Towards an adjustment of the labour market

Link

- After a summer marked mainly by rising long-term interest rates, the markets are seeing a return to optimism, which is supporting risk-taking, based on the idea that the slowdown in economic activity that seems to be on the horizon will enable central banks to ease pressure. We believe that the possibility of a faster cut in key interest rates is likely in 2024, due to a sharper than expected deterioration in economic activity. Nonetheless, we find it difficult to see what forces would enable the economy to regain momentum quickly in 2024. The market, which is certainly a machine for anticipating, seems to us to be a little too optimistic about the ability of activity to rebound, given the weakness of the levers for re-acceleration. Excess demand remains high, fiscal policies are more restrictive and the disinflation process, although underway, is likely to be slow, forcing real interest rates to remain relatively high. Before we become much more optimistic, it seems to us that there is a transition stage, involving adjustments, which could disappoint investors. Nevertheless, in our allocations, while we are finding value in the bond market given the level of interest rates, we are only very moderately underweight equities given the valuations, which seem to us to be less excessive.

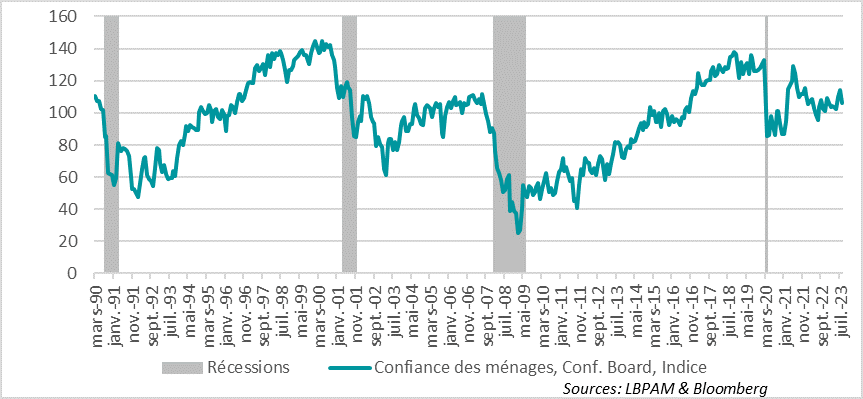

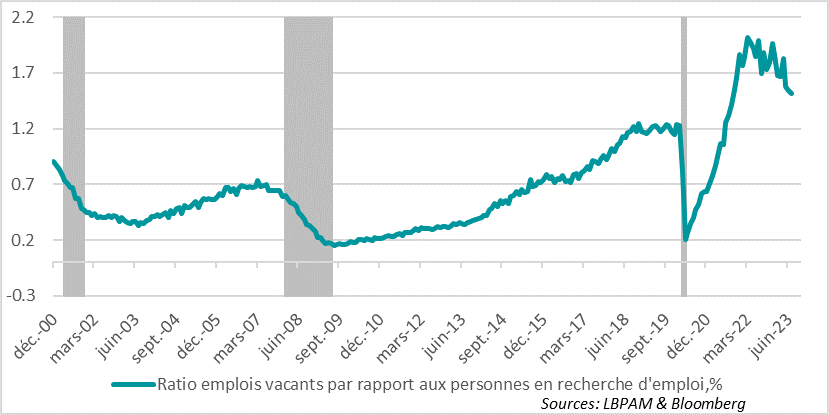

- In the United States, the latest economic data came out less positive than expected. This contrasts with the very good surprises we had at the start of the summer, particularly on consumption and investment. With regard to consumer spending, after a strong rebound in consumer confidence over the last two months, in August we saw a resurgence of concern. The rise in energy prices has something to do with this. However, it would seem that it is the signs of a deterioration, albeit very gradual, in the job market that are affecting consumer morale. We have seen the University of Michigan's confidence indicator fall, and we have just seen the Conference Board's fall. In particular, the Conference Board's indicator shows that the labour market seems to be starting to rebalance. The very buoyant nature of the labour market seems to be triggering a real downturn, albeit a very gradual one. In addition, a statistic that is closely watched by the Fed, namely job vacancies, fell fairly sharply in July. Nevertheless, at just under 9 million, job vacancies remain historically very high. This adjustment, even if it seems slow, could cool consumption and then activity in general more quickly than expected.

- One of the unpleasant surprises of the summer was the sharper than expected deterioration in economic activity in the Eurozone, particularly in the major countries, notably Germany. It seems that this weakening has prompted the German government to react. Chancellor O. Scholz has just announced a €7 billion programme of support for the economy, mainly aimed at businesses and accelerating the energy transition. Admittedly, this represents less than 0.2% of GDP, but it does alter somewhat the rather restrictive policy that the German government had planned for next year. It remains to be seen whether the government will be obliged to do more in view of the poor economic figures. The German economy remains one of the worst performers in the region, with three quarters of slight contraction or stagnation in activity. The only piece of good news, but one that may not last, published with the 2Q23 GDP details, was a year-on-year rise in wages (6.7%), which, for the first time since inflation surged, was very slightly higher than inflation, breaking with the loss of purchasing power of previous quarters.

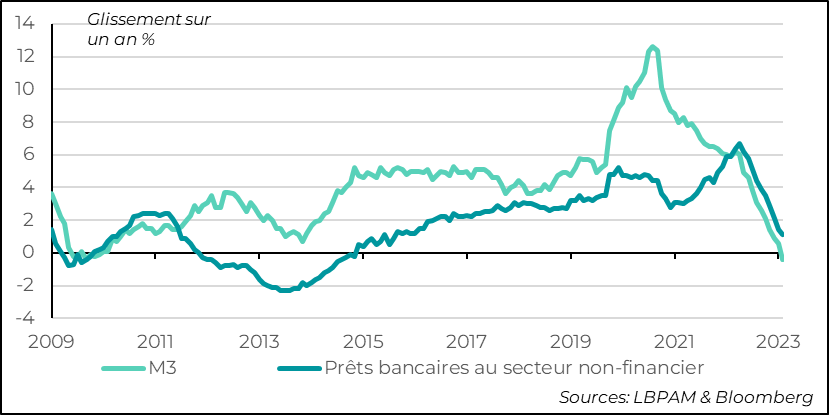

- Still in the Eurozone, as we have been pointing out for some time, the impact of monetary tightening is already proving to be much more marked than in the United States, even if the rise in key central bank interest rates has been less marked than in the US. So, with the European economy far more dependent on bank credit, we can see that it is continuing to slow very rapidly. This is shown by the year-on-year fall in the M3 monetary aggregate in July, and therefore in its counterparts, which obviously include credit. The ECB is obviously keeping a close eye on these dynamics, and this should be a factor in its September decision. We continue to believe that, despite calls from the more orthodox members of the Governing Council to continue raising rates, a pause in September remains the most likely scenario.

US consumer confidence deteriorated in August according to surveys by the University of Michigan and the Conference Board. This is a break with previous months and comes on top of a salvo of much weaker than expected economic data.

Fig.1 United States: US consumer confidence deteriorates in August and remains below pre-covid levels.

The surge in energy prices has undoubtedly contributed to this deterioration, because as we know, it is inflation that has weighed most heavily on consumer morale over the recent period, even though consumers have maintained high levels of consumption.

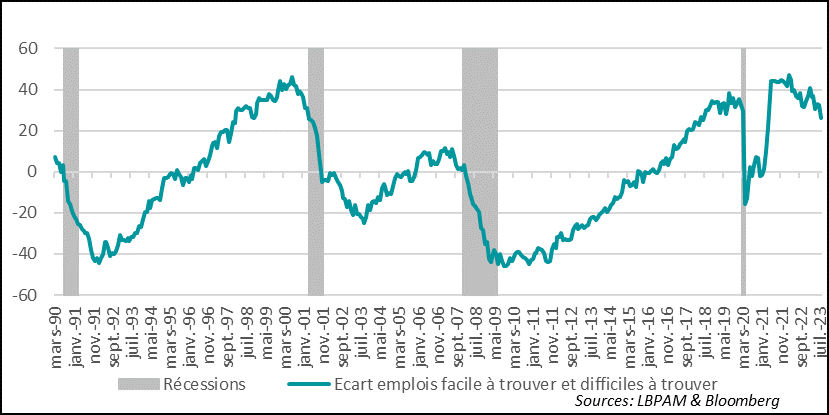

Nevertheless, the latest Conference Board survey reveals that the easing of pressure on the labour market has accelerated slightly. Indeed, one of the useful gauges for monitoring the robustness of the labour market is to calculate the balance of responses between those who find it easy to find a job and those who find it difficult. This balance fell again in August and is below the level reached before Covid. At the same time, the unemployment rate, at 3.5%, remains just as low as it was then. All the same, this shows that an adjustment is taking place. Will it accelerate? It is still difficult to say. This Friday's employment report will undoubtedly give us some valuable insights into the dynamics of the labour market

Fig.2 United States: Tensions on the labour market could be easing, with greater difficulty in finding a job

Corroborating this trend, the Fed's closely watched statistic on job vacancies continued to decline in July, falling below 9 million. This number remains historically high. However, it is a step in the right direction towards easing the labour market, which is necessary to calm the overheating economy. It remains to be seen, as some believe, whether the continued fall in job vacancies can be achieved without the unemployment rate rising.

Fig.3 United States : The imbalance between job vacancies and the number of unemployed remains historically high, even if it is diminishing

In the Eurozone, the latest economic data showed that the slowdown in economic activity was stronger than expected. The situation in Germany is the most worrying. Although GDP growth stopped contracting in 2Q23, after two consecutive quarters of decline since 4Q22, the outlook remains poor according to the latest surveys, including that of the IFO.

When the detailed GDP figures for 2Q23 were published, one piece of good news was the trend in wages. After the sharp loss of purchasing power that accompanied the surge in inflation, real wages stopped falling in the final quarter, thanks to a marked acceleration in nominal wages. However, this was not enough to support consumption. Worry seems to be prevailing among all economic agents. Furthermore, given the deterioration in the economic outlook, wage increases are likely to slow, which will be good news for the ECB.

Fig.4 Germany: Sharp rise in nominal wages in 2Q23, allowing real wages to stagnate after deteriorating in previous quarters

It is against this gloomy backdrop that the German authorities have adopted a recovery plan of less than 0.2 points of GDP. This is positive, but risks being insufficient to provide real support for the economy.

The tightening of monetary policy is obviously playing a key role in the slowdown in activity. The European economy remains highly intermediated by the banking system, unlike, for example, the United States. So the slowdown in bank lending is a factor in the slowdown in activity.

In this sense, the ECB's latest monetary statistics clearly show how credit has rapidly lost momentum. For example, the year-on-year monetary aggregate M3 fell into negative territory in July for the first time since 2014. One of its most important counterparts is obviously credit. The trend is unambiguously downwards.

Fig.5 Eurozone: Monetary tightening transmitted more strongly than elsewhere because of the economy's dependence on bank credit

For the ECB, these statistics should be taken into account in its future decisions. Indeed, even if the priority of the institution and its mandate is to bring inflation rapidly back to 2%, a tightening that would be far too strong could once again create the spectre of a far too severe recession, even fuelling the risk of the emergence of deflationary pressures. This is something the ECB does not want, and something the European economy must avoid.