The U.S. government is heading toward a new record-breaking shutdown.

Link

What should we take away from market news on November 4, 2025? Answers with the analysis of Sebastian Paris Horvitz.

Overviews

► The shutdown of many U.S. federal government services could match—or even surpass—the historic 35-day record set in 2018. In the absence of an imminent budget agreement between Republicans and Democrats in the Senate, the paralysis of government services appears likely to persist. According to the Congressional Budget Office (CBO), an independent body responsible for budgetary forecasts, the economic cost of the shutdown is estimated at 0.3 percentage points of GDP per week. The outcome of this deadlock remains uncertain. If resolved before the end of the year, the negative impact on fourth-quarter 2025 growth should largely be offset in the first quarter of 2026. Nevertheless, the situation poses a downside risk to the trajectory of the U.S. economy in the coming months.

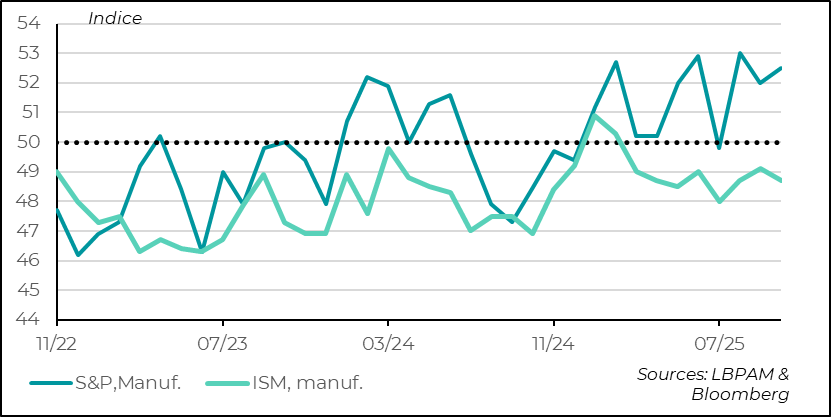

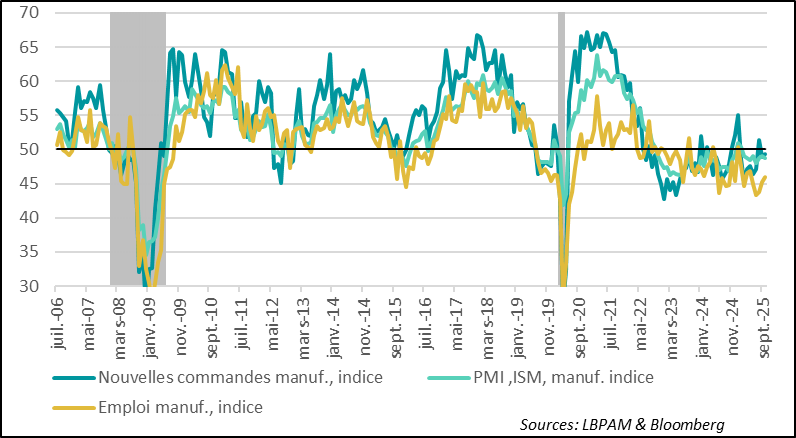

► The recent shutdown could disrupt the rather favorable momentum observed in recent months, driven by consumer spending and substantial investment in artificial intelligence (AI). At the same time, the lack of official statistics—due to the paralysis of public data services—makes it difficult to accurately assess the current economic situation. Nevertheless, the ISM manufacturing survey for October, considered the most reliable gauge of industrial activity, continued to show a contraction, albeit less severe than the previous month. The components related to production, employment, and new orders all declined during the month. The release of the ISM services survey this Wednesday will provide a more comprehensive view of overall activity, although all signs suggest that it remains resilient.

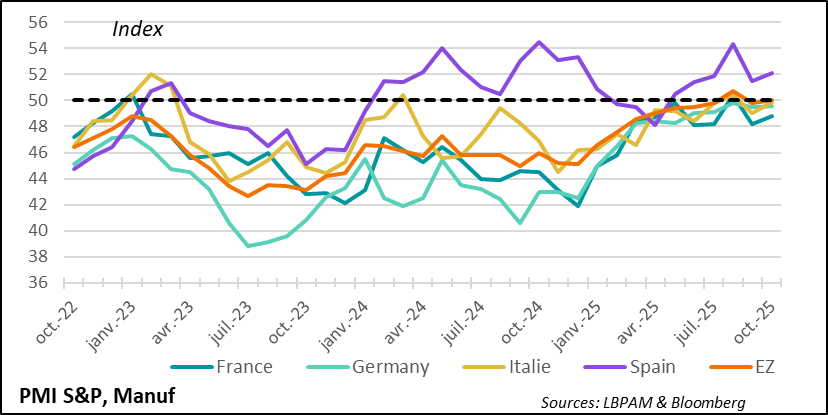

► In the Eurozone, the final S&P PMI survey for October came out unchanged compared to the preliminary estimate, indicating stagnation in industrial activity, with the index at 50—the threshold between contraction and expansion. However, more detailed insights were provided at the country level. The final results showed that the situation in France was better than expected, even though activity continues to contract. It was also reported that expansion is strengthening in Spain, while in Italy, activity has stopped contracting. Overall, the PMI for the Eurozone is consistent with a very gradual recovery in growth, expected to take shape in the coming quarters, driven by more expansionary fiscal policies, particularly in Germany.

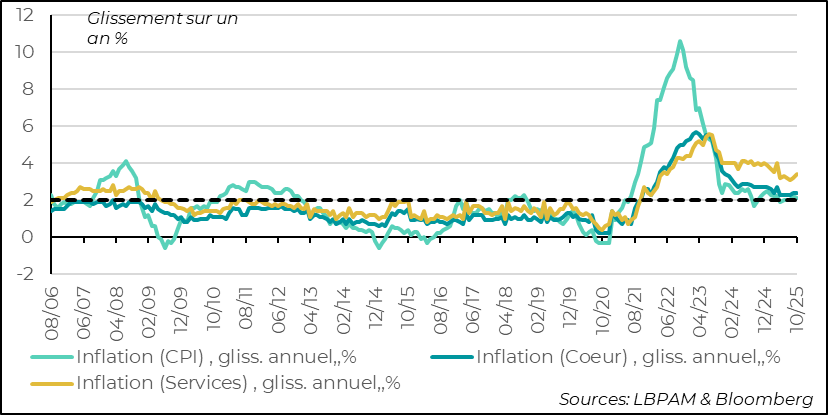

►As expected, overall inflation in the Eurozone slightly declined in October, reaching 2.1%, which is very close to the ECB’s target. However, core inflation remained unchanged at 2.4%, while it had been expected to fall to 2.3%. This weaker-than-expected deceleration in core inflation is partly due to service prices, which have resumed a slight upward trend. Nevertheless, with wage growth expected to slow further in the coming months, inflation should resume its downward trajectory in the region. In fact, the ECB anticipates that inflation will fall below 2% in 2026 and 2027. This continues to support our view that the central bank should cut rates once more to ensure inflation remains close to its target—its primary mandate—rather than allowing it to stay below the target for too long, which could result in an unnecessarily restrictive policy. For now, however, the ECB has clearly opted for patience.

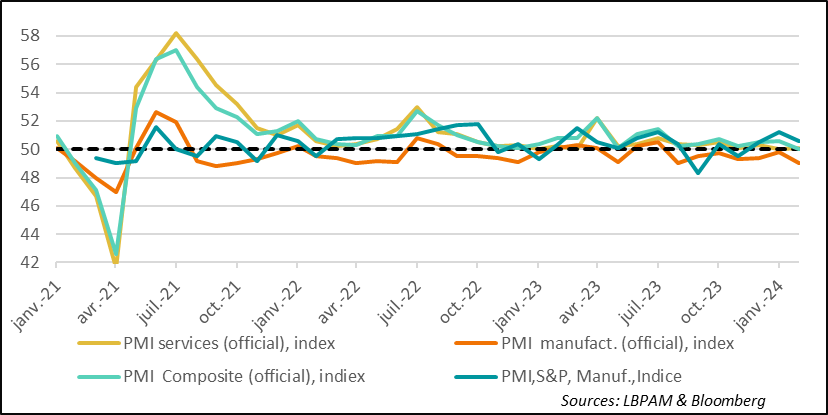

► In China, the official composite PMI (covering both industry and services) for October came in slightly weaker than the previous month, returning to 50. The main reason appears to be a further contraction in industrial activity, although it remains close to stagnation levels. The slowdown in industry was also reflected in the private S&P PMI (RatingDog), with the index approaching 50 again, reversing the rebound that began last summer. In the services sector, the official PMI remains in stagnation territory. This weakness in services is consistent with a sluggish domestic demand dynamic.

Meanwhile, the more pronounced weakening in industry suggests that the tariff shock is beginning to weigh negatively on activity. Indeed, the sub-index for exports has weakened significantly. This could be a signal prompting authorities to introduce new measures to stimulate domestic demand.

Going Further

United States: According to ISM, the American manufacturing sector remains weakened

United States: According to ISM, the American manufacturing sector remains weakened

The ISM survey for the manufacturing sector, considered the most reliable indicator of the industrial cycle, came in weaker than expected in October, at 48.7—still in contraction territory. This result contrasts with the S&P PMI survey, which confirmed the preliminary reading of a much stronger industrial momentum, although the details highlighted signs of weakness, such as ongoing concerns about future prospects given the government's economic policy.

The ISM survey appears more aligned with other indicators, including the results of regional Fed surveys (Beige Book), which reported a rather stagnant situation in the industry. Nevertheless, one might be surprised by the limited impact of the boom related to the deployment of AI-dedicated data centers. It is likely that these effects will appear later in the survey. At the same time, this picture of weak activity seems consistent with the uncertainties caused notably by the protectionist policies of the U.S. administration.

However, despite a manufacturing ISM index at 48.7, indicating contraction in industrial activity, it is worth noting that historically, this level generally corresponds to an expansion in overall economic activity. Therefore, we will need to wait for the release of the ISM services survey this Wednesday to gain a better understanding of the general state of economic momentum. All signs suggest—particularly based on data available just before the shutdown—that the economy continued to show resilience, driven by consumption and investment in AI. Nonetheless, we anticipate a slowdown in the fourth quarter of 2025.

The breakdown of the manufacturing ISM shows continued weakness.

In detail, the ISM survey for the manufacturing sector highlights that demand remains weak. Indeed, the new orders index, although slightly higher than the previous month, remains in slight contraction territory. Similarly, external demand continues to decline, with the new export orders index still low at 44.5.

Regarding employment, the message is similar, with the index still indicating a reduction in headcount, albeit relatively moderate. This seems consistent with pre-shutdown employment figures, showing that manufacturers were mostly in a wait-and-see mode in response to the shock from rising tariffs. This situation appears to be ongoing.

Moreover, somewhat surprisingly, the input prices index—although elevated—declined again in October. This could suggest that the upward pressure triggered by the initial tariff hikes is easing. Since the full extent of the tariff increases has not yet been reflected in import prices, it is likely that we are seeing a temporary pause in cost escalation. It will take several more months to fully assess the impact of tariff hikes on business costs stemming from protectionist policies.

Euro zone: industry stagnates, but shows signs of improvement

The S&P PMI survey for the manufacturing sector is improving

The final S&P survey for European industrial activity in October came out unchanged from the preliminary result: it remains stagnant, with the index exactly at 50—the threshold between contraction and expansion.

However, the final release brought some good news in the country-level details. Notably, in France, the index was revised upward, showing that although activity is still contracting, the pace of contraction has eased. This appears more in line with the results of the INSEE survey. Nevertheless, France remains the laggard of the Eurozone.

Additionally, activity in both Italy and Spain improved in October, with Spain continuing to show the strongest momentum in the region. Germany maintains a favorable recovery trend, which is expected to continue with the implementation of the German government's stimulus plan. We anticipate that this momentum will support the broader industrial sector, although the American protectionist shock is likely to weigh on exporters.

Eurozone: Inflation continues to converge toward the target

Eurozone: Headline inflation reaches the target, but service prices remain sticky

In October, as expected, headline inflation in the Eurozone resumed its downward trend, reaching 2.1% year-on-year. However, core inflation did not follow the same path and remained unchanged at 2.4%. This divergence is partly due to service prices, which showed a slight upward trend, rising to 3.4% for the month. We continue to believe that the ongoing slowdown in wage growth should help ease price pressures in the services sector.

At the same time, price developments across the region are somewhat uneven. Inflation in Germany remains relatively persistent, while Spain shows signs of acceleration. In contrast, inflation in France and Italy is well below the ECB’s 2% target. These divergences are not unusual within the Eurozone, and the ECB must base its policy on the regional average rather than on specific national situations.

In this context, the ECB considers itself to be in a good position and believes its current policy is aligned with the economic environment. Given the recent inflation trends, a wait-and-see approach seems appropriate, especially to allow service inflation to cool further. However, we still see a risk that inflation could fall below the 2% target in the coming quarters. Therefore, we believe the Eurozone could benefit from an additional rate cut by the end of the year or early next year. In fact, in its own projections, the ECB expects inflation to fall below target in 2026 and 2027 (1.7% and 1.9%, respectively). If this scenario materializes, it would clearly mean the ECB is not adhering to its stated strategy of maintaining a symmetric approach to the inflation target. We’ll see in December, with the release of the new economic projections, whether the ECB opts for a revised inflation strategy.

China: economic activity weakens in october

The PMI survey shows a weakening in activity

China’s official PMI survey showed a slowdown in both manufacturing and services activity. This deceleration is also confirmed by the S&P survey for manufacturing (RatingDog), which indicates a loss of momentum.

The weakness in industrial activity appears to be linked in particular to a decline in exports. As such, U.S. protectionist policies are beginning to take effect. Moreover, import restrictions on Chinese goods are emerging in other regions, notably the Eurozone, which had previously offset the drop in Chinese exports to the United States.

In addition, the official PMI survey for services highlights that final domestic demand remains weak. This less favorable trend is likely to prompt Chinese authorities to introduce targeted support measures to stay close to their growth objectives. We anticipate further support for households, but also—and especially—greater efforts in the technology sectors, particularly in the development of AI.

Sebastian Paris Horvitz

Head of search