The US stock market soars

Link

-

The US stock market, still driven by large caps in the technology sector, is at an all-time high. The S&P 500, the flagship index, has reached a new all-time high, surpassing its peak at the end of 2021. The Nasdaq is less than 4% off its previous peak. Most of this rise was driven by rising multiples, even as long-term interest rates rose. These indices are in overbought territory and seem to be feeding on too much optimism, even though the US economy is more robust than expected.

-

Indeed, we have seen that consumer spending is still driving growth, as indicated by retail sales for the month of December, and that construction activity is picking up. The economy also still seems to be benefiting from public support, with the last quarter of 2024 showing a large budget deficit. Reflecting some of this news, the Conference Board's leading indicator saw its smallest fall for almost a year. This indicates a lesser deceleration in activity. Nevertheless, on a year-on-year basis, it still points to a recession.

-

We attribute the resilience of the US economy in part to the strong easing of financial conditions over the last 3 months, due to the marked appreciation of assets (rising stock markets and falling interest rates, essentially). We continue to believe that this may be one of the factors that will prompt the Fed to be patient in initiating rate cuts. Nonetheless, there is a risk that the Fed could declare victory on inflation sooner and focus instead on preserving growth.

-

In terms of announcements by central bankers, it came as no surprise yesterday to see the Bank of Japan (BoJ) maintain its policy of extreme stimulus. The BoJ believes that it is still necessary to be patient before changing policy to ensure that inflation can remain at around 2% for the long term. Wage trends will be an important factor in this decision. We believe that, at the earliest, the first steps could be taken in the spring. In the meantime, the yen should remain weak.

-

In Europe, we know that economic data has been rather disappointing in recent months, particularly in the UK. Nevertheless, in the Eurozone, it would appear that the economic situation, while mediocre, is no longer deteriorating. Although the latest ECB survey of banks on the credit situation shows that credit remains constrained, things seem to be improving. In fact, for the first time since the spring of 2022, credit demand from businesses and households is expected to grow slightly from 1Q24.

-

In the United States, after what appears to be another large victory (55% of the vote) for D. Trump in the Republican primary in the state of New Hampshire, he is almost certain to be the party's presidential candidate. Indeed, N. Haley, his only remaining rival, failed to win this state, which seemed crucial to her ability to counter D. Trump. She remains a candidate, but her chances have diminished considerably.

At the start of the year, US economic data generally came out better than expected. This shows the resilience of the US economy. In part, in our view, the strong easing of financial conditions over the past three months has been one of the factors helping to support demand. Retail sales in December were much stronger than expected, reflecting a sharp rise in consumer confidence in January, according to the U. of Michigan survey. The construction sector also seems to be picking up, with housebuilder confidence rebounding and building permits on the rise. The sharp fall in mortgage rates (down almost 100 points) has undoubtedly contributed to this.

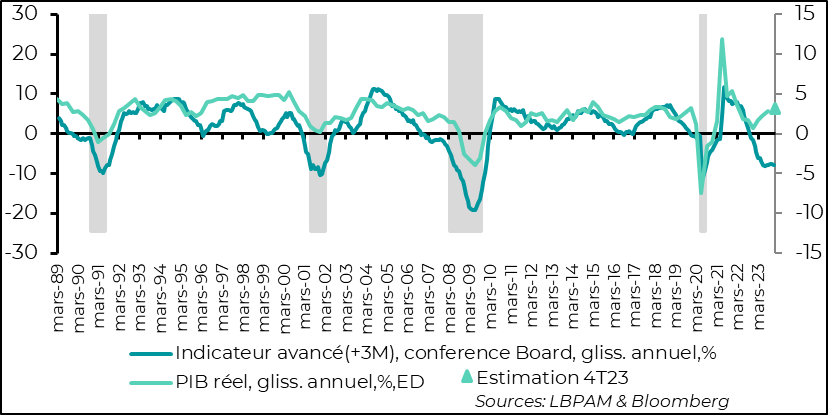

These developments are partly reflected in the Conference Board's leading indicator, which saw its smallest fall for almost a year, down 0.1% in December. It is still pointing to a slowdown in activity, but a much smaller one.

Nevertheless, on a year-on-year basis, the indicator is still sending a pessimistic message about economic conditions, in the sense that it is at a level that is historically compatible with a stagnation or contraction in activity.

Fig.1 United States: The Conference Board's leading indicator falls by the smallest amount in almost a year in December, but remains at recessionary levels

In addition to financial conditions, given the trend in public finances in 4Q23, with a deficit that continues to widen, there is also a risk that the economy will continue to benefit from fiscal stimulus at the start of the year, when more restraint was expected.

At next week's monetary policy meeting, we will see how the Fed deals with the resilience of the economy and the easing of financial conditions that it has helped to generate. We continue to believe that recent developments will lead the Fed to be more patient about possible rate cuts in 2024. But, as in the past, there is a risk that fears about growth will outweigh the impact of this resilience of activity on the inflation outlook.

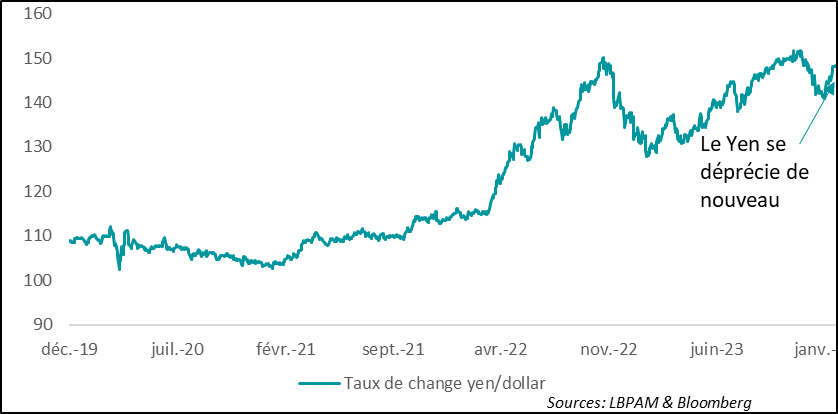

In Japan, the BoJ, as expected, has decided to maintain its ultra-accommodative policy. The strategy of controlling the yield curve is being maintained, with the target for sovereign 10-year rates set at around zero, even though the fluctuation band has been widened.

Even though its projections point to inflation that could be anchored around the 2% target, the BoJ remains patient and believes that it is still too early to leave the current framework.

This remains an element of support for the Japanese economy and is helping to fuel risk appetite, even though the valuations of Japanese equities have already gained considerable ground, prompting us to exercise a degree of caution.

The economy and risky assets are also being supported by the yen, which has resumed its depreciation against the dollar, with the number of Fed rate cuts being revised downwards and, of course, the ultra-accommodative monetary policy being maintained.

Fig.2 Japan: With its ultra-accommodative monetary policy being maintained and expectations of rate cuts in the US fading, the yen depreciate

In contrast to the US, economic news from the Eurozone has not been very encouraging. Nevertheless, the data point to a stabilisation of activity rather than a continued deterioration.

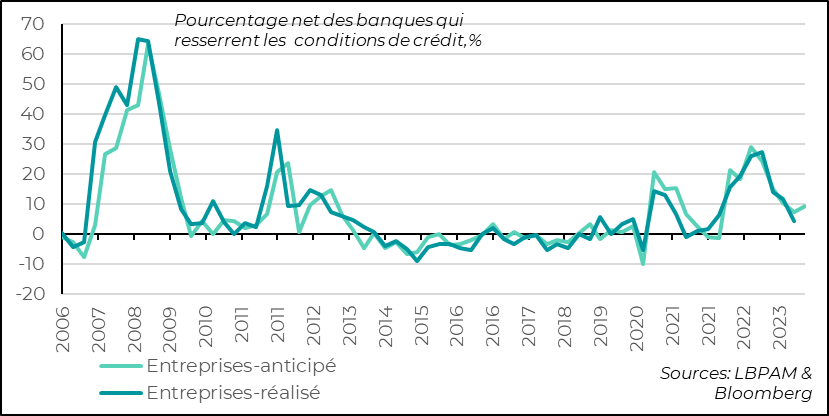

In this respect, the latest ECB survey of banks on the outlook for credit is somewhat encouraging.

Banks continued to tighten lending conditions for businesses last quarter, albeit to a lesser extent. Obviously, given the economic situation and an ECB that is maintaining a restrictive policy, it is hard to see banks not being vigilant about the risks they are taking. In fact, the forecast for this quarter is that caution will continue to be the order of the day.

Fig.3 Eurozone: Banks tightened lending conditions last quarter, albeit to a lesser extent

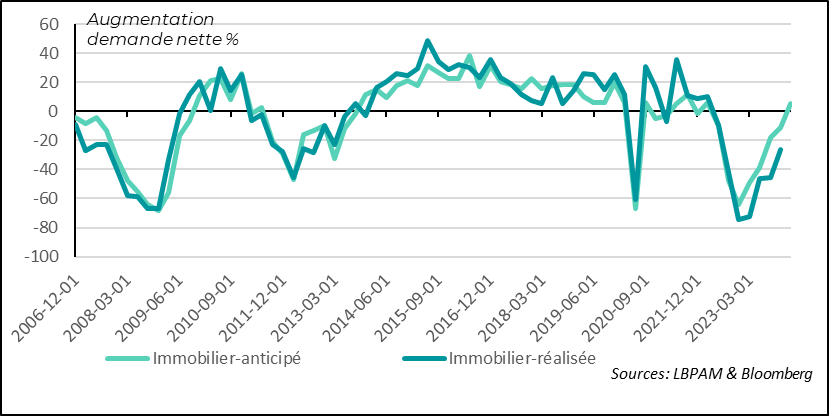

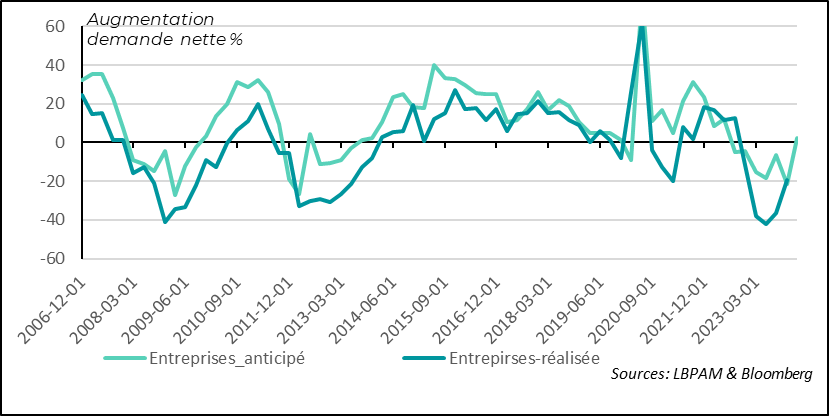

At the same time, we can see that demand for financing is improving slightly. In fact, the fall in demand was smaller in the last quarter, and the outlook seems to be much better. Indeed, for the first time since spring 2012, banks are anticipating the possibility of slight growth in demand for credit.

Fig.4 Eurozone: For the first time since spring 2022, banks anticipate possible growth in demand for credit

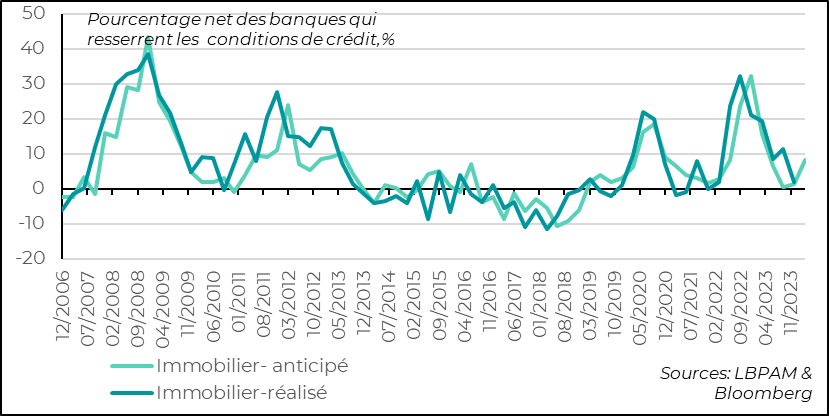

A similar trend can be observed among households. The conditions for obtaining home loans are still tightening, but to a negligible extent compared with the previous quarter. Nevertheless, the outlook is not for banks to relax their caution.

Fig.5 Eurozone: lending conditions for home loans did not tighten further than in the previous quarter

On the other hand, as in the case of businesses, although loan demand was still down last quarter, banks are expecting a clear improvement this quarter. Demand could even grow. This may be over-optimistic, but it seems to us to be consistent with our scenario of economic growth stagnating but not deteriorating further.

Fig.6 Eurozone: Mortgage demand could rebound early this year, according to banks