The world according to D. Trump begins now

Link

Read Sebastian Paris Horvitz's market analysis for January 20, 2025.

Summary

►Today, D. Trump will officially become the new President of the United States. From his first steps, everyone expects an avalanche of executive orders that will set the tone for his intentions. That may well be the case. However, in our opinion, we'll have to wait a little longer to assess the balance he strikes between his pro-business policies (deregulation and tax cuts) and his protectionist ambitions (tariffs and immigration restrictions), which would harm the American and global economy. Uncertainty is unlikely to abate immediately.

►Our central scenario in terms of economic trajectories for the major countries and economic zones incorporates relatively moderate US policies on the protectionist front. If the road is different, we will obviously adjust our forecasts and market views. Nevertheless, in the very short term, it seems to us that the Trump administration is starting its term in office with a very favorable situation. Growth remains very solid in the United States, while inflation, if the latest figures are anything to go by, is slowly continuing to fall. For the rest of the world, the situation is a little less favorable. The eurozone, in particular, is still in search of a more solid and sustainable expansion.

►We will need to be very nimble in our management, in the face of the turbulence that could be caused by the decisions of the new US administration. We still believe that long rates have some downside potential, particularly in the eurozone, and that risky assets should benefit gradually.

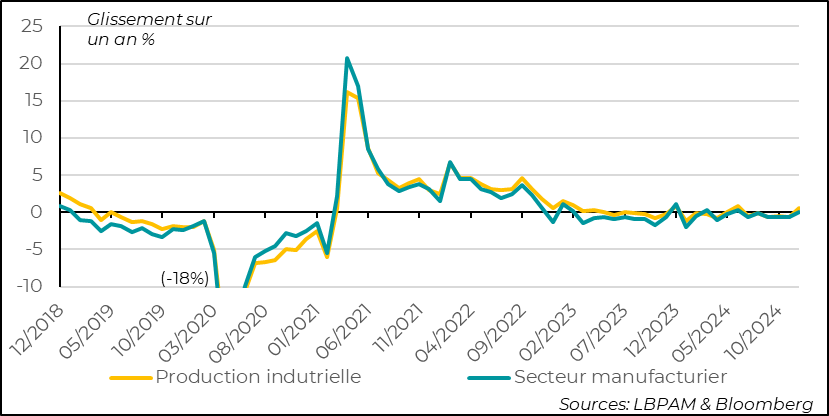

►While the US economy is doing well overall, some sectors are finding it harder to return to more sustained activity. This is obviously the case for industry. Nevertheless, industrial production figures for December confirmed the content of the PMI activity surveys. Indeed, production rebounded more than expected. All business segments saw a clear rebound. The overall index even returned to expansion territory year-on-year. But many sectors, such as the automotive industry, are still far below last year's levels.

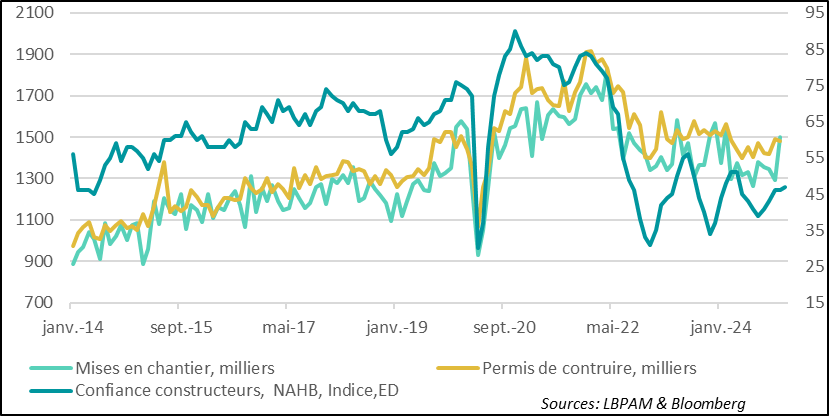

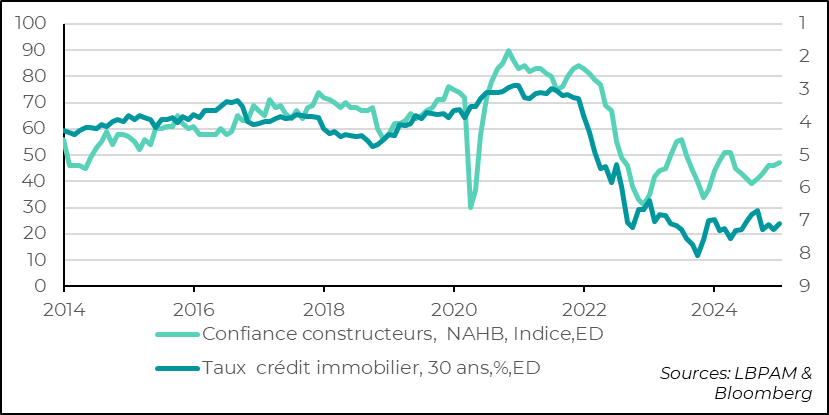

►The industrial sector certainly suffered from sluggish demand, but also from rising interest rates. But no sector suffered more than construction. Nevertheless, housing starts were very strong in December, with the highest monthly increase (15.8%) since 2022. However, this increase was largely due to a catch-up effect from the bad weather that had affected the sector this autumn. As a result, building permits fell over the month. At the same time, homebuilder confidence improved slightly according to the NAHB survey, but remains low. Over the last two quarters, residential investment has made a negative contribution to GDP growth.

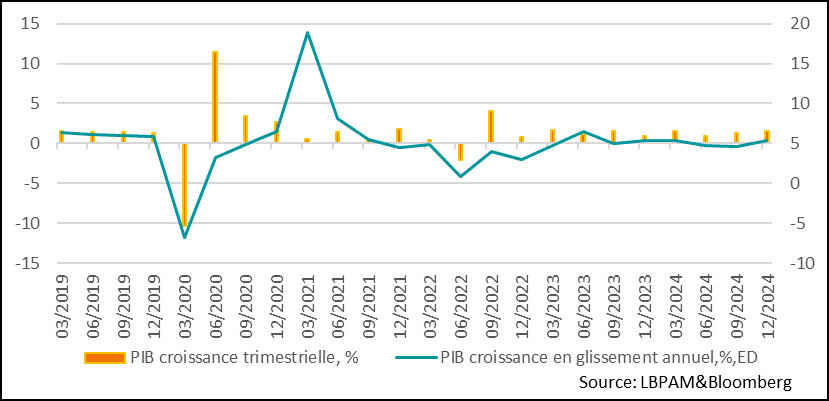

►The end of last week was also marked by growth statistics from China. The good news is that they were stronger than expected. GDP rebounded sharply in 4Q24 (1.6% for the quarter), bringing annual growth to 5%, in line with the authorities' target. This seems to validate in part the beneficial effects of policies implemented by the authorities to support demand. Nevertheless, foreign trade remained one of the main growth drivers. It remains to be seen whether it will maintain its strength in the months ahead.

To go deeper

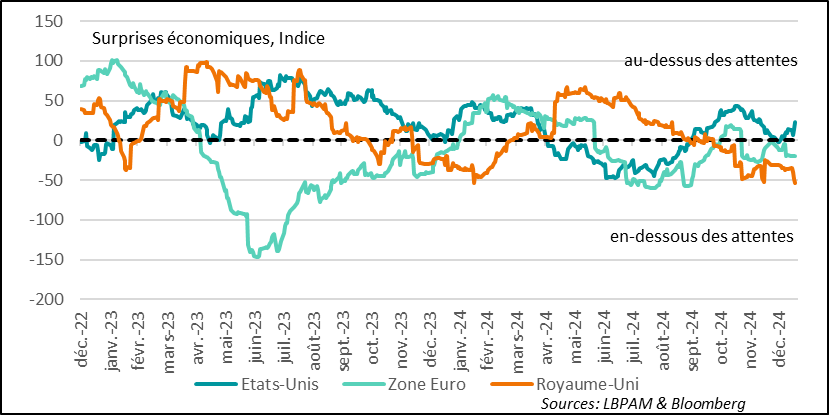

The latest economic statistics have confirmed the continuation of American exceptionalism. Indeed, recently published economic data once again came out better than expected, in stark contrast to the situation in Europe.

United States: economic surprises start to rise again in the United States

Donald Trump has inherited a solid economy, even if inflation has still not been brought back to target and public finances remain on an unsustainable trajectory.

Today, we will begin to see, through the measures that D.Trump will take, whether this robustness will be preserved and existing imbalances addressed.

The end of last week even confirmed the rebound hinted at by industrial activity surveys, with a clear rebound in industrial production in December. Production rose by 0.9% over the month, the strongest monthly increase since last February. More importantly, on a year-on-year basis, it also moved back into expansion territory.

Specific factors, such as the end of the strikes at Boeing, boosted this increase. But, once again, the increase affected most industrial sectors, especially manufacturing.

It remains to be seen whether the rise in business confidence, particularly in the expectation of tax cuts, will maintain this recovery momentum, at a time when industry continues to suffer in many countries.

The latest PMI surveys gave a mixed signal, with new orders nevertheless rising, but overall activity levels remaining weak.

United States: industrial production rebounds sharply in December

The real estate sector is also struggling. Real estate investment has made a negative contribution to GDP growth over the last two quarters. This poor performance is essentially due to worsening conditions of access to home ownership. Not only have prices continued to rise, due to a lack of housing, but interest rates on mortgages have remained very high.

Nevertheless, December saw a strong recovery in housing starts, which rose by almost 16% over the month. However, this increase is mainly a recovery from the disruptions caused by weather conditions during the autumn. As a result, housing starts have returned to a level more in line with building permits, which stagnated over the month.

United States: housing starts rebound sharply, catching up with building permits

The maintenance of a relatively restrictive monetary policy continues to weigh on the sector. Admittedly, the effect of D. Trump's election has also boosted optimism in this sector, with a rebound in homebuilder confidence, according to the NAHB survey in January. Nevertheless, the index is below its historical average and remains weighed down by high interest rates. Despite falling in recent days, interest rates remain at their highest level in 10 years.

United States: high mortgage rates are a handicap for the construction recovery

In China, growth statistics were more favorable than expected at the end of 2024. Indeed, GDP for 4Q24 grew by 1.6% and 5.4% year-on-year, well above expectations.

Industrial production contributed strongly to this performance, with infrastructure construction also providing strong support to growth. On the demand side, foreign trade remained a key driver of Chinese growth. In fact, the impact of the anticipation of possible US protectionist measures probably gave a strong impetus to Chinese industrial production, with the aim of exporting more rapidly. It grew by 6.2% year-on-year in December, well above expectations.

China: GDP growth in 4Q24 was stronger than expected, enabling annual growth to reach the authorities' target of 5%.

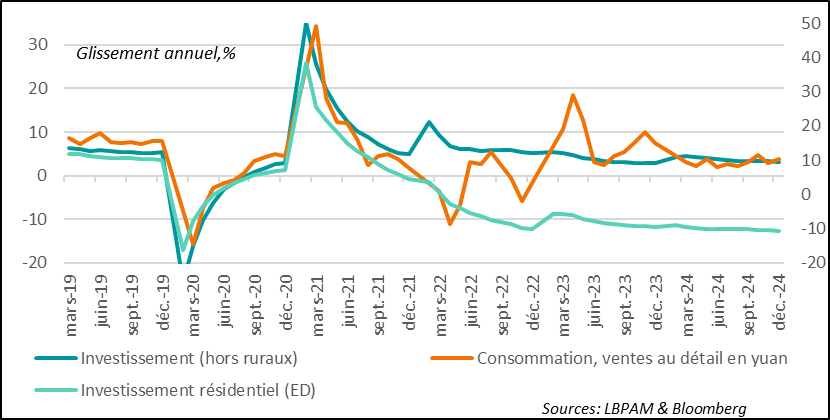

On the domestic demand front, consumption picked up at the end of the year, with retail sales accelerating by 3.7% year-on-year, slightly stronger than expected. This increase partly reflects the effects of the easing of financial conditions, but above all the initiatives taken to support consumption, notably the programs to replace old equipment, including cars.

Nevertheless, expectations remain high that stronger initiatives will be taken by the authorities in the coming months, to further support consumption. The authorities seem intent on waiting for D. Trump's first decisions on foreign policy, including possible protectionist measures, to better calibrate their support for the economy.

In addition, the residential real estate construction sector has taken a beating, with a 10.6% decline. At the same time, real estate sales declined a little less, although still massively at -17.6% year-on-year, compared with -20% the previous month.

China: retail sales pick up a little, investment is weak and the real estate sector remains in a slump

Sebastian PARIS HORVITZ

Head of Research