Too early to cry victory over inflation

Link

- The markets were given a boost by last week's US inflation figures. More specifically, with inflation falling more than expected, risky assets were driven higher, while sovereign bond yields fell. For some, these good figures augur that the Fed could stop its rate hikes and consider cuts as early as the first quarter of 2024. This would mean that we are on the verge of victory in the battle against inflation.

- Inflation decelerated more sharply than expected in June, with headline inflation falling to 3% year-on-year -- the lowest for almost two years. This was in large measure due to very strong base effects linked to commodity prices, particularly energy (-26.8%). Nevertheless, core inflation also fell more than expected to 4.8%, compared with 5.3% in June. This performance is clearly still a long way from the central bank's target (2%). At the same time, the very short-term trend looks favourable, with several price segments moderating within the core inflation. It would however be a trifle too hasty to be convinced from this that we are heading for a rapid fall.

- In fact, the debate between transitory and sustainable inflation is evidently coming back to haunt the markets. In the purest version of the transitory inflation rationale, the upward mechanisms were linked only to the bottlenecks created by the constraints imposed by the closure of economies and the energy shock. Inflation is about to decelerate as these shocks dissipate There is purportedly no excess demand, and wage increases should have no impact on price formation. We still find this view hard to accept. As we see things, it does seem that the Fed-induced deceleration of the economy, albeit not in a violent way, has reduced tensions to some extent -- but not sufficiently yet. According to the latest statistics published by the Atlanta Fed, wages actually continued to rise by 5.6% in June, albeit at a slower pace. In our view, the deceleration in inflation will continue only if the economy continues to slow down. Monetary policy will have to remain restrictive for some time yet for this to materialise. As such, we are moderately cautious in our asset allocation, remaining slightly underweighted on risky assets. This is all the more the case as in our view, the market, particularly in the United States, has become fairly complacent.

- The market participants in Europe seem to be more worried about the outlook than they were a month ago, especially as the ECB is expected to remain aggressive in the face of more resilient inflation. In fact, the ZEW indicator, which reflects the views of market operators in Germany, has drawn close to its lowest levels of the year for its outlook component. At the same time, as was the case for many countries, one of the collateral victims of the view that the Fed would become more accommodating in the near future, was the sharp fall in the dollar. The euro, like most currencies, therefore appreciated, returning to its level of early 2022. If things stay as they are, this should harm the competitiveness of European companies, but help the ECB in its battle against inflation.

- As expected, China's GDP growth slowed to 0.8% in 2Q23, after 2.2% in 1Q23. As indicated by the economic data of recent months, the positive effects of the opening up of the economy following the end of the zero-COVID policy are fading. Consumption, in particular, is losing strength, as is borne out by retail sales in June, which rose by just 3.1% year-on-year, compared with 12.7% the previous month. Furthermore, we know that foreign trade also made a weak contribution. Only investment seems to be holding up somewhat, while industrial production seems to be picking up slightly, despite the fact that the PMIs were still showing signs of weakness. These trends should encourage the government to do more for growth. There is still a certain reluctance on the part of the authorities to give a stronger impetus to business activity for the time being, however.

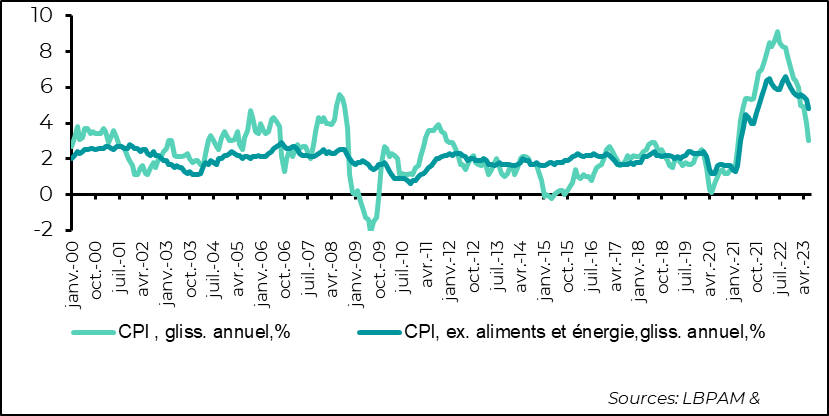

In the United States, inflation fell more than expected in June. Total inflation fell to 3% year-on-year for the first time in almost two years. This fall was largely due to base effects associated with the fall in commodity prices and prices affected by production capacity constraints during the covid period. The main effect came from the sharp fall in energy prices, particularly oil. The year-on-year fall in the energy price mix was 26.8% in June. Given our forecasts for oil prices, this very negative contribution should fade as we move further away from the peak in oil prices that we saw a year ago.

At the same time, core inflation, excluding energy and food, also fell more than expected, to 4.8% year-on-year. This level is obviously still far too high for the Fed, given that it is more than twice the 2% inflation target.

Figure 1 United States : Inflation fell more than expected in June, with energy still making a strong contribution year-on-year. Core inflation remains high.

CPI, year on year, % CPI, excl. food and energy, year-on-year, %

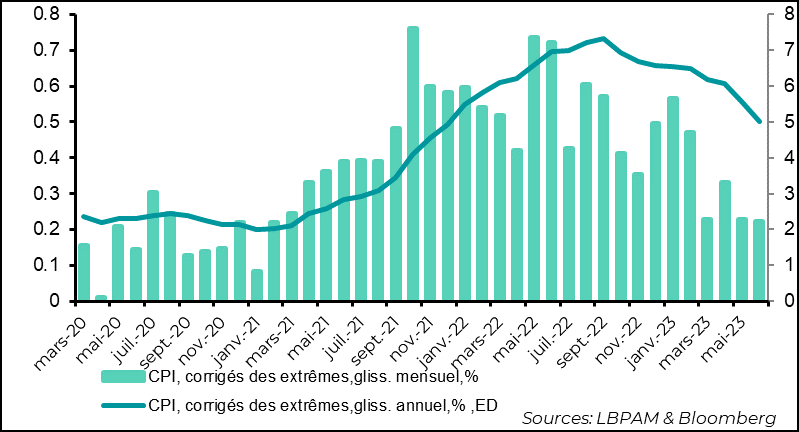

We can only welcome the downward momentum nonetheless. This is well reflected in the underlying measures of inflation such as that published by the Atlanta Fed, which excludes goods whose prices are subject to the most extreme variations upwards as well as downwards.

Thus, even though this measure still stood at 5% in June, it has fallen since peaking at over 7% in October 2022. More importantly, the monthly trend over the past two months has been one of moderation.

Figure 2 United States. Inflation adjusted for extreme upward and downward movements continues to fall, with smaller monthly variations.

CPI, adjusted for extreme movements, month-on-month %

CPI, adjusted for extreme movements, year-on-year %, right scale

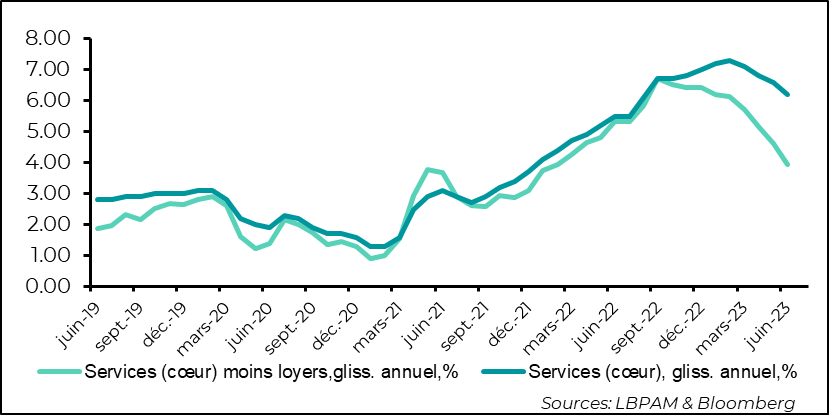

One of the Fed's focal points continues to be the trend in services prices. Here too, inflation is continuing to drop gradually, falling to 6.2% year-on-year from a peak of 7.3% last March. The fall is much sharper on the whole (excluding rents), i.e. 3.8%.

Figure 3 United States: Inflation in core services is also decelerating – even more so when the rise in rents is taken out of the equation.

(Core) services, excl. rents, year-on-year% / (Core) services, year-on-year, %

(Core) services, excl. rents, year-on-year% / (Core) services, year-on-year, %

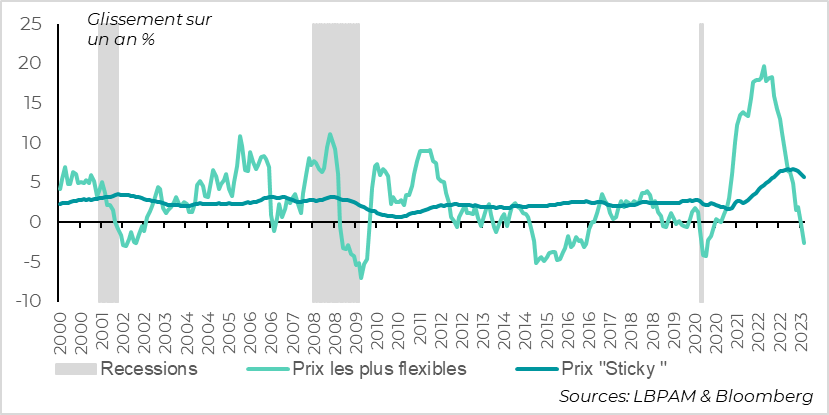

Another interesting measure to monitor so as to understand the trends in inflation is that of sticky prices, i.e. prices which are generally considered to be slow to change. These are beginning to fall, but this trend could prove slow. Conversely, for the most flexible prices, i.e. those that adjust quickly, such as energy prices, we can see that the fall has been very sharp, reflecting, as we have already emphasised, very strong base effects.

Figure 4 united States: Prices, which are generally sticky, are decelerating slightly. The fall in inflation comes mainly from the most flexible prices, including energy.

Year-on-year %

Recessions Most flexible prices Sticky prices

These favourable trends notwithstanding, we still need to ask what the mechanisms behind this decline are. For some, this is a "natural" movement. More specifically, the fall in prices is linked solely to the disappearance of the effects of temporary tensions on the production chains and to the fall in the price of oil and other raw materials.

As we see it, the debate over whether the surge in inflation was temporary or not has been settled. It was not temporary, and more persistent effects were triggered by powerful demand shocks, largely caused by public support and very accommodating monetary policies.

The very strong action taken by central banks over the past year has in our view played a large part in the deceleration in activity, which has made it possible for inflation to begin to fall.

Getting inflation to converge towards central bank targets will nonetheless remain a challenge in the months ahead. We believe that inflationary push can be truly defeated only by maintaining restrictive policies for some time to come.

We are still expecting a relatively 'soft' landing for most economies in the quarters ahead, compared with previous historical episodes, although activity could contract in some countries, including the US. We could be wrong, of course, as there is still a great deal of uncertainty surrounding many parameters.

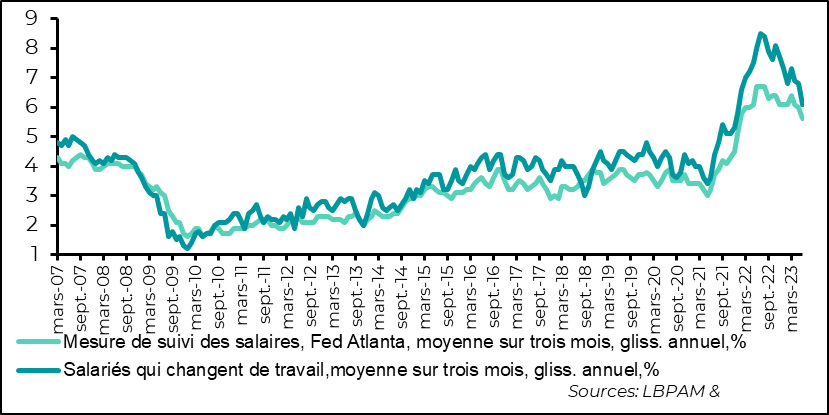

Despite those who seem to think that wage growth plays no role in the dynamics of inflation, we believe that it plays a fundamental role, as apparently most central bankers do as well. In trivial terms, inflation can approach the target set by central banks only if wages converge towards a level that is close to this target plus productivity gains. In the US, wage growth of around 3% in nominal terms is seen as a level compatible with convergence towards medium-term inflation of close to 2%.

It so happens that, even though they show a decline once again, the latest wage statistics underline the fact that year-on-year increases remain high. For example, the Atlanta Fed's June payrolls report, which is more reliable than the employment report, shows that wages are still up by 5.6%. This is admittedly down on last year's peak of 6.7%.

The trend is on the right track, but we are still a long way from having reached the right destination, especially as the job market is still very tight.

Figure 5 United States: Wage growth, as measured by the Atlanta Fed, shows a deceleration, but it remains high.

Wage monitoring measure, Atlanta Fed, average over three months, year-on-year, %

Wage earners who change work, average over three months, year-on-year %

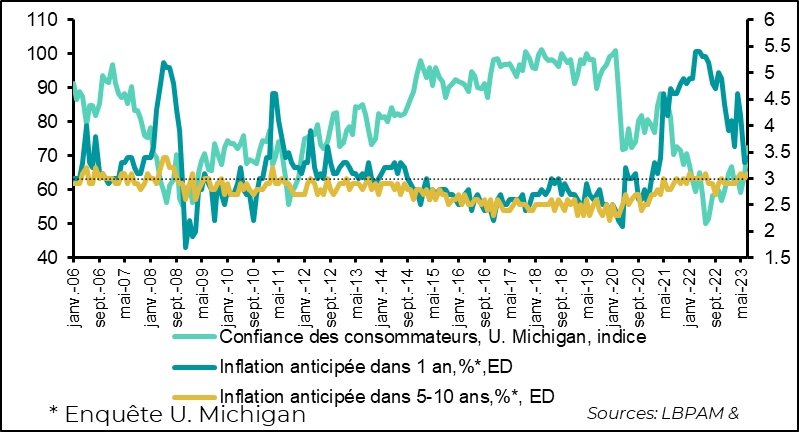

The fall in inflation can therefore be seen as supporting demand, all the more so as wages are rising at a brisk pace. For that matter, this seems to be what emerged from the University of Michigan's Household Confidence Survey, which showed renewed confidence in the preliminary figures for July, even though inflation expectations remained relatively unchanged. This rise in confidence can in fact also be seen to be due to the good performance of the stock market and therefore to a wealth effect that provides a boost, which nevertheless remains at a rather low level in historical terms. If demand does not decelerate, in our view, the Fed is likely to remain vigilant.

Figure 6 United States: Consumer confidence rebounded slightly in June. Inflation is expected to remain high.

Consumer confidence, U. Michigan, index

Inflation expected in 1 year, %*, Right scale

Inflation expected in 5-10 years, %*, Right scale

* U. Michigan Study

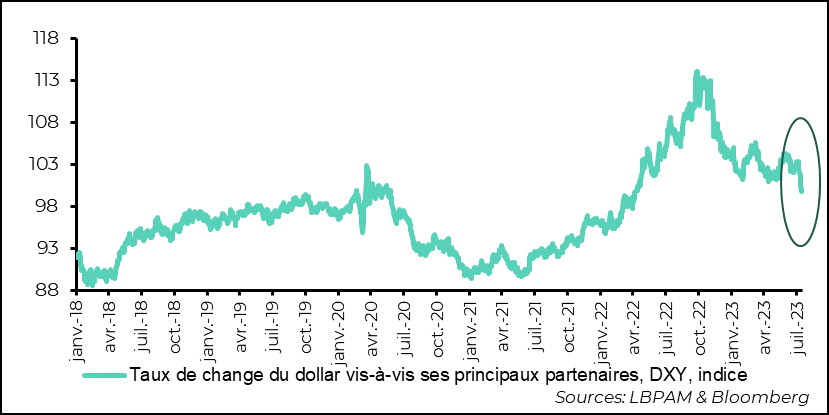

The market's strong reaction to the deceleration in inflation, and its conclusion that the Fed is almost finished with monetary tightening, in addition to the reaction on major financial assets, has also had a very strong impact on the dollar.

The greenback plummeted to its lowest level since the spring of 2022 against its main trading partners.

This should partly help central banks to fight inflation, particularly in emerging countries.

At the same time, these very rapid currency adjustments are causing distortions at the corporate level in addition to losses in competitiveness.

We still believe that the dollar should fall in the medium term, but the movement we have just seen seems to us to be too rapid, even if the differences in the paths of monetary tightening still to come may be more unfavourable to the dollar.

Figure 8 United States: The dollar is the collateral victim of the market’s assumption that the Fed will halt and then ease its monetary policy.