The U.S. Job Market Allows the Fed to Remain Patient

Link

Find the market analysis for March 10, 2025, by Xavier Chapard, focused on the U.S. job market.

Summary

► The U.S. labor market remains resilient in February, although it shows signs of slowing down after several very strong months. Employment increased by 151,000 in February, indicating that companies are still in expansion mode. However, the unemployment rate rose from 4% to 4.1% and would have increased more significantly if the participation rate had remained stable. That said, it remains below its level from last summer and at a historically low level. Finally, hourly wages are stable around 4%, implying that they are no longer a significant source of inflationary pressures.

► The job market is generally where the Fed wants it to be, neither too tight nor too weak. This gives the Fed time to see how policies and the U.S. economy will evolve, justifying a continued pause in short-term rate cuts (including next week).

► We anticipate a slightly more pronounced slowdown in employment in the coming months, which we believe will push the Fed to lower rates again starting in June. However, the persistence of inflation above the target and the risk of unanchoring inflation expectations should limit the speed and extent of these rate cuts. In this context, we will closely monitor February's inflation data released on Wednesday and consumer confidence surveys published this week.

► The market in Europe is rightly focused on the historic fiscal shift in favor of military spending and investment in Germany. This is likely to significantly support the zone's growth in the medium term, even though the ramp-up of these expenditures will be gradual. Thus, we estimate that they will increase the zone's growth by 0.2 percentage points this year and 0.3 percentage points next year, which is significant but gradual. In the short term, the risk related to the trade war could weigh on the European economy.

► In this context, it is reassuring to see that the latest data shows that the Eurozone recovery was underway since last year, even if it was limited. Thus, Eurozone growth in Q4 2024 was revised up again to 0.2% for the quarter, so that growth for last year stands at 0.9% after 0.4% in 2024. And the details of Q4 GDP are encouraging as growth is driven by final domestic demand, particularly consumption and private investment.

► Inflation fell again in China in February (-0.7%) and producer prices continue to decline significantly (-2.2%), indicating that deflationary pressures remain significant due to weak domestic demand. This is consistent with the sharp drop in imports at the beginning of the year (-7.3% in January/February) and justifies the more proactive fiscal policy announced by the authorities last week (deficit increased from 3% to 4% of GDP, over 1 trillion yuan increase in special government bond issuances...). We still believe that the authorities will manage to stabilize growth despite trade tensions, although we expect growth slightly below the reaffirmed target of 5% this year.

Go deeper

United States: Employment Continues to Grow at an Average Pace in February

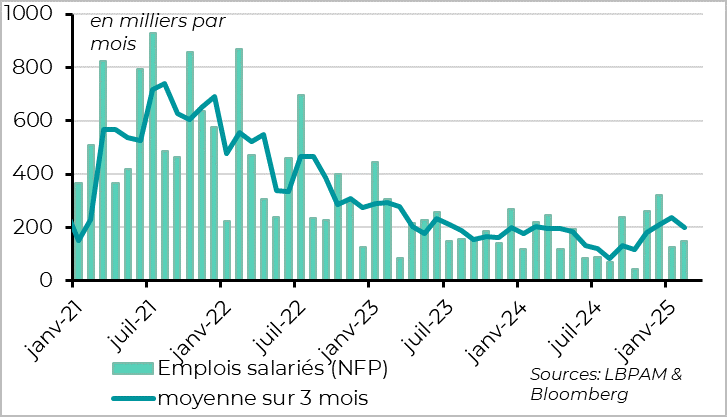

U.S. employment increased by 151,000 in February, close to the 160,000 expected by consensus. This is slightly more than in January (125,000) but below the 200,000 jobs created on average over the past six months.

Federal employment is starting to decline, but the extent is limited. Public employment is slowing but still increased by 11,000, reflecting a rise of 20,000 jobs at the local level and a decrease of 10,000 jobs at the federal level. The decline in federal employment is consistent with the hiring freeze decided by the new administration at the end of January. However, it does not yet reflect the impact of job cuts at DOGE (i.e., Elon Musk) since the employment survey is based on the second week of the month, before the increase in federal job cuts. Federal employment is expected to decline more significantly in the coming months, but it will remain a small fraction of public employment and even more so of total employment in the United States.

Furthermore, industrial employment increased by 10,000 jobs in February, consistent with the rise in manufacturing PMIs to their highest levels since 2022. However, the outlook for the industry is uncertain due to the volatility of U.S. trade policy.

United States: But the Unemployment Rate Increases Again Slightly

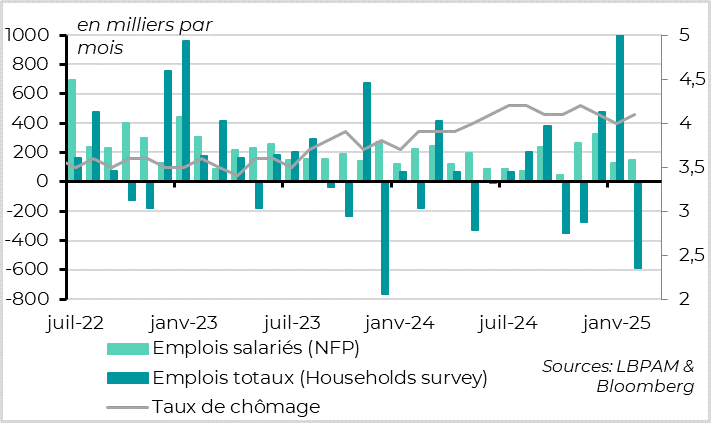

The household survey is a bit less reassuring, although it is far from alarming. The unemployment rate increased from 4% to 4.1% (4.14%), despite the decline in the participation rate for the month (from 62.6% to 62.4%, a two-year low).

This reflects the decline in employment in this survey, which is still volatile month-to-month (-588,000 after +2.2 million in January). The unemployment rate remains within its fluctuation band between 4% and 4.2%, where it has been since last summer, consistent with a stable labor market. And it is below its mid-2024 level (2.2%), which is the rate the Fed considers sustainable in the long term, so still at a solid level.

The underemployment rate, a broader measure of people willing to work, increased more significantly, from 7.5% to 8%, after slightly declining for six months. It is above its mid-2024 level and actually at its highest since Covid, which could be a sign of a continued rise in the unemployment rate in the coming months.

United States: Wage Growth Stabilizes at a Satisfactory Level

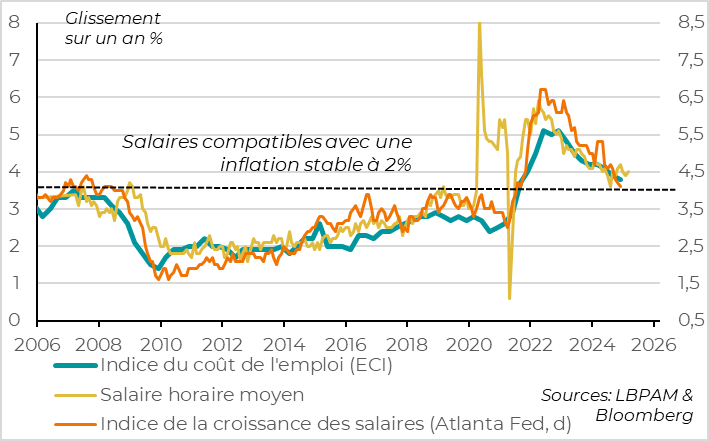

The average hourly wage increased by 0.3% in February after 0.4% in January, as expected. This translates to a 4% increase in wages over the year, consistent for the past three months, which aligns with the 2% inflation target given productivity growth close to 2% over the past year.

The Fed should therefore continue to believe that the labor market no longer contributes to increasing inflationary pressures.

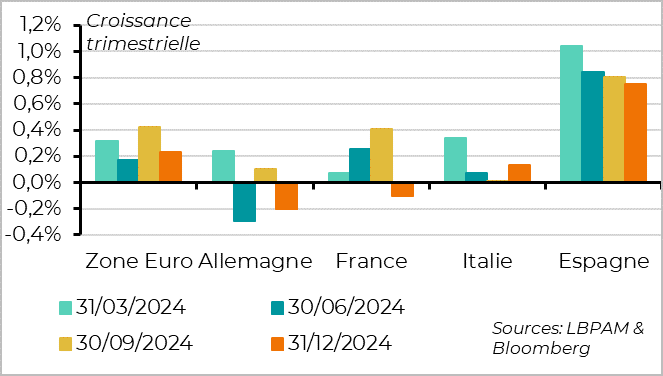

Eurozone: Growth Was Positive at the End of 2024, Although Limited

Eurozone GDP was revised upwards for Q4, from 0.1% to 0.2% quarterly growth (even 0.23%). Recall that the initial estimate indicated stagnation in the zone at the end of 2024 due to declining activity in France and Germany. This growth is somewhat exaggerated by Ireland's 3.6% quarterly growth, whose statistics are very volatile due to transactions related to international companies' tax strategies. Excluding Ireland, Eurozone growth would be 0.1% after 0.3% in Q3. However, the upward revision of growth mainly comes from Italy, which was revised from 0% to 0.1% for Q4. This is reassuring as it shows that Italy maintained a growth dynamic, albeit limited, despite the sharp decline in fiscal support (including the superbonus).

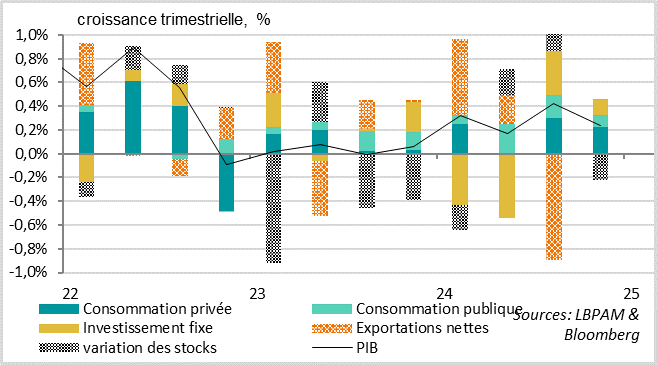

Eurozone: Activity Driven by Private Domestic Demand in H2 2024

The details of Eurozone GDP are encouraging, with a recovery in consumption and private investment in Q4. Inventory variation subtracts 0.2 percentage points from growth, and external trade has a neutral contribution. Thus, it is final domestic demand, as volatile as GDP, that drives growth. It increased by 0.5% in Q4 after 0.9% in Q3, despite the aftermath of the Olympics in France. Household consumption increased by 0.4% in Q4 after 0.6%, confirming its recovery despite the Olympics' aftermath. Public demand also increased, but by 0.4% after 0.9%. Most notably, investment increased by 0.6% and grew for the first time of the year excluding Ireland. This suggests that the ECB's monetary easing is beginning to spread, although high political uncertainties at the beginning of this year could limit its short-term effect.

Xavier Chapard

Strategist