The US job market remains (too) tight

Link

-

US jobs reports for January were much stronger than expected, challenging the idea that the job market is gradually calming down.

-

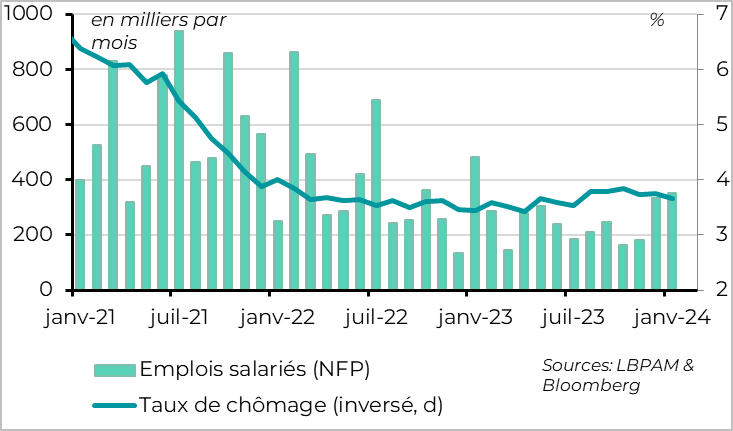

Job creation in the US exceeded 300,000 in December and January, after slowing to 200,000 over the previous 6 months. The unemployment rate remained stable at 3.7% for the third consecutive month, below the 4.1% that the Fed considers to be the sustainable long-term level.

-

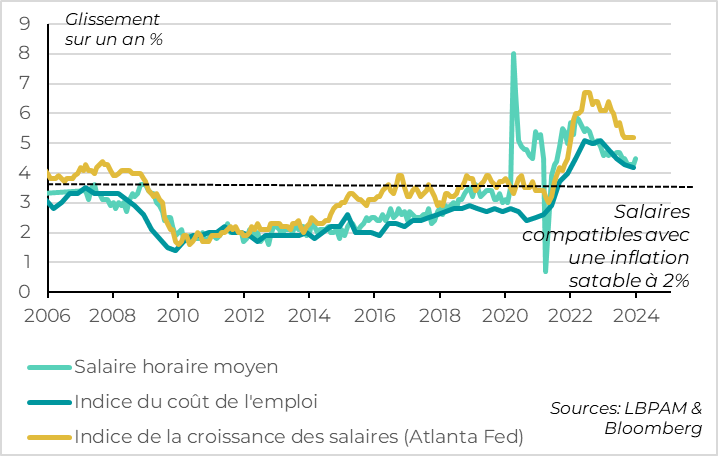

Above all, wages accelerated in January. Average hourly earnings rose from 4.3% to 4.5% year-on-year, a 4-month high. While employment costs, the Fed's preferred measure of wages, had slowed well by the end of 2023 (from 4.3% to 4.2% for Q4 2023), this latest data suggests that wage tensions are still far from normalized.

-

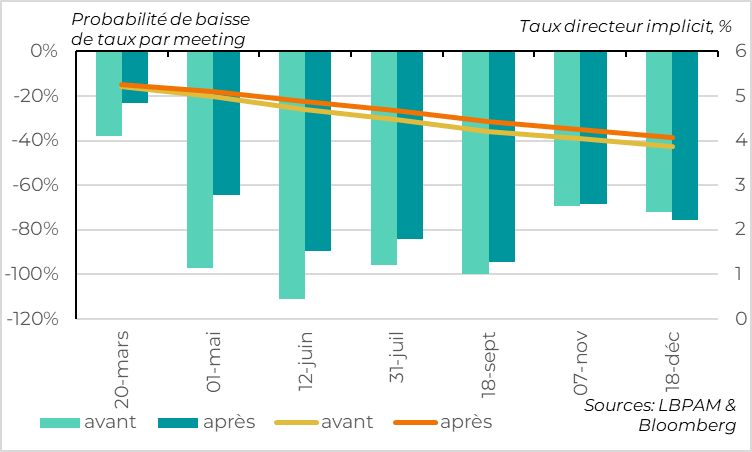

Add to this the lull in fears about US banks following the tensions surrounding New York Community Bancorp (NYCB) last week, and the likelihood of the Fed cutting rates as early as March is virtually nil. In fact, Fed Chairman Jay Powell indicated over the weekend that "the job [of bringing inflation back to 2% on a sustainable basis] is not quite finished".

-

Following this data, the market lowered its expectations of Fed rate cuts, which are now close to ours. We believe the Fed could cut rates from May onwards, and by 1pt by the end of the year. But the risk to these expectations is now that the Fed will have to be even more cautious in its rate cuts. All the more so as the US Congress does not seem ready to reduce fiscal support this year.

Fig.1 United States: The job market remains very (too) buoyant

-Salaried jobs (NFP)

-Unemployment rate (inverted, d)

U.S. employment rose by 353 thousand in January, almost twice as much as expected by the consensus (and higher than the highest expectations of economists surveyed by Bloomberg). In addition, employment figures were revised significantly upwards for previous months (+117 thousand for December). With over 300 net new jobs created in the last two months, this challenges the idea that the labor market is gradually slowing down.

At the same time, the unemployment rate remained stable for the third consecutive month, at 3.7%, whereas the consensus was for a rise to 3.8%. In fact, it even fell slightly to two decimal places, by 0.08pt.

And the outlook for the job market seems rather stable. Job creation is more widespread in terms of sectors than in the second half of 2023. And temporary employment, usually a leading indicator of total employment, stabilized in January after a year of interrupted decline. Although jobless claims picked up at the end of January, they are still at low levels. This does not suggest any imminent deterioration in the job market.

Of course, grumblers will always be able to find unfavorable data in job reports, but the overall picture is one of a labor market that is still very buoyant.

For example, in the household survey used to calculate the unemployment rate, employment has been falling slightly for the past two months (-31 thousand in January). This is not reflected in the unemployment rate, however, due to the concomitant fall in the working population. Also, the proportion of part-time jobs continues to rise. Overall, the underemployment rate (which takes into account involuntary part-time work and the discouraged unemployed) has risen slightly over the past 2 months, to 7.2% in January. But even this measure is back to its historically low level of three months ago.

Fig.2 United States: wages rebound in January, maintaining inflationary pressures for the medium term

-Average hourly wage

-Employment cost index

-Wage growth index (atlanta Fed)

Proof of the persistence of tensions in the US labor market, wages rose twice as much as expected in January, driving annual hourly wage growth up from 4.3% to 4.5%, a 4-month high. This calls into question the slowing wage trend suggested last week by the slowdown in employment costs (from 4.3% to 4.2% for Q4 2023), which is the Fed's preferred wage measure.

We'll have to wait a couple of weeks for the Atlanta Fed's monthly wage measure (which corrects for composition effects), which has been slowing less sharply than average hourly wages in recent months. But it seems clear that wage pressures remain very high.

Fig.3 United States: A rate cut as early as March is virtually out of the question

-Before

-After

-Before

-After

The labor market remains too tight for the Fed to be confident of a sustainable return to 2% inflation. Indeed, the Fed believes that wage growth compatible with 2% inflation in the long term is closer to 3.5%. The probability of a rate cut as early as March is now virtually nil in our view (it dropped from 40% to 20% in the market after the jobs reports were published). And if the data continues to be this strong, it could even at some point call into question our forecast of a first Fed rate cut in early May.

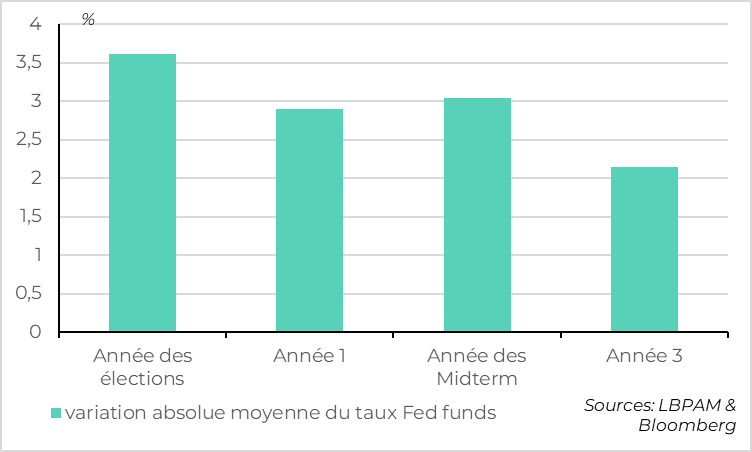

Fig.4 United States: The argument that presidential elections could prevent the Fed from cutting rates later this year is not supported by history

-Average absolute change in Fed funds rate

Some analysts believe that the Fed needs to start cutting rates quickly to avoid having to change rates too close to the presidential election in early November, in order to avoid being seen as helping one side at the expense of the other. This argument does not stand up to the test of historical data. Indeed, the Fed has historically changed its key rates as much in an election year as in any other. We believe that as long as the economy does not collapse, the Fed will remain focused on inflation when deciding its monetary policy.

Our central scenario remains a first rate cut in May and a policy rate ending the year close to 4.5%, which is 0.5% above market expectations. But the risk that the Fed will wait longer and, above all, cut rates less in the coming months increases sharply after these figures.

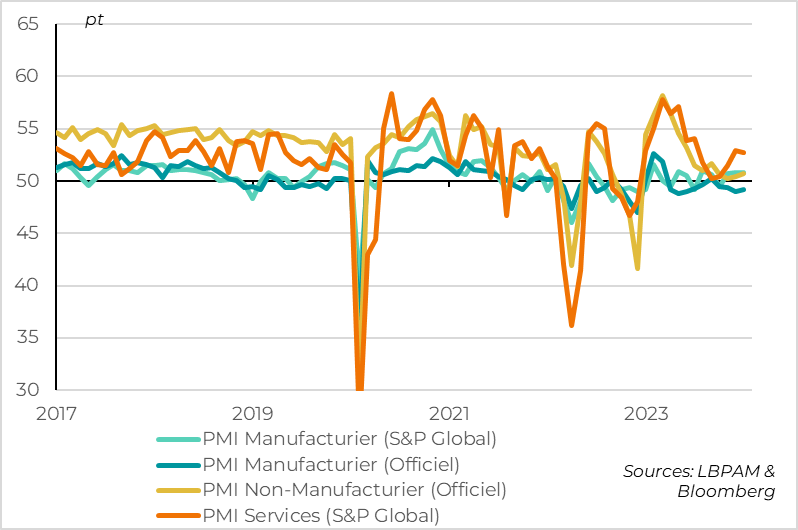

Fig.5 China: PMIs remain stable at limited levels in January

-PMI Manufacturier (S&P Global)

-Manufacturing PMI (Official)

-PMI Non-Manufacturing (Official)

-PMI Services (S&P Global)