To ease market Tensions, the Fed should consider cutting rates

Link

Key takeaways from the august 26, 2025 market update insights from Sebastian Paris Horvitz

Overview

► At last week’s annual Jackson Hole symposium, Fed Chair Jerome Powell signaled the possibility of a rate cut as early as September. He notably shifted the risk assessment, prioritizing the deteriorating labor market over persistent inflation risks stemming from rising tariffs. In our view, such a move could also help ease mounting tensions with President Trump. However, the future path of monetary policy remains uncertain.

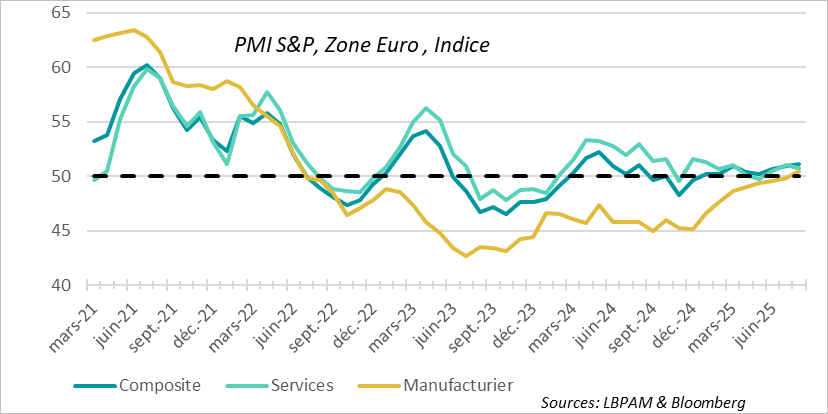

► Preliminary S&P Global PMI surveys for August painted a relatively positive picture of economic activity across major economies. Notably, both sides of the Atlantic saw a rebound, particularly in the industrial sector. In the euro area, the composite index suggests that economic expansion continues at a modest pace. In the U.S., the data remains solid, although price pressures persist.

► Despite concerns over U.S. protectionist policies, market appetite for risk remains strong. Many investors believe the global trade shock will have limited impact due to its slow transmission, allowing for continued robust earnings growth. As a result, several equity indices have reached new highs. However, this has driven valuations to even more demanding levels, especially in the U.S. Is the market becoming overly complacent?

In-Depth insights

The Fed at a crossroads

Fed : high expectations for rate cuts

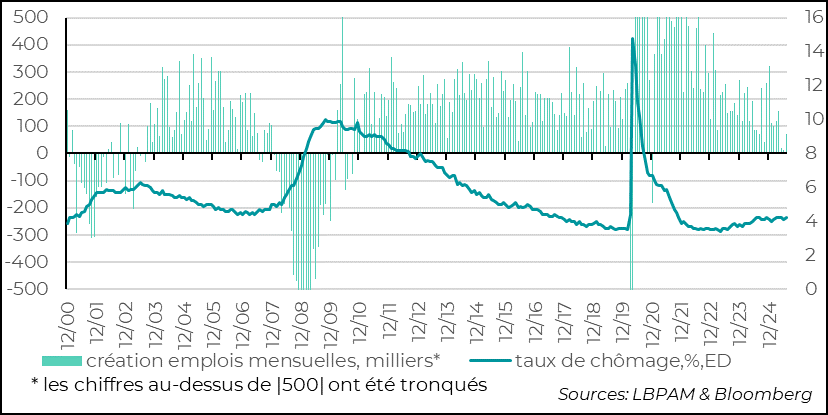

In what may be his final Jackson Hole address as Fed Chair, Jerome Powell revised his stance on the balance of risks between the Fed’s dual mandate: full employment and price stability (with a 2% inflation target). He emphasized that the sharp slowdown in job creation over the past three months—following significant revisions by U.S. statistical agencies—could indicate a more pronounced labor market deterioration than previously anticipated.

Indeed, private sector job creation has averaged just 51,000 per month over the past quarter, a stark contrast to the 130,000 monthly average during the same period last year. Nevertheless, the unemployment rate, which edged up slightly to 4.2% in July, remains near historic lows, suggesting underlying labor market resilience.

Job creation is slowing down, even though the unemployment rate remains low

The interpretation of labor data is complicated by several factors. A more restrictive immigration policy may be reducing labor market entrants, thereby maintaining tight conditions. Additionally, tariff-related uncertainty may be causing firms to delay hiring decisions.

These employment figures align with the anticipated slowdown in economic activity, though uncertainty remains high. Powell also softened his stance on the inflationary impact of tariffs, now suggesting that such effects may be transitory. This marks a departure from the concerns expressed during the last FOMC meeting, where many members feared more persistent inflationary pressures.

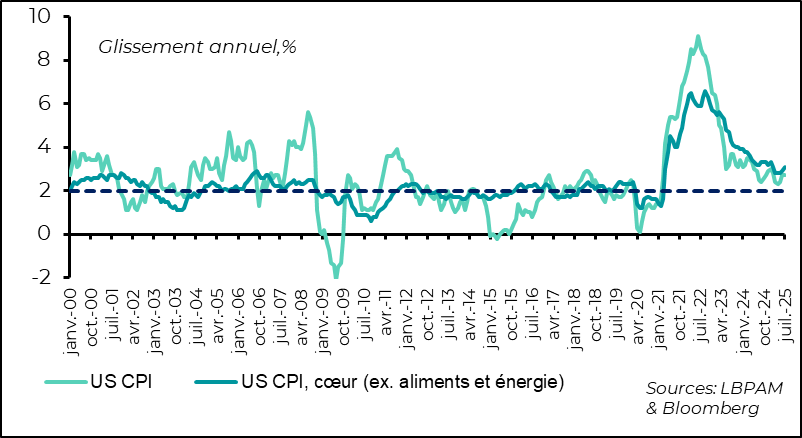

While the pass-through of tariff hikes to consumer prices has been slow, early signs of inflationary strain are emerging. The trend suggests inflation may drift further from the 2% target in the coming months.

Inflation remains above target and shows the scars of rising tariffs

Should inflation accelerate significantly, the Fed is likely to respond. Faced with stagflation risks, we believe the Fed will proceed cautiously with any monetary easing. Powell also unveiled updates to the Fed’s decision-making framework, following a recent review. Key changes aim to clarify how the Fed pursues its congressional mandates, notably removing the assumption that near-zero rates are a long-term norm—a legacy of the post-2008 crisis era.

Overall, the revised framework reflects a pragmatic approach, emphasizing transparency and data-driven decision-making. It also reinforces the importance of the Fed’s independence, which has come under pressure from repeated attacks by President Trump and other administration officials. The nomination of S. Miran—a close presidential advisor—to replace outgoing Board member M. Kugler, and recent calls for the resignation of Board member L. Cook, have heightened these tensions.

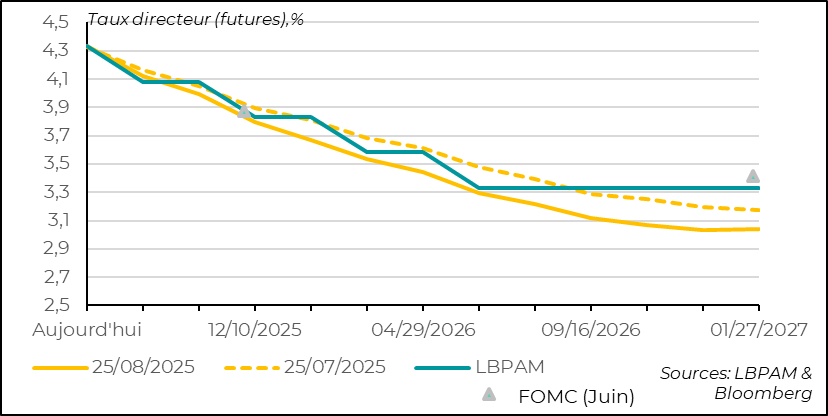

In our view, the justified shift in risk assessment toward a more rapid labor market deterioration supports a 25 basis point rate cut at the mid-September meeting. Such a move could also help alleviate political pressure on the Fed. However, the decision will likely hinge on upcoming employment and inflation data. Even with a rate cut, monetary policy would remain somewhat restrictive, providing a buffer against excessive inflation. We anticipate a gradual easing path, potentially including another rate cut in December.

Global activity shows resilience

Industrial production rebounded sharply in december

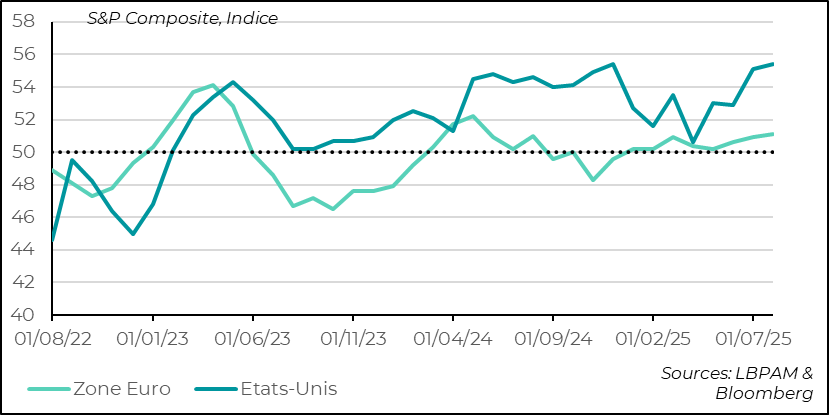

Preliminary S&P Global PMI surveys for August came in stronger than expected, particularly in the manufacturing sector. On both sides of the Atlantic, composite indices (covering services and manufacturing) showed an upward trend, with the rebound especially pronounced in industry.

In the United States, the manufacturing sector led the recovery, while services saw a slight decline. The industrial uptick was again driven by significant inventory accumulation. It remains unclear whether this reflects tariff-related uncertainty or renewed business optimism.

United States: industrial activity rebounds in august

The survey also highlighted persistent price pressures. Respondents indicated that U.S. firms are gradually passing on higher input costs—stemming from tariffs—to customers in order to protect margins.

However, more reliable insights into business dynamics will come from the August ISM surveys, due next week. Last month, ISM data painted a less robust picture of activity compared to S&P’s findings.

In the euro area, PMI surveys also exceeded expectations. While growth remains subdued, expansion continues. The composite PMI remains in expansion territory and has reached its highest level in a year.

Euro Area: composite index hits one-year high

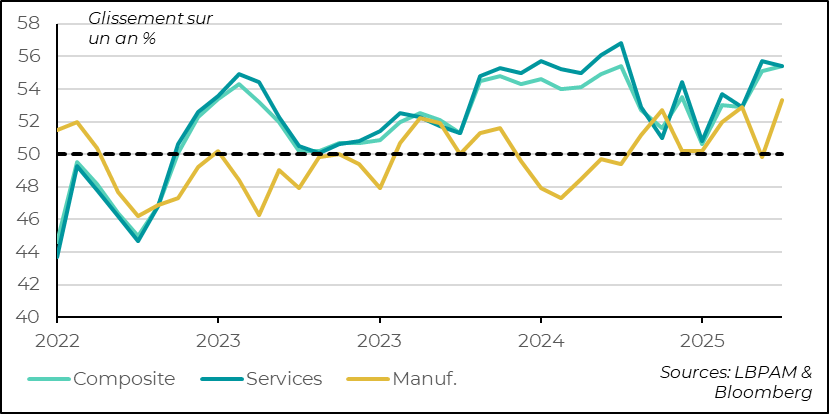

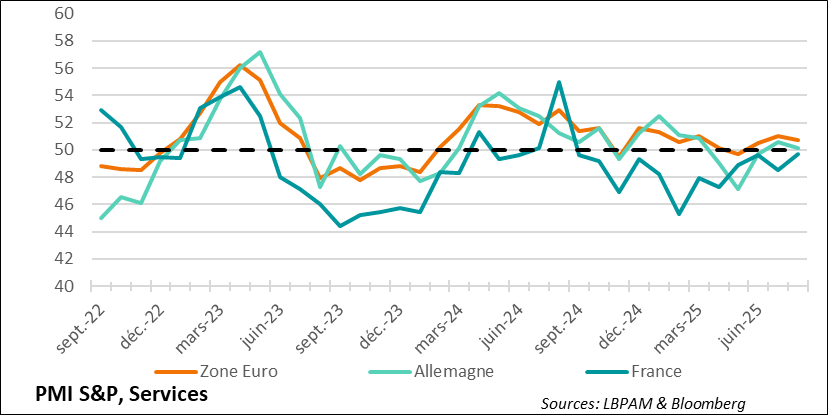

Within the eurozone, France and Germany continue to lag, while peripheral countries are driving growth—primarily through the services sector.

Euro Area: services continue to drive growth

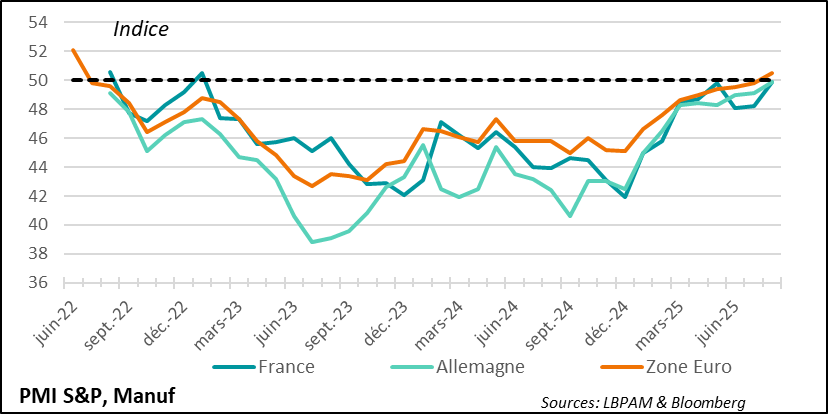

In manufacturing, conditions are gradually improving despite tariff pressures and a stronger euro. The composite index has returned to expansion territory for the first time since June 2022. Both France and Germany are seeing a recovery in industrial activity, although growth remains modest.

Euro Area: manufacturing recovers despite tariffs

Activity in the eurozone is expected to remain weak in the coming months. However, the combination of a more accommodative ECB stance and upcoming fiscal stimulus—particularly in Germany—should help sustain the recovery momentum.

According to survey data, German business leaders remain optimistic. The key question is how rising tariffs and the U.S. slowdown will ultimately affect demand for European goods and services.

Demanding valuations

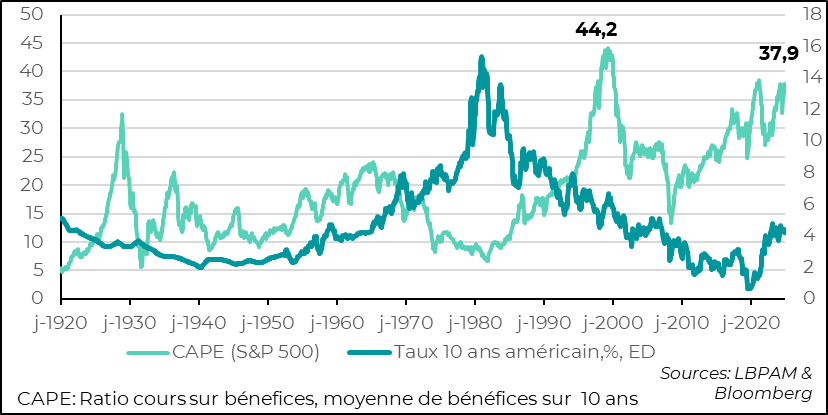

U.S. equity valuations remain elevated

Political turbulence over the summer has not dampened investors’ appetite for risk. This resilience has been partly supported by Q2 2025 earnings, which came in better than expected—albeit against significantly lowered forecasts. Additionally, U.S. companies have continued to benefit from the weaker dollar.

Political turbulence over the summer has not dampened investors’ appetite for risk. This resilience has been partly supported by Q2 2025 earnings, which came in better than expected—albeit against significantly lowered forecasts. Additionally, U.S. companies have continued to benefit from the weaker dollar.

Expectations of rate cuts, particularly from the Federal Reserve, have further fueled risk-taking behavior. However, U.S. equity valuations remain extremely demanding, accompanied by unusually low volatility.

We believe there is a degree of complacency in the market, especially given the many uncertainties surrounding the economic outlook—most notably the impact of U.S. protectionist policies.

At this stage, we maintain a relatively neutral stance in our asset allocation, with a preference for European markets. We believe it is essential to remain agile in our investment decisions, given the sharp market movements observed—and those likely to come—as we enter a seasonally more volatile period.

Sebastian PARIS HORVITZ

Head of research