Towards the end of negative interest rates

Link

-

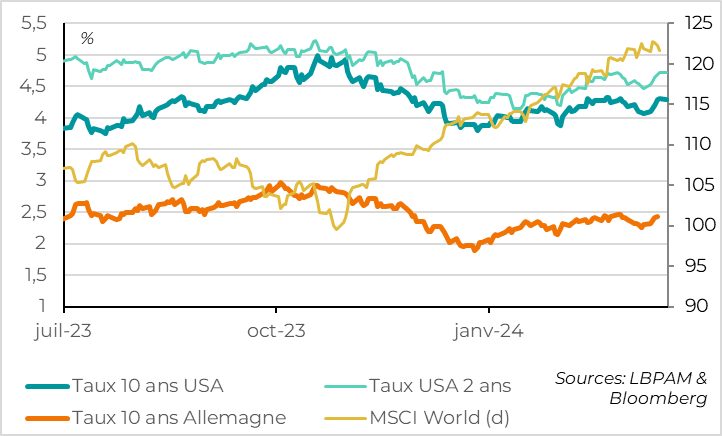

At the start of a busy week in terms of central bank meetings (including the Bank of Japan (BoJ) on Tuesday, the Fed on Wednesday and the Bank of England (BoE) on Thursday), fixed-income markets are fearing less accommodative rhetoric following the upward surprises in inflation since the start of the year. As a result, the US 10-year yield is close to its highest level of the year.

-

The only central bank that could change its monetary policy as early as this week is the BoJ. And this possibility has increased after the sharp rise in negotiated wages, which are at a 33-year high. In our view, the BoJ should act on the end of 10-year rate targeting and prepare for the exit from negative rates, although we think it could wait until its April meeting to actually raise its key rate. In any case, there should be no more debt offering a negative yield in the coming months, which would be a first in over 10 years.

-

We expect the Bank of England to confirm the end to rate hikes it indicated in February, which could result in a rebalancing of votes (2 votes for a rate hike vs. 1 for a rate cut at the last meeting). But it is not rushing to announce when it will be able to start lowering rates.

-

For the Fed, Powell said that a rate cut this week would be too soon. And that was before February's still-high inflation figures. Clearly, the Fed is not going to have gained "greater confidence" in inflation converging towards 2%, which is its criterion for starting to cut rates. But the latest activity figures (industrial production, retail sales, etc.) suggest a slowdown in growth in early 2024, and household inflation expectations remain well anchored. This should enable the Fed to reiterate that the risks between inflation and employment are "gradually rebalancing" (even if they are not yet fully balanced). We don't expect the tone of the press release and Powell's press conference to change too much, indicating that the next move in rates should be downwards, but that it won't happen just yet. The main focus will be on the Fed members' updated rate projections, which may indicate only two rate cuts this year, even though we think it's likely that they'll indicate three more.

-

China's first business figures for 2024 are mixed, but overall point to stable growth around the authorities' target. Industrial production is picking up slightly, thanks to exports and infrastructure investment. But domestic demand remains weak, with retail sales slowing and real estate continuing to contract sharply.

-10-year rate USA

-10-year rate Germany

-USA 2-year rate

-MSCI World (d)

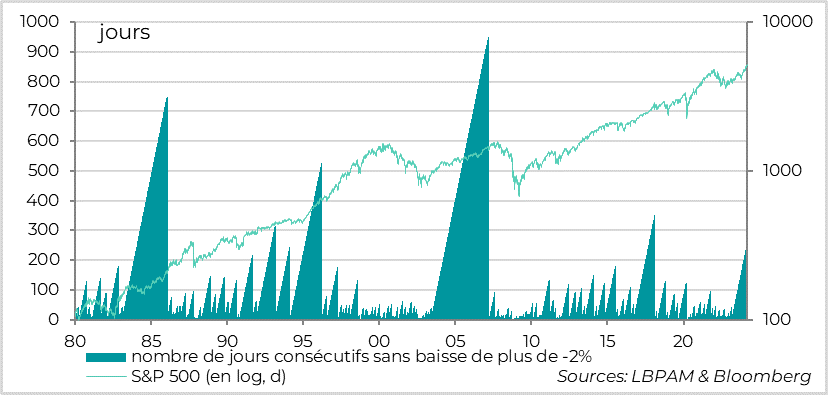

Fig.2 Markets: Equity markets are on hold but have not corrected despite rising rates

-Number of consecutive days without a drop of more than -2%

-S&P 500 (in log, d)

That's 268 consecutive business days since the S&P 500 last fell by at least 2% on any one day, or almost 1 year. This is rare, and hasn't happened for 6 years, although there are several historical episodes that have lasted even longer without a correction (such as in 2018, from 2003 to 2006, in 1995 or between 1983 and 1986).

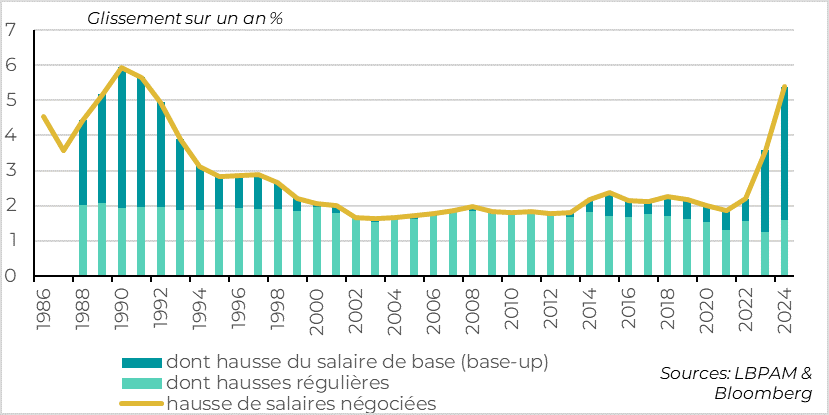

Fig.3 Japan: Negotiated wages to accelerate sharply in 2024

-Of which base-up salary increase

-Of which regular increases

-Negotiated wage increases

The first results of Japan's annual wage negotiations came in well above expectations, which should bolster the Bank of Japan's (BoJ) confidence in exiting its ultra-accommodative policy.

Unions negotiated a 5.28% wage increase for this year, according to the first estimate published on Friday, well above the 3.6% achieved last year and the biggest rise since 1991. This estimate is likely to be revised slightly downwards in the coming months (last year's initial estimate was 3.8%), but should remain well above the level the BoJ considers compatible with a virtuous price-wage cycle that would enable a sustainable exit from deflation.

This should prompt the BoJ to abandon its policy of negative short-term rates (-0.1%) and targeted long-term rates (i.e., control of the yield curve) in the coming months. That said, Japan narrowly avoided recession at the end of 2023, and consumption remains fairly weak in early 2024, prompting the government to remain cautious about a sustainable exit from deflation. This could lead the central bank to remain cautious in adjusting its monetary policy.

All in all, we believe that the BoJ could act on the end of 10-year rate targeting and prepare for the exit from negative rates, which could take place in April when the BoJ presents its new economic projections. But according to the wage figures, the chances of the BoJ taking its key rate out of positive territory as early as this week are increasing. In fact, the market attaches a 60% probability to this possibility.

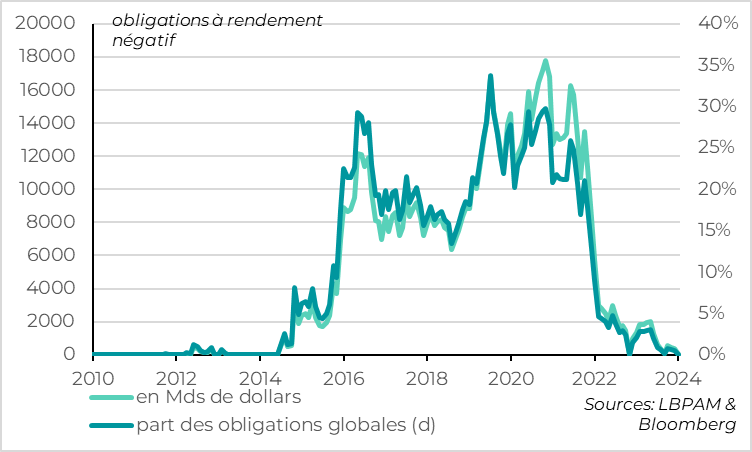

Fig.4 Markets: towards the end of negative yield bonds

-In billions of dollars

-Share of global bonds (d)

When the BoJ moves out of negative rates, it will mark the end (for now) of negative-yield bonds. They had exploded from 2014 onwards with negative key rates in Europe, and even more so in 2016 when the BoJ switched to negative rates. And they had accounted for almost a third of global bond outstandings by the end of the 2010s. Of course, negative rates could return in the future if deflationary risk returns, since they remain in the arsenal of many central banks, particularly in Europe. But central banks are likely to be cautious before embarking on this monetary experiment again.

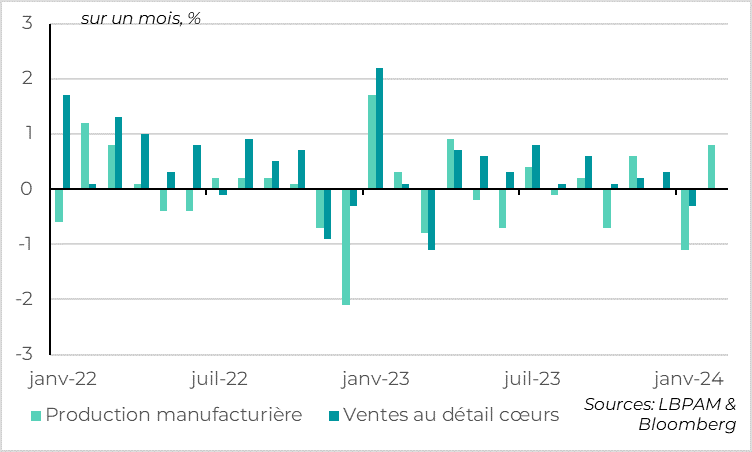

Fig.5 United States: Activity slows in early 2024, beyond the effect of the weather in January

-Manufacturing production

-Core retail sales

US activity data for February were rather disappointing, suggesting a slightly sharper slowdown than expected in early 2024. This is in line with our scenario of a significant slowdown in US growth in the first part of the year, although growth should remain positive.

While the sharp drop in industrial production in January (0.5%) could be explained by unfavorable weather conditions, the absence of a rebound in February (+0.1%) suggests that the momentum of activity is more limited than at the end of 2024. This is also the case for core retail sales, which stagnated in February following a 0.3% drop in January.

That said, the strong momentum at the end of 2024 should enable US growth to remain resilient in Q1. February's activity figures lowered the Atlanta Fed's growth estimate for the current quarter by 1ppt, but the estimate still remains solid at 2.3%.

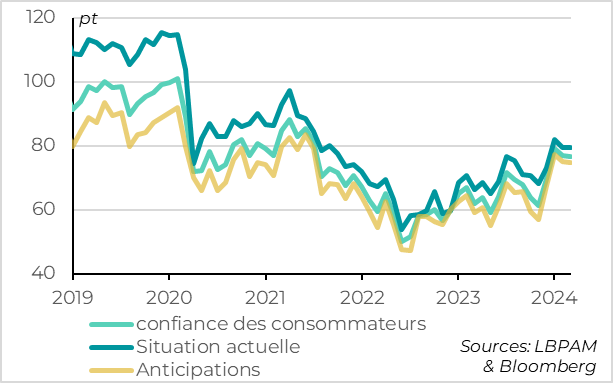

Fig.6 United States: Household confidence holds up

-Consumer confidence

-Current situation

-Anticipations

On the other hand, business and consumer confidence remain satisfactory, which does not suggest that an abrupt slowdown is imminent. According to the University of Michigan's preliminary survey, consumer confidence fell marginally in early March, but after rising sharply at the turn of the year, it remains well above its 2022-2023 levels. Still-high inflation is weighing on the purchasing power of less well-off households, but the strength of the job market continues to support incomes.

Finally, household inflation expectations remain well anchored, despite higher-than-expected inflation at the start of the year, around its historical average of 3%. This should reassure the Fed about the long-term inflation outlook.

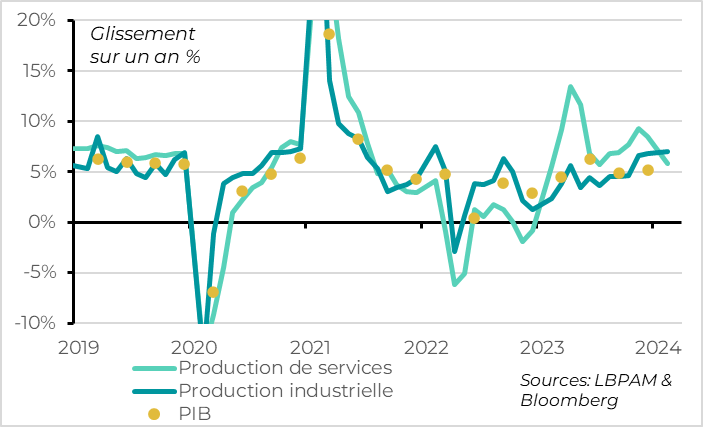

Fig.7 China: Growth remains stable in early 2024 thanks to industry

-Services production

-Industrial production

-GDP

Chinese data for January/February, the first available for 2024, suggest that growth remains stable thanks to external demand and public support, while domestic demand remains weak.

Chinese industrial output accelerated slightly at the start of 2024, to 7.0% over January/February, after 6.8% in December. It was driven by exports (+7.1% after 2.3% in December) and investment (+4.2% after 3% in 2023). Investment is benefiting from rising investment in infrastructure and industry, suggesting increasing support from the authorities and external demand.

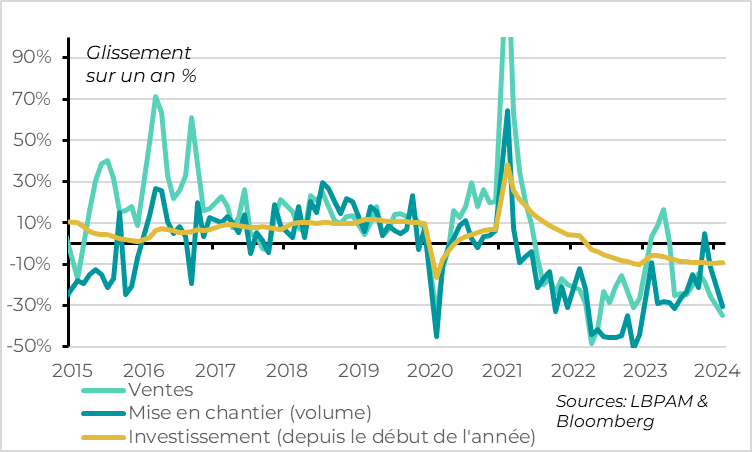

Fig.8 China: Real estate continues to contract sharply

-Sales

-Housing starts (volume)

-Investment (year-to-date)

On the other hand, domestic demand remains limited. Retail sales slowed from 7.4% to 5.5% over the first two months of the year, and real estate investment continues to contract sharply (-9%, the same pace as at the end of 2023). This is weighing on services output, which is slowing from 8.5% at the end of 2023 to 5.8%.

We expect Chinese growth to remain stable, close to the official target of 5% this year. At the start of the year, it should benefit from the fiscal and monetary measures taken since last summer, and from the recovery of the global industrial cycle. But without a stabilization of the property market and a slight return of household confidence, the second half of the year could be more difficult, and would require further support measures from the authorities.