European Union rose by 14% over the period. Similarly, exports to Asia are experiencing favourable momentum. China is finding other outlets. It therefore seems likely that it is seeking, and succeeding, in circumventing US tariffs by re-exporting from other countries that benefit from more favourable tariff conditions on certain goods. It remains to be seen whether this can continue.

We continue to believe that foreign trade could weaken in the coming months as a result of this trade war. This should prompt the Chinese authorities to provide further support for domestic demand. In addition to infrastructure spending, the authorities will need to find other targeted measures to support consumption in order to achieve their growth targets.

Sebastian Paris Horvitz

Head of Search