U.S. data fails to dispel uncertainty

Link

What should we take away from market news on November 21, 2025? Answers with the analysis of Xavier Chapard.

Overviews

► Despite the end of the longest shutdown in history and NVIDIA’s excellent earnings, markets have seen slight consolidation this week, mainly in U.S. risk assets. At this stage, we still view this phase as a healthy pause following the strong performances in September and October, rather than a trend reversal. Uncertainty remains high, but the macroeconomic backdrop is still broadly supportive.

► The U.S. employment reports for September were finally released yesterday, after more than a month of delay. In addition to being outdated, they do not provide a clear picture of the labor market’s actual condition, although they remain broadly consistent with a market that is sluggish but resilient. Employment grew twice as fast as expected in September, but previous months’ data were revised downward. Furthermore, the unemployment rate rose more than anticipated (4.4%), not because jobs declined, but because more people returned to the labor force.

► This situation does not make it easier to resolve the current disagreements within the Fed regarding whether to cut rates again as early as December. Moreover, no new employment report will be available before the December 10 meeting, as the BLS has announced that data for October and November will only be released a week later.

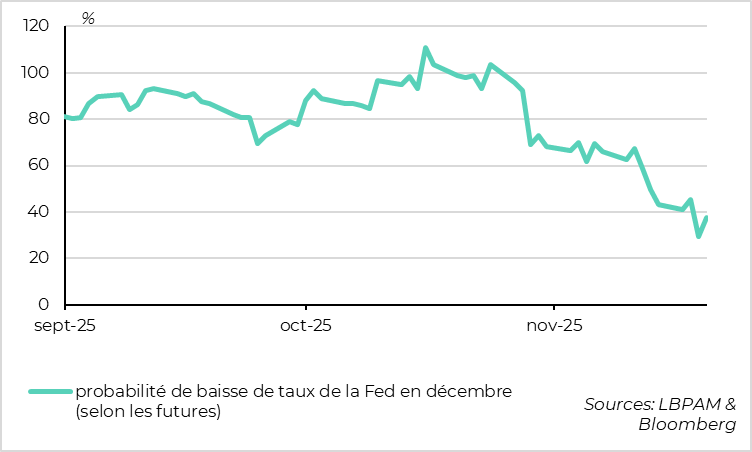

►Like us, the majority of Fed members appeared in favor of pausing rate cuts in December, according to the minutes of the October meeting. However, the decision remains uncertain. Markets now price in only about a 40% chance of a cut, compared to nearly 100% a month ago. We see this adjustment as more reasonable and believe it reduces the risk of a Fed surprise that could weigh on markets again.

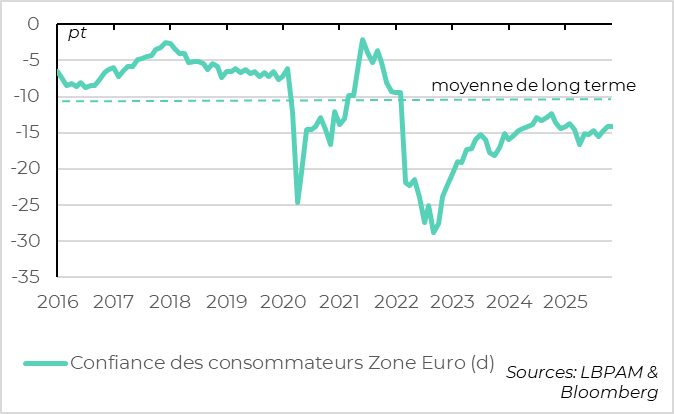

► In the Eurozone, consumer confidence remains stable in November after rebounding significantly since the summer, although it is still at a limited level. We will see if the PMIs published this morning confirm that growth is accelerating, albeit only slightly, in Q4 after holding at 0.2% in Q3.

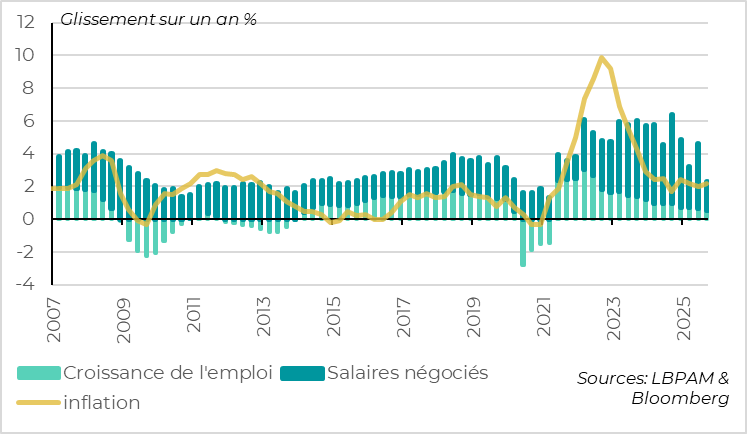

► In the medium term, even a limited improvement in household confidence could support a more pronounced recovery in consumption in the Eurozone, driven by strong purchasing power and a resilient labor market. Employment continued to grow slightly in Q3, and the unemployment rate remains close to its historic lows (6.3%). Combined with the ramp-up of the German stimulus plan, this momentum strengthens our optimism for the economy and European equities in the coming months.

► Following Germany, Japan has now announced a significant increase in its fiscal support for 2026, amounting to $112 billion, with half of this allocated to mitigating the impact of rising prices on households. While this measure is not particularly surprising, it confirms that fiscal policy will remain broadly accommodative next year, which leads us to maintain a cautious stance on long-duration bonds in our allocations.

Going Further

United States: Mixed employment figures keep the Fed in a state of uncertainty

September marks a rebound in job creation

The U.S. employment reports for September, published more than a month late due to the shutdown, send mixed signals.

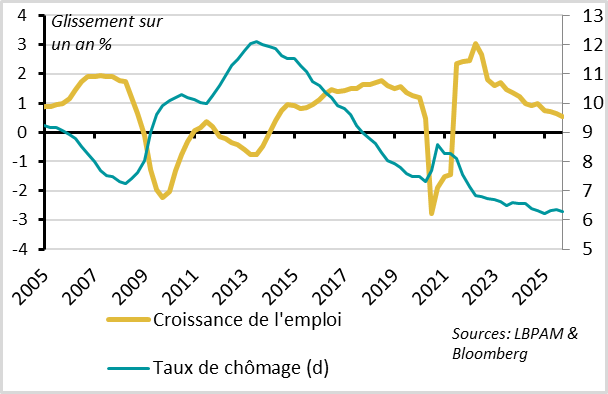

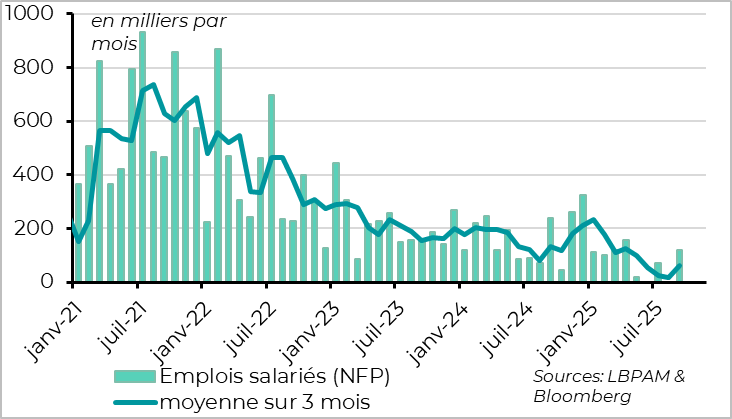

According to the establishment survey, payroll employment rose twice as much as expected in September, reaching 119,000 jobs the highest since April. This rebound is reassuring after four months where average job gains were below 20,000, suggesting that the sharp slowdown seen this summer was temporary. The three-month average has thus climbed back to 60,000, a level close to normal employment growth given the slowdown in immigration.

However, data for the previous two months were revised down by 33,000, resulting in a contraction in August for the second time this summer. Moreover, job gains remain concentrated in two sectors healthcare and tourism while they are declining in cyclical sectors such as manufacturing, warehousing, and business services. This confirms that the labor market remains sluggish.

The unemployment rate continues to rise

The household survey also shows mixed signals.

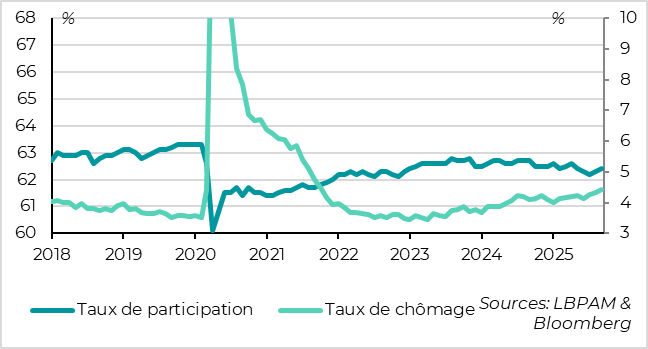

On one hand, the unemployment rate unexpectedly increased, rising from 4.3% to 4.4%. At 4.44%, it is close to rounding up to 4.5%, its highest level since the Covid period, and now exceeds the 4.2% threshold that the Fed considers consistent with full employment. This suggests that business demand is weaker than labor supply.

However, this increase is explained by the rebound in the participation rate, which climbed from 62.3% to 62.4%, reversing the decline observed this summer. Typically, more people returning to the labor market is a sign of strength. It is this rise in job seekers that explains the higher unemployment rate, while the number of jobs actually grew by 250,000 in September according to the household survey.

Wage data is also mixed: the monthly increase (+0.2%) is below expectations, but after revisions to previous months, annual growth reaches 3.8%. More recent indicators confirm this ambivalence: continuing jobless claims hit a cyclical high in early November, while new claims remain stable at a low level.

Fed: An Uncertain Decision for December

Overall, it seems reasonable to consider that the U.S. labor market remains relatively subdued after the summer, without showing a clear deterioration, which aligns with our scenario.

However, the published data is not sufficient to narrow the divergences within the Fed. The risk of a sharper downturn in the coming months is prompting some members to advocate for a swift cut in policy rates, while the absence of significant deterioration is leading others to wait for more data on employment and inflation before acting.

The Fed will not have any new official statistics before its December 10 meeting, as the BLS announced that the October and November reports will only be released on December 16.

The minutes of the last meeting, published on Wednesday, confirm these disagreements: a majority of members consider it appropriate to keep rates unchanged in December before contemplating a moderate cut in the first half of 2026, while “several” members still favor a reduction as early as December.

Following the release of employment reports, markets have slightly raised the probability of a rate cut, now below 50%, compared to near certainty a month ago. This illustrates that the Fed’s decision remains uncertain, but investors are increasingly pricing in a patient Fed scenario.

Eurozone: Strong Potential for a Consumption Recovery

Household Confidence Stabilizes in November

Household confidence remained stable in November at -14.2 points, following the strong rebound seen in September and October. It has thus reached its highest level since the beginning of the year, while still remaining well below its long-term average. This trend is consistent with the slight consolidation of investor confidence (Sentix and ZEW indices) in November, after the sharp rebound in October.

The PMIs published this morning should provide a clearer picture of short-term economic conditions. If they hold steady or decline slightly, this would confirm a moderate acceleration in Eurozone growth in Q4, after holding at +0.2% in Q3.

The labor market shows strong resilience

Household confidence remains limited, likely due to external uncertainties and political tensions in some countries, including France. However, with a still-high savings rate, even a partial improvement in confidence could be enough to support a gradual recovery in consumption.

This confidence is further supported by a resilient labor market in the Eurozone. The unemployment rate fell this summer, from 6.4% to 6.3% in Q3, close to its historic low reached at the end of 2024. Employment continues to grow slightly, although its pace has slowed to +0.5% year-on-year.

Household purchasing power continues its slight upward trend

The slight increase in employment and the gradual slowdown in wages continue to support households’ real purchasing power. Despite volatility linked to bonuses paid in Germany which are expected to mechanically weigh on wage growth in Q3 Eurozone wages are still rising by more than 3% in the second half of the year, well above inflation, which eased to 2.1% in October.

This potential for a consumption rebound, after a challenging start to the year, adds to the decline in trade-related uncertainties and the ramp-up of the German stimulus plan. These factors reinforce our scenario of a clearer Eurozone recovery in the coming quarters and underpin our positive stance on European equities in the months ahead.

Xavier CHAPARD

Strategist