Towards a resolution

Link

- After a few days of downward adjustments on the markets, risk-taking returned with a vengeance on both sides of the Atlantic, with a rally in equities. Central bank language had been hawkish over the past two weeks, particularly in the United States, but market participants seemed to have been reassured by the latest, better-than-expected economic figures. For one thing, they seem to be interpreting the real estate rebound as a sign of greater demand-side resiliency to higher interest rates, which suggests, in turn, that both economic growth and companies’ earnings could remain strong. While acknowledging some pockets of resiliency, our view is less optimistic. We continue to believe that, if inflationary pressures are to be brought under control, it will be difficult to avoid an adjustment in demand. This adjustment is what the central banks are trying to achieve. It does seem as though we are close to resolving this stand-off between the views of bullish equity markets and those of most central banks, who believe that economies must stay well below their potential growth if inflation is to converge towards 2%. This would mean an environment in which companies in general would be unable to keep their margins high. And that is why we remain cautious in our asset allocations.

- The ECB’s annual get-together at Sintra has just begun, and it will, in fact, deal with macroeconomic adjustments during a phase of volatile inflation. Christine Lagarde opened the proceedings by detailing the ECB’s framework for analysis, stressing the basic goals that the ECB is pursuing to tackle inflation that remains very high. First, the central bank must ensure that inflation expectations remain well anchored. “Second, for this to happen, we need to ensure that firms absorb rising labour costs in margins. If monetary policy is sufficiently restrictive, the economy can achieve disinflation overall while real wages recover some of their losses [in purchasing power]. But this hinges on our policy dampening demand for some time so that firms cannot continue to display the pricing behaviour we have recently seen.” Slower-than-expected transmission of monetary policy might be acceptable, but demand must still be cooled off.

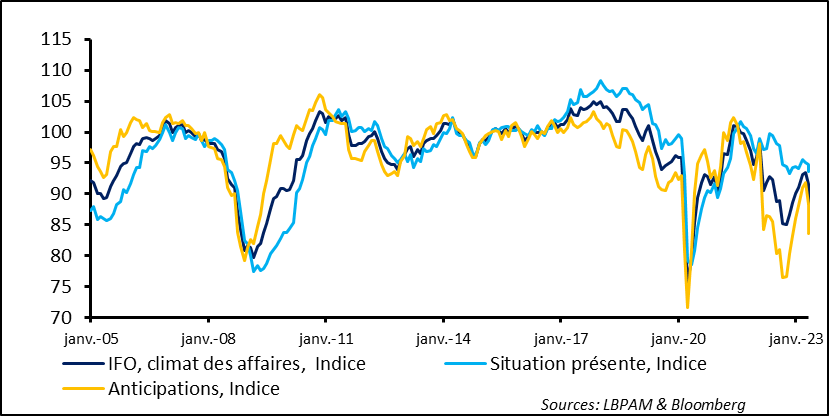

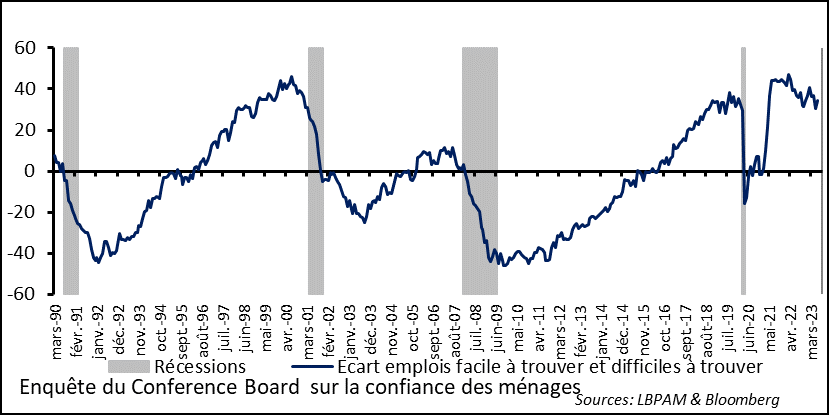

- We still believe that a few more key rate hikes will be enough to put them at a level that is sufficiently restrictive to cool off demand. Unfortunately, if the market’s bullishness on resilience in economic activity were borne out, far more aggressive rate hikes would be necessary, which would, in turn, increase the danger of much harder landings by economies. Once again, while showing that some sectors are holding up well, the latest PMI figures, particularly in the Euro Zone, show that economic activity is indeed weakening. This was confirmed in the recently released IFO survey in Germany, with a steep drop in the Expectations component in particular. In contrast, in the US, the Conference Board’s June survey found that household confidence had rebounded. This may be due in part to lower energy costs but most of all to a solid labour market, as seen in households’ continued views on the ease in finding a job. Likewise, the rebound in new home sales in May, despite high interest rates, does not seem to be pointing in the right direction. These figures are likely to reassure most monetary policy committee members that at least one more key rate hike is needed to dampen demand.

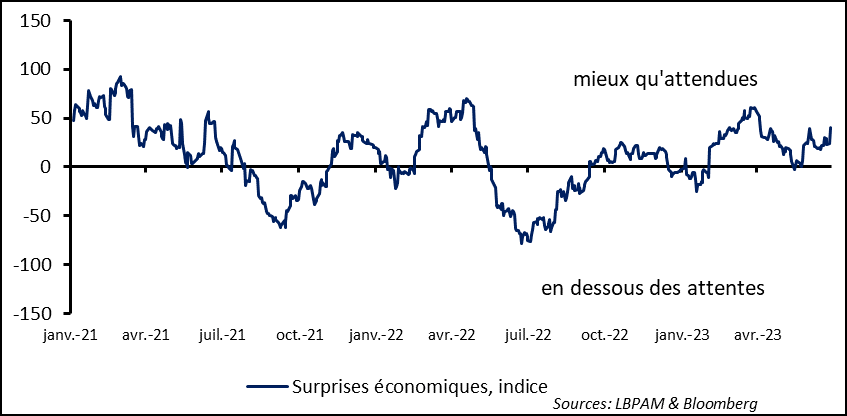

Resilient activity in recent months was one of the biggest surprises against a backdrop of steep interest-rate hikes. Activity indicators such as the PMI services recovered rather nicely, but without erasing the rather pronounced downturn over the past month.

The IFO business climate indicator in Germany fell for the second consecutive month, including a steep drop in June that was driven above all by the worsening in companies’ outlook, with a steep drop in the survey’s Expectations component.

Fig. 1 – Germany: the IFO survey suggests that activity worsened further in June, Expectations in particular.

Bps US 10y-2y yield curve German10y-2y yield curve

Jul. Aug. Sept. Oct. Nov. Dec. Jan. Feb. Mar. Apr. May Jun.

It was much the same story in S&P’s flash PMIs for June. It is well known that Germany is more exposed to the global industrial cycle, as its manufacturing sector plays a bigger role than in most other major countries. Moreover, weak economic activity in China also weighs on demand addressed to Germany.

However, this downturn is also being driven by monetary conditions. At this stage, consumption appears to be holding up, but we expect the constraint imposed by monetary policy to continue to cool off demand and keep economic activity lacklustre, not just in Germany but in the entire region.

Meanwhile, in light of trends that do seem to indicate a weakening in demand, we do not expect the ECB to be overly hawkish in its future additional rate hikes. That’s why we now see it as more likely that it will raise key rates by an additional 25 bps (in July) without going any further. That said, the risk remains on the upside on key rates if weaker demand were to be insufficient in easing inflationary pressures.

In the United States, the latest macroeconomic figures were better than expected, including the Citigroup Economic Surprise Index, which has once again turned back up in recent weeks.

Fig. 2 – US: Economic data better than expected

Equity exposure (NAAIM, right scale)

Equity exposure (NAAIM, right scale)

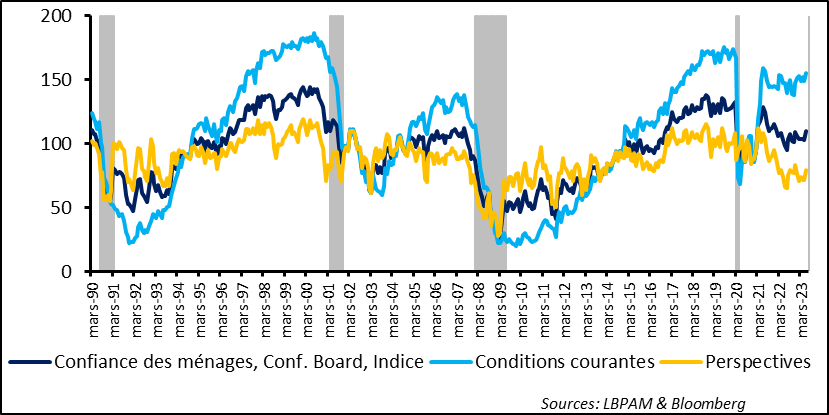

Obviously, everyone looks at US consumers to get a read on demand trends. In light of this, some reassurance was provided by the improvement in the Conference Board Consumer Confidence survey in June, including both Present Situation and the Expectations components.

Fig. 3 – US: Conference Board Consumer Confidence survey improved in June.

Building starts Building permits NAHB builder confidence (right scale)

Building starts Building permits NAHB builder confidence (right scale)

As has been the case for several months now, lower energy prices have restored some household purchasing power, thus, no doubt, providing further reassurance. But the main driver of consumption remains the solid labour market.

Indeed, the survey’s indicator of households’ views of labour market conditions continues to send out a very optimistic message, with the spread between consumers saying jobs are “plentiful” versus “not so plentiful” remaining at historically wide levels and even widening further last month.

Fig. 4 – US: The solid labour market continues to provide support.

‘000 New home sales Avg. monthly mortgage cost (% of income)

‘000 New home sales Avg. monthly mortgage cost (% of income)

This solidity of the labour market is also apparent in the rather pronounced – albeit decelerating – increase in wages, something that is not very compatible with a rapid convergence of inflation towards 2%. Keep in mind that at its last monetary policy committee meeting, Fed members raised their 2023 core inflation forecasts rather aggressively while sticking to 2.6% for 2024.

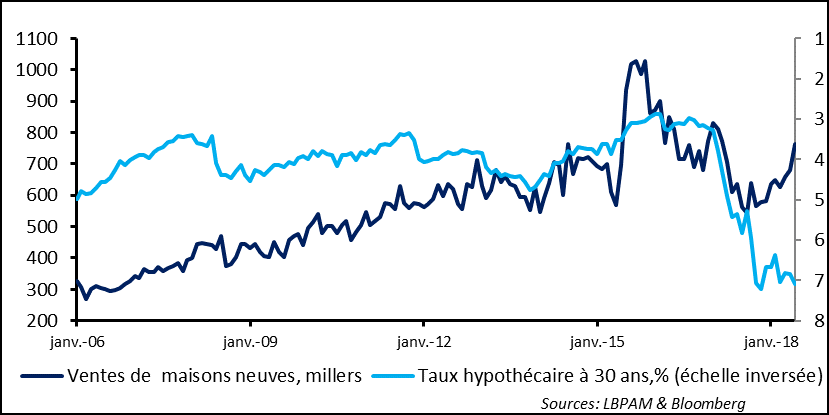

Clouding the Fed’s reading of the current situation in the economy and of monetary policy’s impact on demand, the real-estate market remains surprisingly resilient. In his 21 June research note, Xavier showed that, while it is true that most of the real-estate boom driven by steep interest-rate cuts during Covid had mostly subsided, the rebound seen so far this year does give pause, despite the apparent structural tightness in housing supply resulting from the sector’s adjustment following the bursting of the real-estate bubble in 2008-2009.

This is why the May figures on new home sales are such a surprise, with a robust 12.2% rise on the month – even against a backdrop of highly unfavourable interest rates.

Fig. 5 – US: Real-estate still holding up despite a big increase in the cost of credit a

YoY % chg.

YoY % chg.

Sales (volume) Building starts Investment

For the Fed, these signs of resilience in demand no doubt confirm the need to continue tightening monetary policy. We continue to forecast one last, 25 bps key rate hike, in July. But there’s still a risk that more will be necessary. Once again, we still believe that, barring a lull in demand, inflation will have a hard time converging towards central banks’ targets. The more that demand holds up, the greater the risk of more hawkish monetary policy, and this would push economies towards a far worse growth outlook.